0001097149false00010971492025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 5, 2025

ALIGN TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 000-32259 | | 94-3267295 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

410 North Scottsdale Road, Suite 1300, Tempe, Arizona 85288

(Address of principal executive offices) (Zip Code)

(602) 742-2000

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value | ALGN | The NASDAQ Stock Market LLC |

| | (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 5, 2025, Align Technology, Inc. issued a press release and will hold a conference call regarding its financial results for its fourth quarter and fiscal year ended December 31, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

This information is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ALIGN TECHNOLOGY, INC. |

| | |

| By: | /s/ John F. Morici |

| | John F. Morici

Chief Financial Officer and Executive Vice President, Global Finance |

Date: February 5, 2025

Exhibit 99.1

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

| | | | | |

| Align Technology | Zeno Group |

| Madelyn Valente | Sarah Karlson |

| (909) 833-5839 | (828) 551-4201 |

| mvalente@aligntech.com | sarah.karlson@zenogroup.com |

ALIGN TECHNOLOGY ANNOUNCES FOURTH QUARTER AND FISCAL 2024 FINANCIAL RESULTS

Q4 total revenues of $995.2 million and FY2024 total revenues of $4.0 billion

Q4 and FY2024 total revenues up 4.0% year-over-year and up 3.5% year-over-year, respectively

Q4 Clear Aligner volumes up 1.9% sequentially, and up 6.1% year-over-year

Q4 Systems and Services revenues up 5.2% sequentially, and up 14.9% year-over-year

•2024 total revenues of $4.0 billion, Clear Aligner revenues of $3.2 billion and Systems and Services revenues of $768.9 million

•2024 revenues were unfavorably impacted by foreign exchange of approximately $38.5 million compared to 2023(1)

•2024 operating margin of 15.2%, non-GAAP operating margin of 21.8%, and diluted net income per share of $5.62, non-GAAP diluted net income per share of $9.33

•2024 operating margin was unfavorably impacted by foreign exchange of approximately 0.7 points compared to 2023(1)

•Repurchased $352.9 million of common stock in 2024

•Q4'24 total revenues of $995.2 million, and diluted net income per share of $1.39, non-GAAP diluted net income per share of $2.44

•Q4’24 diluted net income per share was unfavorably impacted by a stronger U.S. dollar, which amounted to approximately $0.14 per diluted share due to net foreign exchange losses related to the revaluation of certain balance sheet accounts

•Q4'24 revenues were favorably impacted by foreign exchange of approximately $0.8 million sequentially and unfavorably impacted by approximately $0.9 million year-over-year(1)

•Q4'24 restructuring and other charges of $37.0 million, primarily related to post-employment benefits

TEMPE, Ariz., February 5, 2025 -- Align Technology, Inc. (Nasdaq: ALGN), a leading global medical device company that designs, manufactures, and sells the Invisalign® System of clear aligners, iTero™ intraoral scanners, and exocad™ CAD/CAM software for digital orthodontics and restorative dentistry, today reported financial results for the fourth quarter ("Q4'24") and year ended December 31, 2024 ("2024"). Q4'24 total revenues were $995.2 million, up 1.8% sequentially and up 4.0% year-over-year. Q4'24 total revenues were favorably impacted by foreign exchange of approximately $0.8 million or 0.1% sequentially and unfavorably impacted by approximately $0.9 million or 0.1% year-over-year.(1) Q4'24 Clear Aligner revenues were $794.3 million, up 0.9% sequentially and up 1.6% year-over-year. Q4'24 Clear Aligner revenues were favorably impacted by foreign exchange of approximately $0.7 million or 0.1% sequentially and unfavorably impacted by approximately $0.7 million or 0.1% year-over-year.(1)

(1) For more information, please see the tables captioned "Unaudited GAAP to Non-GAAP Reconciliation."

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

Q4'24 Clear Aligner volume was up 1.9% sequentially and up 6.1% year-over-year. Q4'24 Imaging Systems and CAD/CAM Services revenues were $200.9 million, up 5.2% sequentially and up 14.9% year-over-year. Q4'24 Imaging Systems and CAD/CAM Services revenues were favorably impacted by foreign exchange of approximately $0.1 million or flat sequentially and unfavorably impacted by approximately $0.2 million or 0.1% year-over-year.(1) Q4'24 operating income was $144.1 million resulting in an operating margin of 14.5%. Q4'24 operating margin was favorably impacted by foreign exchange of approximately 0.1 points sequentially and unfavorably impacted by approximately 0.2 points year-over-year.(1) Q4'24 net income was $103.8 million, or $1.39 per diluted share. Q4’24 diluted net income per share was unfavorably impacted by a stronger U.S. dollar, which amounted to approximately $0.14 per diluted share due to net foreign exchange losses related to the revaluation of certain balance sheet accounts. On a non-GAAP basis, Q4'24 net income was $181.6 million, or $2.44 per diluted share. During Q4'24, we incurred a total of $37.0 million of restructuring and other charges, primarily related to post-employment benefits.

2024 total revenues of $4.0 billion were unfavorably impacted by foreign exchange of approximately $38.5 million or 1.0% compared to 2023.(1) 2024 Clear Aligner revenues of $3.2 billion were unfavorably impacted by foreign exchange of approximately $31.0 million or 1.0% compared to 2023.(1) 2024 Imaging Systems and CAD/CAM Services revenues of $768.9 million were unfavorably impacted by foreign exchange of approximately $7.5 million or 1.0% compared to 2023.(1)

