Ecoslops : 2023 annual results

Paris, Avril 18, 2024, 7:30 pm - Ecoslops, the

cleantech company that brings oil into the circular economy,

announces its results for the year ended December 31, 2023, as

approved by the Board of Directors at its meeting on April 18,

2024.

- Disposal of Ecoslops Provence, enabling refocusing on

profitable, forward-looking activities

- EBITDA 2023 breakeven on activities retained by the

Group

- ISCC PLUS certification obtained for Ecoslops

Portugal

Highlights of the 2023 financial year

- Disposal of Ecoslops Provence in progress at year-end and

finalized on February 29, 2024 as previously announced. As a

result, the Group's consolidated net result has been heavily

impacted by the now non-recurring Ecoslops Provence-related costs

of €5.5M€.

- Satisfactory results in Portugal, with an EBITDA of 2.4M€,

despite lower business volumes and oil prices than in 2022.

- Group refocused on Ecoslops Portugal and the development of the

Scarabox®, profitable and growth-generating activities

- Savings plan in place for support functions to adjust to the

new scope (-20%, i.e. -0.5M€)

Consolidated income statement 2023 (in M€) - Analytical

presentation(Based on audited financial statements, reports in

progress)

Considering the disposal of Ecoslops Provence,

the analytical presentation of the consolidated income statement

below takes into account the Group's new scope and isolates the

non-recurring impact of costs relating to Ecoslops Provence and its

disposal, amounting to (5.5)M€, namely:

|

|

2022 |

2023 |

|

Annual loss Ecoslops Provence |

(2,2) |

(2,9) |

|

Provision for deconsolidation |

|

(1,8) |

|

Restructuring fees |

|

(0,7) |

|

Total |

(2,2) |

(5,5) |

|

|

|

31/12/2022 |

|

31/12/2023 |

|

Variation |

| |

|

|

|

|

|

|

|

Refined products (P2R) |

|

12,3 |

|

7,9 |

|

-4,4 |

|

Scarabox |

|

0,3 |

|

0,0 |

|

-0,3 |

|

Port services & others |

|

2,1 |

|

2,4 |

|

0,3 |

|

Total Turnover |

|

14,7 |

|

10,3 |

|

-4,5 |

|

|

|

|

|

|

|

|

|

Gross Margin |

|

9,0 |

|

7,0 |

|

-2,1 |

|

Gross Margin rate |

|

61% |

|

68% |

|

|

| |

|

|

|

|

|

|

|

Personnel expenses |

|

-3,3 |

|

-3,1 |

|

0,2 |

|

Other expenses |

|

-3,7 |

|

-3,8 |

|

-0,1 |

|

Taxes |

|

-0,1 |

|

-0,2 |

|

-0,1 |

| |

|

|

|

|

|

|

|

EBITDA |

|

2,0 |

|

-0,1 |

|

-2,1 |

| |

|

|

|

|

|

|

|

Depreciation / Provision |

|

-1,4 |

|

-1,5 |

|

-0,1 |

| |

|

|

|

|

|

|

|

Financial result |

|

-1,1 |

|

-1,3 |

|

-0,2 |

| |

|

|

|

|

|

|

|

Corporate tax |

|

0,4 |

|

0,3 |

|

-0,1 |

| |

|

|

|

|

|

|

|

Result before Restructuring / E. Provence |

|

-0,2 |

|

-2,6 |

|

-2,4 |

| |

|

|

|

|

|

|

|

Result linked to Ecoslops Provence |

|

-2,2 |

|

-4,8 |

|

-2,6 |

|

Restructuring costs |

|

0,0 |

|

-0,7 |

|

-0,7 |

| |

|

|

|

|

|

|

|

Net result |

|

-2,4 |

|

-8,0 |

|

-5,7 |

|

Net result - Part for the Group |

|

-1,7 |

|

-7,3 |

|

-5,6 |

Ecoslops Portugal's sales fell by 28%, from

14.4M€ in 2022 to 10.3M€in 2023. The Port Services business grew by

14%, to 2.4M€, while the Refined Products business recorded a drop

in sales, from 12.3M€ in 2022 to 7.9M€ in 2023. This decline can be

broken down into: -20% due to the volume effect, -19% due to the

price effect (the average Brent price having fallen from €94/bbl in

2022 to €76/bbl in 2023) and +3% due to the product mix. Over the

period, the unit produced 20,071 tonnes of refined products,

compared with 24,509 tonnes in 2022, and sold 17,693 tonnes,

compared with 22,165 tonnes the previous year. This drop in volume

is essentially attributable to a shortage of inputs compared with

2022.

