Crypto Liquidations Cross $2.22 Billion, Here’s How Much Dogecoin Traders Lost

February 03 2025 - 8:00AM

NEWSBTC

The entire cryptocurrency market has experienced a steep decline

over the past 24 hours, with its total market cap plunging by

double digits following a barrage of volatile price swings.

Unsurprisingly, this sharp downturn has led to widespread

liquidations among multiple assets within the past trading day.

Notably, this wave of liquidations has led to over $2.22222 billion

being wiped from cryptocurrencies in the past 24 hours.

According to Coinglass data, Dogecoin traders have witnessed

significant losses, with numbers placing the meme coin among the

hardest-hit assets in this liquidation event. Dogecoin Traders Lose

Over $82 Million In 24 Hours Data from Coinglass reveals that

Dogecoin liquidations have been among the most severe in the market

over the past 24 hours, as leveraged positions crumbled under the

weight of rapid price swings. A closer look at the data shows that

the vast majority of these liquidations stemmed from long

positions, with bullish traders suffering losses amounting to

$69.32 million. These traders, mostly expecting a rally this week

or at least a stable market, were caught off guard as Dogecoin’s

price took a sharp turn downward alongside the rest of the market,

forcing liquidations and cascading losses. Related Reading:

70 Million DOGE Make Their Way To Binance Amid 10% Dogecoin Price

Crash Interestingly, despite the broader trend leaning toward a

price decline, short sellers were not spared from the liquidation

frenzy. Data shows that $13.35 million worth of short positions

were liquidated, suggesting that brief price spikes occurred during

the general downtrend. These momentary surges may have triggered

stop losses for some short traders, leading to forced liquidations

even as the overall trajectory remained bearish. Market-Wide

Liquidations Top $2.22 Billion Amid High Volatility The

cryptocurrency market has kicked off the new week on a bearish note

following a period of consolidation throughout the previous week.

Bitcoin, which had maintained relative stability, saw a sharp

decline as the weekend came to a close, breaking below the $100,000

mark on Sunday and continued to extend the downside move from

there. Related Reading: Crypto Fear And Greed Index Barrels Toward

Extreme Greed Again As Bitcoin Price Clears $101,000, Is This Good

News? Bitcoin’s decline triggered a broader market sell-off, with

several major cryptocurrencies following suit. At the time of

writing, the global crypto market cap has dropped by approximately

11% over the past 24 hours and is now at $3 trillion, its lowest

level since November 15, 2024. As such, the broader cryptocurrency

market has experienced a brutal shakeout in the past 24 hours, with

liquidations surpassing $2.22 billion. Bitcoin and Ethereum

traders have taken the biggest hits in this liquidation spree.

Bitcoin alone has recorded over $406.96 million in liquidated

positions, with the majority being long trades of $341.36 million

in the past 24 hours. However, Ethereum traders have experienced

the heaviest liquidations, with $601 million in positions wiped

out. With Dogecoin experiencing $82.67 million in liquidations, the

aftermath of this sell-off could set the stage for increased

volatility alongside other cryptocurrencies in the short term. At

the time of writing, Dogecoin is trading at $0.235, down by 22.5%

in the past 24 hours. Featured image from Adobe Stock, chart from

Tradingview.com

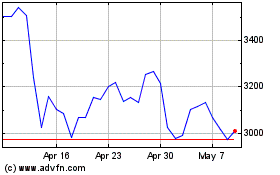

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025