Q3

2024

--11-30

false

0000010329

false

false

false

false

2

http://fasb.org/us-gaap/2024#SecuredOvernightFinancingRateSofrMember

7

00000103292023-11-262024-08-31

thunderdome:item

00000103292023-11-232024-08-31

iso4217:USD

00000103292023-11-25

00000103292024-08-31

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-26

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-08-31

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-11-272023-08-26

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-11-262024-08-31

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-282023-08-26

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-012024-08-31

0000010329srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-11-26

0000010329srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-11-25

0000010329srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-27

0000010329srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-31

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-11-26

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-11-25

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-27

0000010329us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-31

0000010329us-gaap:RetainedEarningsMember2023-08-26

0000010329us-gaap:RetainedEarningsMember2024-08-31

0000010329us-gaap:RetainedEarningsMember2022-11-272023-08-26

0000010329us-gaap:RetainedEarningsMember2023-11-262024-08-31

0000010329us-gaap:RetainedEarningsMember2023-05-282023-08-26

0000010329us-gaap:RetainedEarningsMember2024-06-012024-08-31

0000010329us-gaap:RetainedEarningsMember2022-11-26

0000010329us-gaap:RetainedEarningsMember2023-11-25

0000010329us-gaap:RetainedEarningsMember2023-05-27

0000010329us-gaap:RetainedEarningsMember2024-05-31

0000010329us-gaap:AdditionalPaidInCapitalMember2023-08-26

0000010329us-gaap:AdditionalPaidInCapitalMember2024-08-31

0000010329us-gaap:AdditionalPaidInCapitalMember2022-11-272023-08-26

0000010329us-gaap:AdditionalPaidInCapitalMember2023-11-262024-08-31

0000010329us-gaap:AdditionalPaidInCapitalMember2023-05-282023-08-26

0000010329us-gaap:AdditionalPaidInCapitalMember2024-06-012024-08-31

0000010329us-gaap:AdditionalPaidInCapitalMember2022-11-26

0000010329us-gaap:AdditionalPaidInCapitalMember2023-11-25

0000010329us-gaap:AdditionalPaidInCapitalMember2023-05-27

0000010329us-gaap:AdditionalPaidInCapitalMember2024-05-31

xbrli:shares

0000010329us-gaap:CommonStockMember2023-08-26

0000010329us-gaap:CommonStockMember2024-08-31

0000010329us-gaap:CommonStockMember2022-11-272023-08-26

0000010329us-gaap:CommonStockMember2023-11-262024-08-31

0000010329us-gaap:CommonStockMember2023-05-282023-08-26

0000010329us-gaap:CommonStockMember2024-06-012024-08-31

0000010329us-gaap:CommonStockMember2022-11-26

0000010329us-gaap:CommonStockMember2023-11-25

0000010329us-gaap:CommonStockMember2023-05-27

0000010329us-gaap:CommonStockMember2024-05-31

00000103292022-11-272023-08-26

0000010329us-gaap:CorporateAndOtherMember2022-11-272023-08-26

0000010329bset:RetailSegmentMember2022-11-272023-08-26

0000010329bset:WholesaleSegmentMember2022-11-272023-08-26

0000010329us-gaap:CorporateAndOtherMember2023-11-262024-08-31

0000010329bset:RetailSegmentMember2023-11-262024-08-31

0000010329bset:WholesaleSegmentMember2023-11-262024-08-31

0000010329bset:AccessoriesMattressesAndOtherMember2022-11-272023-08-26

0000010329bset:AccessoriesMattressesAndOtherMemberus-gaap:CorporateAndOtherMember2022-11-272023-08-26

0000010329bset:AccessoriesMattressesAndOtherMemberbset:RetailSegmentMember2022-11-272023-08-26

0000010329bset:AccessoriesMattressesAndOtherMemberbset:WholesaleSegmentMember2022-11-272023-08-26

0000010329bset:AccessoriesMattressesAndOtherMember2023-11-262024-08-31

0000010329bset:AccessoriesMattressesAndOtherMemberus-gaap:CorporateAndOtherMember2023-11-262024-08-31

0000010329bset:AccessoriesMattressesAndOtherMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329bset:AccessoriesMattressesAndOtherMemberbset:WholesaleSegmentMember2023-11-262024-08-31

