Bitcoin Poised for a 200% Rally as Analyst Spot Rare Bullish Pattern

August 23 2024 - 4:00PM

NEWSBTC

Amid Bitcoin’s current gradual recovery in price, attention has

been drawn towards the asset as it prepares to be on the verge of

closing its seventh consecutive monthly candle above the all-time

high (ATH) of 2021. Renowned crypto analyst Moustache recently took

to X to highlight this key milestone, emphasizing the importance of

higher timeframes in trading. According to Moustache, the fact that

Bitcoin is holding above its previous ATH every month is a strong

indicator of support, which could signal continued upward momentum

shortly. Related Reading: Top Economist Predicts Bitcoin Price Top

Before Worst Recession Since 1929 Is Bitcoin Building Momentum For

A Big Move? Mustache’s analysis noted, “Can everyone see what’s

happening here? BTC is about to close its SEVENTH monthly candle

above the ATH of 2021. The higher the timeframe, the stronger the

support. That’s bullish [to be honest].” This statement highlights

the significance of long-term support levels in his BTC outlook.

Notably, in trading, when an asset consistently closes above a

previous peak on higher timeframes, it often indicates that the

market is forming a solid foundation for future growth. This

observation is particularly relevant for Bitcoin, which has

historically exhibited strong price movements following extended

periods of consolidation and support-building. While Bitcoin’s

sustained support above its previous ATH is a positive sign,

another technical indicator also highlighted by the same analysts:

the Bollinger Band Width Percentile (BBWP). BBWP Indicator Signals

200% Rally Ahead In a recent post, Moustache pointed out that the

BBWP on Bitcoin’s 2-week (2W) chart signals the emergence of blue

bars, a rare occurrence only seen once in Bitcoin’s history. The

BBWP is a tool used in technical analysis to measure the width of

the Bollinger Bands, which are volatility indicators that reflect

the range of an asset’s price movement. The blue bars in the BBWP

indicate a period of low volatility, which often precedes

significant price swings. Moustache explained the implications of

this signal, disclosing that the last time the BBWP signaled

multiple blue bars on the 2W-Chart of BTC, BTC saw almost a 200%

upward move. “Incidentally, this is only the second time we’ve seen

blue bars in the BBWP. This has never happened before in history,”

Moustache noted. This observation suggests that Bitcoin could be on

the cusp of a major price movement, with the potential for

significant gains if the historical pattern holds. Related Reading:

Bitcoin And NASDAQ Show Tight Correlation: What Does This Mean For

BTC? Notably, the BBWP’s indication of low volatility aligns with

the concept that markets often experience a surge in price action

following periods of calm. In Bitcoin’s case, the current

environment of subdued volatility, as indicated by the blue bars,

may be setting the stage for a significant price breakout. Featured

image created with DALL-E, Chart from TradingView

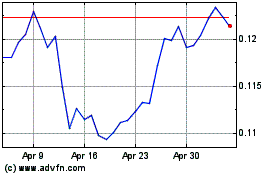

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024