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

Commenting on Align's Q4'24 and 2024 results, Align Technology President and CEO Joe Hogan said, “I am pleased to report that Q4 total revenues, Clear Aligner volumes, and Systems and Services revenues were in line with our Q4 outlook and both GAAP and non-GAAP operating margins were better than our Q4 outlook. Q4 Clear Aligner ASPs were lower than our Q4 outlook due primarily to the impact from unfavorable foreign exchange from the strengthening U.S. dollar against major currencies from late October through December. On a year-over-year basis, fourth quarter revenues of $995.2 million increased 4.0%, reflecting 14.9% growth from Systems and Services revenues and 1.6% growth from Clear Aligner revenues. On a year-over-year basis, Clear Aligner volumes grew 6.1%, driven by increased shipments across all regions—with strength in the EMEA, APAC, and LATAM regions, and stability in North America. From a channel perspective, Clear Aligner volumes in the ortho and general practitioner dentist (“GP”) channels were up on a year-over-year basis with the number of submitters and utilization amongst the highest in the past few years. On a sequential basis, fourth quarter revenue growth of 1.8% reflects continued momentum from sales of our iTero Lumina™ scanners and increased Invisalign® Clear Aligner volumes in the EMEA region, especially from teens and growing patients, as well as growth from the LATAM region - across Orthodontists and GP Dentists, offset by Clear Aligner seasonality in APAC, mostly in China, which had a strong teen quarter in Q3. For Americas, Q4 Clear Aligner volumes reflect a seasonally soft orthodontic channel, offset somewhat by strength in the GP channel in the adult segment. For the full year fiscal 2024, total revenues of $4.0 billion and Clear Aligner volumes of 2.5 million cases were both up 3.5% year-over-year. As of Q4'24, we achieved several cumulative milestones including 271.6 thousand active Invisalign® trained practitioners, 19.5 million Invisalign patients—including over 5.6 million teens and kids, and over 2 billion clear aligners manufactured worldwide."

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

Financial Summary - Fourth Quarter Fiscal 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4'24 | | Q3'24 | | Q4'23 | | Q/Q Change | | Y/Y Change |

| Clear Aligner Shipments* | 628,730 | | 617,220 | | 592,635 | | +1.9% | | +6.1% |

| GAAP | | | | | | | | | |

| Net Revenues | $995.2M | | $977.9M | | $956.7M | | +1.8% | | +4.0% |

| Clear Aligner | $794.3M | | $786.8M | | $781.9M | | +0.9% | | +1.6% |

Imaging Systems and CAD/CAM Services | $200.9M | | $191.0M | | $174.8M | | +5.2% | | +14.9% |

| Net Income | $103.8M | | $116.0M | | $124.0M | | (10.5)% | | (16.3)% |

| Diluted EPS | $1.39 | | $1.55 | | $1.64 | | $(0.16) | | $(0.25) |

| Non-GAAP | | | | | | | | | |

Net Income | $181.6M | | $175.6M | | $183.5M | | +3.4% | | (1.0)% |

Diluted EPS | $2.44 | | $2.35 | | $2.42 | | +$0.09 | | +$0.02 |

Financial Summary - Fiscal 2024

| | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | Y/Y Change |

| Clear Aligner Shipments* | 2,493,735 | | 2,408,520 | | +3.5% |

| GAAP | | | | | |

| Net Revenues | $3,999.0M | | $3,862.3M | | +3.5% |

| Clear Aligner | $3,230.1M | | $3,199.3M | | +1.0% |

Imaging Systems and CAD/CAM Services | $768.9M | | $662.9M | | +16.0% |

| Net Income | $421.4M | | $445.1M | | (5.3)% |

| Diluted EPS | $5.62 | | $5.81 | | $(0.19) |

| Non-GAAP | | | | | |

Net Income | $699.7M | | $659.2M | | +6.1% |

Diluted EPS | $9.33 | | $8.61 | | +$0.72 |

Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding.

*Clear Aligner shipments include Doctor Subscription Program Touch-Up cases.

As of December 31, 2024, we had $1,043.9 million in cash and cash equivalents compared to over $1,041.9 million as of September 30, 2024. As of December 31, 2024, we had $300.0 million available under a revolving line of credit.

During the quarter, we completed a $30.0 million equity investment in Smile Doctors, the largest ortho-focused dental support organization in the U.S.

Commenting on Align's fourth quarter and fiscal 2024 results, Align Technology CFO and EVP Global Finance, John Morici said, "Overall, I am pleased with our fourth quarter and fiscal 2024 results, particularly the year-over-year Clear Aligner volume growth, the record number of submitters, the continued momentum from our Systems and Services business, and our operating margin improvement. After repurchasing $353 million of Align common stock during 2024, we concluded the year with no debt and approximately $1,044 million in cash, and cash equivalents. Our goal, as always, is to deliver value to our shareholders."

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

Recent Highlights

•On January 21, 2025, Align was listed as one of the top 300 companies worldwide that were granted U.S. patents last year on the 2025 Patent 300® list, with Align ranked at #263 with 164 U.S. patents granted in 2024. For reference, Align ranked #270 the year before.

•On January 16, 2025, we announced that Patrick Mahomes, quarterback for the National Football League’s Kansas City Chiefs, joined the Invisalign Smile Squad as an ambassador for the brand. As part of the multi-year agreement, Patrick will share his Invisalign® treatment experience with fans in a multi-channel campaign.

Q4'24 Highlights

•In December, the Invisalign® Palatal Expander System made the cover of the Journal of Clinical Orthodontics. The featured article, “Protocol for the Invisalign Palatal Expander” written by Dr. Jonathan L. Nicozisis, DMD, MS., concluded that Align Technology's Invisalign Palatal Expander System is an effective treatment, with the potential to offer an improved patient experience and better clinical outcomes.

•On November 20, we announced that Align received the CE Mark under the Medical Device Regulation (MDR 2017/745) to market the Invisalign® Palatal Expander System in most of Europe and also completed registration with the Medicines and Healthcare products Regulatory Agency for the United Kingdom and overseas territories.

•On November 12, we shared highlights from the 2024 Invisalign Ortho Summit, Align’s premier clinical education and peer-to-peer networking experience designed to help doctors transform and grow their practice with Invisalign® clear aligners, iTero scanners, and the Align™ Digital Platform. More than 1,000 doctors and practice team members from every region came together, alongside Align and peer-to-peer speakers, to share treatment and workflow best practices, hands-on experiences to sharpen clinical skills, and practice growth and marketing strategies.

•On November 4, we announced the opening of Align's 2025 Annual Research Award Program to support clinical and scientific dental research in universities across the globe. This year, up to $300,000 will be awarded to university faculty for scientific and technological research initiatives to advance patient care in the fields of orthodontics and dentistry. Align Technology’s Research Award Program has funded approximately $3.75 million in research since the program’s inception in 2010.

•On October 23, we announced Frank Quinn, formerly Align vice president and general manager of the United States, rejoined the company as executive vice president and managing director of the Americas region.

