SUI Flashes Overbought Warning, Will A Price Correction Follow?

December 06 2024 - 8:00PM

NEWSBTC

SUI has been on an impressive upward trajectory, but signs of

potential exhaustion are beginning to emerge. Key technical

indicators now suggest the cryptocurrency has entered overbought

territory, sparking speculation about whether a pullback could be

on the horizon. While the recent rally reflects strong bullish

momentum, the market may be approaching a critical juncture. Can

SUI maintain its upward streak, or is a price correction

inevitable? As of writing, SUI has surged over 10%, reaching

a price of $4.23 in the past 24 hours. This movement has boosted

its market capitalization to over $12 billion, with trading volume

exceeding $5.5 billion, indicating strong investor interest and

market activity. Technical Analysis: Indicators Hint At

Overbought Conditions SUI’s price on the 4-hour chart is beginning

to exhibit bearish signals, with a noticeable decline toward the $4

support level and the 100-day Simple Moving Average (SMA). This

downward movement is underscored by the formation of a bearish

candlestick, suggesting growing selling pressure in the market. A

sustained drop below these levels could signal a broader trend

reversal, making this a pivotal moment for its price action.

Additionally, the 4-hour Composite Trend Oscillator for SUI is

flashing an overbought condition, highlighting the asset’s recent

robust upside pressure. Typically, an overbought reading suggests

that the price has risen rapidly within a short period, potentially

leading to market exhaustion as buyers begin to lose strength.

Related Reading: SUI In Bear Territory: RSI Drop Suggests Further

Downside Risk This condition often serves as a cautionary signal

for traders, indicating the possibility of a price correction or a

consolidation phase as the market seeks to regain equilibrium. If

the overbought pressure persists, SUI could face challenges

maintaining its current levels. Key Support Levels To Watch If A

Pullback Occurs If SUI experiences a pullback, monitoring critical

support levels that could provide stability is essential.

Presently, the $4 mark stands out as a key level, reinforced by its

alignment with the 100-day SMA. A dip below this support might

trigger further declines, with support zones near $3.75 and $3.50

acting as potential cushions. These levels are crucial in

determining whether the pullback will be temporary or evolve into a

more extended bearish phase. Related Reading: SUI To Face Another

Pullback Following 5.3% Dip, Analysts Forecast 30% Correction

However, If the bulls manage to trigger a comeback at the $4

support level, it could mark the beginning of a renewed rally for

SUI toward $4.50 and beyond, implying that buyers are regaining

control. Featured image from YouTube, chart from Tradingview.com

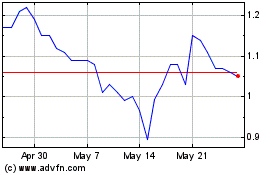

SUI Network (COIN:SUIUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

SUI Network (COIN:SUIUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024