Eurocastle Releases Fourth Quarter and Year End 2022 Financial Results

March 02 2023 - 11:44AM

Eurocastle Releases Fourth Quarter and Year End 2022 Financial

Results

EUROCASTLE INVESTMENT LIMITED

Contact: Oak

Fund Services (Guernsey) LimitedCompany AdministratorAttn: Hannah

CrockerTel: +44 1481

723450

Eurocastle

Releases Fourth Quarter

and Year End

2022 Financial

Results

Guernsey, 2 March 2023 – Eurocastle Investment

Limited (Euronext Amsterdam: ECT) today will release its annual

report for the year ended 31 December 2022.

- Adjusted

Net Asset Value (“NAV”) of €10.3 million1, or

€10.33 per share2, up €0.07 per share vs. Q3 2022 (up €0.54 per

share vs. YE 2021) due to:

- Valuation movements:

- €0.05 per share, or 6%, increase in

Q4 2022 (€0.28 per share increase for FY 2022) on the real estate

fund investments following the sale of the final apartment

units.

- No movement in Q4 2022 (€0.12 per

share increase for FY 2022) on the NPL and other loan interests

which were fully disposed of in the year.

- Reserve and other movements: €0.02

per share increase in Q4 2022 (€0.13 per share increase for FY

2022).

- IFRS NAV of €22.4

million, or €22.45 per share (€32.9 million, or €17.73 per share3,

as at YE 2021).

The

tables below summarise the Adjusted NAV by segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YE 2022 NAV |

|

Q3 2022 NAV |

|

YE 2021

NAV |

|

|

|

€’m |

€ p.s. |

|

€’m |

€ p.s. |

|

€’m |

€ p.s. |

|

Real Estate Funds |

|

0.6 |

0.63 |

|

0.8 |

0.76 |

|

2.8 |

1.49 |

|

Italian NPLs & Other Loans |

|

- |

- |

|

1.0 |

1.01 |

|

1.3 |

0.72 |

|

Net Corporate Cash4 |

|

17.1 |

17.15 |

|

16.2 |

16.27 |

|

28.8 |

15.52 |

|

Legacy German Tax Asset |

|

4.6 |

4.67 |

|

4.6 |

4.67 |

|

- |

- |

|

IFRS NAV |

|

22.4 |

22.45 |

|

22.6 |

22.72 |

|

32.9 |

17.73 |

|

|

|

|

|

|

|

|

|

|

|

|

Additional Reserves |

|

(12.1) |

(12.12) |

|

(12.4) |

(12.46) |

|

(14.8) |

(7.94) |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted NAV |

|

10.3 |

10.33 |

|

10.2 |

10.26 |

|

18.2 |

9.79 |

|

Ordinary shares outstanding |

|

995,555 |

|

995,555 |

|

1,857,535 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at 31 December 2022, the

Company’s remaining assets mainly comprise:

- Two Real Estate Fund Investments with a Q4 2022 NAV of €0.6

million, or €0.63 per share, where the underlying apartments are

now all sold with both funds currently in

liquidation.

- €17.1 million of net corporate cash.

2022

BUSINESS HIGHLIGHTS

FY 2022

Overview

During 2022, the Company made significant

progress on realising its remaining assets as part of its

Realisation Plan, with 96% of its YE 2021 NAV relating to

investments realised in the period. As at 31 December 2022, the

Company had realised 106% of the NAV of the investments reported at

the time of the announcement of the Realisation Plan in November

2019.

In particular, Eurocastle disposed of the two

remaining loan pools that the Company had an interest in and all

remaining apartment units in its two real estate fund investments

were sold. As a result, Eurocastle’s investment interests now

comprise the residual net assets of its two RE Fund Investments

with an NAV of €0.6 million, or 6% of the Company’s total Adjusted

NAV.

