Why Is The Bitcoin Price Falling Today?

May 07 2024 - 7:00AM

NEWSBTC

Bitcoin (BTC) has experienced a price slowdown, having recently

recovered above $60,000. This tepid price movement is believed to

be due to a couple of factors, including the reduced demand for the

Spot Bitcoin ETFs. Spot Bitcoin ETFs Have Lost Their Spark

The Spot Bitcoin ETFs recorded billions of dollars in net inflows

in the first three months of launch. This contributed to the

significant rally that Bitcoin recorded right around when the funds

were approved, with the flagship crypto rising to a new all-time

high (ATH) in March. However, demand for these funds has declined

since the start of this month. Related Reading: Crypto

Analyst Says Cardano Bloodbath Far From Over, Sets Bottom Price For

ADA Research firm Kaiko also noted in its recent report that net

inflows across all ETFs have steadily dropped for a while now. This

has ultimately affected Bitcoin’s bullish momentum, with the

flagship crypto trading sideways. Bitcoin’s price performance in

the last 24 hours suggests that the recovery above $60,000 wasn’t

necessarily a bullish reversal. Andrey Stoychev, Head of Prime

Brokerage at Nexo, had previously warned that Bitcoin was unlikely

to experience any significant price surge without a catalyst. He

added that the crypto token would likely continue to trade around

the $67,000 price range. That means one can expect Bitcoin to keep

bouncing off the support and resistance in the meantime. The

silver lining is that the demand in the Spot Bitcoin ETFs could

pick up soon enough, with these funds likely to provide a

much-needed boost to Bitcoin’s price when that happens. A trend

reversal for these ETFs looks imminent, especially after

Grayscale’s GBTC recorded its first day of net inflows on May

3. Another Reason Why Bitcoin’s Price Is Down Crypto analyst

Mikybull Crypto also recently predicted that Bitcoin could drop

below to clear the CME (Chicago Mercantile Exchange) gap at around

$62,580. This price gap exists because the CME’s Bitcoin futures

market doesn’t run on weekends. The crypto analyst added that

things could pick up once Bitcoin clears the CME gap. Related

Reading: Shiba Inu Price Prediction: Crypto Analyst Says Massive

Surge Is Coming, Here’s The Target The analyst also suggested that

the worst may be behind, irrespective of whether Bitcoin continues

to trade sideways, as he stated that the crypto token’s local

bottom is in. However, Mikybull Crypto also predicts that Bitcoin

will need to clear out the $67,000 price level and consolidate

before it can move towards $73,000. In anticipation of this

price surge, now looks to be an excellent time to accumulate the

flagship crypto as crypto analyst Ali Martinez mentioned that

Bitcoin’s Market Value to Realized Value (MVRV) 90-day ratio

indicates that it is still in a “prime buy zone.” At the time of

writing, Bitcoin is trading at around $63,400, down over 1% in the

last 24 hours, according to data from CoinMarketCap. BTC

price struggles to hold $64,000 | Source: BTCUSD on Tradingview.com

Featured image from Born2Invest, chart from Tradingview.com

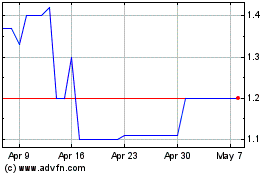

Nexo (COIN:NEXOUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nexo (COIN:NEXOUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025