Q4 total revenues of $995.2 million and

FY2024 total revenues of $4.0 billion

Q4 and FY2024 total revenues up 4.0%

year-over-year and up 3.5% year-over-year, respectively

Q4 Clear Aligner volumes up 1.9%

sequentially, and up 6.1% year-over-year

Q4 Systems and Services revenues up 5.2%

sequentially, and up 14.9% year-over-year

- 2024 total revenues of $4.0 billion, Clear Aligner revenues of

$3.2 billion and Systems and Services revenues of $768.9

million

- 2024 revenues were unfavorably impacted by foreign exchange of

approximately $38.5 million compared to 2023(1)

- 2024 operating margin of 15.2%, non-GAAP operating margin of

21.8%, and diluted net income per share of $5.62, non-GAAP diluted

net income per share of $9.33

- 2024 operating margin was unfavorably impacted by foreign

exchange of approximately 0.7 points compared to 2023(1)

- Repurchased $352.9 million of common stock in 2024

- Q4'24 total revenues of $995.2 million, and diluted net income

per share of $1.39, non-GAAP diluted net income per share of

$2.44

- Q4’24 diluted net income per share was unfavorably impacted by

a stronger U.S. dollar, which amounted to approximately $0.14 per

diluted share due to net foreign exchange losses related to the

revaluation of certain balance sheet accounts

- Q4'24 revenues were favorably impacted by foreign exchange of

approximately $0.8 million sequentially and unfavorably impacted by

approximately $0.9 million year-over-year(1)

- Q4'24 restructuring and other charges of $37.0 million,

primarily related to post-employment benefits

Align Technology, Inc. (Nasdaq: ALGN), a leading global medical

device company that designs, manufactures, and sells the

Invisalign® System of clear aligners, iTero™ intraoral scanners,

and exocad™ CAD/CAM software for digital orthodontics and

restorative dentistry, today reported financial results for the

fourth quarter ("Q4'24") and year ended December 31, 2024 ("2024").

Q4'24 total revenues were $995.2 million, up 1.8% sequentially and

up 4.0% year-over-year. Q4'24 total revenues were favorably

impacted by foreign exchange of approximately $0.8 million or 0.1%

sequentially and unfavorably impacted by approximately $0.9 million

or 0.1% year-over-year.(1) Q4'24 Clear Aligner revenues were $794.3

million, up 0.9% sequentially and up 1.6% year-over-year. Q4'24

Clear Aligner revenues were favorably impacted by foreign exchange

of approximately $0.7 million or 0.1% sequentially and unfavorably

impacted by approximately $0.7 million or 0.1% year-over-year.(1)

Q4'24 Clear Aligner volume was up 1.9% sequentially and up 6.1%

year-over-year. Q4'24 Imaging Systems and CAD/CAM Services revenues

were $200.9 million, up 5.2% sequentially and up 14.9%

year-over-year. Q4'24 Imaging Systems and CAD/CAM Services revenues

were favorably impacted by foreign exchange of approximately $0.1

million or flat sequentially and unfavorably impacted by

approximately $0.2 million or 0.1% year-over-year.(1) Q4'24

operating income was $144.1 million resulting in an operating

margin of 14.5%. Q4'24 operating margin was favorably impacted by

foreign exchange of approximately 0.1 points sequentially and

unfavorably impacted by approximately 0.2 points year-over-year.(1)

Q4'24 net income was $103.8 million, or $1.39 per diluted share.

Q4’24 diluted net income per share was unfavorably impacted by a

stronger U.S. dollar, which amounted to approximately $0.14 per

diluted share due to net foreign exchange losses related to the

revaluation of certain balance sheet accounts. On a non-GAAP basis,

Q4'24 net income was $181.6 million, or $2.44 per diluted share.

During Q4'24, we incurred a total of $37.0 million of restructuring

and other charges, primarily related to post-employment

benefits.

2024 total revenues of $4.0 billion were unfavorably impacted by

foreign exchange of approximately $38.5 million or 1.0% compared to

2023.(1) 2024 Clear Aligner revenues of $3.2 billion were

unfavorably impacted by foreign exchange of approximately $31.0

million or 1.0% compared to 2023.(1) 2024 Imaging Systems and

CAD/CAM Services revenues of $768.9 million were unfavorably

impacted by foreign exchange of approximately $7.5 million or 1.0%

compared to 2023.(1)

Commenting on Align's Q4'24 and 2024 results, Align Technology

President and CEO Joe Hogan said, “I am pleased to report that Q4

total revenues, Clear Aligner volumes, and Systems and Services

revenues were in line with our Q4 outlook and both GAAP and

non-GAAP operating margins were better than our Q4 outlook. Q4

Clear Aligner ASPs were lower than our Q4 outlook due primarily to

the impact from unfavorable foreign exchange from the strengthening

U.S. dollar against major currencies from late October through

December. On a year-over-year basis, fourth quarter revenues of

$995.2 million increased 4.0%, reflecting 14.9% growth from Systems

and Services revenues and 1.6% growth from Clear Aligner revenues.