•On October 23, we announced the release of the next innovation of Invisalign Smile Architect™ software, now with Multiple Treatment Plans allowing doctors to visually compare and modify orthodontic only and ortho restorative treatment plans side-by-side. The Multiple Treatment Plans are integrated into ClinCheck® treatment planning software for doctors to visually compare, review, and choose the best treatment option for each patient.

•On October 23, we announced iTero intraoral scanner product innovations that provide a versatile overall solution for general practitioner ("GP") dentists that enhance digital dentistry workflows and integrated treatment options in oral health, restorative, and ortho treatment in general dentistry practices.

•On October 14, we announced that Align's Invisalign® Palatal Expander System has been listed on the Singapore Medical Device Register as a class B medical device. The Invisalign Palatal Expander System is now

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

commercially available in Singapore and more recently in Hong Kong for broad patient applicability, including growing children, teens and adults (with surgery or other techniques).

Q4'24 Stock Repurchases

•During Q4'24, we initiated a plan to repurchase $275.0 million of our common stock through open market repurchases. As of December 31, 2024 we had purchased approximately 0.9 million shares at an average price of $222.94 per share for an aggregate of $202.9 million. Purchase of the remaining $72.1 million of the $275.0 million was completed in January 2025.

•As of January 31, 2025, $225.0 million remains available for repurchases of our common stock under our stock repurchase program approved in January 2023.

Business Trends Commentary

Align provides the following context around Clear Aligner pricing and potential new tariffs:

Clear Aligner Pricing Commentary:

•On March 1, 2025, we will raise the list price of Clear Aligners by approximately 3% on average in the Americas and EMEA regions. At the same time, we will remove the $10–$15 per order processing fee for new Clear Aligner orders, Clear Aligner refinement orders, and non-DSP Vivera™ cases ordered. We expect the net effect from these two actions on ASPs to be zero for 2025.

Tariffs Commentary:

•We currently manufacture clear aligners in Mexico and ship them to the U.S. primarily for our U.S. customers with the remainder eventually shipping to other international locations. The U.S./Mexico tariff situation remains very fluid, and we are unable to predict whether new tariffs will go into effect in the future. We are monitoring events closely. Our clear aligner COGS include material, labor, overhead, and freight costs. We expect an incremental tariff, if implemented, to be applied to transfer prices from Mexico. These transfer prices would not include treatment planning costs, freight, other overhead, etc. Align’s global operations have evolved significantly over the past several years and we have greater flexibility to support our global business. However, assuming a 25% tariff on goods originating in Mexico, it is still more economical to ship clear aligners to the U.S. from Mexico, due to a variety of factors including the incremental additional freight costs incurred were we to ship from our Polish facility. Regarding China, we currently manufacture our products in China for the benefit of our customers in China.

Fiscal 2025 Business Outlook

With this as a backdrop, assuming no circumstances occur beyond our control, including foreign exchange and new tariffs, for Q1'25 and fiscal 2025 we provide the following outlook:

Q1'25:

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

•We expect Q1 worldwide revenues to be in the range of $965M to $985M, down sequentially from Q4, primarily due to the impact from unfavorable foreign exchange at current spot rates, and lower capital equipment sales, reflecting historical Q1 seasonality.

•We expect Q1 Clear Aligner volume to be up slightly sequentially and expect Q1 Clear Aligner ASPs to be down sequentially, primarily due to unfavorable foreign exchange at current spot rates, as well as continued product mix shift to non-comprehensive clear aligners.

•In addition to seasonality, we expect Q1 Systems and Services revenues to be down sequentially due to the timing of the commercial availability of our iTero Lumina™ scanner with restorative software, which is expected at the end of March.

•We expect our Q1’25 GAAP operating margin to be below Q1’24 GAAP operating margin by approximately 2 points, primarily due to unfavorable foreign exchange at current spot rates.

•We expect our Q1’25 non-GAAP operating margin to be below Q1’24 non-GAAP operating margin by approximately 1 point, primarily due to unfavorable foreign exchange at current spot rates.

For fiscal 2025:

•We expect 2025 year-over-year revenue growth to be low single digits, which reflects approximately 2 points of unfavorable foreign exchange at current spot rates.

•We expect 2025 Clear Aligner volume growth to be up approximately mid-single digits year-over-year, compared to up 3.5% year-over-year in 2024.

•We expect 2025 Clear Aligner ASPs to be down year-over-year due to unfavorable foreign exchange at current spot rates and continued product mix shift to non-comprehensive clear aligners.

•We expect 2025 Systems and Services year-over-year revenues to grow faster than Clear Aligner revenues.

•We expect fiscal 2025 GAAP operating margin to be approximately 2 points above 2024 GAAP operating margin, and we expect 2025 non-GAAP operating margin to be approximately 22.5%, which both reflect the impact of unfavorable foreign exchange at current spot rates, partially offset by the benefits from restructuring actions we took in Q4 to improve profitability and give us margin accretion in 2025, even as we scale our next generation direct 3D printing fabrication manufacturing.

•We expect our investments in capital expenditures for fiscal 2025 to be between $100M and $150M. Capital expenditures primarily relate to building construction and improvements as well as manufacturing capacity in support of our continued expansion.

Align Web Cast and Conference Call

We will host a conference call today, February 5, 2025, at 4:30 p.m. EST, 2:30 p.m. MST, to review our fourth quarter and full year 2024 results, discuss future operating trends, and our business outlook. The conference call will also be webcast live via the Internet. To access the webcast, go to the "Events & Presentations" section under

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

Company Information on Align's Investor Relations website at http://investor.aligntech.com. To access the conference call, participants may register for the call at https://edge.media-server.com/mmc/p/jkuu8qox/. Once registered, participants will receive an email with dial-in number and unique PIN number to access the live event. An archived audio webcast will be available 2 hours after the call's conclusion and will remain available for one month.

About Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States ("GAAP"), we may provide investors with certain non-GAAP financial measures which may include constant currency net revenues, constant currency gross profit, constant currency gross margin, constant currency income from operations, constant currency operating margin, non-GAAP gross profit, non-GAAP gross margin, non-GAAP total operating expenses, non-GAAP income from operations, non-GAAP operating margin, non-GAAP net income before provision for income taxes, non-GAAP provision for income taxes, non-GAAP effective tax rate, non-GAAP net income and/or non-GAAP diluted net income per share, which excludes certain items that may not be indicative of our fundamental operating performance including, foreign currency exchange rate impacts and discrete cash and non-cash charges or gains that are included in the most directly comparable GAAP measure. Unless otherwise indicated, when we refer to non-GAAP financial measures they will exclude the effects of stock-based compensation, amortization of certain acquired intangibles, restructuring and other charges, acquisition-related costs and associated tax impacts.

