Arcadis Trading Update Q3 2021

Continued strong

organic revenue growth and further strengthened balance

sheet

- Sustained strong client demand driven by climate change, energy

transition and urbanization

- Organic net revenue growth of 4.1% to €636 million

- Operating EBITA margin of 10.1%

- Net working capital of 14.0% and DSO of 74 days

- Free cash flow of €75 million

- Organic backlog growth year-over-year of 3.1%

- Successfully re-financed credit facilities into one

sustainability-linked, syndicated Revolving Credit Facility of €500

million

- Arcadis improves Sustainalytics 2021 score and again ranks

number one in the ‘Construction & Engineering’ category,

featuring 292 companies

Amsterdam, 28 October

2021 – Arcadis

(EURONEXT: ARCAD), the leading global Design & Consultancy

organization for natural and built assets,

reports an organic net revenue growth

of 4.1%

and solid operating EBITA

margin of

10.1%

for the

third quarter.

The company was successful in strengthening its balance

sheet, with a lower net debt of €47 million.

Peter Oosterveer, CEO Arcadis, comments: “We

continue to see strong demand from clients to help mitigate the

impact of climate change. We have supported them design and develop

energy transition projects and create sustainable assets and

livable communities, all of which enabled us to deliver robust

overall performance. To accelerate our strategy and even better

leverage the global scale of our expertise and asset knowledge, as

well as to drive greater efficiency, we are gradually organizing

ourselves in three global business areas, Resilience, Places and

Mobility”.

“In September, we announced our commitment to accelerate the

transition to a net zero world, by rapidly reducing our operational

carbon footprint and reach net zero emissions by no later than

2035. An important tenet of our strategy is to put sustainability

at the heart of all the solutions we provide, which is why we

announced the launch of our global Sustainability Advisory

Services, allowing us to consolidate our global capabilities and

bring the very best of Arcadis to all our clients. We are steadfast

to mitigate the impacts of climate change by offering smarter,

cleaner, and greener solutions to our clients and the improved

score from Sustainalytics, ranking Arcadis as number one in our

sector, confirms that we are on the right path”.

“The increased investments from both public and private sector

clients in growth areas such as smart mobility solutions, green

places, energy transition and climate change resilience projects

create a positive business outlook for the future and will enable

Arcadis to secure new projects and maintain a healthy pipeline

of opportunities. This, combined with our organic net revenue

growth, continued robust performance and strong

backlog gives me confidence in our ability to

deliver the strategic targets we have set for

2023.”

REVIEW OF PERFORMANCE

KEY FIGURES

| in €

millions Period ended 30 September |

THIRD

QUARTER |

|

YEAR-TO-DATE |

|

|

2021 |

2020 |

change |

2021 |

2020 |

change |

|

Gross revenues |

829 |

781 |

6% |

2,489 |

2,484 |

0% |

| Net

revenues |

636 |

604 |

5% |

1,912 |

1,890 |

1% |

| Organic growth |

4.1% |

-3.2% |

|

3.4% |

-0.9% |

|

|

EBITDA |

86 |

92 |

-7% |

258 |

246 |

5% |

| EBITDA margin |

13.5% |

15.2% |

|

13.5% |

13.0% |

|

| Adjusted EBITDA1) |

70 |

74 |

-5% |

204 |

187 |

9% |

| EBITA |

61 |

63 |

-4% |

176 |

155 |

13% |

| EBITA margin |

9.6% |

10.5% |

|

9.2% |

8.2% |

|

| Operating

EBITA2) |

64 |

66 |

-3% |

181 |

163 |

11% |

| Operating

EBITA margin |

10.1% |

10.9% |

|

9.5% |

8.6% |

|

| Free cash flow1) |

75 |

119 |

|

105 |

200 |

|

| Net working capital

% |

14.0% |

16.6% |

|

|

|

|

| Days sales

outstanding |

74 |

82 |

|

|

|

|

| Net debt1) |

47 |

195 |

|

|

|

|

| Backlog net revenues

(billions) |

2.1 |

2.0 |

|

|

|

|

| Backlog organic growth

(y-o-y) |

3.1% |

|

|

3.7% |

|

|

1) Excluding IFRS 16 impact, used for Net Debt / EBITDA and Free

Cash Flow calculation2) Excluding restructuring, acquisition &

divestment costs

REVENUES BY SEGMENT

AMERICAS (35% of net revenues)

| in €

millions Period ended 30 September |

THIRD QUARTER |

|

YEAR-TO-DATE |

|

|

2021 |

2020 |

change |

2021 |

2020 |

change |

|

Gross revenues |

339 |

323 |

5% |

1,008 |

1,036 |

-3% |

| Net

revenues |

222 |

218 |

2% |

655 |

671 |

-2% |

| Organic growth |

3% |

|

|

4% |

|

|

Organic net revenue growth increased supported by all business

lines. Order intakes remains robust with significant sustainable

and digital project wins in Los Angeles (L.A. Metro) and New York

(wastewater treatment plants). Our key priority is to retain and

attract talent and to expand the usage of our Global Excellence

Centers.