Gross margin rose from 61% to 68%. This increase

is due in part to the Refined Products business, whose margin rate

rose from 60% to 61%, and in part to the business mix, with the

share of port services in sales rising sharply.

As a result, gross margin stands at 7M€, down

2.1M€ on 2022.

Despite the inflationary context, the Group has

contained its operating expenses. All indirect costs (personnel,

rent, service providers, etc.) have been the subject of a savings

plan that will result in a reduction of (0.5)M€ between 2022 and

2024.

Based on the Group's new scope, EBITDA is close

to breakeven, at (0.1)M€, down by 2.1M€ compared to 2022, entirely

due to the decrease in gross margin.

Net financial expense was a negative 1.3M€. This

mainly comprises 1M€ of interest expense on the EIB loan.

Corporate income tax amounted to 0.3M€, mainly

comprising the research tax credit.

Consolidated balance sheet at December 31, 2023 (in

M€)

(Based on audited financial statements, reports

in progress)As the contract for the sale of Ecoslops Provence was

signed before year end, and its closing before the accounts’

approval by the Board of Directors, the contribution of Ecoslops

Provence to the consolidated balance sheet is presented in the 2023

financial statements on a single, separate line "Net assets

Ecoslops Provence".This has a major impact on balance sheet

variations:

|

|

31/12/2022 |

31/12/2023 |

Var. M€ |

|

Intangible assets |

1,1 |

0,9 |

(0,2) |

|

Tangible assets |

33,2 |

12,0 |

(21,2) |

|

Financial assets |

0,8 |

2,4 |

1,6 |

|

Fixed assets |

35,1 |

15,3 |

(19,8) |

|

Inventory |

1,3 |

1,6 |

0,3 |

|

Trade receivables |

4,0 |

1,6 |

(2,4) |

|

Other receivables |

1,7 |

1,1 |

(0,6) |

|

Deferred tax asset |

1,5 |

1,5 |

(0,0) |

|

Cash and cash equivalent |

6,9 |

3,2 |

(3,7) |

|

Prepaid expenses |

0,9 |

0,7 |

(0,2) |

|

Current assets |

16,3 |

9,7 |

(6,6) |

|

Net asset Ecoslops Provence |

|

9,1 |

9,1 |

|

Total Assets |

51,4 |

34,1 |

(17,3) |

| |

|

|

|

| |

31/12/2022 |

31/12/2023 |

Var. M€ |

|

Capital & Reserves |

16,0 |

14,2 |

(1,8) |

|

Investing subsidy |

1,5 |

1,4 |

(0,1) |

|

Minority shareholders |

(0,1) |

(0,8) |

(0,7) |

|

Net result - Part for the Group |

(1,8) |

(7,3) |

(5,5) |

|

Equity |

15,6 |

7,5 |

(8,1) |

|

Conditional advance |

0,8 |

0,8 |

0,0 |

|

Prov. for Risks & Charges |

0,1 |

1,9 |

1,8 |

|

Financial debt |

29,2 |

20,6 |

(8,6) |

|

Trade payables |

4,0 |

2,0 |

(2,0) |

|

Social and tax liabilities |

1,0 |

0,5 |

(0,5) |

|

Other payables |

0,7 |

0,7 |

0,0 |

|

Current liabilities |

5,7 |

3,2 |

(2,5) |

|

Total Liability & Equity |

51,4 |

34,1 |

(17,3) |

Fixed assets fell by 19.8M€, comprising 20.4M€

due to the sale of Ecoslops Provence, 1.3M€ for depreciation and

amortization, 0.4M€ for capital expenditure, and 1.6M€ for the

reclassification of the receivable from Valtech Energy (previously

classified under trade receivables and now under non-current

financial assets).Current assets, excluding cash and cash

equivalents, fell by 2.9M€, of which 1.3M€ related to the sale of

Ecoslops Provence and 1.6M€ to the reclassification of the

receivable from Valtech Energy as a financial fixed asset.As

indicated above, a provision for contingencies and charges of 1.8M€

has been booked to cover the impact of Ecoslops Provence's exit

from the scope of consolidation, set for January 1, 2024.Financial

debts amounted €20.6M€, down by 8.6M€ compared with 2022. This

reduction is due, on the one hand, to accrued interest on European

