AquaBounty Technologies, Inc. (Nasdaq: AQB) (“AquaBounty” or the

“Company”), a land-based aquaculture company utilizing technology

to enhance productivity and sustainability, today issued a letter

to shareholders from its Chief Executive Officer, Sylvia Wulf.

Dear Fellow Shareholders,

Our mission at AquaBounty is to feed the world with land-based

salmon farmed efficiently, sustainably and profitably. Over the

last year, we’ve made significant strides toward achieving that

mission, and now find ourselves transitioning to a commercial

production enterprise with the continuous harvest and sale of our

proprietary, genetically engineered (“GE”) Atlantic salmon. Now

that production is scaling at our Indiana facility, we have begun

to position AquaBounty for its next phase of growth.

Why AquaBounty is Important

Before I discuss the milestones AquaBounty achieved in 2021, I’d

like to provide a reminder of the problem we are targeting and our

mission to impact it. At its core, the problem is simple – with the

growth in global population and the resulting demand for protein

expected to double by 2050, we need creative solutions to feed the

world. With over 90% of the world's fisheries fully fished or

overfished, no further pressure can be placed on wild fisheries.

Our solution is to improve salmon farming by growing our GE

Atlantic salmon using land-based recirculating aquaculture systems.

This allows us to accelerate production and produce our salmon more

efficiently and sustainably. We can do this while using fewer

inputs and avoiding many of the disease and environmental

challenges often faced in traditional net pen farms. Our approach

uniquely enables us to raise healthier salmon, free of antibiotics

and other contaminants, while remaining good stewards of the planet

and the natural resources entrusted to us.

Commercial Scale Harvests Underway

We began 2021 with a world-class team in place and preparations

to make this our breakthrough year. In the first quarter we

completed a public offering of common stock with $127.1 million in

gross proceeds, fortifying our balance sheet and positioning us to

deliver on our vision for our next farm – a 10,000 metric ton “farm

of the future.” To prove market acceptance for our GE salmon, we

completed the setup of our commercial framework and prepared for

our first commercial scale harvest. After successful sampling

efforts with widely respected seafood distributors and other

interested customers, we began the long-awaited first commercial

sales of our GE salmon from both our Indiana and Prince Edward

Island farms – receiving orders for the entire output from our

first customers, all eager to introduce this locally produced

salmon in their respective markets. Since that time, demand for our

GE salmon has consistently grown– proving its market acceptance. We

continued to scale production output in the third quarter,

harvesting 84 tons of salmon from our two farms and commercial

interest remains high. Harvests increased 8% in the fourth quarter

compared to the third quarter, as we set the stage for continued

operational momentum going into 2022, with a full staff and arrival

of additional automation equipment.

Our Next-Generation 10,000 Metric Ton Facility will be

Transformational

To further grow our production, we moved forward with our plans

to construct a 10,000 metric ton farm, which would have roughly

eight times the output capacity of our Indiana farm. We selected

Pioneer, Ohio as the location for the farm and we have made

significant progress on finalizing site engineering designs and

permitting, including the completion of key hydrology studies,

which confirm that the quantity and quality of water available can

meet the needs of both AquaBounty and the local community. As the

final design for our Ohio farm progressed, we refined our expected

project cost to be in the range of $290 million to $320 million,

including a reserve for potential contingencies of $30 million. Our

plan for financing the farm project includes a significant debt

component, supplemented by our equity contribution – leveraging our

robust balance sheet, which included almost $200 million in cash at

the end of the third quarter.

We began the process for the placement of a mix of tax-exempt

and taxable bonds through the Toledo-Lucas County Port Authority,

whose board approved the issuance of up to $300 million in bonds to

support the financing of the project. We also engaged Wells Fargo

Corporate and Investment Banking to underwrite and market the bond

placement, which we expect to complete in the first quarter of

2022. While there is certainly still plenty of work to be done to

close this transaction, we believe that this financing will be a

major financial milestone for the Company.

During this past year, we have worked through the dual

challenges of labor shortages that have affected the food service

industry during the pandemic and our capacity constraints at our

facilities, incorporating the insights gained from these learnings

into the design of our highly automated large-scale farm in Ohio.