Outstanding organic net revenue growth in Latin America, driven

predominantly by infrastructure work in Brazil.

EUROPE & MIDDLE EAST (EME)(46% of net revenues)

| in €

millions Period ended 30 September |

THIRD QUARTER |

|

YEAR-TO-DATE |

|

|

2021 |

2020 |

change |

2021 |

2020 |

change |

|

Gross revenues |

349 |

318 |

10% |

1,068 |

993 |

7% |

| Net

revenues |

292 |

265 |

10% |

900 |

838 |

7% |

| Organic growth |

7% |

|

|

7% |

|

|

Organic net revenue growth in EME was mainly driven by

significant growth in the UK and several countries in Continental

Europe, compensating for an expected and planned modest decline in

the Middle East, driven by our decision to reduce our footprint in

this region.

The UK’s strong performance continued this quarter with

excellent organic net revenue growth driven by key clients and

sustainability related projects in all business lines. Significant

project wins included a commercial partner role for the

transformative Oxford-Cambridge railway link and contract framework

wins for National Highways.

In Continental Europe we experienced steady organic net revenue

growth. Our presence in several major countries positions us well

for opportunities presented by public and private clients, related

to climate and mobility challenges. This is illustrated by

significant project wins including the decommissioning of 28 gas

extraction plants for the NAM in the Netherlands, a ten-year

contract for energy distributor TenneT to support the energy

transition in Germany and a six-year contract to restore bridges

and quays in Amsterdam.

ASIA PACIFIC (14% of net revenues)

| in €

millions Period ended 30 September |

THIRD QUARTER |

|

YEAR-TO-DATE |

|

|

2021 |

2020 |

change |

2021 |

2020 |

change |

|

Gross revenues |

96 |

88 |

10% |

269 |

270 |

0% |

| Net

revenues |

88 |

80 |

10% |

247 |

244 |

1% |

| Organic growth |

7% |

|

|

0% |

|

|

Revenues in Asia returned to good organic growth in the quarter,

mainly driven by Greater China, while prolonged lockdowns and low

vaccination rates continue to impact numerous Asian countries, such

as Thailand, Vietnam or Malaysia. In Singapore, we were awarded a

significant contract to help strengthen the resilience of the city

state’s rail network.

Australia reported good growth in the quarter, benefiting from

Arcadis strong market position in infrastructure in major cities,

despite repeated regional lockdowns.

CALLISONRTKL(5% of net revenues)

| in €

millions Period ended 30 September |

THIRD QUARTER |

|

YEAR-TO-DATE |

|

|

2021 |

2020 |

change |

2021 |

2020 |

change |

|

Gross revenues |

44 |

52 |

-15% |

144 |

185 |

-22% |

| Net

revenues |

34 |

41 |

-16% |

110 |

138 |

-20% |

| Organic growth |

-17% |

|

|

-15% |

|

|

Organic net revenues are still under pressure due to COVID-19,

affecting mainly retail and commercial sectors, especially in Asia.

However, CallisonRKTL did secure a number of transformational

projects involving collaboration of several practice areas in the

US and in China. NET REVENUESNet revenues totaled €636

million and increased organically by 4.1%, and excluding the Middle

East 4.8%, while the currency impact was 1%. For the first nine

months, net revenues increased organically by 3.4% to €1.912

million. OPERATING EBITAOperating EBITA in the quarter

decreased by 3% compared to last year, to €64 million (Q3 2020: €66

million). The operating EBITA margin of 10.1% decreased compared to

Q3 last year (Q3 2020: 10.9%) due to a variety of COVID-19 measures

taken last year. Non-operating costs were €3 million, compared to

€2 million in Q3 2020.

Year-to-date the Operating EBITA increased by 11% to €181

million, and the operating EBITA margin improved from 8.6%

to 9.5%. CASH FLOW, WORKING CAPITAL AND BALANCE

SHEETFree cash flow in the third quarter was solid at €75 million

(Q3 2020: €119 million), leading to a year-to-date free cash flow

of €105 million (2020: €200 million). In 2020, the full year free

cash flow was exceptionally strong due to the cash program

undertaken and a significant improvement in the invoicing process

in the U.S. following the Oracle implementation.

Net working capital as a percentage of annualized gross

revenues improved to 14.0% (Q3 2020: 16.6%) and Days

Sales Outstanding decreased to 74 days (Q3

2020: 82 days), resulting from our ongoing focus on

timely cash collection.

