Yen Rises Amid Suspected BOJ Fx Intervention

July 11 2024 - 10:17PM

RTTF2

The Japanese yen strengthened against other major currencies in

the Asian session on Friday, as the traders suspect the Bank of

Japan (BoJ) may have intervened in the currency markets to prop up

the currency.

The safe-haven yen rose against the U.S. dollar after soft U.S.

inflation data in the month of June raised prospects of an interest

rate cut by the U.S. Fed as soon as its September meeting. Bond

yields also slipped and the U.S. dollar weakened against most

currencies in the region.

According to CME Group's FedWatch Tool, the chances a rate cut

in September have jumped to 84.6 percent following the report

compared to 69.7 percent two days ago. In economic news, data from

the Ministry of Economy, Trade, and Industry showed that Japan's

industrial production expanded more than initially estimated in May

after falling in the previous month. Industrial production advanced

3.6 percent on a monthly basis, reversing a 0.9 percent decrease in

April. In the initial estimate, the rate of growth was 2.8

percent.

Year-on-year, industrial production recovered 1.1 percent in May

versus a 1.8 percent fall in April. In the flash report, the rate

of increase was 0.3 percent.

The capacity utilization rose 0.1 percent in May after falling

0.3 percent in the prior month.

In the Asian trading today, the yen rose to nearly a 4-week high

of 96.30 against the NZ dollar, from yesterday's closing value of

96.78. The yen may test resistance around the 95.00 region.

Against the euro, the pound and the U.S. dollar, the yen

advanced to 171.84, 204.22 and 157.99 from yesterday's closing

quotes of 172.57, 205.03 and 158.80, respectively. If the yen

extends its uptrend, it is likely to find resistance around 169.00

against the euro, 200.00 against the pound and 155.00 against the

greenback.

The yen touched yesterday's near 4-week high of 176.46 against

the Swiss franc, from yesterday's closing value of 177.08. The yen

is likely to find resistance around the 174.00 region.

Against the Australia and the Canadian dollars, the yen edged up

to 107.00 and 115.98 from Thursday's closing quotes of 107.33 and

116.47, respectively. On the upside, 104.00 against the aussie and

113.00 against the loonie are seen the next resistance levels for

the yen.

Looking ahead, Canada building permits for May, U.S. PPI for

June, U.S. University of Michigan's consumer sentiment index for

July, U.S. WASDE report and U.S. Baker Hughes weekly oil rig count

data are slated for release in the New York session.

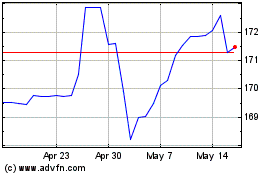

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2024 to Jul 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jul 2023 to Jul 2024