Investment Bank ("EIB") debt (+0.9M€) and, on the other hand, to

the sale of Ecoslops Provence (9.5M€), all debt being taken over by

the buyer as part of this sale.As the Group's scope and profile

have been significantly impacted by the sale of Ecoslops Provence,

Ecoslops SA and the EIB have entered into discussions to amend the

terms and conditions of the existing financial agreements, taking

into account the Group's updated cash flow generation capacities.

As a reminder, 8M€ of the 10M€ granted by the EIB were dedicated to

finance Ecoslops Provence, a business sold at the beginning of

2024.Finally, current liabilities decreased by 2.5M€, of which

3.0M€ is attributable to the disposal of Ecoslops Provence and

+0.5M€ to the increase in trade payables.

Financial position and cashflows

At December 31, 2023, the Group had nearly 3.2M€

in cash, of which 2.4M€ was available (taking into account a 0.8M€

conditional advance on investment grants), and net debt of 18.2M€

(vs. 23.2M€ at December 31, 2022). Cashflow can be analyzed as

follows:

| |

|

Exercice 2023 |

| |

|

|

|

EBITDA |

|

(0,1) |

|

Restructuring costs |

|

(0,7) |

|

Corporate tax |

|

0,3 |

|

Investment subsidy recognition |

|

(0,1) |

|

Operating working capital variance |

|

(0,4) |

|

Operating cashflow |

|

(1,0) |

|

Investments |

|

(0,4) |

|

Investing cashflow |

|

(0,4) |

|

Ecoslops Provence SHL |

|

(1,3) |

|

Loans |

|

(0,1) |

|

Interests paid |

|

(0,4) |

|

Financing cashflow |

|

(1,8) |

|

Cash variance |

|

(3,2) |

| |

|

|

|

Opening cash balance |

|

6,9 |

|

- Disposal Ecoslops Provence |

|

-0,4 |

|

Closing cash balance |

|

3,2 |

|

Variance |

|

(3,2) |

Operating cashflow came to (1.0)M€, impacted by

(0.7)M€ in non-recurring restructuring costs, relating in

particular to the disposal of Ecoslops Provence. The negative

change in WCR stems on the one hand from Ecoslops Portugal for

(1.2)M€ (taking into account an import of slops carried out in

December 2023) and on the other hand from Ecoslops SA for 0.8M€

(increase in trade payables linked to restructuring costs

incurred).Financing activities resulted in a net cash outflow of

1.8M€, mainly comprising a 1.3M€ current account contribution to

Ecoslops Provence (a non-recurring outflow considering the sale of

Ecoslops Provence in February 2024) and 0.4M€ in interest on

borrowings. The closing of the sale of Ecoslops Provence took place

on February 29, 2024, when Ecoslops SA received payment of 8M€.

Part of this payment gave rise, on the same day, to a repayment of

sums due to the EIB in respect of 2023, amounting to 1.9M€ (0.5M€

in amortized capital and 1.4M€ in interest and royalty fees). On

completion of this transaction, Ecoslops SA's net debt was 10.3M€,

halved compared with December 31, 2022, and its free cash position

was 7.2M€.

Strategy and developments

Ecoslops, now refocused on its historic Sines

business and the development of the Scarabox®, now has the

financial and human resources to match its roadmap.

Sines

The Portuguese unit's business is correlated to

oil prices and supplies, and generates an average EBITDA of

2.2M€/year. The subsidiary is financially autonomous and raises its

own financing. As the concession in the Port of Sines is due to

expire at the end of 2027, discussions have already begun to

anticipate its renewal, with a possible extension to 2037.The

recently obtained ISCC PLUS certification is also a very positive

factor insofar as many customers are looking for products with this

sustainability label.