0000010329bset:BassettCasegoodsMember2022-11-272023-08-26

0000010329bset:BassettCasegoodsMemberus-gaap:CorporateAndOtherMember2022-11-272023-08-26

0000010329bset:BassettCasegoodsMemberbset:RetailSegmentMember2022-11-272023-08-26

0000010329bset:BassettCasegoodsMemberbset:WholesaleSegmentMember2022-11-272023-08-26

0000010329bset:BassettCasegoodsMember2023-11-262024-08-31

0000010329bset:BassettCasegoodsMemberus-gaap:CorporateAndOtherMember2023-11-262024-08-31

0000010329bset:BassettCasegoodsMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329bset:BassettCasegoodsMemberbset:WholesaleSegmentMember2023-11-262024-08-31

0000010329bset:BassettCustomWoodMember2022-11-272023-08-26

0000010329bset:BassettCustomWoodMemberus-gaap:CorporateAndOtherMember2022-11-272023-08-26

0000010329bset:BassettCustomWoodMemberbset:RetailSegmentMember2022-11-272023-08-26

0000010329bset:BassettCustomWoodMemberbset:WholesaleSegmentMember2022-11-272023-08-26

0000010329bset:BassettCustomWoodMember2023-11-262024-08-31

0000010329bset:BassettCustomWoodMemberus-gaap:CorporateAndOtherMember2023-11-262024-08-31

0000010329bset:BassettCustomWoodMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329bset:BassettCustomWoodMemberbset:WholesaleSegmentMember2023-11-262024-08-31

0000010329bset:BassettLeatherMember2022-11-272023-08-26

0000010329bset:BassettLeatherMemberus-gaap:CorporateAndOtherMember2022-11-272023-08-26

0000010329bset:BassettLeatherMemberbset:RetailSegmentMember2022-11-272023-08-26

0000010329bset:BassettLeatherMemberbset:WholesaleSegmentMember2022-11-272023-08-26

0000010329bset:BassettLeatherMember2023-11-262024-08-31

0000010329bset:BassettLeatherMemberus-gaap:CorporateAndOtherMember2023-11-262024-08-31

0000010329bset:BassettLeatherMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329bset:BassettLeatherMemberbset:WholesaleSegmentMember2023-11-262024-08-31

0000010329bset:BassettCustomUpholsteryMember2022-11-272023-08-26

0000010329bset:BassettCustomUpholsteryMemberus-gaap:CorporateAndOtherMember2022-11-272023-08-26

0000010329bset:BassettCustomUpholsteryMemberbset:RetailSegmentMember2022-11-272023-08-26

0000010329bset:BassettCustomUpholsteryMemberbset:WholesaleSegmentMember2022-11-272023-08-26

0000010329bset:BassettCustomUpholsteryMember2023-11-262024-08-31

0000010329bset:BassettCustomUpholsteryMemberus-gaap:CorporateAndOtherMember2023-11-262024-08-31

0000010329bset:BassettCustomUpholsteryMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329bset:BassettCustomUpholsteryMemberbset:WholesaleSegmentMember2023-11-262024-08-31

00000103292023-05-282023-08-06

0000010329us-gaap:CorporateAndOtherMember2023-05-282023-08-06

0000010329bset:RetailSegmentMember2023-05-282023-08-06

0000010329bset:WholesaleSegmentMember2023-05-282023-08-06

00000103292024-06-012024-08-31

0000010329us-gaap:CorporateAndOtherMember2024-06-012024-08-31

0000010329bset:RetailSegmentMember2024-06-012024-08-31

0000010329bset:WholesaleSegmentMember2024-06-012024-08-31

0000010329bset:AccessoriesMattressesAndOtherMember2023-05-282023-08-06

0000010329bset:AccessoriesMattressesAndOtherMemberus-gaap:CorporateAndOtherMember2023-05-282023-08-06

0000010329bset:AccessoriesMattressesAndOtherMemberbset:RetailSegmentMember2023-05-282023-08-06

0000010329bset:AccessoriesMattressesAndOtherMemberbset:WholesaleSegmentMember2023-05-282023-08-06

0000010329bset:AccessoriesMattressesAndOtherMember2024-06-012024-08-31

0000010329bset:AccessoriesMattressesAndOtherMemberus-gaap:CorporateAndOtherMember2024-06-012024-08-31

