XRP Spikes 5% After SEC’s ETF Acknowledgment Sends ‘Enormous Message’

February 14 2025 - 5:00AM

NEWSBTC

The US Securities and Exchange Commission (SEC) has officially

acknowledged the receipt of Grayscale Investments’ 19b-4 filing to

convert its XRP Trust into a spot exchange-traded fund (ETF). The

agency’s confirmation—disclosed by Bloomberg ETF analyst James

Seyffart on 14th February—signals the start of the formal review

process that could ultimately decide whether the product is cleared

for public listing. James Seyffart, who reported the news via his X

account, stated: “There it is — The SEC just acknowledged Grayscale

& NYSE’s 19b-4 filing to list an XRP ETF (this was mostly

expected but officially means the clock will start soon for this

and Dogecoin).” Why This Is An ‘Enormous Message’ For Ripple The

SEC’s acknowledgment kicks off a regulatory timetable, opening a

window for public commentary and multiple rounds of

decision-making. The agency is expected to follow this step-by-step

procedure to either approve, reject, or request additional

information concerning the proposed XRP ETF. Related Reading:

Pundit Sounds Major Crash Alarm For XRP Price As ’12-Year Cycle’

Comes To An End Although formal acknowledgment does not guarantee

an approval further down the line, it underscores that the SEC is

sufficiently engaged to put the filing on the official docket. Nate

Geraci, President of the ETF Store and Co-Founder of the ETF

Institute, underlined the significance of this action in the

context of the SEC’s ongoing legal dispute with Ripple. He

remarked: “SEC has acknowledged NYSE’s 19b-4 filing to list &

trade Grayscale XRP ETF… Obviously a potentially huge statement re:

SEC’s case vs Ripple.” Geraci further elaborated on what he

perceives as a remarkable development: “Shocked more people aren’t

talking about SEC accepting XRP ETF filing… They have open

litigation w/ Ripple. Meanwhile, they just acknowledged filing of

ETF holding asset in dispute (they easily could have rejected this

filing). Enormous message IMO.” Related Reading: Massive XRP

Accumulation – Whales Bought 520 Million XRP During Market Dip

These statements highlight how the SEC’s willingness to initiate

the review process—rather than dismissing it outright—could

indicate the SEC’s openness to settle or drop the Ripple case which

is currently at the Court of Appeals. Fox Business journalist

Eleanor Terrett provided additional context on why the

acknowledgment alone is noteworthy: “Because it means this SEC is

being more open-minded and not flat out refusing to consider these

products. Recall, exchanges pulled the SOL 19b-4 applications in

December when the Gensler SEC signaled it would not engage with

them. […] Next up, the SEC should acknowledge the XRP ETF

applications from issuers that filed later than Grayscale —

including Bitwise, 21Shares, Canary Funds, Wisdom Tree. The 240-day

window for Grayscale’s approval starts when it gets posted to the

federal register which should be in a couple of days from now.”

Following the announcement, XRP’s price rose by over 5% in a

relatively muted overall market. However, technical analysis of the

XRP/USDT 4-hour chart indicates that as of press time, the token

failed to break through a major resistance level. The rejection

occurred at the 0.5 Fibonacci retracement (Fib) around $2.58. If

buyers manage to push XRP above this threshold, the next critical

resistance is near $2.77 (the 0.618 Fib). A sustained rally beyond

that point could see the token retest its January 25 high at $3.40.

Featured image created with DALL.E, chart from TradingView.com

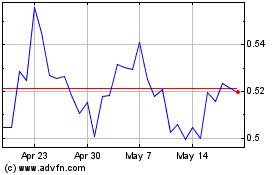

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025