Cardano (ADA) Rally Brewing? On-Chain Metrics Suggest Investors Optimism

September 08 2024 - 5:00AM

NEWSBTC

Cardano (ADA) is currently trading just below a critical resistance

level at $0.33 after a week of intense fear and uncertainty in the

market. However, on-chain data from IntoTheBlock suggests that some

investors see this as a potential buying opportunity, anticipating

a market recovery in the near future. Related Reading: Why Is

Ethereum (ETH) Losing Ground To Bitcoin? Key Report Explains ETH

Struggles Despite the broader downturn, certain metrics indicate

growing optimism, as a portion of the market appears to be

accumulating ADA at these levels. This suggests that investors may

expect a reversal soon. As the market continues to shift,

these metrics could offer key insights for those wondering whether

Cardano is worth buying at this point or if a deeper correction is

likely. With ADA hovering at a critical juncture, investors are

closely monitoring price action and data to determine if this could

be a turning point for the asset. Cardano Investors Getting Ready

To Buy? Data from IntoTheBlock reveals that some investors view

Cardano (ADA) as a promising buying opportunity ahead of a

potential market recovery. One significant indicator supporting

this is the Exchange On-chain Market Depth, which tracks order

books on the top 20 exchanges. This data shows that participants

have placed buy orders for 220 million ADA tokens, amounting to

over $70 million at the current market price. In contrast, bearish

traders have set sell orders for fewer than 170 million ADA tokens,

valued at approximately $52 million. This disparity between buying

and selling volume suggests that Cardano’s price may be poised for

an upward movement. When buy orders significantly outweigh sell

orders, it often signals that investor sentiment is turning more

positive, which can contribute to an increase in price. As long as

this trend persists, with buying pressure dominating, Cardano could

see a rally in the near term. Related Reading: Solana (SOL) 180-Day

Consolidation Set to Break: Massive Rally Just Around the Corner?

However, despite the bullish outlook from some investors, the

broader market remains filled with uncertainty, and Cardano still

faces resistance at the $0.33 level. The overall market sentiment

and external factors will play a crucial role in determining

whether ADA can break through this resistance and enter a more

sustained uptrend. Still, the current data suggests a favorable

environment for a potential recovery if positive sentiment

continues. ADA Price Action ADA is currently trading at

$0.32, facing indecision as it attempts to break the $0.33

resistance, which previously acted as support in early

August. The asset remains under pressure, trading below the

4-hour 200 moving average (MA) at $0.3446. This is a crucial

indicator of short-term strength, and its current position signals

weakness. For bulls to regain momentum, ADA must break past the

$0.33 resistance and reclaim the 4-hour 200 MA as support.

Achieving this would strengthen the bullish case, potentially

leading to a rally. However, if ADA fails to clear these resistance

levels, the outlook could turn bearish. The next significant

support sits at $0.30, and a break below this level would signal

further downside potential. Related Reading: Can Avalanche (AVAX)

Reclaim $30? Top Analyst Predicts A Dip Before A Bounce Traders are

watching closely as the price action around the $0.33 resistance

and 200 MA will determine whether ADA can recover or face a deeper

correction. The market’s uncertainty makes these levels pivotal for

ADA’s near-term direction. Featured image from Dall-E, chart from

TradingView

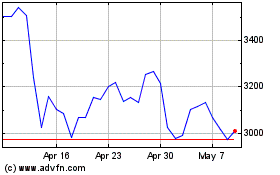

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024