Ubisoft Reports Third-Quarter 2024-25 Sales

UBISOFT REPORTS THIRD-QUARTER 2024-25

SALES

Q3 net bookings in line with revised

expectations, and FY 2024-25 targets confirmed

Positive Assassin’s Creed Shadows

Previews ahead of March 20 launch

Cost reduction program to be achieved by

end FY25, ahead of schedule and in excess of €200m

Review of strategic options

ongoing

Net bookings for the first nine months

of fiscal 2024-25

|

|

In €m

9 months

2024-25

|

Reported change vs.

2023-24

|

% of total net bookings |

|

|

9 months

2024-25 |

9 months

2023-24 |

|

IFRS 15 sales |

990.0 |

-31.4% |

- |

- |

|

Net bookings |

944.0 |

-34.8% |

- |

- |

|

Digital net bookings |

784.0 |

-33.8% |

83.0% |

81.8% |

|

PRI net bookings |

456.5 |

-33.7% |

48.4% |

47.5% |

|

Back-catalog net bookings |

762.3 |

-27.7% |

80.8% |

72.8% |

Net bookings stood at €301.8

million in Q3, in line with the revised expectations, and €944.0

million for the first nine months. Excluding partnerships,

back-catalog net bookings were down mid-single digit year-on-year

in Q3 and up mid-single digit year-on-year over the first nine

months of the fiscal year.

2024-25 targets confirmed: Net

bookings of around €1.9 billion and around break-even non-IFRS

operating income and free cash flow for FY2024-25.

Assassin’s Creed Shadows:

Scheduled to launch on March 20. Positive previews that highlight

the immersive world, stunning graphics and variety of gameplay

brought by the dual-protagonist approach. Pre-orders are tracking

solidly, in line with those of Assassin’s Creed Odyssey, the second

most successful entry of the franchise.

Continued progress on the fixed cost

base reduction: Fixed cost base reduction to exceed €200

million by end of FY2024-25 vs FY2022-23, ahead of schedule thanks

in part to the closure of four production studios in high-cost

geographies and targeted restructurings at three other sites.

Strategic Review: The formal

and competitive process announced on January 9, 2025 is ongoing. An

ad-hoc independent Board committee, chaired by the Lead Independent

Director, will oversee the process in the best interest of all

stakeholders.

PARIS – February 13, 2025 –

Today, Ubisoft released its sales figures for the third quarter of

fiscal 2024-25, i.e. the three months ended December 31, 2024.

Yves Guillemot, Co-Founder and Chief Executive

Officer, said “We are fully focused on the upcoming launch of

Assassin’s Creed Shadows on March 20. Early previews have been

positive, praising its narrative and immersive experience, with

both characters playing critical roles in the game’s storyline, as

well as the quality and complementarity of the gameplay provided by

the dual protagonist approach. I want to commend the incredible

talent and dedication of the entire Assassin’s Creed’s team, who is

working tirelessly to ensure that Shadows delivers on the promise

of what is the franchise’s most ambitious entry yet.

In parallel, we are progressing well on our

cost reduction program. As a result of disciplined execution, we

have announced further targeted restructurings, making difficult

but necessary choices, and now expect to exceed our cost reduction

objective by the end of FY25, ahead of schedule. We plan to pursue

our efforts in FY26, going beyond the initial target by a

significant margin.

Finally, the formal review process of our

strategic options announced earlier this year is now ongoing.

Ultimately, the objective is to unlock the best value from our

assets for our stakeholders and to foster the best conditions to

create great games in a fast-evolving market. We are convinced

there are different potential paths to achieve this

ambition.”

Activity Review

Since the beginning of the fiscal year, MAUs

across Console & PC stood at 36 million, broadly stable year on

year and activity metrics have been solid with Playtime and Session

Days per Player respectively up by 4% and 7%.

Back-catalog

Back-catalog net bookings reached €762 million for the first nine

months and €268 million in Q3. Excluding partnerships, they were up

mid-single digit over nine months and down mid-single digit

year-on-year in Q3.

In a significantly tougher competitive landscape

for first-person shooter Live services games, Rainbow Six

Siege delivered a resilient performance this quarter, with

activity broadly flat year-on-year in December on the back of a

high comparison base. Session Days per Player in Q3 grew

year-on-year, while Year 9 Season 4 reception was solid,

culminating in December achieving the highest monthly ARPPU

(Average Revenue per Paying User) in the game’s history. Looking at

the game’s ranking across all Console & PC genres1,

it ranked in the Top 15 in terms of MAU in both FYQ3 and calendar

year 2024 and even improved in January to get back to the Top 12.

Over the first nine months of the fiscal year, the game’s activity

has been stable year-on-year, and its playtime grew solidly.

Looking ahead, the Six Invitational is taking place in the United

States – the game’s largest market – for the first time. As the

game nears its 10th anniversary, the team is preparing

something significant to celebrate this milestone.

