4 Key Reasons Why The Bitcoin Bull Run Is Far From Over

May 20 2024 - 3:15AM

NEWSBTC

In an analysis shared via X, renowned crypto analyst Ted

(@tedtalksmacro) has provided compelling evidence to support his

assertion that the current Bitcoin bull run is far from over. Ted’s

insights are based on four critical indicators related to

traditional finance and crypto liquidity, each pointing to

sustained growth in the near future. Here’s a breakdown of his

analysis: #1 65-Month Liquidity Cycle Ted highlights the 65-month

liquidity cycle, a historical pattern that marks the ebb and flow

of liquidity in financial markets. According to his analysis, this

cycle bottomed out in October 2023, signaling the beginning of a

new expansion phase. Related Reading: Most Important Bitcoin

Indicator Nears Bullish Flip: $150,000 Soon? “We are now in the

expansion phase, which is expected to peak in 2026,” Ted stated.

This projection aligns with the anticipated easing by central banks

in response to slowing economic data over the next 18 to 24 months.

Historically, increased liquidity has been a precursor to bull

markets in various asset classes, including Bitcoin and the broader

crypto ecosystem. #2 M2 Money Supply The M2 money supply, which

includes cash, checking deposits, and easily convertible near

money, is another crucial indicator, if not the most important

indicator of global liquidity. Ted notes that the rate of expansion

in the M2 money supply is at its lowest since the 1990s. “There is

plenty of room to the upside for easing liquidity conditions,” he

explained. As central banks potentially ease monetary policies to

stimulate economies, increased M2 growth could lead to more capital

flowing into risk assets like Bitcoin. #3 Crypto Liquidity While

liquidity has returned to the crypto markets, particularly with the

introduction of spot Bitcoin ETFs, Ted points out that the velocity

of inflows has not yet reached the levels seen at cycle tops. “The

velocity of inflow has not yet seen a manic phase consistent with

cycle tops,” he noted. Related Reading: Tether Adds Fresh $1

Billion USDT To Supply – Bitcoin To Rally Again? This suggests that

while interest and investment in Bitcoin are growing, the market

has not yet reached the speculative frenzy that typically precedes

a major correction. This phase of measured inflow can provide a

more stable foundation for continued price increases. #4 Spot

Bitcoin ETF Flows The US based spot Bitcoin ETFs have seen

significant inflows, with last week alone witnessing $950 million

flowing into spot Bitcoin ETFs in the US, the largest net inflow

since March. Ted expects these inflows to increase as Bitcoin’s

price rises and traditional finance investors regain confidence in

the asset. “Expect these to only increase as price drifts higher

and tradFi once again renew faith in the asset,” he stated. The

growing acceptance and investment from institutional investors via

ETFs are a strong bullish indicator for Bitcoin’s continued ascent.

Each of these factors points to a sustained and robust bull market

for Bitcoin. Ted’s analysis, grounded in traditional financial

indicators and crypto-specific data, provides a comprehensive

outlook on the current and future state of the Bitcoin market. As

central banks potentially ease monetary policies and institutional

interest continues to grow, the conditions appear ripe for

Bitcoin’s bull run to extend well into the coming years. At press

time, BTC traded at $66,602. Featured image created with DALL·E,

chart from TradingView.com

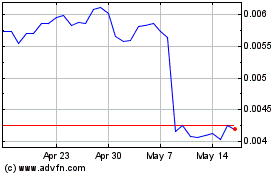

Four (COIN:FOURRUSD)

Historical Stock Chart

From May 2024 to Jun 2024

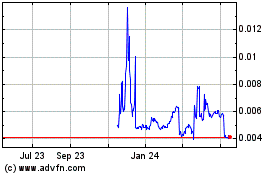

Four (COIN:FOURRUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024