In July, the Company announced the conclusion of

its strategic review and the decision to relaunch the Company’s

investment activity (the “Relaunch”). It also announced a tender

offer to provide a liquidity opportunity for those shareholders who

did not wish to participate in the Relaunch (the “Tender Offer”).

The Tender Offer closed in August with 67% of eligible shares

tendered, resulting in Eurocastle accepting 864,980 shares in

exchange for €10.26 of cash per share, or €8.9 million in

total.

Investment Realisations &

Highlights

- During 2022, the Company realised

€4.8 million from its investments, of which €3.4 million came from

its RE Fund Investments (~91% of their YE 2021 NAV) and €1.5

million from its minority NPL and Other Loan holdings (~109% of

their YE 2021 NAV).

- RE

Redevelopment

Funds - REFI II & REFI V:

Both funds are now in liquidation with all apartment units sold.

During 2022, Eurocastle received €3.4 million comprising (i) €1.0

million from REFI II (~70% of its YE 2021 NAV) and (ii) €2.4

million from REFI V (~103% of its YE 2021 NAV).

- Italian NPLs & Other Loans: The Company

disposed of its residual minority interest in 2 loan pools,

realising €1.3 million and a further €0.2 million in distributions

during the year.

- Additional

Reserves: The Company reduced these reserves from €14.8

million to €12.1 million during the year. The reduction of €2.7

million reflects €1.4 million of reserves being utilised, in line

with anticipated costs, and a release of €1.3 million of the

existing reserves in the year. The majority of this release relates

to the legacy German tax matter following a revision to the

estimated total liability. As at 31 December 2022, of the total

Additional Reserves of €12.1 million, €6.5 million related to the

legacy German tax matter with the balance of approximately €5.5

million in place to allow for an orderly liquidation process.

Relaunch Update

- As at 31 December 2022 the Company

has €17.1 million of net corporate cash and approximately €9.7

million of net available cash to commence seeking new investments

under the new investment strategy. The Company is currently working

with the Manager to finalise the structure and expects to commence

investing in the coming weeks.

SUBSEQUENT

EVENTS TO 31

DECEMBER

2022

As at 2 March 2023, there were no material

subsequent events to disclose.

| |

|

|

|

Income Statement for the Full Year and Fourth Quarter

2022 |

FY 2022 |

Q4 2022 |

|

|

€ Thousands |

€ Thousands |

| Portfolio

Returns |

|

|

|

Italian NPLs & Other Loans realised gain |

116 |

- |

|

Real Estate Funds realised fair value movement |

- |

- |

|

Real Estate Funds unrealised fair value movement |

282 |

48 |

| Fair value movement on

Italian investments |

398 |

48 |

| Fair value movements

on residual Legacy entities |

9 |

9 |

| Interest

income |

68 |

58 |

| Loss on foreign

currency translation |

(7) |

(5) |

|

Total income |

468 |

109 |

|

|

|

|

| Operating

Expenses |

|

|

| Interest

expense |

12 |

- |

| Manager base and incentive

fees |

92 |

17 |

|

Remaining operating expenses |

1,247 |

243 |

|

Other operating expenses |

1,339 |

260 |

|

Total expenses |

1,351 |

260 |

|

|

|

|

|

Net loss for the

period |

(883) |

(152) |

|

€ per share |

(0.58) |

(0.15) |

|

|

Balance Sheet and Adjusted NAV Reconciliation as at 31

December 2022 |

ItalianInvestments€

Thousands |

Corporate€ Thousands |

Total€ Thousands |

|

Assets |

|

|

|

| |

Cash and cash equivalents |

- |

17,721 |

17,721 |

| |

Other assets |

- |

109 |

109 |

| |

Legacy German tax asset |

- |

4,645 |

4,645 |

| |

Investments: |

|

|

|

| |

Real Estate Funds |

628 |

- |

628 |

|

Total assets |

628 |

22,475 |

23,103 |

|

Liabilities |

|

|

|

| |

Trade and other payables |

- |

736 |

736 |

|

|

Manager

base and incentive fees |

- |

17 |

17 |

|

Total liabilities |

- |

753 |

753 |

|

IFRS Net Asset Value |

628 |

21,722 |

22,350 |

| Liquidation cash

reserve |

- |

(5,537) |

(5,537) |

| Legacy German tax

cash reserve |

- |

(1,888) |

(1,888) |

| Legacy German tax

asset |

- |

(4,645) |

(4,645) |

|

Adjusted NAV |

628 |

9,652 |

10,280 |

|

Adjusted NAV (€ per Share) |

0.63 |

9.69 |

10.33 |

NOTICE:

