Anghami Files 2022 Annual Report With 37% Revenue Growth & Announces Q1 2023 Results With 60% Improvement in EBITDA

May 17 2023 - 7:37AM

Business Wire

- 2022 audited total revenue of $48.5 million, an increase of 37%

compared to 2021

- Q1 2023 unaudited revenue of $10.2 million, an increase of 6%

compared to Q1 2022 (+12% growth at constant currency)

- Growth in direct subscriptions revenues of 39% was a key

contributor to the increase in gross profit margins from 17% to

23%, as well as 16% growth in premium subscribers, all compared to

Q1 2022

- Strong revenue growth in the advertisements segment, with an

increase of 10% compared to Q1 2022

- Efficiency and margin improvement initiatives have been

successful, resulting in a $3.1M improvement in Q1 2023 EBITDA

compared to Q1 2022, bringing us closer to profitability.

Anghami Inc. (NASDAQ: ANGH) (the “Company” or “Anghami”), the

leading streaming platform for music and entertainment in the

Middle East and North Africa (MENA) region, has announced its

unaudited preliminary results for Q1 2023, ending March 31,

2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230517005484/en/

ANGHAMI FILES 2022 ANNUAL REPORT, WITH

37% REVENUE GROWTH. ANNOUNCES Q1 2023 RESULTS: EXCEPTIONAL

EFFICIENCY WITH 60% EBITDA IMPROVEMENT, 43% GROSS PROFIT GROWTH, 6%

REVENUE GROWTH COMPARED TO Q1 2022 (Graphic: AETOSWire)

Despite facing currency-related challenges in Egypt and Lebanon,

Anghami successfully achieved a Q1 2023 unaudited revenue of $10.2

million, representing a 6% increase compared to Q1 2022. On a

constant currency basis, the increase would have been 12%,

demonstrating Anghami’s ability to achieve strong growth despite

challenging conditions in Egypt and Lebanon.

By streamlining the technology backend, Anghami has been able to

reduce technology costs while improving performance and

scalability. Furthermore, the platform has optimized its marketing

strategy by concentrating on growth channels with the highest

retention rates. This approach has led to a remarkable improvement

in brand visibility and customer engagement, while also

significantly reducing overall marketing expenses.

Anghami’s continued emphasis on efficiency and path to

profitability led to a substantial increase in gross profit margin,

increasing from 17% in Q1 2022 to 23% in Q1 2023, resulting in a

significant $3.1 million improvement in EBITDA, a 60% improvement

compared to Q1 2022.

Anghami's achievements in Q1 2023 can be attributed to a 39%

increase in revenue from direct subscriptions (non-telco) channels,

a 16% growth in premium subscribers, and improved margins with

content providers and telcos when compared to Q1 2022. Revenue from

the advertisements segment also grew 10% in Q1 2023 compared to Q1

2022, a 32% increase when Q1 2022 advertisements revenue is

adjusted for non-cash barter revenue. The revenue increase in the

advertisements segment was driven by Anghami's leading freemium

platform and Anghami's unique ability to leverage its wealth of

user data, connections with artists, and technology to create

highly engaging branded content. These accomplishments underscore

the platform’s dedication to fostering sustainable growth and

improving margins.

As part of its ongoing commitment to increase the Average

Revenue Per User (ARPU), Anghami plans to launch the Gold

subscription plan in May 2023. This premium offering will feature

innovative AI-generated services and several new features, and will

coincide with the repricing of legacy telco plans to optimize

revenue generation.

Although the occurrence of the Holy month of Ramadan in Q1 2023

(which is usually characterized by slower business activity and

much lower music consumption in the Middle East) affected certain

revenue streams and growth prospects, particularly within the Live

Events segment, Anghami's overall performance demonstrates its

ability to surmount challenges and deliver significant business

improvements.

Eddy Maroun, Anghami CEO, remarked, "Our team's

exceptional execution in the face of bottlenecks and currency

devaluation has culminated in a highly efficient period. Building

on Q1 2023’s strong performance, the momentum continues in April

2023 which already shows record growth in revenue in both

Subscriptions and Advertisements segments."

Elie Habib, Anghami Chairman & CTO, added, "We are

eager to continue enhancing efficiency, delivering higher margins,

and innovating with our upcoming Gold subscription plan, laying the

foundation for a prosperous 2023."

On May 16, 2023, Anghami submitted its annual report, including

audited financials, for the fiscal year ended December 31, 2022, to

the United States Securities and Exchange Commission (SEC) through

Form 20-F. The complete annual report can be accessed on Anghami's

website: https://www.anghami.com/investors.

Continuing its commitment to enhancing margins, Anghami remains

dedicated to leveraging the momentum gained from its focus on

efficiency throughout 2023.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Anghami’s actual

results may differ from its expectations, estimates, and

projections and, consequently, you should not rely as predictions

of future events.

About Anghami Inc.

The leading music streaming technology platform in the Arab

world. To learn: https://anghami.com/investors

*Source: AETOSWire

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230517005484/en/

Marian Bahader press@anghami.com

Investor Contact: Questions addressed to Anghami Investor

Relations can be sent to ir@anghami.com

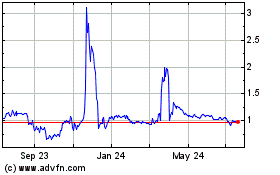

Anghami (NASDAQ:ANGH)

Historical Stock Chart

From Jan 2025 to Feb 2025

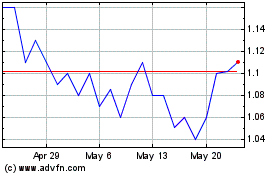

Anghami (NASDAQ:ANGH)

Historical Stock Chart

From Feb 2024 to Feb 2025