Elsewhere in the back-catalog, the

Assassin’s Creed franchise performed strongly

throughout the quarter, notably highlighted by the Steam release of

Assassin’s Creed Mirage, confirming the brand is

in great shape. Meanwhile, The Crew Motorfest

launched its Year 2 of content, featuring the brand-new island of

Maui. The game’s retention and monetization metrics continue to

significantly outperform those of The Crew 2 since launch, and

achieved its highest monthly player count to date in December.

Overall, The Crew franchise saw Session Days grow 38% year-on-year

this quarter.

Q4

Assassin’s Creed Shadows is set

to launch on March 20. The game builds on the franchise’s core

strengths while introducing fresh elements that enhance variety and

engagement, and to date previews have been positive. Critics

praised its immersive world, stunning visuals, and richly detailed

setting. The dual-protagonist gameplay was particularly well

received, offering two distinct playstyles that cater to different

player preferences as well as both characters playing critical

roles in the game’s storyline. Stealth mechanics and parkour

fluidity were highlighted as major improvements, while the revamped

combat system was praised for its strength. Finally, the inclusion

of Canon Mode and Immersive Mode was seen as a thoughtful addition,

specifically tailored to core fans. Pre-orders for the game are

tracking solidly, in line with those of Assassin’s Creed Odyssey,

the second most successful entry of the franchise.

Cost Reduction Plan to exceed €200m by

FY2024-25, ahead of schedule

As part of its ongoing efforts to streamline

operations and enhance collective efficiency, Ubisoft continued to

drive significant cost reductions as it adopts an even more

selective approach to investments.

In December, following a thorough assessment of

its performance, profitability and market conditions, Ubisoft

announced the discontinuation of XDefiant and the closure of three

production studios in high-cost geographies. Additionally, in

January, the Group announced the closure of an additional

production site and targeted restructurings that impacted three

studios.

The Company now expects to exceed €200 million

in fixed cost reductions by FY2024-25 compared to FY2022-23, ahead

of schedule, and plans to pursue these efforts in FY26, going

beyond the initial target by a significant margin.

Review of Strategic Options

The review of various transformational strategic

and capitalistic options is now ongoing. The Board has established

an ad-hoc independent Committee to oversee this formal and

competitive process, so as to extract the best value from Ubisoft’s

assets and franchises for all stakeholders. The Committee is

composed of three independent Directors and chaired by Lead

Independent Director, Claude France.

As previously indicated, Ubisoft will inform the

market in accordance with applicable regulations if and once a

transaction materializes.

Sales and net bookings

Note

The Group presents indicators which are not prepared strictly

in accordance with IFRS as it considers that they are the best

reflection of its operating and financial performance. The

definitions of the non-IFRS indicators are appended to this press

release.

In € millions

|

Q3 |

9 months |

|

2024-25 |

2023-24 |

2024-25 |

2023-24 |

|

IFRS 15 sales |

318.1 |

606.4 |

990.0 |

1,442.5 |

|

Restatements related to IFRS 15 |

16.3 |

19.8 |

46.0 |

6.1 |

|

Net bookings |

301.8 |

626.2 |

944.0 |

1,448.6 |

|

Digital net bookings |

257.4 |

468.2 |

784.0 |

1,185.0 |

|

PRI net bookings |

143.7 |

174.4 |

456.5 |

688.6 |

|

Back-catalog net bookings |

268.1 |

359.9 |

762.3 |

1,054.6 |

IFRS 15 sales for the third quarter of 2024-25

came to €318.1 million, down 47.5% (47.8% at constant exchange

rates2). For the first nine months of 2024-25, IFRS 15

sales amounted to €990.0 million, down 31.4% (31.5% at constant

exchange rates).

Net bookings for the third-quarter 2024-25

totaled €301.8 million, in line with the Group’s revised

expectation of around €300 million and representing a decrease of

51.8% (52.0% at constant exchange rates). For the first nine months

of 2024-25, net bookings stood at €944.0 million, down 34.8% (34.9%

at constant exchange rates).

Outlook

Full-year 2024-25

The company confirms its financial targets. It

expects net bookings of around €1.9 billion and approximately

break-even non-IFRS operating income and free cash flow for

FY2024-25.

Together with a solid back catalog and expected

material partnerships, Q4 net bookings are planned to grow

year-on-year thanks to the Assassin’s Creed Shadows release on

March 20.

Conference call

Ubisoft will hold a conference call today, Thursday February 13,

2025, at 6:15 p.m. Paris time/5:15 p.m. London time/12:15 p.m.

New York time.

The conference call can be accessed live and via replay by clicking

on the following link:

https://edge.media-server.com/mmc/p/nb5rhxgg

Contacts

Investor Relations

Alexandre Enjalbert

Head of Investor Relations

+ 33 1 48 18 50 78

alexandre.enjalbert@ubisoft.com |

Press Relations

Michael Burk

VP, Corporate Communication michael.burk@ubisoft.com |

|

|

Disclaimer

This press release may contain estimated financial data,

information on future projects and transactions and future

financial results/performance. Such forward-looking data are

provided for information purposes only. They are subject to market

risks and uncertainties and may vary significantly compared with

the actual results that will be published. The estimated financial

data have been approved by the Board of Directors, and have not

been audited by the Statutory Auditors. (Additional information is

provided in the most recent Ubisoft Registration Document filed on

June 20, 2024 with the French Financial Markets Authority

(l’Autorité des Marchés Financiers)).