On a year-over-year basis, Clear Aligner volumes grew 6.1%, driven

by increased shipments across all regions—with strength in the

EMEA, APAC, and LATAM regions, and stability in North America. From

a channel perspective, Clear Aligner volumes in the ortho and

general practitioner dentist (“GP”) channels were up on a

year-over-year basis with the number of submitters and utilization

amongst the highest in the past few years. On a sequential basis,

fourth quarter revenue growth of 1.8% reflects continued momentum

from sales of our iTero Lumina™ scanners and increased Invisalign®

Clear Aligner volumes in the EMEA region, especially from teens and

growing patients, as well as growth from the LATAM region - across

Orthodontists and GP Dentists, offset by Clear Aligner seasonality

in APAC, mostly in China, which had a strong teen quarter in Q3.

For Americas, Q4 Clear Aligner volumes reflect a seasonally soft

orthodontic channel, offset somewhat by strength in the GP channel

in the adult segment. For the full year fiscal 2024, total revenues

of $4.0 billion and Clear Aligner volumes of 2.5 million cases were

both up 3.5% year-over-year. As of Q4'24, we achieved several

cumulative milestones including 271.6 thousand active Invisalign®

trained practitioners, 19.5 million Invisalign patients—including

over 5.6 million teens and kids, and over 2 billion clear aligners

manufactured worldwide.”

Financial Summary - Fourth Quarter

Fiscal 2024

Q4'24

Q3'24

Q4'23

Q/Q Change

Y/Y Change

Clear Aligner Shipments*

628,730

617,220

592,635

+1.9%

+6.1%

GAAP

Net Revenues

$995.2M

$977.9M

$956.7M

+1.8%

+4.0%

Clear Aligner

$794.3M

$786.8M

$781.9M

+0.9%

+1.6%

Imaging Systems and CAD/CAM Services

$200.9M

$191.0M

$174.8M

+5.2%

+14.9%

Net Income

$103.8M

$116.0M

$124.0M

(10.5)%

(16.3)%

Diluted EPS

$1.39

$1.55

$1.64

$(0.16)

$(0.25)

Non-GAAP

Net Income

$181.6M

$175.6M

$183.5M

+3.4%

(1.0)%

Diluted EPS

$2.44

$2.35

$2.42

+$0.09

+$0.02

Financial Summary - Fiscal

2024

2024

2023

Y/Y Change

Clear Aligner Shipments*

2,493,735

2,408,520

+3.5%

GAAP

Net Revenues

$3,999.0M

$3,862.3M

+3.5%

Clear Aligner

$3,230.1M

$3,199.3M

+1.0%

Imaging Systems and CAD/CAM Services

$768.9M

$662.9M

+16.0%

Net Income

$421.4M

$445.1M

(5.3)%

Diluted EPS

$5.62

$5.81

$(0.19)

Non-GAAP

Net Income

$699.7M

$659.2M

+6.1%

Diluted EPS

$9.33

$8.61

+$0.72

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding.

*Clear Aligner shipments include Doctor

Subscription Program Touch-Up cases.

As of December 31, 2024, we had $1,043.9 million in cash and

cash equivalents compared to over $1,041.9 million as of September

30, 2024. As of December 31, 2024, we had $300.0 million available

under a revolving line of credit.

During the quarter, we completed a $30.0 million equity

investment in Smile Doctors, the largest ortho-focused dental

support organization in the U.S.

Commenting on Align's fourth quarter and fiscal 2024 results,

Align Technology CFO and EVP Global Finance, John Morici said,

"Overall, I am pleased with our fourth quarter and fiscal 2024

results, particularly the year-over-year Clear Aligner volume

growth, the record number of submitters, the continued momentum

from our Systems and Services business, and our operating margin

improvement. After repurchasing $353 million of Align common stock

during 2024, we concluded the year with no debt and approximately

$1,044 million in cash, and cash equivalents. Our goal, as always,

is to deliver value to our shareholders."

Recent Highlights

- On January 21, 2025, Align was listed as one of the top 300

companies worldwide that were granted U.S. patents last year on the

2025 Patent 300® list, with Align ranked at #263 with 164 U.S.

patents granted in 2024. For reference, Align ranked #270 the year

before.

- On January 16, 2025, we announced that Patrick Mahomes,

quarterback for the National Football League’s Kansas City Chiefs,

joined the Invisalign Smile Squad as an ambassador for the brand.

As part of the multi-year agreement, Patrick will share his

Invisalign® treatment experience with fans in a multi-channel

campaign.

Q4'24 Highlights

- In December, the Invisalign® Palatal Expander System made the

cover of the Journal of Clinical Orthodontics. The featured

article, “Protocol for the Invisalign Palatal Expander” written by

Dr. Jonathan L. Nicozisis, DMD, MS., concluded that Align

Technology's Invisalign Palatal Expander System is an effective

treatment, with the potential to offer an improved patient

experience and better clinical outcomes.

- On November 20, we announced that Align received the CE Mark

under the Medical Device Regulation (MDR 2017/745) to market the

Invisalign® Palatal Expander System in most of Europe and also

completed registration with the Medicines and Healthcare products

Regulatory Agency for the United Kingdom and overseas

territories.

- On November 12, we shared highlights from the 2024 Invisalign

Ortho Summit, Align’s premier clinical education and peer-to-peer

networking experience designed to help doctors transform and grow

their practice with Invisalign® clear aligners, iTero scanners, and

the Align™ Digital Platform. More than 1,000 doctors and practice

team members from every region came together, alongside Align and

peer-to-peer speakers, to share treatment and workflow best

practices, hands-on experiences to sharpen clinical skills, and

practice growth and marketing strategies.