In fact, some of the most concerning discoveries surrounding the

pandemic were the global supply chain disruptions, which

highlighted the need for technology-enabled, domestic supply

chains. These events further serve to remind us of the need for a

safe, sustainable and secure food supply.

Our Shared Future

In 2021, we announced our firm commitment to sustainability and

corporate responsibility, highlighted by the announcement of our

Environmental, Social and Governance (ESG) reporting initiative and

we will use the reporting standard of the Sustainability Accounting

Standards Board (SASB). We believe that ESG reporting is critical

to operational risk reduction, aligning well with our mission to

contribute to global sustainability by conducting our business in

an environmentally responsible manner. We look forward to sharing

our first public ESG report in the new year.

Final Words

We enter 2022 in a strong position – both operationally and

financially – supported by the momentum from our successful

commercial scale harvests and our robust balance sheet. We look

forward to onboarding additional customers and increasing our

weekly harvest volumes to fulfill the strong demand in the weeks

and months to come. Our expansion plans are moving forward

domestically with our Ohio farm and internationally with potential

opportunities in Brazil, Israel and China.

As a company, we remain focused on our goals and we are poised

to take the lead in bringing fresh, sustainable salmon to the

markets we serve. We look forward to sharing our accomplishments in

the coming year as we strive to create value for our customers,

shareholders, employees and communities – and we thank all our

stakeholders for their support of our mission.

Sincerely,

Sylvia WulfPresident & CEO

About AquaBounty:

AquaBounty Technologies, Inc. (NASDAQ: AQB) is a leader in

aquaculture leveraging decades of technology expertise to deliver

game-changing solutions that solve global problems, while improving

efficiency, sustainability and profitability. AquaBounty provides

fresh Atlantic salmon to nearby markets by raising its fish in

carefully monitored land-based fish farms through a safe, secure

and sustainable process. The Company’s land-based Recirculating

Aquaculture System (“RAS”) farms, located in Indiana, United States

and Prince Edward Island, Canada, are close to key consumption

markets and are designed to prevent disease and to include multiple

levels of fish containment to protect wild fish

populations. AquaBounty is raising nutritious salmon that is

free of antibiotics and other contaminants and provides a solution

resulting in a reduced carbon footprint and no risk of pollution to

marine ecosystems as compared to traditional sea-cage farming. For

more information on AquaBounty, please

visit www.aquabounty.com or follow us on Facebook,

Twitter, LinkedIn and Instagram.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, each as

amended. All statements other than statements of historical fact

contained in this release are forward-looking statements,

including, but not limited to, statements regarding the location

and anticipated capacity of our planned farm in Ohio; the timing

and commencement of construction and commercial production; the

expected demand for and output of our products; our harvesting

schedule, purchase orders, and prospective agreements with

customers; international expansion plans and the anticipated growth

in market size; anticipated productivity, the expected benefits of

AquAdvantage salmon and land-based production to consumers and the

environment, including consistency of supply, disease- and

antibiotic-free production, resource conservation, and reduced

carbon footprint; and ESG reporting initiatives . Forward-looking

statements may be identified with words such as “will,” “may,”

“can,” “expect,” “plan,” “anticipate,” “upcoming,” “believe,”

“estimate,” or similar terminology, and the negative of these

terms. Forward-looking statements are not promises or guarantees of

future performance and are subject to a variety of risks and

uncertainties, many of which are beyond our control, which could

cause actual results to differ materially from those contemplated

in these forward-looking statements. Forward-looking statements

speak only as of the date hereof, and, except as required by law,

we undertake no obligation to update or revise these

forward-looking statements. For additional information regarding

these and other risks faced by us, please refer to our public

filings with the Securities and Exchange Commission (“SEC”),

available on the Investors section of www.aquabounty.com and on the

SEC’s website at www.sec.gov.

Company Contact:AquaBounty TechnologiesDave

ConleyCorporate Communications(613) 294-3078

Investor Relations:Greg Falesnik or Luke

ZimmermanMZ Group - MZ North America(949)

259-4987AQB@mzgroup.us

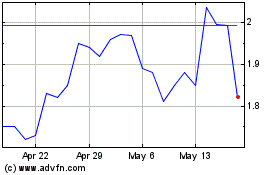

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Jan 2025 to Feb 2025

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Feb 2024 to Feb 2025