0000010329bset:AccessoriesMattressesAndOtherMemberbset:RetailSegmentMember2024-06-012024-08-31

0000010329bset:AccessoriesMattressesAndOtherMemberbset:WholesaleSegmentMember2024-06-012024-08-31

0000010329bset:BassettCasegoodsMember2023-05-282023-08-06

0000010329bset:BassettCasegoodsMemberus-gaap:CorporateAndOtherMember2023-05-282023-08-06

0000010329bset:BassettCasegoodsMemberbset:RetailSegmentMember2023-05-282023-08-06

0000010329bset:BassettCasegoodsMemberbset:WholesaleSegmentMember2023-05-282023-08-06

0000010329bset:BassettCasegoodsMember2024-06-012024-08-31

0000010329bset:BassettCasegoodsMemberus-gaap:CorporateAndOtherMember2024-06-012024-08-31

0000010329bset:BassettCasegoodsMemberbset:RetailSegmentMember2024-06-012024-08-31

0000010329bset:BassettCasegoodsMemberbset:WholesaleSegmentMember2024-06-012024-08-31

0000010329bset:BassettCustomWoodMember2023-05-282023-08-06

0000010329bset:BassettCustomWoodMemberus-gaap:CorporateAndOtherMember2023-05-282023-08-06

0000010329bset:BassettCustomWoodMemberbset:RetailSegmentMember2023-05-282023-08-06

0000010329bset:BassettCustomWoodMemberbset:WholesaleSegmentMember2023-05-282023-08-06

0000010329bset:BassettCustomWoodMember2024-06-012024-08-31

0000010329bset:BassettCustomWoodMemberus-gaap:CorporateAndOtherMember2024-06-012024-08-31

0000010329bset:BassettCustomWoodMemberbset:RetailSegmentMember2024-06-012024-08-31

0000010329bset:BassettCustomWoodMemberbset:WholesaleSegmentMember2024-06-012024-08-31

0000010329bset:BassettLeatherMember2023-05-282023-08-06

0000010329bset:BassettLeatherMemberus-gaap:CorporateAndOtherMember2023-05-282023-08-06

0000010329bset:BassettLeatherMemberbset:RetailSegmentMember2023-05-282023-08-06

0000010329bset:BassettLeatherMemberbset:WholesaleSegmentMember2023-05-282023-08-06

0000010329bset:BassettLeatherMember2024-06-012024-08-31

0000010329bset:BassettLeatherMemberus-gaap:CorporateAndOtherMember2024-06-012024-08-31

0000010329bset:BassettLeatherMemberbset:RetailSegmentMember2024-06-012024-08-31

0000010329bset:BassettLeatherMemberbset:WholesaleSegmentMember2024-06-012024-08-31

0000010329bset:BassettCustomUpholsteryMember2023-05-282023-08-06

0000010329bset:BassettCustomUpholsteryMemberus-gaap:CorporateAndOtherMember2023-05-282023-08-06

0000010329bset:BassettCustomUpholsteryMemberbset:RetailSegmentMember2023-05-282023-08-06

0000010329bset:BassettCustomUpholsteryMemberbset:WholesaleSegmentMember2023-05-282023-08-06

0000010329bset:BassettCustomUpholsteryMember2024-06-012024-08-31

0000010329bset:BassettCustomUpholsteryMemberus-gaap:CorporateAndOtherMember2024-06-012024-08-31

0000010329bset:BassettCustomUpholsteryMemberbset:RetailSegmentMember2024-06-012024-08-31

0000010329bset:BassettCustomUpholsteryMemberbset:WholesaleSegmentMember2024-06-012024-08-31

0000010329us-gaap:OtherCurrentAssetsMemberbset:SalesCommissionsMember2023-11-25

0000010329us-gaap:OtherCurrentAssetsMemberbset:SalesCommissionsMember2024-08-31

0000010329us-gaap:CorporateAndOtherMember2023-11-25

0000010329us-gaap:CorporateAndOtherMember2024-08-31

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentMember2023-11-25

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentMember2024-08-31

0000010329us-gaap:OperatingSegmentsMemberbset:WholesaleSegmentMember2023-11-25

0000010329us-gaap:OperatingSegmentsMemberbset:WholesaleSegmentMember2024-08-31

00000103292023-05-282023-08-26

0000010329us-gaap:CorporateAndOtherMember2023-05-282023-08-26

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentMember2022-11-272023-08-26