- On November 4, we announced the opening of Align's 2025 Annual

Research Award Program to support clinical and scientific dental

research in universities across the globe. This year, up to

$300,000 will be awarded to university faculty for scientific and

technological research initiatives to advance patient care in the

fields of orthodontics and dentistry. Align Technology’s Research

Award Program has funded approximately $3.75 million in research

since the program’s inception in 2010.

- On October 23, we announced Frank Quinn, formerly Align vice

president and general manager of the United States, rejoined the

company as executive vice president and managing director of the

Americas region.

- On October 23, we announced the release of the next innovation

of Invisalign Smile Architect™ software, now with Multiple

Treatment Plans allowing doctors to visually compare and modify

orthodontic only and ortho restorative treatment plans

side-by-side. The Multiple Treatment Plans are integrated into

ClinCheck® treatment planning software for doctors to visually

compare, review, and choose the best treatment option for each

patient.

- On October 23, we announced iTero intraoral scanner product

innovations that provide a versatile overall solution for general

practitioner (“GP”) dentists that enhance digital dentistry

workflows and integrated treatment options in oral health,

restorative, and ortho treatment in general dentistry

practices.

-

On October 14, we announced that Align's Invisalign® Palatal

Expander System has been listed on the Singapore Medical Device

Register as a class B medical device. The Invisalign Palatal

Expander System is now commercially available in Singapore and more

recently in Hong Kong for broad patient applicability, including

growing children, teens and adults (with surgery or other

techniques).

Q4'24 Stock Repurchases

- During Q4'24, we initiated a plan to repurchase $275.0 million

of our common stock through open market repurchases. As of December

31, 2024 we had purchased approximately 0.9 million shares at an

average price of $222.94 per share for an aggregate of $202.9

million. Purchase of the remaining $72.1 million of the $275.0

million was completed in January 2025.

- As of January 31, 2025, $225.0 million remains available for

repurchases of our common stock under our stock repurchase program

approved in January 2023.

Business Trends

Commentary

Align provides the following context around Clear Aligner

pricing and potential new tariffs:

Clear Aligner Pricing Commentary:

-

On March 1, 2025, we will raise the list price of Clear Aligners

by approximately 3% on average in the Americas and EMEA regions. At

the same time, we will remove the $10–$15 per order processing fee

for new Clear Aligner orders, Clear Aligner refinement orders, and

non-DSP Vivera™ cases ordered. We expect the net effect from these

two actions on ASPs to be zero for 2025.

Tariffs Commentary:

-

We currently manufacture clear aligners in Mexico and ship them

to the U.S. primarily for our U.S. customers with the remainder

eventually shipping to other international locations. The

U.S./Mexico tariff situation remains very fluid, and we are unable

to predict whether new tariffs will go into effect in the future.

We are monitoring events closely. Our clear aligner COGS include

material, labor, overhead, and freight costs. We expect an

incremental tariff, if implemented, to be applied to transfer

prices from Mexico. These transfer prices would not include

treatment planning costs, freight, other overhead, etc. Align’s

global operations have evolved significantly over the past several

years and we have greater flexibility to support our global

business. However, assuming a 25% tariff on goods originating in

Mexico, it is still more economical to ship clear aligners to the

U.S. from Mexico, due to a variety of factors including the

incremental additional freight costs incurred were we to ship from

our Polish facility. Regarding China, we currently manufacture our

products in China for the benefit of our customers in China.

Fiscal 2025 Business

Outlook

With this as a backdrop, assuming no circumstances occur beyond

our control, including foreign exchange and new tariffs, for Q1'25

and fiscal 2025 we provide the following outlook:

Q1’25:

- We expect Q1 worldwide revenues to be in the range of $965M to

$985M, down sequentially from Q4, primarily due to the impact from

unfavorable foreign exchange at current spot rates, and lower

capital equipment sales, reflecting historical Q1 seasonality.

- We expect Q1 Clear Aligner volume to be up slightly

sequentially and expect Q1 Clear Aligner ASPs to be down

sequentially, primarily due to unfavorable foreign exchange at

current spot rates, as well as continued product mix shift to

non-comprehensive clear aligners.

- In addition to seasonality, we expect Q1 Systems and Services

revenues to be down sequentially due to the timing of the

commercial availability of our iTero Lumina™ scanner with

restorative software, which is expected at the end of March.

- We expect our Q1’25 GAAP operating margin to be below Q1’24

GAAP operating margin by approximately 2 points, primarily due to

unfavorable foreign exchange at current spot rates.

- We expect our Q1’25 non-GAAP operating margin to be below Q1’24

non-GAAP operating margin by approximately 1 point, primarily due

to unfavorable foreign exchange at current spot rates.

For fiscal 2025:

- We expect 2025 year-over-year revenue growth to be low single

digits, which reflects approximately 2 points of unfavorable

foreign exchange at current spot rates.

- We expect 2025 Clear Aligner volume growth to be up

approximately mid-single digits year-over-year, compared to up 3.5%

year-over-year in 2024.

- We expect 2025 Clear Aligner ASPs to be down year-over-year due

to unfavorable foreign exchange at current spot rates and continued

product mix shift to non-comprehensive clear aligners.

- We expect 2025 Systems and Services year-over-year revenues to

grow faster than Clear Aligner revenues.

- We expect fiscal 2025 GAAP operating margin to be approximately

2 points above 2024 GAAP operating margin, and we expect 2025

non-GAAP operating margin to be approximately 22.5%, which both

reflect the impact of unfavorable foreign exchange at current spot

rates, partially offset by the benefits from restructuring actions

we took in Q4 to improve profitability and give us margin accretion

in 2025, even as we scale our next generation direct 3D printing

fabrication manufacturing.