Our management believes that the use of certain non-GAAP financial measures provides meaningful supplemental information regarding our recurring core operating performance. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the performance of our business.

There are limitations to using non-GAAP financial measures as they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. The non-GAAP financial measures are limited in value because they exclude certain items that may have a material impact upon our reported financial results. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which charges are excluded from the non-GAAP financial measures. We compensate for these limitations by analyzing current and future results on a GAAP as well as a non-GAAP basis and also by providing GAAP measures in our public disclosures. The presentation of non-GAAP financial information is meant to be considered in addition to, not as a substitute for or in isolation from, the directly comparable financial measures prepared in accordance with GAAP. We urge investors to review the reconciliation of our GAAP financial measures to the comparable non-GAAP financial measures included herein and not to rely on any single financial measure to evaluate our business. For more information on these non-GAAP financial measures, please see the tables captioned "Unaudited GAAP to Non-GAAP Reconciliation."

About Align Technology, Inc.

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

Align Technology designs and manufactures the Invisalign® System, the most advanced clear aligner system in the world, iTero™ intraoral scanners and services, and exocad™ CAD/CAM software. These technology building blocks enable enhanced digital orthodontic and restorative workflows to improve patient outcomes and practice efficiencies for over 271.6 thousand doctor customers and are key to accessing Align’s 600 million consumer market opportunity worldwide. Over the past 27 years, Align has helped doctors treat approximately 19.5 million patients with the Invisalign System and is driving the evolution in digital dentistry through the Align™ Digital Platform, our integrated suite of unique, proprietary technologies and services delivered as a seamless, end-to-end solution for patients and consumers, orthodontists and GP dentists, and lab/partners. Visit www.aligntech.com for more information.

For additional information about the Invisalign System or to find an Invisalign doctor in your area, please visit www.invisalign.com. For additional information about the iTero digital scanning system, please visit www.itero.com. For additional information about exocad dental CAD/CAM offerings and a list of exocad reseller partners, please visit www.exocad.com.

Invisalign, iTero, exocad, Align, Align Digital Platform, and iTero Lumina are trademarks of Align Technology, Inc.

Forward-Looking Statements

This news release, including the tables below, contains forward-looking statements, including statements of beliefs and expectations regarding our ability to successfully control our business and operations and pursue our strategic growth drivers, our expectations of the impact of ASPs from pricing adjustments, our expectations regarding possible tariffs, our expectations for the commercial availability of our products, our expectations for market opportunities, our expectations for worldwide revenues, Clear Aligner volume, Clear Aligner ASP, Systems and Services revenues and GAAP and non-GAAP operating margin, and 2025 capital expenditures. Forward-looking statements contained in this press release relating to expectations about future events or results are based upon information available to Align as of the date hereof. Readers are cautioned that these forward-looking statements reflect our best judgments based on currently known facts and circumstances and are subject to risks, uncertainties, and assumptions that are difficult to predict. As a result, actual results may differ materially and adversely from those expressed in any forward-looking statement.

Factors that might cause such a difference include, but are not limited to:

•macroeconomic conditions, including fluctuations in currency exchange rates, inflation, higher interest rates, market volatility, threats or actual imposition of tariffs, threats of or actual economic slowdowns or recessions;

•customer and consumer purchasing behavior and changes in consumer spending habits;

•the economic and geopolitical ramifications of the military conflicts in the Middle East and Ukraine, including sanctions, retaliatory sanctions, nationalism, supply chain disruptions and other consequences, any of which may or will continue to adversely impact our operations and assets and our research and development activities;

•variations in our product mix, product adoption and selling prices regionally and globally;

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

•competition from existing and new competitors;

•declines in, or the slowing of growth of, sales of our clear aligners or intraoral scanners domestically and/or internationally and the impact either would have on the adoption of Invisalign products;

•the timing and availability and cost of raw materials, components, products and other shipping and supply chain constraints, disruptions or costs;

•unexpected or rapid changes in the growth or decline of our domestic and/or international markets;

•rapidly evolving and groundbreaking advances that fundamentally alter the dental industry or the way new and existing customers market and provide products and services to consumers;

•the ability to protect and enforce our intellectual property rights;

•continued compliance with regulatory requirements;

•the willingness and ability of our customers to maintain and/or increase product utilization;

•the possibility that the development and release of new products or enhancements to existing products do not proceed in accordance with the anticipated timeline or may themselves contain bugs, errors or defects in software or hardware requiring remediation and that the market for the sale of these new or enhanced products may not develop as expected;

•a tougher consumer demand environment in China generally, especially for manufacturers and service providers whose headquarters or primary operations are not based in China;

•the risks relating to our ability to sustain or increase profitability or revenue growth in future periods (or minimize declines) while controlling expenses;

•expansion of our business and products;

•the impact of excess or constrained capacity at our manufacturing and treat operations facilities and pressure on our internal systems and personnel;

•the compromise of our systems or networks, including any customer and/or patient data contained therein, for any reason;

•the timing of case submissions from our doctor customers within a quarter as well as an increased manufacturing costs per case;

•foreign operational, political, military and other risks relating to our operations; and

•the loss of key personnel, labor shortages or work stoppages for us or our suppliers.