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentMember2023-05-282023-08-26

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentMember2024-06-012024-08-31

0000010329us-gaap:OperatingSegmentsMemberbset:WholesaleSegmentMember2022-11-272023-08-26

0000010329us-gaap:OperatingSegmentsMemberbset:WholesaleSegmentMember2023-11-262024-08-31

0000010329us-gaap:OperatingSegmentsMemberbset:WholesaleSegmentMember2023-05-282023-08-26

0000010329us-gaap:OperatingSegmentsMemberbset:WholesaleSegmentMember2024-06-012024-08-31

0000010329us-gaap:IntersegmentEliminationMember2022-11-272023-08-26

0000010329us-gaap:IntersegmentEliminationMember2023-11-262024-08-31

0000010329us-gaap:IntersegmentEliminationMember2023-05-282023-08-26

0000010329us-gaap:IntersegmentEliminationMember2024-06-012024-08-31

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentsMember2022-11-272023-08-26

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentsMember2023-11-262024-08-31

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentsMember2023-05-282023-08-26

0000010329us-gaap:OperatingSegmentsMemberbset:RetailSegmentsMember2024-06-012024-08-31

0000010329us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-11-272023-08-26

0000010329us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-11-262024-08-31

0000010329us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-05-282023-08-26

0000010329us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-06-012024-08-31

0000010329bset:WholesaleSegmentMember2023-05-282023-08-26

0000010329us-gaap:IntersegmentEliminationMemberbset:WholesaleSegmentMember2022-11-272023-08-26

0000010329us-gaap:IntersegmentEliminationMemberbset:WholesaleSegmentMember2023-11-262024-08-31

0000010329us-gaap:IntersegmentEliminationMemberbset:WholesaleSegmentMember2023-05-282023-08-26

0000010329us-gaap:IntersegmentEliminationMemberbset:WholesaleSegmentMember2024-06-012024-08-31

xbrli:pure

0000010329bset:UnvestedSharesMember2022-11-272023-08-26

0000010329bset:UnvestedSharesMember2023-11-262024-08-31

0000010329bset:UnvestedSharesMember2023-05-282023-08-26

0000010329bset:UnvestedSharesMember2024-06-012024-08-31

iso4217:USDxbrli:shares

00000103292024-05-262024-08-31

0000010329bset:LeaseObligationsOfLicenseeOperatorsMember2023-11-25

0000010329bset:LeaseObligationsOfLicenseeOperatorsMember2024-08-31

iso4217:CAD

0000010329bset:NoaHomeIncMembersrt:ScenarioForecastMember2024-12-31

0000010329bset:NoaHomeIncMember2022-11-272023-08-26

0000010329bset:NoaHomeIncMember2023-11-262024-08-31

0000010329bset:WarehouseLocationsMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329bset:UnderperformingRetailStoresMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329us-gaap:LeaseholdImprovementsMemberbset:RetailSegmentMember2023-11-262024-08-31

0000010329bset:DeferredCompensationPlansMember2023-11-25

0000010329bset:DeferredCompensationPlansMember2024-08-31

0000010329bset:PostEmploymentBenefitObligationsMemberbset:DeferredCompensationPlansMember2023-11-25

0000010329bset:PostEmploymentBenefitObligationsMemberbset:DeferredCompensationPlansMember2024-08-31

0000010329bset:AccruedCompensationAndBenefitsMemberbset:DeferredCompensationPlansMember2023-11-25

0000010329bset:AccruedCompensationAndBenefitsMemberbset:DeferredCompensationPlansMember2024-08-31

0000010329bset:DeferredCompensationManagementSavingsPlanMember2023-11-25

0000010329bset:DeferredCompensationManagementSavingsPlanMember2024-08-31

0000010329bset:UnfundedDeferredCompensationPlanMember2023-11-25

0000010329bset:UnfundedDeferredCompensationPlanMember2024-08-31

0000010329bset:PensionPlansDefinedBenefitAndSupplementalEmployeeRetirementPlanMember2023-11-25

0000010329bset:PensionPlansDefinedBenefitAndSupplementalEmployeeRetirementPlanMember2024-08-31

