Total revenues in 2Q25 were $106.7 million

2Q25 net income was $0.6 million and Adjusted EBITDA1 was

$15.4 million

Bioceres Crop Solutions Corp. (Bioceres) (NASDAQ:

BIOX), a leader in the development and commercialization of

productivity solutions designed to regenerate agricultural

ecosystems while making crops more resilient to climate change,

announced financial results for the fiscal second quarter ended

December 31, 2024. Financial results are expressed in U.S. dollars

and are presented in accordance with International Financial

Reporting Standards. All comparisons in this announcement are

year-over-year (YoY), unless otherwise noted.

Financial & Business Highlights

- Revenues in 2Q25 totaled $106.7 million, down from

quarterly record-high of $140.2 million in 2Q24, as tight farm

economics and elevated channel inventories in Argentina — a

decisive market for the quarter — significantly contracted the

overall market for crop protection and specialty fertilizers. This

led to a year-over-year reduction in sales of non-core CP products

and micro-beaded fertilizers, roughly in line with the market

decline.

- Operating profit was $7.9 million and net income was $0.6

million. Adjusted EBITDA for the quarter was $15.4 million,

mainly driven by top-line and gross profit performance from

Argentina.

- New strategy defined for seed business, exiting breeding and

seed production activities to focus on trait development and key

partnerships for market access:

- Alliance with GDM to use Verdeca’s patented platform to develop

and market next generation varieties that combine superior

agronomic performance with biotech traits.

- Trigall Genetics to focus on HB4 trait development in wheat and

transfer breeding programs to Florimond Desprez. Rights to HB4

technology outside of Latin America are now fully controlled by

Bioceres.

- Milen Marinov appointed Chief Commercial Officer

(CCO).

Management Review

Mr. Federico Trucco, Bioceres´ Chief Executive Officer,

commented: “Calendar year 2024 has been a reminder that growth, at

least in the agriculture industry, is seldom linear. The conditions

in Argentina, which remains our primary market, have proven

increasingly difficult. This has affected the performance of our

fiscal first half, a period during which we are more exposed to

sales in the Southern Hemisphere. While we have maintained or

gained market share in all our key product segments, we believe

this macro environment provides unique opportunities to unlock the

full commercial potential of our differentiated portfolio of

products and technologies. As a result, we are implementing two

significant strategic changes.

First, we are appointing Milen Marinov, who previously served as

our EVP of Commercial for North America, as our new Chief

Commercial Officer. Milen’s past experience in key commercial

development roles in Valagro and then Syngenta, as well as his

track record with us since joining the Profarm team last year,

positions him uniquely to help us streamline our commercial

operations, accelerate the on-boarding of new commercial partners,

and better prioritize, diversify and synchronize our portfolio

opportunities for profitable growth.

Second, in the seed segment, we are sharpening our focus on what

we do best: sourcing cutting-edge science and cost-effectively

developing patented seed traits until commercial approval. We have

made the strategic decision to exit breeding, seed production and

seed sales and will instead partner with industry leaders who are

better structured for these activities. As a first step in this new

strategy, we are announcing a strategic agreement with GDM for the

development of new soybean solutions, with exclusive rights outside

the drought tolerance space. Additionally, we are a redefining the

scope of our wheat joint venture with Florimond Desprez, exiting

conventional breeding operations in Argentina and Australia, while

directly licensing our HB4 wheat technology to partners outside of

Latin America. We believe these initiatives will enable us to scale

our current and future seed technologies more rapidly and

efficiently.”

Mr. Enrique Lopez Lecube, Bioceres´ Chief Financial Officer,

noted: “While our fiscal first half results reflect the challenges

posed by the Argentine market, particularly the decline in farmer

economics driven by lower commodity prices and weak yield

forecasts, we view this setback as temporary.

Argentine farmers faced significant pressure on their

per-hectare income from summer crops due to these external factors,

which was partially passed on to costs in the form of reduced use

of fertilizers and crop protection products. This, in the context

of a well-supplied ag-inputs market from aggressive purchasing in

the prior season, resulted into price pressure and reduced spending

on high-value technologies like ours. However, we are encouraged

that we maintained our market share in key product families,

despite the overall Argentine market contraction.

We remain optimistic about our long-term prospects, driven by

our commitment to developing and commercially scaling up innovative

technologies that create value for end-users. We are also cognizant

that successfully navigating this period of market volatility

requires a strong focus on capital allocation, driving cost

efficiencies to safeguard profitability, and transitioning towards

a more asset-light business model. The strategic repositioning of

our seed business and tighter inventory management are initial

steps in this direction.

In the near future we will continue to explore additional

opportunities to enhance profitability and cash flows, ensuring

we’re well-positioned to capitalize on the groundwork already made

to support our global expansion as well as to benefit from the

recovery of the Argentine market.”