The foregoing and other risks are detailed from time to time in our periodic reports filed with the Securities and Exchange Commission, including, but not limited to, our Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the Securities and Exchange Commission ("SEC") on February 28, 2024 and our latest Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which was filed with the SEC on November 5, 2024. Align undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Net revenues | | $ | 995,219 | | | $ | 956,726 | | | $ | 3,999,012 | | | $ | 3,862,260 | |

| Cost of net revenues | | 298,278 | | | 287,202 | | | 1,199,853 | | | 1,155,397 | |

| Gross profit | | 696,941 | | | 669,524 | | | 2,799,159 | | | 2,706,863 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | 424,971 | | | 402,503 | | | 1,763,193 | | | 1,703,379 | |

| Research and development | | 94,878 | | | 82,160 | | | 364,202 | | | 346,830 | |

| Restructuring and other charges | | 33,168 | | | 13,316 | | | 33,168 | | | 13,316 | |

| Legal settlement loss | | (225) | | | — | | | 30,968 | | | — | |

| Total operating expenses | | 552,792 | | | 497,979 | | | 2,191,531 | | | 2,063,525 | |

| Income from operations | | 144,149 | | | 171,545 | | | 607,628 | | | 643,338 | |

| Interest income and other income (expense), net: | | | | | | | | |

| Interest income | | 8,522 | | | 4,978 | | | 20,218 | | | 17,258 | |

| Other income (expense), net | | (11,894) | | | (3,643) | | | (18,887) | | | (19,392) | |

| Total interest income and other income (expense), net | | (3,372) | | | 1,335 | | | 1,331 | | | (2,134) | |

| Net income before provision for income taxes | | 140,777 | | | 172,880 | | | 608,959 | | | 641,204 | |

| Provision for income taxes | | 36,970 | | | 48,866 | | | 187,597 | | | 196,151 | |

| Net income | | $ | 103,807 | | | $ | 124,014 | | | $ | 421,362 | | | $ | 445,053 | |

| | | | | | | | |

| Net income per share: | | | | | | | | |

| Basic | | $ | 1.39 | | | $ | 1.64 | | | $ | 5.63 | | | $ | 5.82 | |

Diluted | | $ | 1.39 | | | $ | 1.64 | | | $ | 5.62 | | | $ | 5.81 | |

| Shares used in computing net income per share: | | | | | | | | |

| Basic | | 74,419 | | | 75,703 | | | 74,877 | | | 76,426 | |

| Diluted | | 74,465 | | | 75,802 | | | 74,993 | | | 76,568 | |

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | | | | | | | | | | | | |

| | December 31,

2024 | | December 31,

2023 |

| ASSETS | | | | |

| | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 1,043,887 | | | $ | 937,438 | |

| Marketable securities, short-term | | — | | | 35,304 | |

| Accounts receivable, net | | 995,685 | | | 903,424 | |

| Inventories | | 254,287 | | | 296,902 | |

| Prepaid expenses and other current assets | | 198,582 | | | 273,550 | |

| Total current assets | | 2,492,441 | | | 2,446,618 | |

| | | | |

| Marketable securities, long-term | | — | | | 8,022 | |

| Property, plant and equipment, net | | 1,271,134 | | | 1,290,863 | |

| Operating lease right-of-use assets, net | | 113,376 | | | 117,999 | |

| Goodwill | | 442,630 | | | 419,530 | |

| Intangible assets, net | | 103,488 | | | 82,118 | |

| Deferred tax assets | | 1,557,372 | | | 1,590,045 | |

| Other assets | | 234,159 | | | 128,682 | |

| | | | |

| Total assets | | $ | 6,214,600 | | | $ | 6,083,877 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 108,693 | | | $ | 113,125 | |

| Accrued liabilities | | 598,188 | | | 525,780 | |

| Deferred revenues | | 1,331,146 | | | 1,427,706 | |

| Total current liabilities | | 2,038,027 | | | 2,066,611 | |

| | | | |

| Income tax payable | | 96,466 | | | 116,744 | |

| Operating lease liabilities | | 88,214 | | | 96,968 | |

| Other long-term liabilities | | 139,908 | | | 173,065 | |

| Total liabilities | | 2,362,615 | | | 2,453,388 | |

| | | | |

| Total stockholders’ equity | | 3,851,985 | | | 3,630,489 | |

| | | | |

| Total liabilities and stockholders’ equity | | $ | 6,214,600 | | | $ | 6,083,877 | |

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | | | | |

| | Year Ended

December 31, |

| | 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net cash provided by operating activities | | $ | 738,231 | | | $ | 785,776 | |

| | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | |

| Net cash used in investing activities | | (254,912) | | | (195,943) | |

| | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Net cash used in financing activities | | (355,722) | | | (598,340) | |

| | | | |

| Effect of foreign exchange rate changes on cash, cash equivalents, and restricted cash | | (21,153) | | | 4,671 | |

| Net (decrease) increase in cash, cash equivalents, and restricted cash | | 106,444 | | | (3,836) | |

| Cash, cash equivalents, and restricted cash at beginning of the period | | 938,519 | | | 942,355 | |

| Cash, cash equivalents, and restricted cash at end of the period | | $ | 1,044,963 | | | $ | 938,519 | |

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

INVISALIGN BUSINESS METRICS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal | | | | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | | | 2024 | | 2024 | | 2024 | | 2024 | | 2024 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Number of Invisalign Trained Doctors Cases Were Shipped To |

| | 82,730 | | | 83,440 | | | 85,195 | | | 83,700 | | | 125,845 | | | | | 83,510 | | | 86,135 | | | 87,380 | | | 85,685 | | | 130,370 | |

| Invisalign Trained Doctor Utilization Rates* | | | | | | | | | | | | | | |

| North America | | 9.5 | | 9.8 | | 9.6 | | 9.1 | | 27.6 | | | | | 9.5 | | | 9.9 | | | 9.7 | | | 9.3 | | | 28.0 | |

| North American Orthodontists | | 28.7 | | 29.2 | | 28.8 | | 25.9 | | 94.5 | | | | 28.2 | | | 28.8 | | | 28.3 | | | 26.3 | | | 95.0 | |

| North American GP Dentists | | 4.9 | | 5.2 | | 4.9 | | 5.0 | | 14.0 | | | | | 4.9 | | | 5.3 | | | 5.0 | | | 5.1 | | | 14.3 | |

| International | | 6.2 | | 6.6 | | 6.1 | | 6.5 | | 16.3 | | | | 6.3 | | | 6.7 | | | 6.2 | | | 6.8 | | | 16.2 | |

| Total Utilization Rates** | | 7.1 | | 7.5 | | 7.1 | | 7.1 | | 19.1 | | | | 7.2 | | | 7.5 | | | 7.1 | | | 7.3 | | | 19.1 | |

| Clear Aligner Revenue Per Case Shipment*** | | | | | | | | | | | | | | |

| | $ | 1,335 | | | $ | 1,335 | | | $ | 1,320 | | | $ | 1,320 | | | $ | 1,330 | | | | | $ | 1,350 | | | $ | 1,295 | | | $ | 1,275 | | | $ | 1,265 | | | $ | 1,295 | |

* # of cases shipped / # of doctors to whom cases were shipped

** LATAM utilization rate is not separately disclosed but included in the total utilization rates

*** Clear Aligner revenues / Case shipments

Note: During the third quarter of 2023, we began including Touch Up cases revenues that were previously included in

Non-Case revenues and have recast business metrics for the periods presented above accordingly.