- We expect our investments in capital expenditures for fiscal

2025 to be between $100M and $150M. Capital expenditures primarily

relate to building construction and improvements as well as

manufacturing capacity in support of our continued expansion.

Align Web Cast and Conference

Call

We will host a conference call today, February 5, 2025, at 4:30

p.m. EST, 2:30 p.m. MST, to review our fourth quarter and full year

2024 results, discuss future operating trends, and our business

outlook. The conference call will also be webcast live via the

Internet. To access the webcast, go to the "Events &

Presentations" section under Company Information on Align's

Investor Relations website at http://investor.aligntech.com. To

access the conference call, participants may register for the call

at https://edge.media-server.com/mmc/p/jkuu8qox/. Once registered,

participants will receive an email with dial-in number and unique

PIN number to access the live event. An archived audio webcast will

be available 2 hours after the call's conclusion and will remain

available for one month.

About Non-GAAP Financial

Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with generally accepted

accounting principles in the United States ("GAAP"), we may provide

investors with certain non-GAAP financial measures which may

include constant currency net revenues, constant currency gross

profit, constant currency gross margin, constant currency income

from operations, constant currency operating margin, non-GAAP gross

profit, non-GAAP gross margin, non-GAAP total operating expenses,

non-GAAP income from operations, non-GAAP operating margin,

non-GAAP net income before provision for income taxes, non-GAAP

provision for income taxes, non-GAAP effective tax rate, non-GAAP

net income and/or non-GAAP diluted net income per share, which

excludes certain items that may not be indicative of our

fundamental operating performance including, foreign currency

exchange rate impacts and discrete cash and non-cash charges or

gains that are included in the most directly comparable GAAP

measure. Unless otherwise indicated, when we refer to non-GAAP

financial measures they will exclude the effects of stock-based

compensation, amortization of certain acquired intangibles,

restructuring and other charges, acquisition-related costs and

associated tax impacts.

Our management believes that the use of certain non-GAAP

financial measures provides meaningful supplemental information

regarding our recurring core operating performance. We believe that

both management and investors benefit from referring to these

non-GAAP financial measures in assessing our performance and when

planning, forecasting, and analyzing future periods. We believe

these non-GAAP financial measures are useful to investors both

because (1) they allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision-making and (2) they are used by our institutional

investors and the analyst community to help them analyze the

performance of our business.

There are limitations to using non-GAAP financial measures as

they are not prepared in accordance with GAAP and may be different

from non-GAAP financial measures used by other companies. The

non-GAAP financial measures are limited in value because they

exclude certain items that may have a material impact upon our

reported financial results. In addition, they are subject to

inherent limitations as they reflect the exercise of judgments by

management about which charges are excluded from the non-GAAP

financial measures. We compensate for these limitations by

analyzing current and future results on a GAAP as well as a

non-GAAP basis and also by providing GAAP measures in our public

disclosures. The presentation of non-GAAP financial information is

meant to be considered in addition to, not as a substitute for or

in isolation from, the directly comparable financial measures

prepared in accordance with GAAP. We urge investors to review the

reconciliation of our GAAP financial measures to the comparable

non-GAAP financial measures included herein and not to rely on any

single financial measure to evaluate our business. For more

information on these non-GAAP financial measures, please see the

tables captioned "Unaudited GAAP to Non-GAAP Reconciliation."

About Align Technology,

Inc.

Align Technology designs and manufactures the Invisalign®

System, the most advanced clear aligner system in the world, iTero™

intraoral scanners and services, and exocad™ CAD/CAM software.

These technology building blocks enable enhanced digital

orthodontic and restorative workflows to improve patient outcomes

and practice efficiencies for over 271.6 thousand doctor customers

and are key to accessing Align’s 600 million consumer market

opportunity worldwide. Over the past 27 years, Align has helped

doctors treat approximately 19.5 million patients with the

Invisalign System and is driving the evolution in digital dentistry

through the Align™ Digital Platform, our integrated suite of

unique, proprietary technologies and services delivered as a

seamless, end-to-end solution for patients and consumers,

orthodontists and GP dentists, and lab/partners. Visit

www.aligntech.com for more information.

For additional information about the Invisalign System or to

find an Invisalign doctor in your area, please visit

www.invisalign.com. For additional information about the iTero

digital scanning system, please visit www.itero.com. For additional

information about exocad dental CAD/CAM offerings and a list of

exocad reseller partners, please visit www.exocad.com.

Invisalign, iTero, exocad, Align, Align Digital Platform, and

iTero Lumina are trademarks of Align Technology, Inc.

Forward-Looking

Statements

This news release, including the tables below, contains

forward-looking statements, including statements of beliefs and

expectations regarding our ability to successfully control our

business and operations and pursue our strategic growth drivers,

our expectations of the impact of ASPs from pricing adjustments,

our expectations regarding possible tariffs, our expectations for

the commercial availability of our products, our expectations for

market opportunities, our expectations for worldwide revenues,

Clear Aligner volume, Clear Aligner ASP, Systems and Services

revenues and GAAP and non-GAAP operating margin, and 2025 capital

expenditures. Forward-looking statements contained in this press

release relating to expectations about future events or results are

based upon information available to Align as of the date hereof.