The balance sheet was further strengthened resulting in a

significantly lower net debt of €47 million (Q3 2020: €195

million), mainly due to the strong cash collection.

Arcadis refinanced its credit facilities into a

Sustainability-linked, syndicated Revolving Credit Facility of €500

million. The Sustainability-link allows Arcadis to benefit from an

interest discount in case the ESG management score reported by

Sustainalytics improves considerably. The lenders in the new

Revolving Credit Facility remains the same group of reputable,

international banks. The maturity of the new Revolving Credit

Facility is October 2026, with two additional options to extend for

one year. The terms and conditions have further improved due to the

strong financial profile of Arcadis and the more accommodative

market circumstances.

Arcadis commenced a share buyback program for 1.85 million

shares on February 19, 2021. to cover existing obligations under

employee incentive plans and commitments for stock dividend. the

program was concluded on August 13, 2021. The 1.85 million shares

have been repurchased at a volume-weighted average share price of

€34.22, for a total consideration of €63.3 million. Arcadis

cancelled 616,854 repurchased shares, which is the same amount as

issued for the dividend payment in shares. BACKLOGAt the

end of September 2021 backlog was €2.1 billion (Q3 2020: €2.0

billion), representing 10 months of net revenues. Organic backlog

increased with 3.1% year-over-year, and 3.7% year-to-date.

SUSTAINALYTICS As announced on our Sustainability Day on

September 30th, Arcadis is committed to accelerating the industry’s

transition to a net zero world, while improving quality of life for

everyone. Our strategy, ‘Maximizing Impact’, lays out how we will

embrace sustainability in all that we do. This includes our

services and advice to clients, the way we operate our company, and

how we engage with our people and communities.

Sustainalytics provides an independent, comprehensive assessment

of how well companies are managing material environmental, social

and governance (ESG) issues, and thus how well we are putting

sustainability core in everything we do. On October 22nd,

Sustainalytics published the new score for Arcadis. The ESG risk

score further improved to 12.9, with which Arcadis is again leading

the “Construction & Engineering” industry, featuring 292

companies.

FOR FURTHER INFORMATION PLEASE CONTACT:ARCADIS

INVESTOR RELATIONSJurgen PullensMobile: +31 6 5159

9483E-mail: jurgen.pullens@arcadis.com

ARCADIS CORPORATE COMMUNICATIONSDaan HeijbroekMobile: +31 6

1026 1955E-mail: daan.heijbroek@arcadis.com

ANALYST MEETINGArcadis will hold an analyst meeting and

webcast to discuss the Q3 results for 2021. The analyst meeting

will be held at 10.00 hours CET today. The webcast can be accessed

via the investor relations section on the company’s website at

https://www.arcadis.com/en/global/investors/.

ABOUT ARCADISArcadis is a leading global Design &

Consultancy organization for natural and built assets. Applying our

deep market sector insights and collective design, consultancy,

engineering, project and management services we work in partnership

with our clients to deliver exceptional and sustainable outcomes

throughout the lifecycle of their natural and built assets. We are

28,000 people, active in over 70 countries that generate €3.5

billion in revenues. We support UN-Habitat with knowledge

and expertise to improve the quality of life in rapidly

growing cities around the world. www.arcadis.com.

REGULATED INFORMATIONThis press release contains information

that qualifies or may qualify as inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

FORWARD LOOKING STATEMENTSStatements included in this press

release that are not historical facts (including any statements

concerning investment objectives, other plans and objectives of

management for future operations or economic performance, or

assumptions or forecasts related thereto) are forward-looking

statements. These statements are only predictions and are not

guarantees. Actual events or the results of our operations could

differ materially from those expressed or implied in the

forward-looking statements. Forward-looking statements are

typically identified by the use of terms such as “may,” “will”,

“should”, “expect”, “could”, “intend”, “plan”, “anticipate”,

“estimate”, “believe”, “continue”, “predict”, “potential” or the

negative of such terms and other comparable terminology. The

forward-looking statements are based upon our current expectations,

plans, estimates, assumptions and beliefs that involve numerous

risks and uncertainties. Assumptions relating to the foregoing

involve judgments with respect to, among other things, future

economic, competitive and market conditions and future business

decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond our control. Although we

believe that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, our actual results

and performance could differ materially from those set forth in the

forward-looking statements.

- Arcadis Q3 2021 Trading Update

- Arcadis Q3 2021 results presentation

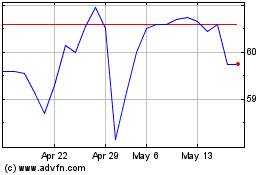

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Feb 2024 to Feb 2025