ALIGN TECHNOLOGY, INC.

STOCK-BASED COMPENSATION

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal | | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | 2024 | | 2024 | | 2024 | | 2024 |

| Stock-based Compensation (SBC): | | | | | | | | | | | | | | | | | | | | |

| SBC included in Gross Profit | | $ | 1,807 | | | $ | 1,901 | | | $ | 1,974 | | | $ | 1,780 | | | $ | 7,462 | | | $ | 2,064 | | | $ | 2,582 | | | $ | 3,070 | | | $ | (721) | | | $ | 6,995 | |

| SBC included in Operating Expenses | | 35,928 | | | 35,959 | | | 37,628 | | | 37,049 | | | 146,564 | | | 36,724 | | | 44,446 | | | 45,969 | | | 39,569 | | | 166,708 | |

| Total SBC | | $ | 37,735 | | | $ | 37,860 | | | $ | 39,602 | | | $ | 38,829 | | | $ | 154,026 | | | $ | 38,788 | | | $ | 47,028 | | | $ | 49,039 | | | $ | 38,848 | | | $ | 173,703 | |

| | | | | | | | | | | | | | | | | | | | |

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION+

CONSTANT CURRENCY NET REVENUES

(in thousands, except percentages)

Sequential constant currency analysis:

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | December 31, 2024 | | September 30, 2024 | | Impact % of Revenue |

| GAAP net revenues | | $ | 995,219 | | | $ | 977,872 | | | |

Constant currency impact (1) | | (783) | | | | | (0.1) | % |

Constant currency net revenues (1) | | $ | 994,436 | | | | | |

| | | | | | |

| GAAP Clear Aligner net revenues | | $ | 794,289 | | | $ | 786,844 | | | |

Clear Aligner constant currency impact (1) | | (719) | | | | | (0.1) | % |

Clear Aligner constant currency net revenues (1) | | $ | 793,570 | | | | | |

| | | | | | |

GAAP Imaging Systems and CAD/CAM Services net revenues | | $ | 200,930 | | | $ | 191,028 | | | |

Imaging Systems and CAD/CAM Services constant currency impact (1) | | (64) | | | | | — | % |

Imaging Systems and CAD/CAM Services constant currency net revenues (1) | | $ | 200,866 | | | | | |

Year-over-year constant currency analysis:

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | |

| | 2024 | | 2023 | | Impact % of Revenue |

| GAAP net revenues | | $ | 995,219 | | | $ | 956,726 | | | |

Constant currency impact (1) | | 918 | | | | | 0.1 | % |

Constant currency net revenues (1) | | $ | 996,137 | | | | | |

| | | | | | |

| GAAP Clear Aligner net revenues | | $ | 794,289 | | | $ | 781,912 | | | |

Clear Aligner constant currency impact (1) | | 706 | | | | | 0.1 | % |

Clear Aligner constant currency net revenues (1) | | $ | 794,995 | | | | | |

| | | | | | |

GAAP Imaging Systems and CAD/CAM Services net revenues | | $ | 200,930 | | | $ | 174,814 | | | |

Imaging Systems and CAD/CAM Services constant currency impact (1) | | 212 | | | | | 0.1 | % |

Imaging Systems and CAD/CAM Services constant currency net revenues (1) | | $ | 201,142 | | | | | |

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION CONTINUED+

CONSTANT CURRENCY NET REVENUES CONTINUED

(in thousands, except percentages)

Current year versus prior year constant currency analysis:

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | |

| | 2024 | | 2023 | | Impact % of Revenue |

| GAAP net revenues | | $ | 3,999,012 | | | $ | 3,862,260 | | | |

Constant currency impact (1) | | 38,460 | | | | | 1.0 | % |

Constant currency net revenues (1) | | $ | 4,037,472 | | | | | |

| | | | | | |

| GAAP Clear Aligner net revenues | | $ | 3,230,122 | | | $ | 3,199,329 | | | |

Clear Aligner constant currency impact (1) | | 31,002 | | | | | 1.0 | % |

Clear Aligner constant currency net revenues (1) | | $ | 3,261,124 | | | | | |

| | | | | | |

GAAP Imaging Systems and CAD/CAM Services net revenues | | $ | 768,890 | | | $ | 662,931 | | | |

Imaging Systems and CAD/CAM Services constant currency impact (1) | | 7,458 | | | | | 1.0 | % |

Imaging Systems and CAD/CAM Services constant currency net revenues (1) | | $ | 776,348 | | | | | |

Note:

(1) We define constant currency net revenues as total net revenues excluding the effect of foreign exchange rate movements and use it to determine the percentage for the constant currency impact on net revenues on a sequential, year-over-year and current year versus prior year basis. Constant currency impact in dollars is calculated by translating the current period GAAP net revenues using the foreign currency exchange rates that were in effect during the previous comparable period and subtracting it by the current period GAAP net revenues. The percentage for the constant currency impact on net revenues is calculated by dividing the constant currency impact in dollars (numerator) by constant currency net revenues in dollars (denominator).

(+) Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding. Refer to "About Non-GAAP Financial Measures" section of press release.

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION CONTINUED+

CONSTANT CURRENCY GROSS PROFIT AND GROSS MARGIN

(in thousands, except percentages)

Sequential constant currency analysis:

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | December 31, 2024 | | September 30,

2024 |

| GAAP gross profit | | $ | 696,941 | | | $ | 681,774 | |

| Constant currency impact on net revenues | | (783) | | | |

| Constant currency gross profit | | $ | 696,158 | | | |

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | December 31, 2024 | | September 30,

2024 |

GAAP gross margin | | 70.0 | % | | 69.7 | % |

Gross margin constant currency impact (1) | | 0.0 | | | |

Constant currency gross margin (1) | | 70.0 | % | | |

Year-over-year constant currency analysis:

| | | | | | | | | | | | | | |

| | Three Months Ended

December 31, |

| | 2024 | | 2023 |

| GAAP gross profit | | $ | 696,941 | | | $ | 669,524 | |

| Constant currency impact on net revenues | | 918 | | | |

| Constant currency gross profit | | $ | 697,859 | | | |

| | | | | | | | | | | | | | |

| | Three Months Ended

December 31, |

| | 2024 | | 2023 |

GAAP gross margin | | 70.0 | % | | 70.0 | % |

Gross margin constant currency impact (1) | | 0.0 | | | |

Constant currency gross margin (1) | | 70.1 | % | | |

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION CONTINUED+

CONSTANT CURRENCY GROSS PROFIT AND GROSS MARGIN

(in thousands, except percentages)