Key Financial Metrics

Table 1: 2Q25 & 1H25 Key

Financial Metrics

(In millions of U.S. dollars)

2Q24

2Q25

%CHANGE

1H24

1H25

%CHANGE

Revenue by Segment

Crop Protection

71.2

55.2

(23%)

127.2

101.1

(20%)

Seed and Integrated Products

32.2

23.3

(28%)

54.5

43.9

(20%)

Crop Nutrition

36.8

28.2

(23%)

75.1

55.0

(27%)

Total Revenue

140.2

106.7

(24%)

256.8

200.0

(22%)

Gross Profit

51.5

45.1

(12%)

96.5

82.6

(14%)

Gross Margin

37%

42%

557 bps

38%

41%

375 bps

2Q24

2Q25

%CHANGE

1H24

1H25

%CHANGE

GAAP net income or loss

1.2

0.6

(51%)

(1.4)

(5.6)

(287%)

Adjusted EBITDA

24.1

15.4

(36%)

40.4

23.8

(41%)

2Q25 Summary: Total revenues in 2Q25 were $106.7 million,

a 24% decline from the record $140.2 million in the same period

last year. The downturn was primarily driven by performance in

Argentina where tighter on-farm margins altered farmer purchasing

behavior, leading to a significant contraction of the crop

protection and specialty fertilizers markets compared to the prior

year. Reduced end-user demand added to high channel inventories

derived from aggressive purchases in the prior summer crop season,

ahead of expectations of changes in macro conditions in Argentina.

Non-core crop protection products and micro-beaded fertilizers were

the main product categories affected by the market contraction in

Argentina and explain the decline in Crop Protection and Crop

Nutrition sales, albeit with a roughly stable market share for both

categories. Sales in Seed and Integrated Products decreased on the

back of reduced downstream grain sales in line with the strategic

pivoting of the seed business, partially offset by seed treatment

packs sales which showed a modest top-line growth in Argentina

despite the market contraction dynamics. Revenues for the first

half of FY25 declined by 22% compared to the year-ago period,

primarily driven by the crop protection and specialty fertilizers

market downturn in Argentina, although the decline was not at the

expense of losing market share. Outside of Argentina, revenues

showed a modest year-over-year increase in 2Q25 after an

overperformance in 1Q25, leading to net growth in 1H25.

Gross profit for the quarter was $45.1 million, a 12% decline

year-over-year. The decline in revenues was buffered by an improved

product mix, particularly in the Crop Nutrition and Seed and

Integrated Products segments, as the company successfully

maintained sales of higher-margin inoculants, biostimulants and

seed treatment packs, as opposed to reduced sales of lower-margin

micro-beaded fertilizers, non-core crop protection products and

downstream grain sales. As a result, gross margin increased from

37% to 42%, compared to the previous year. Similarly, first-half

gross margin increased from 38% to 41%, as core product families

increased contribution to the product mix.

Operating profit for the quarter was $7.9 million, with a net

income of 0.6 million. Adjusted EBITDA1 for the quarter was $15.4

million, primarily driven by revenues and gross profit

performance.

For a full version of Bioceres’ second quarter fiscal year

2025 earnings release, click here.

Second Quarter 2025 Earnings Conference Call

Management will host a conference call and question-and-answer

session, which will be accompanied by a presentation available

during the webcast or accessed via the investor relations section

of the company’s website.

To access the call, please use the following information:

Date: Wednesday, February 12,

2025

Please dial in 5-10 minutes prior to the

start time to register and join. The conference call will be

broadcast live and available for replay here and via the

investor relations section of the company’s website

here.

A replay of the call will be available

through February 19, 2025, following the conference.

Toll Free Replay Number:

1-866-813-9403

International Replay Number: +44

204 525 0658

Replay ID: 783074

Time: 8:30 a.m. EST, 5:30 a.m.

PST

US Toll Free dial-in number:

1-833-470-1428

International dial-in numbers:

Click here

Conference ID: 525329

Webcast: Click here

About Bioceres Crop Solutions Corp.

Bioceres Crop Solutions Corp. (NASDAQ: BIOX) is a leader in the

development and commercialization of productivity solutions

designed to regenerate agricultural ecosystems while making crops

more resilient to climate change. To do this, Bioceres’ solutions

create economic incentives for farmers and other stakeholders to

adopt environmentally friendlier production practices.

The company has a unique biotech platform with high-impact,

patented technologies for seeds and microbial ag-inputs, as well as

next generation Crop Nutrition and Protection solutions. Through

its HB4® program, the company is bringing digital solutions to

support growers’ decisions and provide end-to-end traceability for

production outputs. For more information, visit here.