0000010329bset:PostEmploymentBenefitObligationsMemberbset:PensionPlansDefinedBenefitAndSupplementalEmployeeRetirementPlanMember2023-11-25

0000010329bset:PostEmploymentBenefitObligationsMemberbset:PensionPlansDefinedBenefitAndSupplementalEmployeeRetirementPlanMember2024-08-31

0000010329bset:AccruedCompensationAndBenefitsMemberbset:PensionPlansDefinedBenefitAndSupplementalEmployeeRetirementPlanMember2023-11-25

0000010329bset:AccruedCompensationAndBenefitsMemberbset:PensionPlansDefinedBenefitAndSupplementalEmployeeRetirementPlanMember2024-08-31

0000010329bset:ManagementSavingsPlanMember2023-11-25

0000010329bset:ManagementSavingsPlanMember2024-08-31

0000010329bset:ManagementSavingsPlanMember2017-05-022017-05-02

0000010329us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-11-25

0000010329us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-08-31

0000010329bset:BankOneMember2024-08-31

0000010329bset:BankOneMember2024-06-012024-08-31

00000103292024-05-152024-05-15

0000010329bset:RetailSegmentMember2024-08-31

0000010329bset:WholesaleSegmentMember2024-08-31

0000010329us-gaap:CustomerRelationshipsMember2023-11-25

0000010329us-gaap:CustomerRelationshipsMember2024-08-31

0000010329us-gaap:CorporateNonSegmentMember2024-08-31

0000010329us-gaap:CorporateNonSegmentMember2023-11-262024-08-31

0000010329us-gaap:CorporateNonSegmentMember2023-11-25

0000010329srt:WeightedAverageMember2023-11-262024-08-31

0000010329srt:MaximumMember2023-11-262024-08-31

0000010329srt:MinimumMember2023-11-262024-08-31

utr:M

0000010329us-gaap:CertificatesOfDepositMember2023-11-25

0000010329us-gaap:CertificatesOfDepositMember2024-08-31

00000103292023-08-26

00000103292022-11-26

00000103292024-10-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended August 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________________________ to _______________________

Commission File No. 000-00209

BASSETT FURNITURE INDUSTRIES, INCORPORATED

(Exact name of Registrant as specified in its charter)

| Virginia |

54-0135270 |

| (State or other jurisdiction |

(I.R.S. Employer |

| of incorporation or organization) |

Identification No.) |

3525 Fairystone Park Highway

Bassett, Virginia 24055

(Address of principal executive offices)

(Zip Code)

(276) 629-6000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of exchange on which registered

|

|

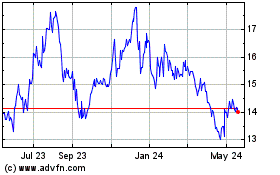

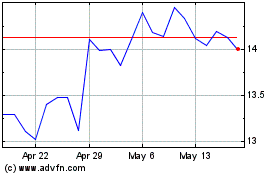

Common Stock ($5.00 par value)

|

|

BSET

|

|

NASDAQ

|

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer |

☐ |

Accelerated Filer |

☒ |

| Non-accelerated Filer |

☐ |

Smaller Reporting Company |

☒ |

| |

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At October 4, 2024, 8,801,137 shares of common stock of the Registrant were outstanding.

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

TABLE OF CONTENTS

| ITEM |

|

PAGE |

| |

|

|

| PART I - FINANCIAL INFORMATION |

| |

|

|

| 1. |

Condensed Consolidated Financial Statements as of August 31, 2024 (unaudited) and November 25, 2023 and for the three and nine months ended August 31, 2024 (unaudited) and August 26, 2023 (unaudited) |

| |

|

|

| |

Condensed Consolidated Statements of Operations |

3 |

| |

|

|

| |

Condensed Consolidated Statements of Comprehensive Income (Loss) |

4 |

| |

|

|

| |

Condensed Consolidated Balance Sheets |

5 |

| |

|

|

| |

Condensed Consolidated Statements of Cash Flows |

6 |

| |

|

|

| |

Notes to Condensed Consolidated Financial Statements |

7 |

| |

|

|

| 2. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

21 |

| |

|

|

| 3. |

Quantitative and Qualitative Disclosures About Market Risk |

34 |

| |

|

|

| 4. |

Controls and Procedures |

34 |

| |

|

|

| PART II - OTHER INFORMATION |

| |

|

|

| 1. |

Legal Proceedings |

35 |

| |

|

|

| 1A. |

Risk Factors |

35 |

| |

|

|

| 2. |

Unregistered Sales of Equity Securities, Use of Proceeds and Issuer Purchases of Equity Securities |