Readers are cautioned that these forward-looking statements reflect

our best judgments based on currently known facts and circumstances

and are subject to risks, uncertainties, and assumptions that are

difficult to predict. As a result, actual results may differ

materially and adversely from those expressed in any

forward-looking statement.

Factors that might cause such a difference include, but are not

limited to:

- macroeconomic conditions, including fluctuations in currency

exchange rates, inflation, higher interest rates, market

volatility, threats or actual imposition of tariffs, threats of or

actual economic slowdowns or recessions;

- customer and consumer purchasing behavior and changes in

consumer spending habits;

- the economic and geopolitical ramifications of the military

conflicts in the Middle East and Ukraine, including sanctions,

retaliatory sanctions, nationalism, supply chain disruptions and

other consequences, any of which may or will continue to adversely

impact our operations and assets and our research and development

activities;

- variations in our product mix, product adoption and selling

prices regionally and globally;

- competition from existing and new competitors;

- declines in, or the slowing of growth of, sales of our clear

aligners or intraoral scanners domestically and/or internationally

and the impact either would have on the adoption of Invisalign

products;

- the timing and availability and cost of raw materials,

components, products and other shipping and supply chain

constraints, disruptions or costs;

- unexpected or rapid changes in the growth or decline of our

domestic and/or international markets;

- rapidly evolving and groundbreaking advances that fundamentally

alter the dental industry or the way new and existing customers

market and provide products and services to consumers;

- the ability to protect and enforce our intellectual property

rights;

- continued compliance with regulatory requirements;

- the willingness and ability of our customers to maintain and/or

increase product utilization;

- the possibility that the development and release of new

products or enhancements to existing products do not proceed in

accordance with the anticipated timeline or may themselves contain

bugs, errors or defects in software or hardware requiring

remediation and that the market for the sale of these new or

enhanced products may not develop as expected;

- a tougher consumer demand environment in China generally,

especially for manufacturers and service providers whose

headquarters or primary operations are not based in China;

- the risks relating to our ability to sustain or increase

profitability or revenue growth in future periods (or minimize

declines) while controlling expenses;

- expansion of our business and products;

- the impact of excess or constrained capacity at our

manufacturing and treat operations facilities and pressure on our

internal systems and personnel;

- the compromise of our systems or networks, including any

customer and/or patient data contained therein, for any

reason;

- the timing of case submissions from our doctor customers within

a quarter as well as an increased manufacturing costs per

case;

- foreign operational, political, military and other risks

relating to our operations; and

- the loss of key personnel, labor shortages or work stoppages

for us or our suppliers.

The foregoing and other risks are detailed from time to time in

our periodic reports filed with the Securities and Exchange

Commission, including, but not limited to, our Annual Report on

Form 10-K for the year ended December 31, 2023, which was filed

with the Securities and Exchange Commission ("SEC") on February 28,

2024 and our latest Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024, which was filed with the SEC on November

5, 2024. Align undertakes no obligation to revise or update

publicly any forward-looking statements for any reason.

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share data)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Net revenues

$

995,219

$

956,726

$

3,999,012

$

3,862,260

Cost of net revenues

298,278

287,202

1,199,853

1,155,397

Gross profit

696,941

669,524

2,799,159

2,706,863

Operating expenses:

Selling, general and administrative

424,971

402,503

1,763,193

1,703,379

Research and development

94,878

82,160

364,202

346,830

Restructuring and other charges

33,168

13,316

33,168

13,316

Legal settlement loss

(225

)

—

30,968

—

Total operating expenses

552,792

497,979

2,191,531

2,063,525

Income from operations

144,149

171,545

607,628

643,338

Interest income and other income

(expense), net:

Interest income

8,522

4,978

20,218

17,258

Other income (expense), net

(11,894

)

(3,643

)

(18,887

)

(19,392

)

Total interest income and other income

(expense), net

(3,372

)

1,335

1,331

(2,134

)

Net income before provision for income

taxes

140,777

172,880

608,959

641,204

Provision for income taxes

36,970

48,866

187,597

196,151

Net income

$

103,807

$

124,014

$

421,362

$

445,053

Net income per share:

Basic

$

1.39

$

1.64

$

5.63

$

5.82

Diluted

$

1.39

$

1.64

$

5.62

$

5.81

Shares used in computing net income per

share:

Basic

74,419

75,703

74,877

76,426

Diluted

74,465

75,802

74,993

76,568

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

December 31,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,043,887

$

937,438

Marketable securities, short-term

—

35,304

Accounts receivable, net

995,685

903,424

Inventories

254,287

296,902

Prepaid expenses and other current

assets

198,582

273,550

Total current assets

2,492,441

2,446,618

Marketable securities, long-term

—

8,022

Property, plant and equipment, net

1,271,134

1,290,863

Operating lease right-of-use assets,

net

113,376

117,999

Goodwill

442,630

419,530

Intangible assets, net

103,488

82,118

Deferred tax assets

1,557,372

1,590,045

Other assets

234,159

128,682

Total assets

$

6,214,600

$

6,083,877

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

108,693

$

113,125

Accrued liabilities

598,188

525,780

Deferred revenues

1,331,146

1,427,706

Total current liabilities

2,038,027

2,066,611

Income tax payable

96,466

116,744

Operating lease liabilities

88,214

96,968

Other long-term liabilities

139,908

173,065

Total liabilities

2,362,615

2,453,388

Total stockholders’ equity

3,851,985

3,630,489

Total liabilities and stockholders’

equity

$

6,214,600

$

6,083,877

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended

December 31,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net cash provided by operating

activities

$

738,231

$

785,776

CASH FLOWS FROM INVESTING

ACTIVITIES

Net cash used in investing activities

(254,912

)

