Is This The Bottom? Experts Weigh In On Bitcoin 13% Dip And Potential Recovery

December 21 2024 - 12:00AM

NEWSBTC

Bitcoin (BTC) is experiencing its first seven-day decline in eight

weeks, prompted by hawkish signals from the US Federal Reserve

(Fed) that have led traders to sell off the asset, which has more

than doubled in value this year. Bitcoin Rebounds To $97,500

After Historic ETF Outflow The market’s leading cryptocurrency saw

a drop of as much as 5.3% to $92,149 on Friday, following a record

high of just above $108,000 earlier in the week. Since then the

Bitcoin price has recovered the $97,500 mark, down approximately 5%

since Sunday. This downturn has also affected smaller

cryptocurrencies, including Ethereum (ETH) and Dogecoin

(DOGE), despite a generally positive performance in US equities.

Related Reading: Bitcoin Rally Loses Momentum: Could A Drop To

$75,000 Signal The Final Correction? The shift in sentiment is

further highlighted by a significant outflow from US

exchange-traded funds (ETFs) that invest directly in Bitcoin. On

Thursday, these funds recorded a historic outflow of $680 million,

ending a 15-day streak of inflows, according to data compiled by

Bloomberg. The heightened volatility in the crypto market follows a

rally that began after Donald Trump’s victory in the US

presidential election on November 5. Analysts from QCP

Capital have noted that positioning in the market had become

“overly bullish,” leaving digital assets susceptible to

fluctuations in the Federal Reserve’s tone regarding inflation

control. With the US Federal Reserve signaling a potential

slowdown in its easing measures with its chair’s Powell

announcement on Wednesday, the focus is shifting to the pace at

which traditional financial institutions adopt cryptocurrency.

Historical Patterns Suggest Potential Rebound For BTC’s Price

Hani Abuagla, a senior market analyst at XTB, stated in a recent

note that the interplay of monetary policy, institutional adoption,

and political developments suggests that Bitcoin will remain

sensitive to both macroeconomic and crypto-specific catalysts

through 2025. This sentiment is echoed by Chris Weston, head

of research at Pepperstone Group, who advised caution in the short

term. Weston noted that while a collapse in price is not imminent,

the momentum behind Bitcoin’s recent rally has diminished,

indicating a shift in market control. Related Reading: XRP, Solana

Among Altcoins Witnessing TD Buy Signal, Analyst Reveals Market

expert Lark Davis on the other hand, weighed in on the current

price action, reassuring investors that historical patterns could

suggest a rebound in the coming days. The expert referenced

December 2020, when Bitcoin experienced a 12% drop following a 77%

rally in the preceding months but then surged from $17,000 to

$41,000—a 136% increase—in just 23 days. Davis posits that a

similar scenario may be unfolding now, with Bitcoin facing a 13%

dip after a robust fourth quarter. While he acknowledges the

possibility of an additional 10-15% correction, he remains

optimistic about the potential for further upward movement in the

cryptocurrency market. Featured image from DALL-E, chart from

TradingView.com

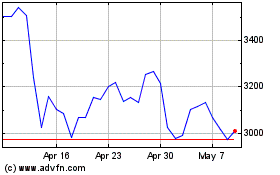

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024