false

0001677077

false

false

false

false

0001677077

2024-12-12

2024-12-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

___________________________________________________________________

Date of Report (Date of earliest event reported): December

12, 2024

ALZAMEND NEURO, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40483 |

|

81-1822909 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

3480 Peachtree Road NE, Second Floor, Suite

103, Atlanta, GA 30326

(Address of principal executive offices) (Zip Code)

(844) 722-6333

(Registrant's telephone number, including area

code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

ALZN |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02 | Results of Operations and Financial Condition |

On December 12, 2024, Alzamend Neuro, Inc. (the

“Company”) issued a press release announcing its unaudited financial results for the six months ended October 31, 2024

(the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated by reference

herein.

The information contained in this Item 2.02 and

in the Press Release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed "filed" for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11

and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the Press Release furnished

as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the Securities and Exchange

Commission made by the Company whether made before or after the date hereof, except as expressly set forth by specific reference in such

a filing.

The Securities and Exchange Commission encourages

registrants to disclose forward-looking information so that investors can better understand the future prospects of a registrant and make

informed investment decisions. This Current Report on Form 8-K and exhibits may contain these types of statements, which are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and which involve risks, uncertainties and

reflect the Registrant’s judgment as of the date of this Current Report on Form 8-K. Forward-looking statements may relate to, among

other things, operating results and are indicated by words or phrases such as “expects,” “should,” “will,”

and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ

materially from those anticipated at the date of this Current Report on Form 8-K. Investors are cautioned not to rely unduly on forward-looking

statements when evaluating the information presented within.

Where You Can Find Additional Information

Investors and security holders will be able to

obtain documents filed with the Securities and Exchange Commission free of charge at the Commission’s website, www.sec.gov. Security

holders may also read and copy any reports, statements and other information filed by the Company with the Commission, at the SEC public

reference room at 100 F Street, N.E., Washington D.C. 20549. Please call the Commission at 1-800-SEC-0330 or visit the Commission’s

website for further information on its public reference room.

| Item 9.01 | Financial Statements and Exhibits |

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release dated December 12, 2024 |

| |

|

|

| 101 |

|

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language). |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ALZAMEND NEURO, INC. |

| |

|

| |

|

| Dated: December 12, 2024 |

/s/ David J. Katzoff

David J. Katzoff

Chief Financial Officer |

3

Exhibit 99.1

Alzamend Neuro Reports Second Quarter 2025 Financial

Results and Provides Update on Clinical Programs

| · | During the six months ended October 31,

2024, net cash provided by financing activities was $8.3 million |

| · | Stockholder equity of $3.8 million at October

31, 2024, including $4.1 million of cash |

| · | Strengthened balance sheet in preparation

for five clinical trials to be initiated in 2025 |

ATLANTA, GA, December 12, 2024 -- Alzamend

Neuro, Inc. (Nasdaq: ALZN) (“Alzamend”), a clinical-stage biopharmaceutical company, focused on developing novel

products for the treatment of Alzheimer’s disease (“Alzheimer’s”), bipolar disorder (“BD”),

major depressive disorder (“MDD”) and post-traumatic stress disorder (“PTSD”), reported its

financial results for the second quarter ended October 31, 2024, which were disclosed on a quarterly report on Form 10-Q filed on December

11, 2024, with the Securities and Exchange Commission (the “Commission”). Alzamend has strengthened its financial foundation,

reflecting a strategic focus on fiscal prudence and effective capital management. Key financial highlights include:

| · | Net cash provided by financing activities of

$8.3 million for the six months ended October 31, 2024; |

| · | Stockholder equity of $3.8 million at October

31, 2024, compared to a stockholder deficit of $2.6 million at April 30, 2024; |

| · | Cash of $4.1 million at October 31, 2024, compared

to $0.4 million at April 30, 2024; and |

| · | Total liabilities of $1.3 million at October

31, 2024, compared to $3.2 million at April 30, 2024. |

This year, Alzamend entered into a securities

purchase agreement with an institutional investor to purchase up to $25 million of preferred stock and warrants over a two-year period.

In addition, Alzamend entered into an at-the-market sales agreement, with the right of Alzamend to strategically sell up to $6.5 million

of common stock at its option. Please see Alzamend’s Commission filings for additional

information regarding these agreements and the terms of such financing transactions.

“These financing transactions have allowed

us to greatly improve our financial situation” said Stephan Jackman, Chief Executive Officer of Alzamend. “In the first six

months of this fiscal year, we have gone from a stockholder deficit to several million in stockholder equity, significantly reduced our

outstanding liabilities and increased our cash on hand. These financial improvements allowed us to regain compliance with all applicable

requirements for our stock to continue to be listed on Nasdaq and provides us with the capital in preparation of the upcoming clinical

trials to be initiated in 2025.”