Scarabox®

This business, born of repeated requests from

numerous prospects over the years, got off to a slower start than

expected. After the construction and delivery of the first unit for

Valtech Energy in Cameroon, assembly and start-up work was hampered

by a lack of local human and financial resources. Ecoslops, for its

part, was faced at the same time with the difficulties of Ecoslops

Provence, and was unable to make up for these delays. The

refocusing of Ecoslops means that the necessary technical and

financial resources can now be dedicated to this activity. As

regards Ivory Coast, a letter of intent was signed at the beginning

of the year between Ecoslops, Parlym and SIR (Ivory Coast’s

national refinery with a capacity of 4 million tonnes), under which

SIR is to take a 5% stake in the local company and be given a

directorship.

To sum up, Ecoslops, having refocused on

profitable, forward-looking activities and aligned its costs

accordingly, is now focused on successfully completing the next

stages of its plan, namely:- Structured, long-term renegotiation of

the EIB facility (nominal 9.5M€, initial maturity 2027)- Renewal of

the concession in the Port of Sines with GALP- Securing medium-term

supplies for the Sines plant- Development of the Scarabox®

(Cameroon, Ivory Coast, other prospects...)

Gouvernance

The Board of Directors is made up of members

with seniority and experience of the Group's activities and issues,

and of its sector. It has made a significant contribution to the

strategic decisions taken in 2023, and has supported management in

the execution of its decisions. It is therefore important for the

Group to be able to count on the continuity of this Board.

Accordingly, at the forthcoming Annual General Meeting on June 11,

shareholders will be asked to renew, without further nomination,

the mandates which expire on that date, with the exception of that

of Mr. Bindschedler, who is not standing for renewal.

ESG

On June 2, 2023, the Group published its fourth

sustainability report, covering the 2022 financial year.The Group's

commitment to continuous improvement is illustrated by the further

rise in its ESG 2023 rating for 2022 from the Ethifinance ESG

Campaign (formerly Gaïa Research). The company confirms its

performance, now ranked 24th/310 (vs. 39th/371 in the previous

campaign) in the general panel, 10th/416 in the panel of companies

with sales of less than 150M€ (vs. 14th/126 in the previous

campaign) and 4th/272 in the industry panel (vs. 7th/76 for

2021).In addition, the Solar Impulse Foundation's "Efficient

Solution" label, focused on promoting efficient, cost-effective

solutions to protect the environment, was successfully renewed in

January 2024.Finally, in December 2023, Ecoslops Portugal obtained

ISCC PLUS certification for all its refined production. This

certification attests the product compliance with sustainability

and traceability requirements, and is recognized by all

stakeholders for recycled products.

Outlook for 2024

In 2024, Ecoslops Portugal forecasts production

of 24,500 tonnes, representing sales of around 13M€ (including port

services) based on current Brent prices.

In 2024, Ecoslops also aims to contract the sale

of a new Scarabox in Ivory Coast.

Financial Agenda

Annual General Meeting: June 11, 2024

Publication of 1st half 2024 sales: July 15,

2024

Publication of half-year results: September 26,

2024

ABOUT ECOSLOPSEcoslops is listed on Euronext

Growth in Paris Code ISIN: FR0011490648 - Ticker: ALESA / PEA-PME

eligible Investor Relations: ir@ecoslops.com - +33 (0)1 83 64 47

43

Ecoslops is the cleantech that brings oil into

the circular economy thanks to an innovative technology allowing

the company to upgrade oil residues and used lub oil into new fuels

and light bitumen. The solution proposed by Ecoslops is based on a

unique micro-refining industrial process that transforms these

residues into commercial products that meet international

standards. Ecoslops offers an economic and more ecological solution

to port infrastructure, waste collectors and ship-owners through

its processing plants.

- PR_18apr24_ECOSLOPS_2023_RESULTS

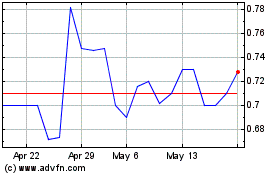

Ecoslops (EU:ALESA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ecoslops (EU:ALESA)

Historical Stock Chart

From Feb 2024 to Feb 2025