Quadient S.A. - Q3 2024: accelerated growth in Digital at c.+9% and

surge in Lockers at +14%, in line with Capital Markets Day

ambitions

Q3 2024: accelerated growth in Digital at

c.+9% and surge in Lockers at +14%, in line with Capital Markets

Day ambitions

Key highlights

- 9M

2024 consolidated revenue of €797 million, up

+2.4% on a reported basis including the contribution of

the two recent acquisitions and up +0.6%

organically(1)

- 9M 2024

subscription-related revenue (72% of total revenue)

increased by +1.4% on an organic basis, with

Digital posting a 10.1% organic increase

- Q3 2024

consolidated revenue of €263 million, up 0.3%

organically(2)

- Q3 2024

subscription-related revenue up +2.6% organically,

with +12.9% in Digital and +15.7% in

Lockers. Share of subscription-related revenue up

2 points to 72% at Group level

- Continued strong

performance from North America at +3.0%

organic growth in Q3 2024, representing 58% of Group

revenue

- Q3 2024 organic

revenue growth brings Solutions performance in line with

Capital Markets Day ambitions with Digital at c.9% and Lockers

above 14%

- FY 2024

outlook confirmed

Paris, 27 November 2024

Quadient S.A. (Euronext Paris:

QDT), a global automation platform powering secure and sustainable

business connections, today announces its 2024 third quarter and

nine-month consolidated revenue (period ended

on 31 October 2024).

Geoffrey Godet, Chief Executive Officer of

Quadient S.A., stated:

“The third quarter of 2024 has been a strong

quarter for our Digital and Lockers solutions, which delivered

solid levels of organic revenue growth at c.+9% for Digital and

above +14% for Lockers. This growth acceleration is in line with

the ambitions presented during our Capital Markets Day in June and,

more importantly, this significant improvement was driven by an

even stronger acceleration of the subscription-related revenue. At

+12.9% for Digital and +15.7% for Lockers, organic growth from

subscription-related revenue shows the strength and success of our

business model.

With the fast roll-out of our open networks

of Lockers in the UK and in France, volumes have now picked up as

usage increases with the density of the networks. We expect this

virtuous circle to continue to accelerate as we are heading into

the busiest quarter of the year. Growth from our Digital Automation

platform benefited from the solid level of booking experienced

earlier in the year, driven the fast adoption of our financial

automation solutions. This positive trend is expected to continue

in Q4.

This solid performance has been partially

offset by the high year-over-year comparison basis in Mail hardware

sales which led to an organic revenue decline higher than in recent

quarters. Business disruptions caused by the Milton hurricane in

the US in October also impacted our Mail hardware sales in the

quarter.

As we are heading into the fourth quarter,

the solid organic growth trend in subscription-related revenue from

our Digital and Lockers solutions, combined with an expected return

to a normalized Mail decline, make us confident in our ability to

deliver full year organic growth in revenue and in current EBIT, in

line with our guidance.”

Comments on Q3 and 9M 2024

performance

Group revenue came in at

€797 million in 9M 2024, a 2.4% increase on a reported

basis, and +0.6% organic growth compared to 9M 2023,

in line with Quadient’s expectations. Reported growth includes a

negative currency impact of €3 million and a positive scope effect

of €17 million, which is related to the acquisition of

Daylight (e-forms capability for Digital) in September 2023 and to

the acquisition of Frama (Mail consolidation in Europe) in

February 2024. In Q3 2024, reported revenue growth stood at

+0.8% and organic revenue growth at +0.3% compared to Q3 2023.

Subscription related revenue (€572 million, 72%

of total sales) increased by +1.4% organically over 9M 2024, with

an acceleration in Q3 2024, up 2.6% against Q3 2023, driven by a

double-digit organic increase in Digital and in Lockers.

Non-recurring revenue slightly decline by 1.2% organically over 9M

2024, including a stronger decline in Q3 2024 at -5.3% essentially

reflecting a high comparison basis in Mail hardware sales with a

deal worth more than €3 million signed with NBT Norway in Q3

2023.

By geography, North America (58% of revenue)

continued to outperform other regions with a +2.9% organic growth

achieved in 9M 2024, while Main European countries (34% of revenue)

had a steady performance (at -1.6%). The International segment (8%

of revenue) was notably impacted by the high basis of comparison in

Mail in Q3.

Consolidated revenue by

solution

Q3 2024 consolidated revenue

|

In € million |

Q3 2024 |

Q3 2023

restated (a) |

Change |

Organic change |

|

Digital |

65 |

60 |

+8.0% |

+8.7% |

|

Mail |

175 |

180 |

(3.0)% |

(4.1)% |

|

Lockers |

24 |

21 |

+12.3% |

+14.3% |

|

Group total |

263 |

261 |

+0.8% |

+0.3% |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As in full-year 2023 statements, Q3 2023 revenue from the

afore-mentioned subsidiary is not included in the consolidated

revenue of the Group as it is recorded as discontinued operations.

