- Organic growth of 19.4% at constant exchange rates and scope

of consolidation over the first nine months of the year:

- €2,266 million in sales

- Up 17.5% as reported

- Further exceptional momentum in the third quarter driven by

the molecular biology solutions, resulting in quarterly growth of

26.5%.

- Moderate year-on-year slowdown in immunoassays, clinical

microbiology and industrial applications, however improving

compared with the previous quarter.

- 2020 outlook: bioMérieux expects sales growth to be above

16% at constant exchange rates and scope of consolidation, and

contributive operating income before non-recurring items to exceed

€520 million.

Alexandre Mérieux, Chairman and Chief Executive Officer, said:

“Fighting the pandemic is a priority for bioMérieux. Our employees

are fully engaged and we are mobilizing as much of our production,

logistics and R&D resources as possible to fulfill our public

health mission. bioMérieux performed exceptionally well in the

third quarter, however recent pandemic-related developments and the

associated lockdown measures require us to be cautious in our

performance outlook. We can nonetheless confirm that, in 2020, we

will deliver remarkable growth of consolidated sales and

contributive operating income before non-recurring items. Even so,

this performance is not projectable as such beyond 2020”

Regulatory News:

bioMérieux (Paris:BIM), a world leader in the field of in vitro

diagnostics, today released its business review for the nine months

ended September 30, 2020.

SALES

Consolidated sales reached €2,266 million for the first nine

months of 2020 versus €1,928 million for the prior-year period,

representing growth of 17.5% as reported. Organic growth (at

constant exchange rates and scope of consolidation) picked up pace

in the third quarter to reach 19.4% for the first nine months of

the year. Exchange rate movements resulted in a negative currency

effect of €34.5 million, primarily reflecting the devaluation of

certain South American and Asian currencies. In addition, the

positive effect recorded in the first half thanks to the US dollar

was offset by its decrease against the euro in the third

quarter.

Analysis of sales

In € millions

SALES - NINE MONTHS ENDED SEPTEMBER 30,

2019

1,928

Currency effect

-35

-1.8%

Changes in scope of consolidation(1)

-2

-0.1%

Organic growth (at constant exchange rates

and scope of consolidation)

+374

+19.4%

SALES - NINE MONTHS ENDED SEPTEMBER 30,

2020

2,266

+17.5%

(1) Disposal of businesses in Australia

ANALYSIS OF SALES BY APPLICATION

Sales by Application

In € millions

Q3 2020

Q3 2019

% change as reported

% change at constant

exchange rates and scope of consolidation

9 months ended Sept. 30,

2020

9 months ended Sept. 30, 2019

% change as reported

% change at constant

exchange rates and scope of consolidation

Clinical Applications

679.9

536.6

+26.7%

+32.0%

1,937.3

1,589.3

+21.9%

+23.2%

Molecular biology

318.8

151.3

+110.0%

+119.8%

875.1

477.6

+83.2%

+84.8%

Microbiology

236.2

259.0

-8.8%

-5.2%

696.6

740.3

-5.9%

-4.5%

Immunoassays

111.4

117.6

-5.3%

-0.9%

306.4

346.0

-11.4%

-9.7%

Other lines(1)

14.5

8.7

+66.3%

+77.5%

59.1

25.4

+132.9%

+131.2%

Industrial Applications

109.5

116.5

-6.0%

+0.6%

328.3

338.9

-3.1%

+0.9%

TOTAL SALES

789.4

653.1

+20.9%

+26.5%

2,265.6

1,928.1

+17.5%

+19.4%

(1) Including Applied Maths and BioFire Defense

- Clinical applications sales, which accounted for around

85% of bioMérieux’s consolidated total, rose by 32% year-on-year to

€680 million for the third quarter of 2020 and by 23.2% to €1,937

million for the nine months ended September 30, 2020.

- In molecular biology, the BIOFIRE® FILMARRAY® product

line recorded growth of 120% in the third quarter, driven by very

strong demand for the BioFire® Respiratory Panel 2.1 plus (RP2.1

plus), which can detect SARS-CoV-2, the virus behind the COVID-19

epidemic. The installed base continued to expand significantly.

More than 1,900 units were deployed during the quarter, bringing

the total installed base to around 15,900 units. The extraction and

ARGENE® solutions used in the fight against the COVID-19 epidemic

continued to contribute to the segment’s growth.

- In microbiology, business improved versus the second

quarter, particularly in Europe and the Americas. Yet reagent sales

were down again year-on-year, as they continued to be affected by

the decline in hospital visits.

- In immunoassays, sales contracted slightly in

third-quarter 2020 versus. 2019 but nonetheless improved in all

regions versus the second quarter. In particular, the two serology

tests VIDAS® anti-SARS-CoV-2 IgM and VIDAS® anti-SARS-CoV-2 IgG

contributed to this improvement.

