Circle Strategic Defense: $1 Billion War Chest Shields Against Shrinking Market Share

August 10 2023 - 11:00PM

NEWSBTC

According to a Bloomberg report, Circle, a prominent player in the

stablecoin market, strategically leverages its substantial cash

reserves of over $1 billion to weather fresh competition from

non-crypto giants like PayPal. The company’s market share of

the second-largest stablecoin, USD Coin (USDC), has been declining,

mainly due to factors such as Binance’s decision to reduce its

usage of USDC. However, per the report, Circle remains

optimistic about the future of stablecoins and aims to stem the

decline while exploring new revenue streams and global expansion.

Circle Relies On $1 Billion Cash Cushion The circulation of

Circle’s USDC has witnessed a significant drop from $45 billion to

approximately $26 billion this year, while Tether, the leading

stablecoin, has experienced growth during the same period.

Related Reading: Whale Purchases $10 Million stETH In The past Day,

Here Are Possible Reasons Why Circle attributes part of this

decline to Binance’s reduced utilization of USDC to promote its

native token. Increasing competition from non-crypto companies like

PayPal further intensifies the challenges for Circle. The company’s

over $1 billion cash cushion provides a significant hedge against

market headwinds. The company generates revenue primarily from

interest income on assets backing the USDC, including dollar

deposits and short-term Treasuries. According to Bloomberg,

Circle’s strong financial performance is “evident,” with revenues

exceeding $779 million in the year’s first half. Adjusted

earnings before interest, taxes, depreciation, and amortization

(EBITDA) reached $219 million in the same period, exceeding the

2022 full-year figure of $150 million. Circle’s CEO Remains Bullish

On Stablecoins While acknowledging the impact of “tail-risk

events” on USDC adoption, Circle’s CEO, Jeremy Allaire, remains

optimistic about stablecoins’ mainstream potential. Allaire

believes that increasing competition, such as PayPal’s recent entry

into the market, will drive more financial services and internet

payment firms to embrace stablecoins. Circle is actively

pursuing partnerships to promote the broader adoption of USDC and

plans to enhance transparency by regularly sharing financial

reports. Moreover, the company has engaged Deloitte as its auditor.

Allaire anticipates that stablecoin issuers will face greater

scrutiny and regulatory standards in the coming years. With

regulators tightening control over stablecoins globally, he

predicts that entities unable to meet these standards will be

crowded out of the mainstream market. Related Reading: PEPE

Coin Makes Minor Gains With 3.5% Spike – Sign Of Recovery?

Nevertheless, Circle remains confident in its ability to adapt and

benefit from the evolving regulatory environment. Despite potential

interest rate declines, Circle expects increased crypto activity,

positioning the company for further growth. Circle is leveraging

its substantial cash reserves to navigate market challenges and

competition from non-crypto players. Despite declining market

share, Circle remains focused on expanding revenue streams,

promoting wider adoption of USDC, and embracing transparent

financial reporting. With the regulatory landscape evolving,

Circle aims to meet the highest standards and thrive in the

stablecoin market, positioning itself for long-term success.

Conversely, USDC currently boasts a market capitalization of

approximately $26.17 billion, securing its place as the

sixth-largest cryptocurrency by market cap, according to

CoinMarketCap data. This figure represents a minute 0.37% of

the total cryptocurrency market, indicating the stablecoin’s steady

performance despite the highly dynamic nature of the crypto space.

With a circulating supply of 26.17 billion USDC tokens, the

stablecoin has established a robust presence in the market.

Furthermore, USDC’s trading volume has surged, reaching an

impressive $3.03 billion in the past 24 hours. This substantial

trading activity positions USDC as the fourth most actively traded

cryptocurrency, evidencing its liquidity and attractiveness to

market participants. The 24-hour trading volume to market cap

ratio stands at 11.59%, reflecting the strong liquidity and market

depth of USDC, which further contributes to its stability and

utility. Featured image from Unsplash, chart from TradingView.com

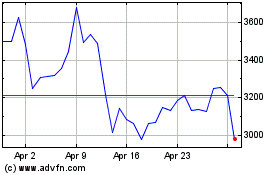

stETH (COIN:STETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024