This is still the case in Q3 2024. |

9M 2024 consolidated revenue

|

In € million |

9M 2024 |

9M 2023

restated(a) |

Change |

Organic change |

|

Digital |

194 |

179 |

+8.2% |

+6.8% |

|

Mail |

536 |

533 |

+0.6% |

(1.7)% |

|

Lockers |

67 |

66 |

+0.8% |

+2.9% |

|

Group total |

797 |

778 |

+2.4% |

+0.6% |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As in full-year 2023 statements, 9M 2023 revenue from the

afore-mentioned subsidiary is not included in the consolidated

revenue of the Group as it is recorded as discontinued operations.

This is still the case in 9M 2024. |

Digital

In 9M 2024, revenue from Digital reached

€194 million, a 6.8% organic

increase (+8.7% in Q3 2024 vs. Q3 2023)

and +8.2% on a reported basis

(including the contribution from Daylight) compared to 9M 2023.

This solid performance was driven by

subscription-related revenue which recorded a strong 10.1%

organic growth in 9M 2024, driven by an

acceleration in Q3 2024 (+12.9% vs Q3

2023), including a high 20% increase in North America and continued

positive commercial trends across the platform with further solid

cross-selling and up-selling. Subscription-related revenue

now represents €161 million or 83% of

Digital total sales, a further increase from 80%

in 9M 2023. The share of SaaS customers stands at

84% at the end of October 2024.

At the end of 9M 2024, annual recurring

revenue (ARR), which is a forward-looking indicator of

future subscription-related revenue, reached

€226 million, vs. €206 million at the end of

FY 2023, representing a 13.4%

organic(3)

growth on an annualized basis.

Regarding the upcoming e-invoicing regulation in

France, which is due to progressively come into force between 2026

and 2028, the role of Partner Dematerialization Platforms (PDP)

will be reinforced by the closing of the French free public

invoicing portal project (PPF). Being registered as a PDP in France

reinforces Quadient’s positioning as a partner of choice

e-invoicing thanks to:

- its large Mail

customer base;

- its complete

suite of financial automation and digital document processing

solutions.

More generally, in Europe, the EU

ViDA(4) regulation will drive

digital invoicing across Europe to modernize VAT systems and

address Europe VAT fraud gap.

Mail

Mail revenue reached

€536 million in 9M 2024, a 1.7% decline on an

organic basis (-4.1% in Q3 2024 vs. Q3 2023). 9M 2024

reported growth stood at +0.6%, including the contribution

of Frama.

Hardware sales recorded a 0.7% organic

growth in 9M 2024, a positive performance despite the

-7.0% decline registered in Q3 2024, reflecting:

- a high

comparison basis due to the more than €3 million deal signed with

NBT Norway in Qv3 2023 ; and

- the temporary

business disruption caused by the Milton hurricane in Florida.

Subscription-related revenue (€369 million or

69% of Mail sales) continued to record a slow organic decline

(-2.8% in 9M 2024), including the impact from lower supplies’

orders.

In Q3 2024, Quadient made further progress in

the deployment of new mail products and solutions. The Group signed

in Q3 2024 a USD 1 million contract with a large U.S

federal agency, which already operates 60 Quadient mailing systems,

for a comprehensive mail modernization project to enhance process

efficiency. In addition, Quadient launched a new version of its

high-end folder inserter dedicated to production mail (DS 1200

document system). A first contract has already been signed early Q4

2024 in the U.S. encompassing 10 DS 1200 units.

At the end of October 2024, already 40% of

Quadient installed base has been upgraded with its newest

technology.

Lockers

Lockers revenue reached €67

million in 9M 2024, a 2.9% increase on an organic basis

and +0.8% on a reported basis compared to 9M 2023. In Q3 2024,

however, Lockers revenue growth showed significant acceleration at

+14.3% organically compared to Q3 2023.

Subscription-related revenue increased

by 8.7% organically in 9M 2024 (+15.7% in Q3

2024 vs Q3 2023), benefiting from:

- the continued

strong volumes ramp up in the UK and the French

open networks;

- an acceleration

in the U.S. thanks to new initiatives for end-user management

programs launched in the region;

- a resilient

performance in Japan, despite an unfavorable e-commerce

environment.

Overall, subscription-related revenue

stood at €43 million or 64% of total revenue in 9M 2024,

vs. 61% in 9M 2023.

