Better.com launches Betsy™, the First Voice-Based AI Loan Assistant for the US Mortgage Industry

October 17 2024 - 8:00AM

Business Wire

Betsy leverages true generative AI to enable

Better’s Loan Officers to dramatically increase efficiency and

customer satisfaction

Better Home & Finance Holding Company (NASDAQ: BETR)

(“Better.com”), the leading digital homeownership company, today

announced the launch of Betsy™, the first voice-based AI Loan

Assistant for the US mortgage industry. As the latest innovation

built through Tinman™, the company’s proprietary loan origination

platform, Betsy enhances the operational efficiency of Better.com’s

licensed Loan Officers, Processors and Closers and improves its

customer experience with more intelligent, timely and accurate

answers to customer inquiries on an instant basis.

Betsy leverages AI and large language models (LLMs) to

accelerate a customer’s entire mortgage journey from pre-approval

start to closed loan. The platform is programmed to communicate

with prospective and existing Better.com customers to answer

mortgage application inquiries and to collect and verify

outstanding application data, all while interfacing with Tinman™ in

real-time. Uniquely, Tinman is a single, unified system where all

relevant facts of a loan application are stored within one

comprehensive data structure. This contrasts with traditional

mortgage industry software, where information is spread across

multiple systems and datasets such as Point of Sale, CRM, Loan

Origination System, Document Management System, and Pricing Engine.

Tinman’s centralized and context-rich data environment is organized

in a hierarchical, tree-like structure that is easily understood by

LLMs like Betsy. This allows her to access and interpret

information with full context, enabling her to understand the

nuances of each customer's loan application. As a result, Betsy can

accurately answer questions in great detail and assist with

outstanding tasks efficiently. The results enable faster service

times, enhanced self-service capabilities, improved customer

engagement, and greater sales efficiency.

“This launch is a seismic moment for Better and the entire

mortgage industry,” said Vishal Garg, CEO & Founder of

Better.com. “Fulfilling a mortgage loan is labor-intensive and

rules-driven, and Betsy serves as a highly intelligent front end

enabling customers to automate the process with the full power of

our proprietary loan engine, Tinman. This isn’t just another text

chatbot or document processing service launched through a

traditional CRM or OCR vendor, this is true disruption of the

non-licensed tasks performed by armies of traditional customer

service reps, Loan Officers and Processors in the mortgage

industry. We believe that Betsy will catalyze our growth over the

coming years by making our existing Loan Officers, Processors,

Coordinators and Closers far more efficient. We are only beginning

to witness how AI will disrupt the traditional mortgage industry,

and our technology is setting the standard in delivering maximum

value, savings and service to American homeowners.”

With access to a repository of customer-provided application

data, Betsy enables Loan Officers to focus their time on discussing

interest rate details and other licensed activity with a seamless

transition of information.

“The average cost to sell and process a mortgage in the United

States is nearly $9,000 per loan,” said Kevin Ryan, CFO of

Better.com. “Utilizing Tinman’s capabilities, we have been able to

automate time and labor-intensive components of the mortgage

process and reduce that cost by over 35% of the industry average.

As we continue to supplement Betsy’s capabilities, we believe this

technology will significantly drive down our costs further,

resulting in lowered rates and superior service for our

customers.”

Better.com plans to develop additional components to Betsy’s AI

technology to bolster its consumer offerings and make its Loan

Officers even more productive in the near future. Betsy is live on

the Better.com website and a demonstration of Betsy's capabilities

is available at: better.com/betsy.

About Better Home & Finance Holding Company

Since 2016, Better Home & Finance Holding Company (NASDAQ:

BETR; BETRW) has leveraged its industry-leading technology

platform, Tinman™, to fund more than $100 billion in mortgage

volume. Tinman™ allows customers to see their rate options in

seconds, get pre-approved in minutes, lock in rates and close their

loan all entirely online. Better’s mortgage offerings include

GSE-conforming mortgage loans, FHA and VA loans, and jumbo mortgage

loans. Better launched its "One Day Mortgage" program in January

2023, which allows eligible customers to go from click to

Commitment Letter within 24 hours. Better was named Best Online

Mortgage Lender by Forbes and Best Mortgage Lender for

Affordability by WSJ in 2023, ranked #1 on LinkedIn’s Top Startups

List for 2021 and 2020, #1 on Fortune’s Best Small and Medium

Workplaces in New York, #15 on CNBC’s Disruptor 50 2020 list, and

was listed on Forbes FinTech 50 for 2020. Better serves customers

in all 50 US states and the United Kingdom.

Forward-Looking Statements

This press release contains forward-looking statements related

to, among other things, the development and use of artificial

intelligence by Better.com. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this communication, including

Better.com’s ability to effectively manage the risks, challenges

and efficiencies presented by using artificial Intelligence in its

business. Such factors can be found in Better.com’s annual report

on Form 10-K and Better.com’s quarterly reports on Form 10-Q, which

are available, free of charge, at the SEC’s website at www.sec.gov.

New risks and uncertainties arise from time to time, and it is

impossible for Better.com to predict these events or how they may

affect Better.com. You are cautioned not to place undue reliance

upon any forward-looking statements, which speak only as of the

date made, and Better.com undertakes no obligation, except as

required by law, to update or revise the forward-looking

statements, whether as a result of new information, changes in

expectations, future events or otherwise.

For more information, follow @betterdotcom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241017222780/en/

Nneka Etoniru better@avenuez.com

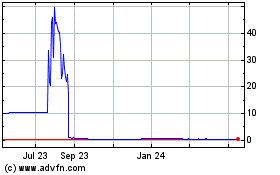

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Dec 2024 to Jan 2025

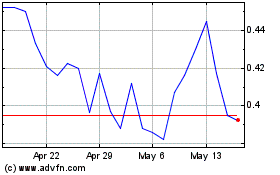

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Jan 2024 to Jan 2025