COIL: IMPROVED RESULTS FOR THE FIRST HALF OF 2024

PRESS RELEASE

Brussels, 31 October 2024 (17.45) |

World leader in aluminium anodising |

IMPROVED RESULTS FOR THE FIRST HALF OF

2024

- Sales and license revenues: €13.1M

(+11.3%)

- EBITDA: €2.0M (compared to €0M), with a margin of

15.5%

- Operating income: €0.7M, an improvement of

+€1.4M

- Net income: €0.5M, with a margin of 3.4%

- Net financial debt reduced to 15.5% of equity at June

30, 2024

- COIL demonstrates its ability to develop its business

model and enhance profitability despite uncertain economic

conditions

COIL, world leader in aluminium anodising,

has released its results for the first half of the 2024 financial

year.

Implementation of a strategic agreement in

China

In February 2024, COIL signed a collaboration

and licensing agreement with a Chinese company to leverage its

advanced technology in the People's Republic of China and Eastern

Asia. The agreement includes the establishment of a new factory in

Fuzhou, Jiangxi province, equipped with a state-of-the-art

continuous anodising line for the architectural market.

COIL will provide technical expertise and

engineering support for the construction of the production line,

while the Chinese company will be responsible for all purchases

related to the construction of this line. In addition, COIL has

granted an exclusive and permanent license to the Chinese company

for the use of its technology and brands in China, Southeast Asia,

and Northeast Asia. In return, COIL will receive upfront and

milestone payments, as well as royalties on future sales. Initial

upfront payments (€2.0M) were received during the first half of the

year, and COIL will also take a 5% stake in the Chinese

company.

This strategic agreement in China represents a

key lever for COIL's development, creating long-term value while

opening up new opportunities in the Asian market.

Solid growth despite challenging market

conditions

Despite a global economic slowdown and declining

demand in key markets, COIL recorded an 11.3% increase in business

revenues in the first half of 2024. This performance was driven by

a positive trend in tolling sales and the initial royalties from

the collaboration and licensing agreement in China.

Tolling activities (83% of first-half 2024

sales) picked up in the second quarter, boosted by a major order

for a rolling mill, which offset the sluggish start to the year

still impacted by the slowdown in 2023. Over the half-year, tolling

sales were nearly stable at €9.2M. After a long period of

destocking in the distribution chain, these sales are expected to

continue to recover against a backdrop of rising aluminium prices,

prompting distributors to restock.

Packaged sales, including metal (17% of

first-half 2024 sales), were €1.9M, down 23.0% due to the slowdown

in demand in the European market.

Licensing revenues from the collaboration

agreement in China have already generated €2.0M in royalties during

the half-year, with further payments of €2.0M expected in the

coming months. This agreement is therefore expected to generate a

total of €4.0M in non-recurring revenues over the 2024 and 2025

financial years.

The financial statements for the half-year show

a clear improvement compared to the first half of 2023. The Company

succeeded in mitigating the impact of the low level of tolling

activities by focusing production on a limited number of lines,

both at its Landen site in Belgium and its Bernburg site in

Germany. Growth in revenues, driven by the initial royalties in

China and a more favourable revenue mix, also had a significant

effect on the Company's profitability.

EBITDA came to €2.0M, a significant improvement

compared to the nearly breakeven level in the first half of 2023.

This change was mainly driven by an increase in gross margin and a

reduction in operating expenses.

After a €0.1M reduction in provisions and

depreciation, operating income stood at €0.7M, up €1.4M

year-on-year, representing an operating margin of 5.7%.

Taking into account net financial expenses of

€0.1M and taxes of €0.2M, net income reached €0.5M, compared with a

loss of (€0.1)M. It's worth noting that the results for the first

half of 2023 were positively impacted by €1.5M in non-recurring

items.

Overall, despite a highly uncertain economic

climate, COIL has demonstrated its ability to develop its business

model and enhance profitability.