Non-recurring revenue (license

& hardware sales and professional services) declined by 6.2%

organically in 9M 2024 but delivered a solid 12.1%

increase in Q3 2024 thanks to an

improvement in unit installations in North America and a

large hardware deal signed in International. Quadient’s global

locker installed base reached c.22,000 units at the end of

9M 2024 vs. c.20,200 units at the end of

FY 2023. This is reflecting the stronger pace of

installation of new lockers, notably in the UK, fueled by

the partnerships signed by Quadient to host parcel lockers in new

prime locations.

In Japan (International),

Quadient released a new mobile application to enable local

businesses to offer parcel locker delivery services to their

customers. This application aims at maximizing lockers’

usage thanks to an enhanced customer experience compared to

traditional delivery. Its ease of use and flexibility enable the

end-users to pick up a parcel in any locker of Quadient’s

network.

In France, Quadient added open-network options

to the click & collect lockers configuration installed at

Decathlon stores. This is providing all Quadient’s carrier partners

with the opportunity to deliver third party products in Decathlon

lockers, extending the range of parcel flow consolidation options.

The carriers using Quadient French open network

are GLS, Relais Colis, UPS, Pickup, Colissimo/Chronopost

and DHL.

DISCONTINUED OPERATIONS

The Italian Mail subsidiary was reclassified as

discontinued operations under IFRS 5 in full-year 2023. An

agreement for its sale has been signed with a local mail

distribution company in July 2024. The deal was closed in October

2024.

FY 2024 GUIDANCE

Quadient confirms its FY 2024 financial guidance

of organic growth at both revenue and current EBIT levels. While

the Q3 2024 decline in Mail hardware sales was expected (due to a

high comparison basis), it was amplified by the business disruption

caused by the Milton hurricane in Florida. On the other hand, both

Digital and Lockers delivered improved performance, in line with

the medium-term ambitions announced during the Capital Markets

Day.

Q3 2024 BUSINESS HIGHLIGHTS

Quadient receives 'AA' MSCI ESG rating,

recognizing longstanding commitment to Sustainability and Corporate

Social Responsibility

On 9 October 2024, Quadient announced it has been awarded an 'AA'

rating in the MSCI ESG Ratings of September 2024. For the ninth

consecutive year, MSCI has placed Quadient in the Leaders category,

recognizing its strong performance among global peers and its

dedication to sustainability, a reflection of the company’s

consistent efforts in managing environmental, social and governance

(ESG) risks and opportunities.

Quadient secures new c.USD 1-million

contract with U.S. federal agency for mail modernization

project

On 21 October 2024, Quadient announced that a large U.S. federal

government agency, which already operates 60 Quadient mailing

systems, has awarded Quadient a contract worth nearly USD 1 million

for a comprehensive mail modernization project to enhance process

efficiency. This opportunity, secured through one of Quadient’s

business partners, highlights Quadient's commitment to fostering

long-term customer relationships and developing strategic

partnerships to better serve customers while reaching new

businesses in need of process automation platforms.

Co-op teams up with Quadient to deliver

parcel locker convenience in communities in the UK

On 24 October 2024, Quadient has partnered with Co-op in the United

Kingdom to deliver further parcel locker growth and added

convenience to its communities. The partnership to supply Parcel

Pending by Quadient lockers to Co-op’s stores, aims to align

Co-op’s footprint in the heart of local communities with the

continued growth in consumer demand for safe, secure and accessible

parcel lockers.

Quadient secures €25 million

Schuldschein facility from EBRD

to finance R&D programs in Czech Republic

On 30 October 2024, Quadient announced that it has secured a new

€25 million Schuldschein facility from the European

Bank of Reconstruction and Development (EBRD) with maturities

spread equally between 5 and 7 years. The Schuldschein

loan from the EBRD aims at financing R&D programs at Quadient’s

state of the art Digital R&D center in Hradec Králové, Czech

Republic.

POST-CLOSING EVENTS

Quadient Strengthens Leadership Position

in the 2024 Top 250 Ranking of French Software

Companies

On 21 November 2024, Quadient announced that it

has achieved considerable progress in the prestigious Top 250

ranking of French software companies published by EY and Numeum.

Quadient advanced to the

11th

position in the overall ranking, up from

15th in 2023, and achieved second place

in the "Horizontal Publishers" category, rising from fifth last

year. The progress highlights Quadient’s strong performance and

unwavering focus on innovation and customer success.

Quadient and DECATHLON Expand Parcel Locker

Partnership in France with Additional Stores and

Services

On 25 November 2024, Quadient announced new momentum in its project

with DECATHLON, the globally recognized multi-specialist sports

brand. Over the past 12 months, the partnership has resulted in the

installation of more than 140 additional lockers across DECATHLON

stores in France. This expansion brings the total number of

equipped locations to 210, a substantial increase from just 70 in

May 2022.

To know more about Quadient’s news flow,

previous press releases are available on our website at the

following address: https://invest.quadient.com/en/newsroom.