(195,943

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Net cash used in financing activities

(355,722

)

(598,340

)

Effect of foreign exchange rate changes on

cash, cash equivalents, and restricted cash

(21,153

)

4,671

Net (decrease) increase in cash, cash

equivalents, and restricted cash

106,444

(3,836

)

Cash, cash equivalents, and restricted

cash at beginning of the period

938,519

942,355

Cash, cash equivalents, and restricted

cash at end of the period

$

1,044,963

$

938,519

ALIGN TECHNOLOGY, INC.

INVISALIGN BUSINESS METRICS

Q1

Q2

Q3

Q4

Fiscal

Q1

Q2

Q3

Q4

Fiscal

2023

2023

2023

2023

2023

2024

2024

2024

2024

2024

Number of Invisalign Trained Doctors

Cases Were Shipped To

82,730

83,440

85,195

83,700

125,845

83,510

86,135

87,380

85,685

130,370

Invisalign Trained Doctor Utilization

Rates*

North America

9.5

9.8

9.6

9.1

27.6

9.5

9.9

9.7

9.3

28.0

North American Orthodontists

28.7

29.2

28.8

25.9

94.5

28.2

28.8

28.3

26.3

95.0

North American GP Dentists

4.9

5.2

4.9

5.0

14.0

4.9

5.3

5.0

5.1

14.3

International

6.2

6.6

6.1

6.5

16.3

6.3

6.7

6.2

6.8

16.2

Total Utilization Rates**

7.1

7.5

7.1

7.1

19.1

7.2

7.5

7.1

7.3

19.1

Clear Aligner Revenue Per Case

Shipment***

$

1,335

$

1,335

$

1,320

$

1,320

$

1,330

$

1,350

$

1,295

$

1,275

$

1,265

$

1,295

* # of cases shipped / # of doctors to

whom cases were shipped

** LATAM utilization rate is not

separately disclosed but included in the total utilization

rates

*** Clear Aligner revenues / Case

shipments

Note: During the third quarter of 2023, we

began including Touch Up cases revenues that were previously

included in

Non-Case revenues and have recast business

metrics for the periods presented above accordingly.

ALIGN TECHNOLOGY, INC.

STOCK-BASED COMPENSATION

(in thousands)

Q1

Q2

Q3

Q4

Fiscal

Q1

Q2

Q3

Q4

Fiscal

2023

2023

2023

2023

2023

2024

2024

2024

2024

2024

Stock-based Compensation (SBC):

SBC included in Gross Profit

$

1,807

$

1,901

$

1,974

$

1,780

$

7,462

$

2,064

$

2,582

$

3,070

$

(721

)

$

6,995

SBC included in Operating Expenses

35,928

35,959

37,628

37,049

146,564

36,724

44,446

45,969

39,569

166,708

Total SBC

$

37,735

$

37,860

$

39,602

$

38,829

$

154,026

$

38,788

$

47,028

$

49,039

$

38,848

$

173,703

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP

RECONCILIATION+

CONSTANT CURRENCY NET REVENUES

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

December 31,

2024

September 30,

2024

Impact % of

Revenue

GAAP net revenues

$

995,219

$

977,872

Constant currency impact (1)

(783

)

(0.1

)%

Constant currency net revenues

(1)

$

994,436

GAAP Clear Aligner net revenues

$

794,289

$

786,844

Clear Aligner constant currency impact

(1)

(719

)

(0.1

)%

Clear Aligner constant currency net

revenues (1)

$

793,570

GAAP Imaging Systems and CAD/CAM

Services net revenues

$

200,930

$

191,028

Imaging Systems and CAD/CAM Services

constant currency impact (1)

(64

)

—

%

Imaging Systems and CAD/CAM Services

constant currency net revenues (1)

$

200,866

Year-over-year constant currency

analysis:

Three Months Ended

December 31,

2024

2023

Impact % of

Revenue

GAAP net revenues

$

995,219

$

956,726

Constant currency impact (1)

918

0.1

%

Constant currency net revenues

(1)

$

996,137

GAAP Clear Aligner net revenues

$

794,289

$

781,912

Clear Aligner constant currency impact

(1)

706

0.1

%

Clear Aligner constant currency net

revenues (1)

$

794,995

GAAP Imaging Systems and CAD/CAM

Services net revenues

$

200,930

$

174,814

Imaging Systems and CAD/CAM Services

constant currency impact (1)

212

0.1

%

Imaging Systems and CAD/CAM Services

constant currency net revenues (1)

$

201,142

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

CONSTANT CURRENCY NET REVENUES

CONTINUED

(in thousands, except percentages)

Current year versus prior year constant

currency analysis:

Year Ended December

31,

2024

2023

Impact % of Revenue

GAAP net revenues

$

3,999,012

$

3,862,260

Constant currency impact (1)

38,460

1.0

%

Constant currency net revenues

(1)

$

4,037,472

GAAP Clear Aligner net revenues

$

3,230,122

$

3,199,329

Clear Aligner constant currency impact

(1)

31,002

1.0

%

Clear Aligner constant currency net

revenues (1)