This announcement contains inside information

for the purposes of the Market Abuse Regulation 596/2014.

ADDITIONAL INFORMATION

For investment portfolio information, please

refer to the Company’s most recent Financial Report, which will be

available on the Company’s website (www.eurocastleinv.com).

ABOUT EUROCASTLE

Eurocastle Investment Limited (“Eurocastle” or

the “Company”) is a publicly traded closed-ended investment

company. On 18 November 2019, the Company announced a plan to

realise the majority of its assets with the aim of accelerating the

return of value to shareholders. On 8 July 2022, the Company

announced the relaunch of its investment activity and is currently

in the early stages of pursuing its new strategy by initially

focusing on opportunistic real estate in Greece with a plan to

expand across Southern Europe. For more information regarding

Eurocastle Investment Limited and to be added to our email

distribution list, please visit www.eurocastleinv.com.

FORWARD LOOKING STATEMENTS

This release contains statements that constitute

forward-looking statements. Such forward-looking statements may

relate to, among other things, future commitments to sell real

estate and achievement of disposal targets, availability of

investment and divestment opportunities, timing or certainty of

completion of acquisitions and disposals, the operating performance

of our investments and financing needs. Forward-looking statements

are generally identifiable by use of forward-looking terminology

such as “may”, “will”, “should”, “potential”, “intend”, “expect”,

“endeavor”, “seek”, “anticipate”, “estimate”, “overestimate”,

“underestimate”, “believe”, “could”, “project”, “predict”,

"project", “continue”, “plan”, “forecast” or other similar words or

expressions. Forward-looking statements are based on certain

assumptions, discuss future expectations, describe future plans and

strategies, contain projections of results of operations or of

financial condition or state other forward-looking information. The

Company’s ability to predict results or the actual effect of future

plans or strategies is limited. Although the Company believes that

the expectations reflected in such forward-looking statements are

based on reasonable assumptions, its actual results and performance

may differ materially from those set forth in the forward-looking

statements. These forward-looking statements are subject to risks,

uncertainties and other factors that may cause the Company’s actual

results in future periods to differ materially from forecasted

results or stated expectations including the risks regarding

Eurocastle’s ability to declare dividends or achieve its targets

regarding asset disposals or asset performance.

1 In light of the Realisation Plan announced in November 2019,

the Adjusted NAV as at 31 December 2022 reflects additional

reserves for future costs and potential liabilities, which have not

been accounted for under the IFRS NAV (“Additional Reserves”). No

commitments for these future costs and potential liabilities

existed as at 31 December 2022.

2 Per share calculations for Eurocastle

throughout this document are based on 995,555 shares, unless

otherwise stated.3 Based on 1,857,535 shares outstanding at YE

2021.4 Reflects corporate cash net of accrued liabilities and other

assets.

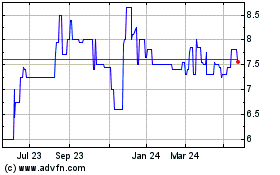

Eurocastle Investment (EU:ECT)

Historical Stock Chart

From Jan 2025 to Feb 2025

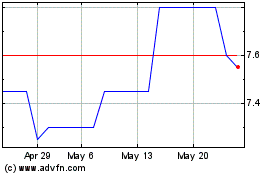

Eurocastle Investment (EU:ECT)

Historical Stock Chart

From Feb 2024 to Feb 2025