CONFERENCE CALL &

WEBCAST

Quadient will host a

conference call and webcast today at 6:00 pm Paris time (5:00 pm

London time).

To join the webcast,

click on the following link: Webcast.

To join the conference

call, please use one of the following phone numbers:

▪ France: +33 (0) 1 70

37 71 66.

▪ United States: +1

786 697 3501.

▪ United Kingdom

(standard international): +44 (0) 33 0551 0200.

Password: Quadient

A replay of the

webcast will also be available on Quadient’s Investor Relations

website for 12 months.

Calendar

- 26 March 2025:

Q4 sales and Full-year 2024 results release (after

close of trading on the Euronext Paris regulated market).

About Quadient®

Quadient is a global

automation platform provider powering secure and sustainable

business connections through digital and physical channels.

Quadient supports businesses of all sizes in their digital

transformation and growth journey, unlocking operational efficiency

and creating meaningful customer experiences. Listed in

compartment B of Euronext Paris (QDT) and part of the CAC® Mid

& Small and EnterNext® Tech 40 indices, Quadient shares

are eligible for PEA-PME investing.

For more information about Quadient, visit

https://invest.quadient.com/en/.

Contacts

Catherine Hubert-Dorel, Quadient

+33 (0)1 45 36 30 56

c.hubert-dorel@quadient.com

financial-communication@quadient.com |

OPRG Financial

Fabrice Baron

+33 (0)6 14 08 29 81

fabrice.baron@omnicomprgroup.com |

Caroline Baude, Quadient

+33 (0)1 45 36 31 82

c.baude@quadient.com |

|

APPENDIX

Digital: New name for Intelligent Communication

Automation

Mail: New name for Mail-Related Solutions

Lockers: New name for Parcel Locker Solutions

Q3 2024 and 9M 2024 consolidated

revenue

Q3 2024 consolidated revenue by

geography

|

In € million |

Q3 2024 |

Q3 2023

restated (a) |

Change |

Organic

change |

|

North America |

153 |

152 |

+0.6% |

+3.0% |

|

Main European countries(b) |

87 |

83 |

+5.1% |

(1.6)% |

|

International(c) |

23 |

26 |

(11.9)% |

(9.1)% |

|

Group total |

263 |

261 |

+0.8% |

+0.3% |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As in full-year 2023 statements, Q3 2023 revenue from the

afore-mentioned subsidiary is not included in the consolidated

revenue of the Group as it is recorded as discontinued operations.

This is still the case in Q3 2024.

(b) Including Austria, Benelux, France, Germany,

Ireland, Italy (excluding Mail), Switzerland, and the United

Kingdom.

(c) International includes the activities of

Digital, Mail and Lockers outside of North America and the Main

European countries. |

9M 2024 consolidated revenue by

geography

|

In € million |

9M 2024 |

9M 2023

restated (a) |

Change |

Organic

change |

|

North America |

460 |

447 |

+2.9% |

+2.9% |

|

Main European countries(b) |

269 |

256 |

+5.0% |

(1.6)% |

|

International(c) |

68 |

75 |

(9.4)% |

(4.8)% |

|

Group total |

797 |

778 |

+2.4% |

+0.6% |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As in full-year 2023 statements, 9M 2023 revenue from the

afore-mentioned subsidiary is not included in the consolidated

revenue of the Group as it is recorded as discontinued operations.

This is still the case in 9M 2024.

(b) Including Austria, Benelux, France, Germany,

Ireland, Italy (excluding Mail), Switzerland, and the United

Kingdom.

(c) International includes the activities of

Digital, Mail and Lockers outside of North America and the Main

European countries. |

(1) 9M 2024 sales are

compared to 9M 2023 sales, to which is added pro rata temporis the

revenue of Daylight and Frama for a consolidated amount of €17

million. The currency impact is negative for €3

million.

(2) Q3 2024 sales are compared to Q3 2023 sales, to

which is added pro rata temporis the revenue of Daylight and Frama

for a consolidated amount of €5 million. The currency impact

is negative for €4 million.

(3) 9M 2024 ARR is

impacted by a €0.7 million negative currency effect vs 31 January

2024.

(4) ViDA: VAT in Digital Age.

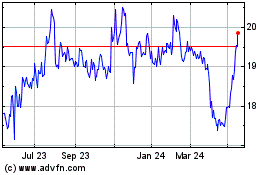

QUADIENT (EU:QDT)

Historical Stock Chart

From Feb 2025 to Mar 2025

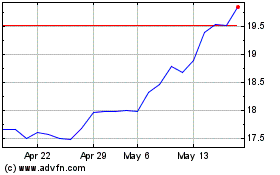

QUADIENT (EU:QDT)

Historical Stock Chart

From Mar 2024 to Mar 2025