Current year versus prior year constant currency analysis:

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| GAAP gross profit | | $ | 2,799,159 | | | $ | 2,706,863 | |

| Constant currency impact on net revenues | | 38,466 | | | |

| Constant currency gross profit | | $ | 2,837,625 | | | |

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| GAAP gross margin | | 70.0 | % | | 70.1 | % |

Constant currency impact on net revenues(1) | | 0.3 | | | |

Constant currency gross margin(1) | | 70.3 | % | | |

Note:

(1) We define constant currency gross margin as constant currency gross profit as a percentage of constant currency net revenues. Gross margin constant currency impact is the increase or decrease in constant currency gross margin compared to the GAAP gross margin.

(+) Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding. Refer to "About Non-GAAP Financial Measures" section of press release.

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION CONTINUED+

CONSTANT CURRENCY INCOME FROM OPERATIONS AND OPERATING MARGIN

(in thousands, except percentages)

Sequential constant currency analysis:

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | December 31, 2024 | | September 30,

2024 |

| GAAP income from operations | | $ | 144,149 | | | $ | 162,298 | |

Income from operations constant currency impact (1) | | (778) | | | |

Constant currency income from operations (1) | | $ | 143,371 | | | |

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | December 31, 2024 | | September 30,

2024 |

GAAP operating margin | | 14.5 | % | | 16.6 | % |

Operating margin constant currency impact (2) | | (0.1) | | | |

Constant currency operating margin (2) | | 14.4 | % | | |

Year-over-year constant currency analysis:

| | | | | | | | | | | | | | |

| | Three Months Ended

December 31, |

| | 2024 | | 2023 |

| GAAP income from operations | | $ | 144,149 | | | $ | 171,545 | |

Income from operations constant currency impact (1) | | 1,680 | | | |

Constant currency income from operations (1) | | $ | 145,829 | | | |

| | | | | | | | | | | | | | |

| | Three Months Ended

December 31, |

| | 2024 | | 2023 |

GAAP operating margin | | 14.5 | % | | 17.9 | % |

Operating margin constant currency impact (2) | | 0.2 | | | |

Constant currency operating margin (2) | | 14.6 | % | | |

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION CONTINUED+

CONSTANT CURRENCY INCOME FROM OPERATIONS AND OPERATING MARGIN CONTINUED

(in thousands, except percentages)

Current year versus prior year constant currency analysis:

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| GAAP income from operations | | $ | 607,628 | | | $ | 643,338 | |

Income from operations constant currency impact (1) | | 34,379 | | | |

Constant currency income from operations (1) | | $ | 642,007 | | | |

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| GAAP operating margin | | 15.2 | % | | 16.7 | % |

Operating margin constant currency impact (2) | | 0.7 | | | |

Constant currency operating margin (2) | | 15.9 | % | | |

Notes:

(1) We define constant currency income from operations as GAAP income from operations excluding the effect of foreign exchange rate movements for GAAP net revenues and operating expenses on a sequential, year-over-year and current year versus prior year basis. Constant currency impact in dollars is calculated by translating the current period GAAP net revenues and operating expenses using the foreign currency exchange rates that were in effect during the previous comparable period and subtracting it by the current period GAAP net revenues and operating expenses.

(2) We define constant currency operating margin as constant currency income from operations as a percentage of constant currency net revenues. Operating margin constant currency impact is the increase or decrease in constant currency operating margin compared to the GAAP operating margin.

(+) Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding. Refer to "About Non-GAAP Financial Measures" section of press release.

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION CONTINUED+

FINANCIAL MEASURES OTHER THAN CONSTANT CURRENCY

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP gross profit | | $ | 696,941 | | | $ | 669,524 | | | $ | 2,799,159 | | | $ | 2,706,863 | |

| Stock-based compensation | | (721) | | | 1,780 | | | 6,995 | | | 7,462 | |

Amortization of intangibles (1) | | 3,699 | | | 2,773 | | | 14,803 | | | 11,182 | |

Restructuring charges (2) | | 3,823 | | | 673 | | | 3,823 | | | 673 | |

Other Non-GAAP items (3) | | 1,410 | | | — | | | 1,410 | | | — | |

| Non-GAAP gross profit | | $ | 705,152 | | | $ | 674,750 | | | $ | 2,826,190 | | | $ | 2,726,180 | |

| | | | | | | | |

| GAAP gross margin | | 70.0 | % | | 70.0 | % | | 70.0 | % | | 70.1 | % |

| Non-GAAP gross margin | | 70.9 | % | | 70.5 | % | | 70.7 | % | | 70.6 | % |

| | | | | | | | |

| GAAP total operating expenses | | $ | 552,792 | | | $ | 497,979 | | | $ | 2,191,531 | | | $ | 2,063,525 | |

| Stock-based compensation | | (39,569) | | | (37,049) | | | (166,708) | | | (146,564) | |

Amortization of intangibles (1) | | (879) | | | (866) | | | (3,497) | | | (3,497) | |

Restructuring and other charges (2) | | (33,168) | | | (13,316) | | | (32,722) | | | (13,316) | |

| | | | | | | | |

| Legal settlement loss | | 225 | | | — | | | (30,968) | | | — | |

Other Non-GAAP items (3) | | (4,676) | | | — | | | (4,676) | | | — | |

| Non-GAAP total operating expenses | | $ | 474,725 | | | $ | 446,748 | | | $ | 1,952,960 | | | $ | 1,900,148 | |

| | | | | | | | |

| GAAP income from operations | | $ | 144,149 | | | $ | 171,545 | | | $ | 607,628 | | | $ | 643,338 | |

| Stock-based compensation | | 38,848 | | | 38,829 | | | 173,703 | | | 154,026 | |

Amortization of intangibles (1) | | 4,578 | | | 3,639 | | | 18,300 | | | 14,679 | |