- Simplified income

statement

|

(€M) |

2024 H1

(6 months) |

2023 H1

(6 months) |

Change |

2023

(12 months) |

|

Sales and license revenues |

13.1 |

11.8 |

+11.3% |

21.8 |

|

Tolling sales |

9.2 |

9.3 |

-0.9% |

17.4 |

|

Package

sales1 |

1.9 |

2.5 |

-23.0% |

4.4 |

|

Licensing & Royalties |

2.0 |

- |

n.a. |

- |

|

EBITDA |

2.0 |

0.0 |

+€2.0m |

0.6 |

|

% of sales and revenues |

15.5% |

0.1% |

|

2.6% |

|

Recurring operating profit |

0.7 |

(1.4) |

+€2.2m |

(2.1) |

|

% of sales and revenues |

5.7% |

(11.9)% |

|

(9.8)% |

|

Operating profit |

0.7 |

(0.7) |

+€1.4m |

(2.7) |

|

% of sales and revenues |

5.7% |

(5.6)% |

|

(12.3)% |

|

Income before tax |

0.6 |

(0.1) |

+€0.7m |

(2.2) |

|

Net income |

0.5 |

(0.1) |

+€0.6m |

(2.2) |

|

% of sales and revenues |

3.4% |

(0.9)% |

|

(10.2)% |

After taking into account profit for the

half-year, shareholders' equity at 30 June 2024 was €21.8M, up

€0.5M compared to 31 December 2023. Net financial debt at 30 June

2024 was €3.4M, down €1.8M from the end of 2023, representing 15.5%

of equity, compared to 24.3% at 31 December 2023.

Sales for the third quarter of 2024 totaled

€5.2M, down slightly by 0.8% year-on-year. This reflects an

increase in tolling sales to €4.4M (+3.4%), while packaged sales

came to €0.9M (-17.6%). No royalties were received in China during

this quarter.

For the first nine months of the year, sales and

license revenues came to €18.4M, up 7.6% compared with the same

period in 2023. Tolling sales increased by +0.5% to €13.6M, while

packaged sales fell by -21.4% to €2.8M. License revenues from the

strategic agreement in China amounted to €2.0M over the period.

The Company aims to replicate its success in

continuous anodising in the Asian market, where demand for anodised

aluminium remains strong, by leveraging a competitive and

value-creating business model. In Europe, the Company remains

cautious in view of macroeconomic challenges and volatile demand.

With its flexible industrial resources, the company is ready to

quickly react to any sustained market upturn.

By leveraging its technological and commercial

assets and diversifying its positions in mature and emerging

markets, the Company is confident in its development prospects,

capitalising on its broad portfolio of premium, sustainable

products with a smaller carbon footprint to boost its business

potential and seize future opportunities.

The financial statements were approved by the

Board of Directors on 30 October 2024. They are included in the

half-yearly financial report for 2024 available on the Company's

financial website. (http://investors.coil.be).

2024 annual sales figures will be published on 4

February 2025 after the close of trading.

About COIL

COIL is the world's leading anodiser in the

building and industrial sectors and trades under the ALOXIDE brand

name.

Anodising is an electrochemical process

(electrolysis) which develops a natural, protective oxide layer on

the surface of aluminium and can be coloured in a range of UV-proof

finishes. It gives the metal excellent resistance to corrosion

and/or reinforces its functional qualities. Anodising preserves all

the natural and ecological properties of aluminium; it retains its

high rigidity and excellent strength-to-weight ratio, its

non-magnetic properties, its exceptional resistance to corrosion.

The metal remains totally and repeatedly recyclable through simple

re-melting. Anodised aluminium is used in a wide variety of

industries and applications: architecture, design, manufacturing,

and the automotive sector.

COIL deploys an industrial model that creates

value by leveraging its unique know-how, its operational

excellence, the quality of its investments and the expertise of its

people. COIL has around 110 employees in Belgium and Germany and

has recently broadened its business model with the signing of

license agreement accelerating the diffusion of its technology in

Asia. The Company generated a turnover of €21,8 million in

2023.

Listed on Euronext Growth Paris | Isin:

BE0160342011 | Reuters: ALCOI.PA | Bloomberg: ALCOI: FP

For more information, please visit

www.aloxide.com

Contact

COIL

Tim Hutton | Chief Executive Officer

tim.hutton@coil.be | Tel.: +32 (0)11 88 01 88 |

CALYPTUS

Cyril Combe

cyril.combe@calyptus.net | Tel.: +33 (0)1 53 65 68 68 |

1 Anodising and metal included.

- COILpressrelease31oct2024_EN

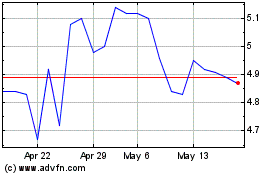

COIL (EU:ALCOI)

Historical Stock Chart

From Feb 2025 to Mar 2025

COIL (EU:ALCOI)

Historical Stock Chart

From Mar 2024 to Mar 2025