Forward-Looking Statements

This communication includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,”

“expect,” “estimate,” “plan,” “outlook,” and “project” and other

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. Such

forward-looking statements include estimated financial data, and

any such forward-looking statements involve risks, assumptions and

uncertainties. These forward-looking statements include, but are

not limited to, whether (i) the health and safety measures

implemented to safeguard employees and assure business continuity

will be successful and (ii) we will be able to coordinate efforts

to ramp up inventories. Such forward-looking statements are based

on management’s reasonable current assumptions, expectations, plans

and forecasts regarding the company’s current or future results and

future business and economic conditions more generally. Such

forward-looking statements involve risks, uncertainties and other

factors, which may cause the actual results, levels of activity,

performance or achievement of the company to be materially

different from any future results expressed or implied by such

forward-looking statements, and there can be no assurance that

actual results will not differ materially from management’s

expectations or could affect the company’s ability to achieve its

strategic goals, including the uncertainties relating to the other

factors that are described in the sections entitled “Risk Factors”

in the company's Securities and Exchange Commission filings updated

from time to time. The preceding list is not intended to be an

exhaustive list of all of our forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements as predictions of future events. All forward-looking

statements contained in this release are qualified in their

entirety by this cautionary statement. Forward-looking statements

speak only as of the date they are or were made, and the company

does not intend to update or otherwise revise the forward-looking

statements to reflect events or circumstances after the date of

this release or to reflect the occurrence of unanticipated events,

except as required by law.

Unaudited Consolidated Statement of

Comprehensive Income (Figures in million of U.S. dollars)

Three-month period ended

12/31/2024

Three-month period ended

12/31/2023

Revenues from contracts with customers

106.8

140.3

Initial recognition and changes in the fair value of biological

assets at the point of harvest

(0.1)

(0.1)

Cost of sales

(61.6)

(88.7)

Gross profit

45.1

51.5

% Gross profit

42%

37%

Operating expenses

(37.4)

(34.8)

Share of profit of JV

0.4

2.1

Change in net realizable value of agricultural products

(0.8)

(0.7)

Other income or expenses, net

0.5

(1.2)

Operating profit

7.9

16.8

Financial result

(7.5)

(7.3)

Profit/(loss) before income tax

0.4

9.6

Income tax

0.2

(8.3)

Profit/(loss) for the period

0.6

1.2

Other comprehensive loss

(0.2)

0.5

Total comprehensive profit/(loss)

0.4

1.7

Profit/(loss) for the period attributable to:

Equity holders of the parent

0.1

0.1

Non-controlling interests

0.5

1.1

0.6

1.2

Total comprehensive profit/(loss) attributable to:

Equity holders of the parent

0.2

0.5

Non-controlling interests

0.2

1.2

0.4

1.7

Weighted average number of shares

Basic

62.8

62.8

Diluted

63.2

63.9

Unaudited Consolidated Statement of

Financial Position (Figures in million of U.S. dollars)

ASSETS

12/31/2024

06/30/2024

CURRENT ASSETS

Cash and cash equivalents

29.2

44.5

Other financial assets

2.0

11.7

Trade receivables

227.7

207.3

Other receivables

17.2

18.3

Recoverable income taxes

1.5

0.7

Inventories

101.8

125.9

Biological assets

4.4

0.3

Total current assets

383.7

408.7

NON-CURRENT ASSETS

Other financial assets

0.8

0.6

Other receivables

18.2

18.0

Recoverable income taxes

0.0

0.0

Deferred tax assets

12.1

9.7

Investments in joint ventures and associates

40.0

39.8

Investment properties

0.6

0.6

Property, plant and equipment

74.9

74.6

Intangible assets

176.3

176.9

Goodwill

112.2

112.2

Right of use asset

16.3

11.6

Total non-current assets

451.4

443.9

Total assets

835.2

852.5

LIABILITIES

CURRENT LIABILITIES

Trade and other payables

144.0

168.7

Borrowings

119.2

136.7

Employee benefits and social security

8.2

7.3

Deferred revenue and advances from customers

2.9

3.9

Income tax payable

5.9

4.8

Consideration for acquisition

3.2

4.6

Lease liabilities

5.3

3.1

Total current liabilities

288.8

329.3

NON-CURRENT LIABILITIES

Borrowings

66.9

42.1

Deferred revenue and advances from customers

1.9

1.9

Joint ventures and associates

0.7

0.3

Deferred tax liabilities

33.2

35.0

Provisions

1.1

1.3

Consideration for acquisition

2.2

2.3

Secured notes

83.4

80.8

Lease liabilities

10.8

8.2

Total non-current liabilities

200.4

171.9

Total liabilities

489.2

501.2

EQUITY

Equity attributable to owners of the parent

309.4

315.0

Non-controlling interests

36.6

36.3

Total equity

346.0

351.4

Total equity and liabilities

835.2

852.5

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211746936/en/

Bioceres Crop Solutions Paula Savanti Head of Investor Relations

investorrelations@biocerescrops.com

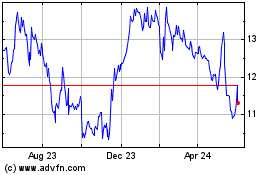

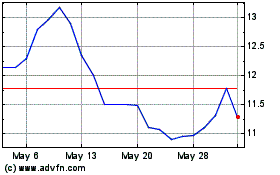

Bioceres Crop Solutions (NASDAQ:BIOX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bioceres Crop Solutions (NASDAQ:BIOX)

Historical Stock Chart

From Feb 2024 to Feb 2025