Chainlink Sees 296% Jump In Large Transactions As Active Addresses Rise 14.7%, What’s Going On?

September 25 2024 - 9:30AM

NEWSBTC

Chainlink whales are once again on the move in what seems to be a

general reawakening. Large transactions on the blockchain network

have ballooned recently, alongside a drastic increase in active

addresses, hinting at a notable development. Therefore, in this

report, we take a look at the significant increase in whale

transactions and active addresses, as well as what could have

triggered this burst of interest on the previously muted

blockchain. Chainlink Whale Volumes Rises 295.93% According to data

from the IntoTheBlock website, Chainlink whales are getting active

again after a previous drop in activity. This time around, whale

transactions consisting of LINK tokens with values of at least

$100,000 and above, have seen a notable increase. Related Reading:

Bitcoin Prediction: Crypto Pundit Reveals Why $100,000 Is The

Nominal Price Level For 2025 On September 22, the number of large

Chainlink transactions recorded was only 65, but by September 23,

this number had risen to 130. This translates to a 100% increase in

the number of transactions. In the same vein, the amount of tokens

transacted also surged, but to a larger degree. Data shows that

only 1.86 million LINK tokens were moved by Chainlink whales on

September 22. However, this figure rose to 7.28 million tokens by

September 23. In dollar terms, Chainlink whales moved $20.71

million on September 22 and $82.01 million on September 23. The

total growth during this time came out to 295.93%. Daily active

addresses also saw a significant increase on the network, although

to a lesser degree compared to the whale volumes. Active addresses

rose from 1,810 addresses to 2,070 addresses, representing a 14.72%

increase. This rise in active addressees, coupled with the increase

in whale transactions, suggests that attention is, once again,

turning to the Chainlink network. What’s Driving The Recovery? So

far, one notable development seems to be the driving force behind

the Chainlink recovery and it has to do with the 21.co Bitcoin

wrapper. The company announced that it was adopting the Chainlink

Proof of Reserves mechanism for its 21BTC token, which is a wrapped

version of Bitcoin that was made available on the Solana blockchain

in May 2024. Related Reading: Shiba Inu Symmetrical Triangle

Pattern Reappears, Why A 200% Rally Is Possible This move was to

enable the company ensure completely transparency with 21BTC, while

also tapping into the decentralization, programmability, and

investor confidence that already exists in the Chainlink Proof of

Reserves program. This will span across the 21BTC offering on both

the Solana and Ethereum blockchains. As expected, the news was

well-received by the community, triggering more active

participation from investors. However, it has not had much of an

impact on the LINK price, which continues to tread around the $11

level. The altcoin’s is seeing around 5% gains in the last week,

meaning only small gains were recorded as a result of the

announcement. Featured image created with Dall.E, chart from

Tradingview.com

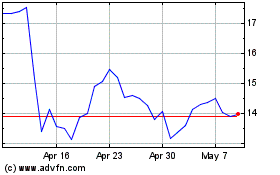

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024