- Industrial applications sales, which account for around

15% of the consolidated total, came to €110 million for

third-quarter 2020, representing a slight increase (0.6%)

year-on-year and a substantial improvement versus the second

quarter. Business was driven by sales growth in microbiology

reagents for pharmaceutical industry clients. The agri-foods

segment continued to contract slightly, under the impact of the

health crisis. Sales for the first nine months of the year came to

€328 million, up 0.9% year-on-year.

ANALYSIS OF SALES BY REGION

Sales by Region

In € millions

Q3 2020

Q3 2019

% change as reported

% changeat constant

exchange rates and scope of consolidation

9 months ended Sept. 30,

2020

9 months ended Sept. 30, 2019

% change as reported

% changeat constant

exchange rates and scope of consolidation

Americas

410.5

284.3

+44.4%

+54.0%

1,173.3

866.1

+35.5%

+37.9%

North America

367.7

244.9

+50.1%

+57.6%

1,052.0

752.8

+39.7%

+39.8%

Latin America

42.8

39.4

+8.8%

+32.4%

121.3

113.3

+7.0%

+25.3%

Europe(1)

257.9

234.6

+9.9%

+11.9%

729.7

689.3

+5.9%

+7.0%

Asia Pacific

121.0

134.2

-9.9%

-5.8%

362.6

372.7

-2.7%

-0.7%

TOTAL SALES

789.4

653.1

+20.9%

+26.5%

2,256.6

1,928.1

+17.5%

+19.4%

(1) Including the Middle East and Africa

- Sales in the Americas (52% of the consolidated total)

reached €411 million in third-quarter 2020, an increase of 54% on

third-quarter 2019. Sales for the nine months ended September 30,

2020 came to €1,173 million, up 37.9% year-on-year.

- In North America (47% of the consolidated total),

third-quarter growth was led by a strong performance from the

BIOFIRE® FILMARRAY® molecular biology product line.

- Latin America recorded robust organic growth in

quarterly sales, driven by the strong dynamic in molecular biology

and by price increases to offset devaluations of local

currencies.

- Sales in the Europe – Middle East – Africa region (33%

of the consolidated total) came to €258 million for third-quarter

2020, up 11.9% year-on-year. Sales for the full nine months totaled

€730 million, representing a year-on-year increase of 7%.

- In Europe (27% of the consolidated total), particularly

rapid sales growth was reported in most countries, fueled by strong

demand in molecular biology. Alongside this exceptional

performance, the slowdown in the microbiology and immunoassay lines

was less pronounced than in the second quarter.

- In the Russia – Middle East – Africa region, the decline

in certain countries in immunoassays and microbiology was offset by

double-digit growth in molecular biology. As a result,

third-quarter 2020 sales were stable compared with third-quarter

2019.

- Sales in the Asia Pacific region (15% of the consolidated

total) amounted to €121 million for the third quarter of 2020, down

5.8% from the prior-year period but with pronounced differences

between countries. Japan recorded strong sales growth driven by the

molecular biology lines, while India managed to maintain a

satisfactory performance in an environment complicated by the

pandemic. The health crisis had a negative impact on sales in ASEAN

countries, and China recorded another year-on-year decline. For the

nine months ended September 30, 2020, total consolidated sales for

the Asia Pacific region came to €363 million, down a slight 0.7%

year-on-year.

EVENTS OF THIRD-QUARTER 2020 AND SUBSEQUENT EVENTS

- CE marking of BIOFIRE® Respiratory Panel 2.1 plus with

SARS-CoV-2 This panel, which tests for 19 viruses including

SARS-CoV-2 and four bacteria responsible for the most frequent

respiratory tract infections, was CE marked in July 2020. The panel

also includes an assay for the Middle East Respiratory Syndrome

Coronavirus (MERS-CoV). While maintaining an assay runtime of about

45 minutes, the BIOFIRE® RP2.1 plus runs on the fully automated

FILMARRAY® 2.0 and FILMARRAY® TORCH systems and is extremely easy

to use.

- Launch of BIOFIRE® MYCOPLASMA In July 2020, bioMérieux

announced the launch of BIOFIRE® MYCOPLASMA, an innovative test for

mycoplasma detection in pharmaceutical products used for

biotherapeutics (antibodies, hormones, cell and gene therapies,

etc.), the most vibrant sector in the pharmaceutical industry. All

the reagents and controls necessary for the analysis are included

in a single pouch, making it possible to perform the test close to

where the samples are taken and obtain the results in less than one

hour.