35 |

| |

|

|

| 3. |

Defaults Upon Senior Securities |

35 |

| |

|

|

| 5. |

Other Information |

35 |

| |

|

|

| 6. |

Exhibits |

36 |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE PERIODS ENDED AUGUST 31, 2024 AND AUGUST 26, 2023 – UNAUDITED

(In thousands except per share data)

| |

|

Quarter Ended

|

|

|

Nine Months Ended

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

August 31, 2024

|

|

|

August 26, 2023

|

|

|

August 31, 2024

|

|

|

August 26, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales of furniture and accessories

|

|

$ |

75,619 |

|

|

$ |

87,217 |

|

|

$ |

245,583 |

|

|

$ |

295,434 |

|

|

Cost of furniture and accessories sold

|

|

|

35,526 |

|

|

|

42,173 |

|

|

|

113,863 |

|

|

|

140,360 |

|

|

Gross profit

|

|

|

40,093 |

|

|

|

45,044 |

|

|

|

131,720 |

|

|

|

155,074 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

45,210 |

|

|

|

48,848 |

|

|

|

142,141 |

|

|

|

154,709 |

|

|

Loss on contract abandonment

|

|

|

1,240 |

|

|

|

- |

|

|

|

1,240 |

|

|

|

- |

|

|

Asset impairment charges

|

|

|

- |

|

|

|

- |

|

|

|

5,515 |

|

|

|

- |

|

|

Gain on revaluation of contingent consideration

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,013 |

|

|

Income (loss) from operations

|

|

|

(6,357 |

) |

|

|

(3,804 |

) |

|

|

(17,176 |

) |

|

|

1,378 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

692 |

|

|

|

923 |

|

|

|

2,075 |

|

|

|

1,644 |

|

|

Other loss, net

|

|

|

(109 |

) |

|

|

(309 |

) |

|

|

(489 |

) |

|

|

(1,381 |

) |

|

Income (loss) before income taxes

|

|

|

(5,774 |

) |

|

|

(3,190 |

) |

|

|

(15,590 |

) |

|

|

1,641 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit)

|

|

|

(1,269 |

) |

|

|

(599 |

) |

|

|

(2,691 |

) |

|

|

711 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(4,505 |

) |

|

$ |

(2,591 |

) |

|

$ |

(12,899 |

) |

|

$ |

930 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share

|

|

$ |

(0.52 |

) |

|

$ |

(0.30 |

) |

|

$ |

(1.48 |

) |

|

$ |

0.11 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share

|

|

$ |

(0.52 |

) |

|

$ |

(0.30 |

) |

|

$ |

(1.48 |

) |

|

$ |

0.11 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regular dividends per share

|

|

$ |

0.20 |

|

|

$ |

0.18 |

|

|

$ |

0.54 |

|

|

$ |

0.50 |

|

The accompanying notes to condensed consolidated financial statements are an integral part of the condensed consolidated financial statements.

PART I – FINANCIAL INFORMATION – CONTINUED

ITEM 1. FINANCIAL STATEMENTS

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

FOR THE PERIODS ENDED AUGUST 31, 2024 AND AUGUST 26, 2023 – UNAUDITED

(In thousands)

| |

|

Quarter Ended

|

|

|

Nine Months Ended

|

|

| |

|

August 31, 2024

|

|

|

August 26, 2023

|

|

|

August 31, 2024 |

|

|

August 26, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(4,505 |

) |

|

$ |

(2,591 |

) |

|

$ |

(12,899 |

) |

|

$ |

930 |

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

(32 |

) |

|

|

42 |

|

|

|

(266 |

) |

|

|

(237 |

) |

|

Income taxes related to foreign currency translation adjustments

|

|

|

8 |

|

|

|

(11 |

) |

|

|

68 |

|

|

|

63 |

|

|

Amortization associated with

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long Term Cash Awards (LTCA)

|

|

|

16 |

|

|

|

31 |

|

|

|

46 |

|

|

|

98 |

|

|

Income taxes related to LTCA

|

|

|

(4 |

) |

|

|

(8 |

) |

|

|

(12 |

) |

|

|

(28 |

) |

|

Amortization associated with supplemental executive retirement defined benefit plan (SERP)