Strategic Clinical Advancements

Alzamend is developing innovative treatments for

Alzheimer’s, BD, MDD and PTSD. Its leading drug candidate, AL001, utilizes a novel lithium-salicylate/L-proline ionic cocrystal

to enhance the safety and efficacy of lithium therapy. This improved formulation has shown promise in preclinical studies, demonstrating

higher lithium-brain concentrations with reduced toxicity compared to traditional treatments.

Following successful Phase I and IIA trials, AL001

is positioned for five Phase II trials in partnership with Massachusetts General Hospital in 2025. These trials aim to redefine lithium

therapy across neurodegenerative and neuropsychiatric conditions by leveraging a lower-dose, high-efficacy approach anticipated to qualify

for the U.S. Food and Administration 505(b)(2) approval pathway.

Alzamend’s secondary candidate, ALZN002,

is an active immunotherapy aimed at strengthening the ability of a patient’s immunological system to combat Alzheimer’s. The

Phase I/IIA trial assesses its safety and efficacy, with trial resumption planned for 2025 following re-engagement of a new clinical research

organization.

“We are deeply grateful for the unwavering

support of our stockholders and are steadfast in our commitment to maintaining transparency as we drive forward in our mission to deliver

breakthrough therapies for the over 43 million Americans affected by Alzheimer’s, BD, MDD, and PTSD,” said Mr. Jackman. “While

recent market fluctuations have challenged our stock performance, I am confident that our upcoming studies are set to significantly advance

the healthcare industry and enhance stockholder value.”

About Alzamend Neuro

Alzamend Neuro is a clinical-stage biopharmaceutical

company focused on developing novel products for the treatment of Alzheimer’s, BD, MDD and PTSD. Our mission is to rapidly develop

and market safe and effective treatments. Our current pipeline consists of two novel therapeutic drug candidates, AL001 - a patented ionic

cocrystal technology delivering lithium via a therapeutic combination of lithium, salicylate and L-proline, and ALZN002 - a patented method

using a mutant-peptide sensitized cell as a cell-based therapeutic vaccine that seeks to restore the ability of a patient’s immunological

system to combat Alzheimer’s. Both of our product candidates are licensed from the University of South Florida Research Foundation,

Inc. pursuant to royalty-bearing exclusive worldwide licenses.

Forward-Looking Statements

This press release contains “forward looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. These forward-looking statements generally include statements that are predictive in nature and depend upon or

refer to future events or conditions, and include words such as “believes,” “plans,” “anticipates,”

“projects,” “estimates,” “expects,” “intends,” “strategy,” “future,”

“opportunity,” “may,” “will,” “should,” “could,” “potential,”

or similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based

on current beliefs and assumptions that are subject to risks and uncertainties. Forward-looking statements speak only as of the date they

are made, and Alzamend undertakes no obligation to update any of them publicly in light of new information or future events. Actual results

could differ materially from those contained in any forward-looking statement as a result of various factors. More information, including

potential risk factors, that could affect Alzamend’s business and financial results are included in Alzamend’s filings with

the U.S. Securities and Exchange Commission. All filings are available at www.sec.gov and on Alzamend’s

website at www.Alzamend.com.

Contacts:

Email: Info@Alzamend.com

or call: 1-844-722-6333

v3.24.3

Cover

|

Dec. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 12, 2024

|

| Entity File Number |

001-40483

|

| Entity Registrant Name |

ALZAMEND NEURO, INC.

|

| Entity Central Index Key |

0001677077

|

| Entity Tax Identification Number |

81-1822909

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3480 Peachtree Road NE

|

| Entity Address, Address Line Two |

Second Floor

|

| Entity Address, Address Line Three |

Suite

103

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30326

|

| City Area Code |

(844)

|

| Local Phone Number |

722-6333

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

ALZN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

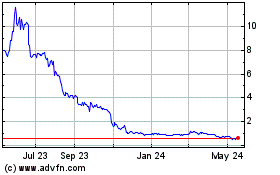

Alzamend Neuro (NASDAQ:ALZN)

Historical Stock Chart

From Dec 2024 to Jan 2025

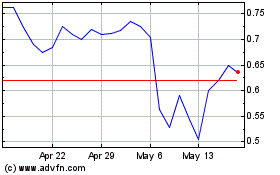

Alzamend Neuro (NASDAQ:ALZN)

Historical Stock Chart

From Jan 2024 to Jan 2025