- AMSP partners with bioMérieux to facilitate supply of

high-quality COVID-19 diagnostics in Africa In October 2020,

bioMérieux and the Africa Medical Supplies Platform (AMSP)

announced a new partnership to facilitate the supply of

high-quality diagnostic solutions from the bioMérieux Pandemic

Response Portfolio to African Union Member States. The partnership

aims to respond to supply shortages experienced in Africa by

guaranteeing efficient, continuous and rapid access to bioMérieux

solutions, available at very competitive prices.

- bioMérieux receives Emergency Use Authorization for BIOFIRE®

Respiratory Panel EZ 2.1 with SARS-CoV-2 On October 2, 2020,

bioMérieux received Emergency Use Authorization from the U.S. Food

and Drug Administration (FDA) for a new version of the BIOFIRE®

RP-EZ respiratory panel that includes SARS-CoV-2. Launched in 2016,

RP-EZ is the subject of a Clinical Laboratory Improvement

Amendments (CLIA) waiver, which enables it to be used outside

traditional clinical laboratories in sites such as physician’s

offices and urgent care centers.

INVESTOR PRESENTATION

bioMérieux will hold an investor presentation on Thursday,

October 22, 2020 at 3:00 pm Paris time (GMT+1). The presentation

will be given in English and will be accessible via conference call

only.

France

Europe

United States

+33 (0)1 76 77 22 57

+44 (0)330 336 9411

+1 323 794 2588

Access code: 728 8051

INVESTOR CALENDAR

Fourth-quarter 2020 sales and 2020

financial results

February 24, 2021

First-quarter 2021 sales

April 27, 2021

Second-quarter 2021 sales and first-half

2021 financial results

Third-quarter 2021 sales

September 1, 2021

October 21, 2021

Notes and definitions

The above forward-looking statements are based, entirely or

partially, on assessments or judgments that may change or be

modified, due to uncertainties and risks related to the Company’s

economic, financial, regulatory and competitive environment,

notably those described in the 2019 Universal Registration

Document. Accordingly, the Company cannot give any assurance nor

make any representation as to whether the objectives will be met.

The Company does not undertake to update or otherwise revise any

forecasts or objectives presented herein, except in compliance with

the disclosure obligations applicable to companies whose shares are

listed on a stock exchange.

Currency effect: this is

established by converting actual numbers at the average rates of

year y-1. In practice, those rates are either average rates

communicated by the ECB, or hedged rates if hedging instruments

have been set up.

Changes in scope of consolidation:

these are determined:

- for acquisitions in the period, by deducting from sales for the

period the amount of sales generated during the period by acquired

entities as from the date they entered the consolidated reporting

scope;

- for acquisitions in the previous period, by deducting from

sales for the period the amount of sales generated in the months in

the previous period during which the acquired entities were not

consolidated;

- for disposals in the period, by adding to sales for the period

the amount of sales generated by entities sold during the previous

period in the months of the current period during which these

entities were no longer consolidated;

- for disposals in the previous period, by adding to sales for

the period the amount of sales generated during the previous period

by the entities sold.

ABOUT BIOMÉRIEUX

Pioneering Diagnostics

A world leader in the field of in vitro diagnostics for over 55

years, bioMérieux is present in 44 countries and serves more than

160 countries with the support of a large network of distributors.

In 2019, revenues reached €2.7 billion, with over 90% of sales

outside of France.

bioMérieux provides diagnostic solutions (systems, reagents,

software and services) which determine the source of disease and

contamination to improve patient health and ensure consumer safety.

Its products are mainly used for diagnosing infectious diseases.

They are also used for detecting microorganisms in agri-food,

pharmaceutical and cosmetic products.

bioMérieux is listed on the Euronext Paris stock market. Symbol:

BIM – ISIN Code: FR0013280286 Reuters: BIOX.PA/Bloomberg:

BIM.FP

Corporate website: www.biomerieux.com

Note: Unless otherwise stated,

growth is expressed year-on-year at constant exchange rates and

scope of consolidation (like-for-like).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201021005902/en/

Investor Relations bioMérieux Franck Admant Tel.:

+33 (0)4 78 87 20 00 investor.relations@biomerieux.com Media

Relations bioMérieux Olivier Rescaniere Tel.: +33 (0)4

78 87 20 00 media@biomerieux.com Image Sept Laurence

Heilbronn Tel.: +33 (0)1 53 70 74 64 lheilbronn@image7.fr Claire

Doligez Tel.: +33 (0)1 53 70 74 48 cdoligez@image7.fr

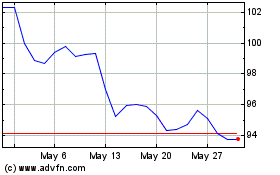

Biomerieux (EU:BIM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Biomerieux (EU:BIM)

Historical Stock Chart

From Nov 2023 to Nov 2024