Bank Of Korea Keeps Interest Rate At 15-Year High

August 21 2024 - 10:11PM

RTTF2

The Bank of Korea left its benchmark interest rate unchanged on

Thursday but it signaled a reduction in the near term as inflation

continued its downward trend and the recovery in domestic economy

remains weak.

The Monetary Policy Board headed by Rhee Chang Yong unanimously

decided to hold the Base Rate at a 15-year high of 3.50

percent.

This was the thirteenth consecutive hold and the outcome of the

meeting came in line with expectations.

Suggesting that a rate cut is now closer, the bank said it will

maintain a restrictive policy stance but dropped the phrase "for a

sufficient period of time" from the previous statement.

However, the bank cautioned that risks related to real estate

project financing. Housing prices in Seoul and its surrounding

areas increased at a faster pace as transactions volumes increased,

while the downward trend in the remaining part of the country

continued.

Household loans retained its growth at a high level driven by

housing-related loans. With policymakers now more confident about

achieving their inflation target and domestic demand set to remain

weak, the BoK will start to cut rates in October and that the

easing cycle will be larger than most expect, Capital Economics'

economist Shivaan Tandon said.

ING economist said Min Joo Kang said the rate cut could come in

either October or November. As the focus has shifted to financial

market stability and growth, the bank will watch the US Federal

Reserve's rate decision in September and market's reaction to it

before making any decision, the economist noted.

The central bank today downgraded its economic growth outlook

for 2024 to 2.4 percent from 2.5 percent, while the projection for

2025 was retained at 2.1 percent.

The future growth will be influenced by the recovery in

consumption, the expansion of the IT sector and also economic

conditions in major economies, the central bank noted.

Further, the bank forecast inflation to continue its slowing

trend, owing to the base effect from the sharp increases in global

oil and agricultural product prices last year and due to moderate

demand pressures, the bank observed.

Inflation is projected to be 2.5 percent this year, which was

revised down from 2.6 percent estimated in May. For the next year,

the bank said inflation will align with the previous forecast of

2.1 percent.

Core inflation is expected to be 2.2 percent in 2024 and 2.0

percent in 2025, consistent with the May forecast.

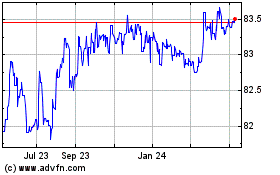

US Dollar vs INR (FX:USDINR)

Forex Chart

From Feb 2025 to Mar 2025

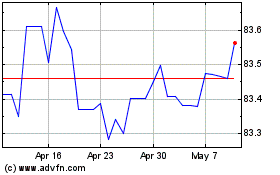

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Mar 2025