Sui (SUI) Continues Downward Trend As Bears Maintain Control

May 28 2023 - 4:50AM

NEWSBTC

The crypto market once again experienced a sell-off this week,

leading to a plunge in the price of many crypto assets. The impact

of this market downturn is not limited to Bitcoin alone, as it has

affected various cryptocurrencies, including Sui (SUI), a Layer 1

smart contract platform. Sui has witnessed a significant decline of

15% in its value over the past seven days, reflecting the broader

negative sentiment prevailing in the market. Sui Dips Below $1

Support Levels SUI experienced a significant setback this week,

breaching its crucial support level at $1. This support had been

maintained since early May, providing stability for the token

during that period. However, after enduring two weeks of

downward-sloping resistance from above, SUI finally succumbed to

selling pressure. Related Reading: Shiba Inu Burn Rate Surges 1500%

In 24 Hours, Yet Price Continues To Struggle In Red The token’s

decline reached a low point of $0.95 on Wednesday, marking an

all-time low for SUI since its launch at the beginning of the

month. This sharp drop highlights the prevailing bearish sentiment

surrounding the token and its challenges in the current market

conditions. Technical Indicators Point To Potential Bearish Path

Sui, a layer 1 smart contract platform, distinguishes itself with

its unique programming language called ‘Move.’ Developed by the

lead executives of Meta’s now-defunct Diem stablecoin project, Sui

aims to address common pain points of first-generation blockchains,

such as scalability and programmability. Despite its innovative

approach, Sui has struggled to generate substantial gains since its

inception in the trading market. In the short term, the coin may

continue to experience lower lows. According to technical analysis

on TradingView, the current conditions indicate that asset selling

might be prudent. Seven of the 11 daily technical indicators are

signaling a ‘strong sell,’ with no indicators displaying buy

signals. Related Reading: Aptos Hackathon, Partnerships Set APT

Bulls Up For A Strong Run Additionally, the relative strength index

(RSI) for SUI is currently hovering slightly above 40. With the RSI

above 40, it suggests that there is a moderate level of buying

pressure, but the overall sentiment remains uncertain. To

counteract this bearish trend, Sui would need to reclaim the $1.05

level as support, which could provide a foothold for potential

recovery. However, if Bitcoin fails to maintain its support at

$26,000, Sui will likely face further downward pressure,

potentially sinking as low as $0.90. Given the current market

conditions and technical indicators, investors and traders should

exercise caution and closely monitor Sui’s performance. Evaluating

factors such as market sentiment, trading volume, and overall

market dynamics will be crucial in determining the future

trajectory of Sui and whether it can reverse its bearish trend. At

press time, SUI price was $0.987 $ with a 24-hour trading volume of

$89,278,135 USD. -Featured image from iStock, charts from

CoinMarket and TradingView.com

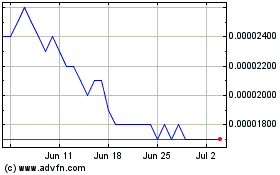

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025