Restructuring and other charges (2) | | 36,991 | | | 13,989 | | | 36,545 | | | 13,989 | |

| | | | | | | | |

| Legal settlement loss | | (225) | | | — | | | 30,968 | | | — | |

Other Non-GAAP items (3) | | 6,086 | | | — | | | 6,086 | | | — | |

| Non-GAAP income from operations | | $ | 230,427 | | | $ | 228,002 | | | $ | 873,230 | | | $ | 826,032 | |

| | | | | | | | |

| GAAP operating margin | | 14.5 | % | | 17.9 | % | | 15.2 | % | | 16.7 | % |

| Non-GAAP operating margin | | 23.2 | % | | 23.8 | % | | 21.8 | % | | 21.4 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| GAAP net income before provision for income taxes | | $ | 140,777 | | | $ | 172,880 | | | $ | 608,959 | | | $ | 641,204 | |

| Stock-based compensation | | 38,848 | | | 38,829 | | | 173,703 | | | 154,026 | |

Amortization of intangibles (1) | | 4,578 | | | 3,639 | | | 18,300 | | | 14,679 | |

Restructuring and other charges (2) | | 36,991 | | | 13,989 | | | 36,545 | | | 13,989 | |

| Legal settlement loss | | (225) | | | — | | | 30,968 | | | — | |

Other Non-GAAP items (3) | | 6,086 | | | — | | | 6,086 | | | — | |

Non-GAAP net income before provision for income taxes | | $ | 227,055 | | | $ | 229,337 | | | $ | 874,561 | | | $ | 823,898 | |

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION CONTINUED

FINANCIAL MEASURES OTHER THAN CONSTANT CURRENCY CONTINUED

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Year Ended

December 31, | |

| | 2024 | | 2023 | | | 2024 | | 2023 | |

| GAAP provision for income taxes | | $ | 36,970 | | | $ | 48,866 | | | | $ | 187,597 | | | $ | 196,151 | | |

| Tax impact on non-GAAP adjustments | | 8,441 | | | (2,998) | | | | (12,715) | | | (31,415) | | |

| Non-GAAP provision for income taxes | | $ | 45,411 | | | $ | 45,868 | | | | $ | 174,882 | | | $ | 164,736 | | |

| | | | | | | | | | |

| GAAP effective tax rate | | 26.3 | % | | 28.3 | % | | | 30.8 | % | | 30.6 | % | |

| Non-GAAP effective tax rate | | 20.0 | % | | 20.0 | % | | | 20.0 | % | | 20.0 | % | |

| | | | | | | | | | |

| GAAP net income | | $ | 103,807 | | | $ | 124,014 | | | | $ | 421,362 | | | $ | 445,053 | | |

| Stock-based compensation | | 38,848 | | | 38,829 | | | | 173,703 | | | 154,026 | | |

Amortization of intangibles (1) | | 4,578 | | | 3,639 | | | | 18,300 | | | 14,679 | | |

Restructuring and other charges (2) | | 36,991 | | | 13,989 | | | | 36,545 | | | 13,989 | | |

| | | | | | | | | | |

| Legal settlement loss | | (225) | | | — | | | | 30,968 | | | — | | |

Other Non-GAAP items (3) | | 6,086 | | | — | | | | 6,086 | | | — | | |

| Tax impact on non-GAAP adjustments | | (8,441) | | | 2,998 | | | | 12,715 | | | 31,415 | | |

| Non-GAAP net income | | $ | 181,644 | | | $ | 183,469 | | | | $ | 699,679 | | | $ | 659,162 | | |

| | | | | | | | | | |

| GAAP diluted net income per share | | $ | 1.39 | | | $ | 1.64 | | | | $ | 5.62 | | | $ | 5.81 | | |

| Non-GAAP diluted net income per share | | $ | 2.44 | | | $ | 2.42 | | | | $ | 9.33 | | | $ | 8.61 | | |

| | | | | | | | | | |

| Shares used in computing diluted net income per share | | 74,465 | | | 75,802 | | | | 74,993 | | | 76,568 | | |

Notes:

(1) Amortization of intangible assets related to certain acquisitions

(2) During the fourth quarters of 2023 and 2024, we initiated restructuring plans to reduce headcount and increase efficiencies across the organization and lower the overall cost structure. Restructuring charges are primarily related to severance and other post-employment one-time benefits.

(3) Other Non-GAAP items from the fourth quarter of 2024 primarily include settlements of various indirect tax obligations related to prior years.

(+) Changes and percentages are based on actual values. Certain tables may not sum or recalculate due to rounding. Refer to "About Non-GAAP Financial Measures" section of press release.

Align Technology Announces Fourth Quarter and Fiscal 2024 Results

ALIGN TECHNOLOGY, INC.

Q1 2025 OUTLOOK - GAAP TO NON-GAAP RECONCILIATION

| | | | | | | | | | | |

| GAAP Operating Margin | | Approximately 13.5% | |

| Stock-based compensation | | ~4.5% | |

Amortization of intangibles (1) | | ~0.5% | |

| Non-GAAP Operating Margin | | Approximately 18.5% | |

ALIGN TECHNOLOGY, INC.

FISCAL 2025 OUTLOOK - GAAP TO NON-GAAP RECONCILIATION

| | | | | | | | |

| GAAP Operating Margin | | Approximately 17.0% |

| Stock-based compensation | | ~5.0% |

Amortization of intangibles (1) | | ~0.5% |

| Non-GAAP Operating Margin | | Approximately 22.5% |

(1) Amortization of intangible assets related to certain acquisitions

Refer to "About Non-GAAP Financial Measures" section of press release.

v3.25.0.1

Document and Entity Information Document and Entity Information

|

Feb. 05, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 05, 2025

|

| Entity Registrant Name |

ALIGN TECHNOLOGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-32259

|

| Entity Tax Identification Number |

94-3267295

|

| Entity Address, Address Line One |

410 North Scottsdale Road, Suite 1300

|

| Entity Address, City or Town |

Tempe

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85288

|

| City Area Code |

602

|

| Local Phone Number |

742-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value

|

| Trading Symbol |

ALGN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001097149

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

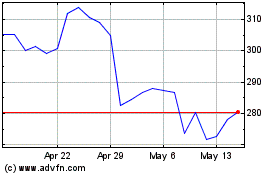

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Mar 2024 to Mar 2025