About Ubisoft

Ubisoft is a creator of worlds, committed to enriching players’

lives with original and memorable entertainment experiences.

Ubisoft’s global teams create and develop a deep and diverse

portfolio of games, featuring brands such as Assassin’s Creed®,

Brawlhalla®, For Honor®, Far Cry®, Tom Clancy’s Ghost Recon®, Just

Dance®, Rabbids®, Tom Clancy’s Rainbow Six®, The Crew® and Tom

Clancy’s The Division®. Through Ubisoft Connect, players can enjoy

an ecosystem of services to enhance their gaming experience, get

rewards and connect with friends across platforms. With Ubisoft+,

the subscription service, they can access a growing catalog of more

than 100 Ubisoft games and DLC. For the 2023–24 fiscal year,

Ubisoft generated net bookings of €2.32 billion. To learn more,

please visit: www.ubisoftgroup.com.

© 2025 Ubisoft Entertainment. All Rights

Reserved. Ubisoft and the Ubisoft logo are registered trademarks in

the US and/or other countries.

APPENDICES

Definition of non-IFRS financial

indicators

Net bookings corresponds to sales restated for

the services component, including unconditional amounts related to

license or distribution agreements recognized independently of the

achievement of performance obligations, and restated for the

financing component.

Player Recurring Investment (PRI) corresponds to

sales of digital items, DLC, season passes, subscriptions and

advertising.

Non-IFRS operating income calculated based on

net bookings corresponds to operating income less the following

items:

- Stock-based compensation expense

arising on free share plans, group savings plans and/or stock

options.

- Depreciation of acquired intangible

assets with indefinite useful lives.

- Non-operating income and expenses

resulting from restructuring operations within the Group.

Breakdown of net bookings by geographic

region

|

|

Q3

2024-25

|

Q3

2023-24

|

9 months

2024-25

|

9 months

2023-24

|

|

Europe |

35% |

43% |

35% |

40% |

| Northern

America |

49% |

47% |

50% |

49% |

|

Rest of the world |

16% |

10% |

15% |

11% |

|

TOTAL |

100% |

100% |

100% |

100% |

Breakdown of net bookings by

platform

|

|

Q3

2024-25

|

Q3

2023-24

|

9 months

2024-25

|

9 months

2023-24

|

|

CONSOLES |

54% |

62% |

55% |

63% |

| PC |

26% |

30% |

25% |

24% |

| MOBILE |

10% |

5% |

9% |

7% |

Others*

|

10% |

3% |

11% |

6% |

|

TOTAL |

100% |

100% |

100% |

100% |

*Ancillaries, etc.

Title release schedule

4th quarter

(January – March 2025)

PACKAGED & DIGITAL

|

|

|

|

|

ASSASSIN’S CREED® SHADOWS |

AMAZON LUNA,

MAC WITH APPLE SILICON,

PC, PLAYSTATION®5, XBOX SERIES X/S

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

DIGITAL ONLY

|

|

|

BUMP! Superbrawl

|

ANDROID, IOS, PC |

FOR HONOR®: Year 9 – Season 1

|

PC, PLAYSTATION®4, XBOX ONE

|

|

RIDERS REPUBLIC™: Season 14 |

AMAZON LUNA, PC,

PLAYSTATION®4, PLAYSTATION®5,

XBOX ONE, XBOX SERIES X/S

|

|

TOM CLANCY’S RAINBOW SIX® SIEGE: Year 10 – Season 1 |

AMAZON LUNA, PC,

PLAYSTATION®4, PLAYSTATION®5,

XBOX ONE, XBOX SERIES X/S

|

|

TOM CLANCY’S THE DIVISION® 2: Year 6 - Season 3 |

AMAZON LUNA, PC,

PLAYSTATION®4, XBOX ONE

|

|

THE CREW ® MOTORFEST: Season 6 |

AMAZON LUNA, PC,

PLAYSTATION®4, PLAYSTATION®5,

XBOX ONE, XBOX SERIES X/S

|

|

STAR WARS™ OUTLAWS: DELUXE EDITION |

AMAZON LUNA, PC,

PLAYSTATION® 5, XBOX SERIES X/S

|

1 Source: Ampere

2 Sales at constant exchange rates

are calculated by applying to the data for the period under review

the average exchange rates used for the same period of the previous

year.

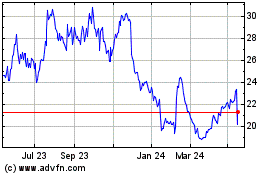

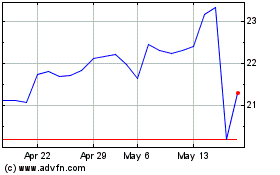

- Ubisoft Reports Third-Quarter 2024-25 Sales

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

From Jan 2025 to Feb 2025

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

From Feb 2024 to Feb 2025