|

|

|

(5 |

) |

|

|

- |

|

|

|

(16 |

) |

|

|

- |

|

|

Income taxes related to SERP

|

|

|

1 |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss), net of tax

|

|

|

(16 |

) |

|

|

54 |

|

|

|

(176 |

) |

|

|

(104 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss)

|

|

$ |

(4,521 |

) |

|

$ |

(2,537 |

) |

|

$ |

(13,075 |

) |

|

$ |

826 |

|

The accompanying notes to condensed consolidated financial statements are an integral part of the condensed consolidated financial statements.

PART I – FINANCIAL INFORMATION – CONTINUED

ITEM 1. FINANCIAL STATEMENTS

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

AUGUST 31, 2024 AND NOVEMBER 25, 2023

(In thousands)

| |

|

(Unaudited)

|

|

|

|

|

|

| |

|

August 31, 2024

|

|

|

November 25, 2023

|

|

| Assets |

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

38,329 |

|

|

$ |

52,407 |

|

|

Short-term investments

|

|

|

17,834 |

|

|

|

17,775 |

|

|

Accounts receivable, net

|

|

|

12,974 |

|

|

|

13,736 |

|

|

Inventories

|

|

|

56,138 |

|

|

|

62,982 |

|

|

Recoverable income taxes

|

|

|

2,846 |

|

|

|

2,574 |

|

|

Other current assets

|

|

|

9,421 |

|

|

|

8,480 |

|

|

Total current assets

|

|

|

137,542 |

|

|

|

157,954 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

78,564 |

|

|

|

83,981 |

|

| |

|

|

|

|

|

|

|

|

|

Deferred income taxes

|

|

|

7,410 |

|

|

|

4,645 |

|

|

Goodwill and other intangible assets

|

|

|

14,199 |

|

|

|

16,067 |

|

|

Right of use assets under operating leases

|

|

|

90,274 |

|

|

|

100,888 |

|

|

Other

|

|

|

7,873 |

|

|

|

6,889 |

|

|

Total long-term assets

|

|

|

119,756 |

|

|

|

128,489 |

|

|

Total assets

|

|

$ |

335,862 |

|

|

$ |

370,424 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

14,232 |

|

|

$ |

16,338 |

|

|

Accrued compensation and benefits

|

|

|

6,595 |

|

|

|

8,934 |

|

|

Customer deposits

|

|

|

23,700 |

|

|

|

22,788 |

|

|

Current portion operating lease obligations

|

|

|

18,504 |

|

|

|

18,827 |

|

|

Other current liabilites and accrued expenses

|

|

|

10,086 |

|

|

|

11,003 |

|

|

Total current liabilities

|

|

|

73,117 |

|

|

|

77,890 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term liabilities

|

|

|

|

|

|

|

|

|

|

Post employment benefit obligations

|

|

|

10,885 |

|

|

|

10,207 |

|

|

Long-term portion of operating lease obligations

|

|

|

85,310 |

|

|

|

97,357 |

|

|

Other long-term liabilities

|

|

|

1,514 |

|

|

|

1,529 |

|

|

Total long-term liabilities

|

|

|

97,709 |

|

|

|

109,093 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

43,674 |

|

|

|

43,842 |

|

|

Retained earnings

|

|

|

121,387 |

|

|

|

139,354 |

|

|

Additional paid-in capital

|

|

|

- |

|

|

|

93 |

|

|

Accumulated other comprehensive income (loss)

|

|

|

(25 |

) |

|

|

152 |

|

|

Total stockholders' equity

|

|

|

165,036 |

|

|

|

183,441 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

335,862 |

|

|

$ |

370,424 |

|

The accompanying notes to condensed consolidated financial statements are an integral part of the condensed consolidated financial statements.

