SergeFerrari Group Posts Its Q3 2024 Revenues

October 31 2024 - 11:50AM

Business Wire

- Continued upturn in business observed in Q2, driven by the

European market (Q3 revenues -0.6% vs. Q3 23)

- Operational implementation of the Transform 2025 Plan

Regulatory News:

SergeFerrari Group (FR0011950682 - SEFER), a leading global

supplier of innovative flexible composite materials, listed on

Euronext Paris – Compartment C, today announced its revenues for Q3

2024 and as of September 30, 2024.

Revenues breakdown by region (unaudited)

(€ thousands)

Q3 2024

Q3 2023

Ch. at current scope and exchange

rates

Ch. at constant scope and

exchange rates

As of 30 Sep. 2024

As of 30 Sep. 2023

Ch. at current scope and exchange

rates

Ch. at constant scope and

exchange rates

Europe

52,144

49,279

5.8

%

5.8

%

172,366

179,384

-3.9

%

-3.7

%

Americas

7,519

8,681

-13.4

%

-12.5

%

23,522

28,810

-18.4

%

-18.1

%

Asia – Africa – Pacific

12,560

15,077

-16.7

%

-14.8

%

37,942

40,391

-6.1

%

-5.2

%

Total revenues

72,222

73,035

-1.1

%

-0.6

%

233,829

248,584

-5.9

%

-5.6

%

Sébastien Baril, Chairman of the SergeFerrari Group’s

Executive Board, stated: "Following on the upturn in business

observed in Q2 2024, revenues in Q3 2024 confirmed the first signs

of improvement in our core activities, particularly in Europe. The

final quarter should enable us to confirm the continuation of this

recovery, and also benefit from the first positive impacts of our

Transform 2025 plan.”

Activity as of September 30, 2024: revenues of €233.8

million

In the first nine months of 2024, the Group recorded revenues of

€233.8 million, a slight decline of -5.9% at current scope and

exchange rates, and -5.6% at constant scope and exchange rates.

However, this level of business confirms the positive trend already

observed at the end of the first half, which was itself down 7.8%

vs. 2023.

The trend observed over the first 9 months of the fiscal year at

constant scope and exchange rates reflects contrasting situations

by geographical area:

- The Europe region continues its recovery, with a

moderate decline in revenues of -3.9% compared to the same period

in 2023 at current scope, and -3.7% at constant scope and exchange

rates. It returned to growth in Q3, indeed as a reminder in the

first half year of 2024, the Europe region was down by -7.1% at

constant scope and exchange rates vs. N-1.

- The Americas region continues to be penalized by a

wait-and-see political and economic context and thus recorded a

decrease in its revenues of -18.1% at constant scope and exchange

rates, representing a slight improvement on the first half of the

year, which was down of 20.5% at constant scope and exchange

rates.

- The Asia-Pacific-Middle East-Africa region recorded a

decline in its revenues of -6.1% at current scope and exchange

rates, and -5.2% at constant scope and exchange rates, and

continues to decrease due to the postponement of projects in

Tensile Architecture.

Activity of the 3rd quarter 2024: revenues of €72.2

million

Revenues for the 3rd quarter of 2024 stood at €72.2 million,

down -1.1% at current scope and currency, and -0.6% at constant

scope and exchange rates, compared to the 3rd quarter of 2023,

driven in particular by a return to growth in its core markets in

Europe.

The global trend in this 3rd quarter is the result of:

- A price/volume-mix stood at -0.6%

- An exchange rate effect relatively stable at -0.7%

- A scope effect of +0.2%

Outlook

The final quarter 2024 should see a continuation of the upturn

in businesses seen in the Q2 and Q3 of the year. At the same time,

the Group will pursue its operational optimization efforts in the

final quarter, linked in particular to the execution of its

Transform 2025 plan, and will begin to benefit from its initial

positive effects. The implementation of this plan, combined with an

improvement in business activity which is now beginning, gives the

Group confidence in its ability to return to profitability in the

medium term.

Financial calendar

- Publication of 2024 Full-year revenues,

on January 23, 2025, after market close. - Publication of

2024 Full-year results, on March 27, 2025, after market

close.

ABOUT SERGEFERRARI GROUP

The Serge Ferrari Group is a leading global supplier of

composite materials for Tensile Architecture, Modular Structures,

Solar Protection and Furniture/Marine, in a global market estimated

by the Company at around €6 billion. The unique characteristics of

these products enable applications that meet the major technical

and societal challenges: energy-efficient buildings, energy

management, performance and durability of materials, concern for

comfort and safety together, opening up of interior living spaces

etc. Its main competitive advantage is based on the implementation

of differentiating proprietary technologies and know-how. The Group

has manufacturing facilities in France, Switzerland, Germany, Italy

and Asia. Serge Ferrari operates in 80 countries via subsidiaries,

sales offices and a worldwide network of over 100 independent

distributors.

In 2023, Serge Ferrari posted consolidated revenues of €327.6

million, over 80% of which was generated outside France. The

SergeFerrari Group share is listed on Euronext Paris – Compartment

C (ISIN: FR0011950682). SergeFerrari Group shares are eligible for

the French PEA-PME and FCPI investment schemes.

www.sergeferrari.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031902284/en/

Valentin Chefson Head of Investor Relations

investor@sergeferrari.com

NewCap Investor Relations – Financial

Communication Théo Martin / Nicolas Fossiez Tél. : 01 44 71 94

94 sferrari@newcap.eu

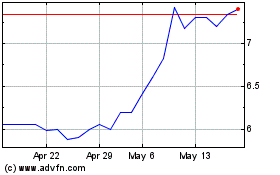

Sergeferrari (EU:SEFER)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sergeferrari (EU:SEFER)

Historical Stock Chart

From Jan 2024 to Jan 2025