$

3,261,124

GAAP Imaging Systems and CAD/CAM

Services net revenues

$

768,890

$

662,931

Imaging Systems and CAD/CAM Services

constant currency impact (1)

7,458

1.0

%

Imaging Systems and CAD/CAM Services

constant currency net revenues (1)

$

776,348

Note:

(1)

We define constant currency net revenues

as total net revenues excluding the effect of foreign exchange rate

movements and use it to determine the percentage for the constant

currency impact on net revenues on a sequential, year-over-year and

current year versus prior year basis. Constant currency impact in

dollars is calculated by translating the current period GAAP net

revenues using the foreign currency exchange rates that were in

effect during the previous comparable period and subtracting it by

the current period GAAP net revenues. The percentage for the

constant currency impact on net revenues is calculated by dividing

the constant currency impact in dollars (numerator) by constant

currency net revenues in dollars (denominator).

(+)

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding. Refer to "About Non-GAAP Financial Measures" section of

press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

CONSTANT CURRENCY GROSS PROFIT AND GROSS

MARGIN

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

December 31,

2024

September 30,

2024

GAAP gross profit

$

696,941

$

681,774

Constant currency impact on net

revenues

(783

)

Constant currency gross profit

$

696,158

Three Months Ended

December 31,

2024

September 30,

2024

GAAP gross margin

70.0

%

69.7

%

Gross margin constant currency impact

(1)

0.0

Constant currency gross margin

(1)

70.0

%

Year-over-year constant currency

analysis:

Three Months Ended

December 31,

2024

2023

GAAP gross profit

$

696,941

$

669,524

Constant currency impact on net

revenues

918

Constant currency gross profit

$

697,859

Three Months Ended

December 31,

2024

2023

GAAP gross margin

70.0

%

70.0

%

Gross margin constant currency impact

(1)

0.0

Constant currency gross margin

(1)

70.1

%

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

CONSTANT CURRENCY GROSS PROFIT AND GROSS

MARGIN

(in thousands, except percentages)

Current year versus prior year constant

currency analysis:

Year Ended December

31,

2024

2023

GAAP gross profit

$

2,799,159

$

2,706,863

Constant currency impact on net

revenues

38,466

Constant currency gross profit

$

2,837,625

Year Ended December

31,

2024

2023

GAAP gross margin

70.0

%

70.1

%

Constant currency impact on net

revenues(1)

0.3

Constant currency gross

margin(1)

70.3

%

Note:

(1)

We define constant currency gross margin

as constant currency gross profit as a percentage of constant

currency net revenues. Gross margin constant currency impact is the

increase or decrease in constant currency gross margin compared to

the GAAP gross margin.

(+)

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding. Refer to "About Non-GAAP Financial Measures" section of

press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

CONSTANT CURRENCY INCOME FROM OPERATIONS

AND OPERATING MARGIN

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

December 31,

2024

September 30,

2024

GAAP income from operations

$

144,149

$

162,298

Income from operations constant currency

impact (1)

(778

)

Constant currency income from

operations (1)

$

143,371

Three Months Ended

December 31,

2024

September 30,

2024

GAAP operating margin

14.5

%

16.6

%

Operating margin constant currency impact

(2)

(0.1

)

Constant currency operating margin

(2)

14.4

%

Year-over-year constant currency

analysis:

Three Months Ended

December 31,

2024

2023

GAAP income from operations

$

144,149

$

171,545

Income from operations constant currency

impact (1)

1,680

Constant currency income from

operations (1)

$

145,829

Three Months Ended

December 31,

2024

2023

GAAP operating margin

14.5

%

17.9

%

Operating margin constant currency impact

(2)

0.2

Constant currency operating margin

(2)

14.6

%

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

CONSTANT CURRENCY INCOME FROM OPERATIONS

AND OPERATING MARGIN CONTINUED

(in thousands, except percentages)

Current year versus prior year constant

currency analysis:

Year Ended December

31,

2024

2023

GAAP income from operations

$

607,628

$

643,338

Income from operations constant currency

impact (1)

34,379

Constant currency income from

operations (1)

$

642,007

Year Ended December

31,

2024

2023

GAAP operating margin

15.2

%

16.7

%

Operating margin constant currency impact

(2)

0.7

Constant currency operating margin

(2)

15.9

%

Notes:

(1)

We define constant currency income from

operations as GAAP income from operations excluding the effect of

foreign exchange rate movements for GAAP net revenues and operating

expenses on a sequential, year-over-year and current year versus

prior year basis. Constant currency impact in dollars is calculated

by translating the current period GAAP net revenues and operating

expenses using the foreign currency exchange rates that were in

effect during the previous comparable period and subtracting it by

the current period GAAP net revenues and operating expenses.

(2)

We define constant currency operating

margin as constant currency income from operations as a percentage

of constant currency net revenues. Operating margin constant

currency impact is the increase or decrease in constant currency

operating margin compared to the GAAP operating margin.

