SUI Price Stability At $3.5 Signals Room For More Growth, $4 Mark Imminent?

November 19 2024 - 9:30AM

NEWSBTC

Despite market fluctuations, SUI has demonstrated remarkable

stability, holding steady above the critical $3.5 support level.

This steady performance reflects underlying bullish momentum, as

buyers continue to defend this key zone, boosting confidence in the

asset’s upward potential. With strong support intact, SUI appears

well-positioned to target higher resistance levels, sparking

optimism for further gains. This analysis aims to explore SUI’s

ability to stay above the $3.5 level and assess its implications

for future price movements. By examining key technical indicators

and resistance zones, this piece seeks to provide insights into

whether SUI can sustain its bullish strength or if market pressures

could trigger a shift in its trajectory. What SUI Stability Above

$3.5 Means For Bulls SUI is showcasing renewed bullish strength as

it maintains a firm position above the critical $3.5 support level.

This stability highlights growing buying interest and market

confidence, paving the way for a possible move toward the $4 mark.

Its ability to hold above this key level and the 4-hour Simple

Moving Average (SMA) reinforces the asset’s upward momentum, and

positions SUI for further gains if positive sentiment persists. An

analysis of the 4-hour Relative Strength Index (RSI) analysis shows

a rebound from 51%, rising toward and above the 60% level,

indicating a renewed optimistic outlook. If the RSI continues to

rise above 60%, it would confirm the positive trend, boosting the

potential for more price growth. Related Reading: SUI Eyes

Potential Breakout Amid Market Retrace, Is $2.3 Next? Additionally,

SUI shows significant upward movement on the daily chart, marked by

the formation of a bullish candlestick as it moves toward the $4

mark. Trading above the crucial 100-day SMA reinforces the positive

trend, indicating sustained strength. As SUI continues to climb, it

bolsters market confidence, setting the stage for growth. With

upside pressure brewing, the next key target to watch out for is

the $4 resistance level, which could determine whether the bullish

move extends. The daily chart’s RSI has increased to 80%, signaling

strong positive sentiment with sustained buying pressure. While the

asset remains in an overbought territory, it shows no signs of

weakening. If the momentum continues, further price gains are

possible, though one should be cautious, as prolonged overbought

conditions could lead to a correction if buying pressure decreases.

Potential Scenarios: Upside Targets And Risks To Watch SUI’s

current stability above the $3.5 support level indicates potential

for continued upside. Should buying pressure persist, the next key

target lies at $4, where bullish interest could be triggered,

leading to new price highs. Related Reading: Can SUI Reach $2.18?

Bullish Pressure Builds Toward Key Milestone However, if resistance

at $4 proves challenging to break through, consolidation or a minor

decline may occur, possibly causing the price to retreat toward the

$3.5 support level. A break below this level could result in

additional losses, with the next key support target being around

$2.8, followed by other support areas below. Featured image from

YouTube, chart from Tradingview.com

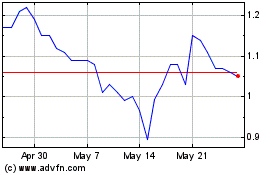

SUI Network (COIN:SUIUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

SUI Network (COIN:SUIUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024