(+)

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding. Refer to "About Non-GAAP Financial Measures" section of

press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

FINANCIAL MEASURES OTHER THAN CONSTANT

CURRENCY

(in thousands, except per share data)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

GAAP gross profit

$

696,941

$

669,524

$

2,799,159

$

2,706,863

Stock-based compensation

(721

)

1,780

6,995

7,462

Amortization of intangibles (1)

3,699

2,773

14,803

11,182

Restructuring charges (2)

3,823

673

3,823

673

Other Non-GAAP items (3)

1,410

—

1,410

—

Non-GAAP gross profit

$

705,152

$

674,750

$

2,826,190

$

2,726,180

GAAP gross margin

70.0

%

70.0

%

70.0

%

70.1

%

Non-GAAP gross margin

70.9

%

70.5

%

70.7

%

70.6

%

GAAP total operating expenses

$

552,792

$

497,979

$

2,191,531

$

2,063,525

Stock-based compensation

(39,569

)

(37,049

)

(166,708

)

(146,564

)

Amortization of intangibles (1)

(879

)

(866

)

(3,497

)

(3,497

)

Restructuring and other charges (2)

(33,168

)

(13,316

)

(32,722

)

(13,316

)

Legal settlement loss

225

—

(30,968

)

—

Other Non-GAAP items (3)

(4,676

)

—

(4,676

)

—

Non-GAAP total operating

expenses

$

474,725

$

446,748

$

1,952,960

$

1,900,148

GAAP income from operations

$

144,149

$

171,545

$

607,628

$

643,338

Stock-based compensation

38,848

38,829

173,703

154,026

Amortization of intangibles (1)

4,578

3,639

18,300

14,679

Restructuring and other charges (2)

36,991

13,989

36,545

13,989

Legal settlement loss

(225

)

—

30,968

—

Other Non-GAAP items (3)

6,086

—

6,086

—

Non-GAAP income from operations

$

230,427

$

228,002

$

873,230

$

826,032

GAAP operating margin

14.5

%

17.9

%

15.2

%

16.7

%

Non-GAAP operating margin

23.2

%

23.8

%

21.8

%

21.4

%

GAAP net income before provision for

income taxes

$

140,777

$

172,880

$

608,959

$

641,204

Stock-based compensation

38,848

38,829

173,703

154,026

Amortization of intangibles (1)

4,578

3,639

18,300

14,679

Restructuring and other charges (2)

36,991

13,989

36,545

13,989

Legal settlement loss

(225

)

—

30,968

—

Other Non-GAAP items (3)

6,086

—

6,086

—

Non-GAAP net income before provision

for income taxes

$

227,055

$

229,337

$

874,561

$

823,898

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

FINANCIAL MEASURES OTHER THAN CONSTANT

CURRENCY CONTINUED

(in thousands, except per share data)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

GAAP provision for income taxes

$

36,970

$

48,866

$

187,597

$

196,151

Tax impact on non-GAAP adjustments

8,441

(2,998

)

(12,715

)

(31,415

)

Non-GAAP provision for income

taxes

$

45,411

$

45,868

$

174,882

$

164,736

GAAP effective tax rate

26.3

%

28.3

%

30.8

%

30.6

%

Non-GAAP effective tax rate

20.0

%

20.0

%

20.0

%

20.0

%

GAAP net income

$

103,807

$

124,014

$

421,362

$

445,053

Stock-based compensation

38,848

38,829

173,703

154,026

Amortization of intangibles (1)

4,578

3,639

18,300

14,679

Restructuring and other charges (2)

36,991

13,989

36,545

13,989

Legal settlement loss

(225

)

—

30,968

—

Other Non-GAAP items (3)

6,086

—

6,086

—

Tax impact on non-GAAP adjustments

(8,441

)

2,998

12,715

31,415

Non-GAAP net income

$

181,644

$

183,469

$

699,679

$

659,162

GAAP diluted net income per

share

$

1.39

$

1.64

$

5.62

$

5.81

Non-GAAP diluted net income per

share

$

2.44

$

2.42

$

9.33

$

8.61

Shares used in computing diluted net

income per share

74,465

75,802

74,993

76,568

Notes:

(1)

Amortization of intangible assets related

to certain acquisitions

(2)

During the fourth quarters of 2023 and

2024, we initiated restructuring plans to reduce headcount and

increase efficiencies across the organization and lower the overall

cost structure. Restructuring charges are primarily related to

severance and other post-employment one-time benefits.

(3)

Other Non-GAAP items from the fourth

quarter of 2024 primarily include settlements of various indirect

tax obligations related to prior years.

(+)

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding. Refer to "About Non-GAAP Financial Measures" section of

press release.

ALIGN TECHNOLOGY, INC.

Q1 2025 OUTLOOK - GAAP TO NON-GAAP

RECONCILIATION

GAAP Operating Margin

Approximately 13.5%

Stock-based compensation

~4.5%

Amortization of intangibles (1)

~0.5%

Non-GAAP Operating Margin

Approximately 18.5%

ALIGN TECHNOLOGY, INC.

FISCAL 2025 OUTLOOK - GAAP TO NON-GAAP

RECONCILIATION

GAAP Operating Margin

Approximately 17.0%

Stock-based compensation

~5.0%

Amortization of intangibles (1)

~0.5%

Non-GAAP Operating Margin

Approximately 22.5%

(1)

Amortization of intangible assets related

to certain acquisitions

Refer to "About Non-GAAP Financial Measures" section of press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204696984/en/

Align Technology Madelyn Valente

(909) 833-5839 mvalente@aligntech.com

Zeno Group Sarah Karlson (828)

551-4201 sarah.karlson@zenogroup.com

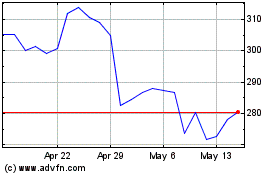

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Feb 2024 to Feb 2025