PART I – FINANCIAL INFORMATION – CONTINUED

ITEM 1. FINANCIAL STATEMENTS

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE PERIODS ENDED AUGUST 31, 2024 AND AUGUST 26, 2023 – UNAUDITED

(In thousands)

| |

|

Nine Months Ended

|

|

| |

|

August 31, 2024

|

|

|

August 26, 2023

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(12,899 |

) |

|

$ |

930 |

|

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

7,613 |

|

|

|

7,502 |

|

|

Asset impairment charges

|

|

|

5,515 |

|

|

|

- |

|

|

Gain on revaluation of contingent consideration

|

|

|

- |

|

|

|

(1,013 |

) |

|

Inventory valuation charges

|

|

|

4,954 |

|

|

|

3,814 |

|

|

Deferred income taxes

|

|

|

(2,765 |

) |

|

|

473 |

|

|

Other, net

|

|

|

937 |

|

|

|

1,781 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

762 |

|

|

|

2,499 |

|

|

Inventories

|

|

|

1,890 |

|

|

|

14,797 |

|

|

Other current assets

|

|

|

(1,213 |

) |

|

|

(289 |

) |

|

Right of use assets under operating leases

|

|

|

13,029 |

|

|

|

13,668 |

|

|

Customer deposits

|

|

|

912 |

|

|

|

(12,337 |

) |

|

Accounts payable and other liabilities

|

|

|

(5,364 |

) |

|

|

(6,586 |

) |

|

Obligations under operating leases

|

|

|

(15,694 |

) |

|

|

(14,990 |

) |

|

Net cash provided by (used in) operating activities

|

|

|

(2,323 |

) |

|

|

10,249 |

|

| |

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(4,720 |

) |

|

|

(14,657 |

) |

|

Proceeds from the disposal of discontinued operations, net

|

|

|

- |

|

|

|

1,000 |

|

|

Other

|

|

|

(909 |

) |

|

|

(1,664 |

) |

|

Net cash used in investing activities

|

|

|

(5,629 |

) |

|

|

(15,321 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Cash dividends

|

|

|

(4,909 |

) |

|

|

(4,406 |

) |

|

Other issuance of common stock

|

|

|

275 |

|

|

|

275 |

|

|

Repurchases of common stock

|

|

|

(1,127 |

) |

|

|

(4,056 |

) |

|

Taxes paid related to net share settlement of equity awards

|

|

|

(161 |

) |

|

|

(109 |

) |

|

Repayments of finance lease obligations

|

|

|

(210 |

) |

|

|

(208 |

) |

|

Net cash used in financing activities

|

|

|

(6,132 |

) |

|

|

(8,504 |

) |

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

6 |

|

|

|

(37 |

) |

|

Change in cash and cash equivalents

|

|

|

(14,078 |

) |

|

|

(13,613 |

) |

|

Cash and cash equivalents - beginning of period

|

|

|

52,407 |

|

|

|

61,625 |

|

|

Cash and cash equivalents - end of period

|

|

$ |

38,329 |

|

|

$ |

48,012 |

|

The accompanying notes to condensed consolidated financial statements are an integral part of the condensed consolidated financial statements.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

1. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all of the information and footnotes required by accounting principles generally accepted in the United States (“GAAP”) for complete financial statements. In our opinion, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included.

References to “ASC” included hereinafter refer to the Accounting Standards Codification established by the Financial Accounting Standards Board (“FASB”) as the source of authoritative GAAP.

The condensed consolidated financial statements include the accounts of Bassett Furniture Industries, Incorporated (“Bassett”, “we”, “our”, or the “Company”) and our wholly-owned subsidiaries of which we have a controlling interest. In accordance with ASC Topic 810, we have evaluated our licensees and certain other entities to determine whether they are variable interest entities (“VIEs”) of which we are the primary beneficiary and thus would require consolidation in our financial statements. To date we have concluded that none of our licensees represent VIEs.

Revenue from the sale of furniture and accessories is reported in the accompanying condensed consolidated statements of operations net of estimates for returns and allowances.

Our fiscal year, which ends on the last Saturday of November, periodically results in a 53-week year instead of the normal 52 weeks. The current fiscal year ending November 30, 2024 is a 53-week year, with the additional week being included in our first fiscal quarter. Accordingly, the information presented below includes 40 weeks of operations for the nine months ended August 31, 2024 as compared with 39 weeks included in the nine months ended August 26, 2023.

Certain prior year amounts in the consolidated financial statements have been reclassified to conform to the current year presentation with no effect on previously reported net income or Stockholders' equity.

2. Interim Financial Presentation and Other Information

All intercompany accounts and transactions have been eliminated in the condensed consolidated financial statements. The results of operations for the three and nine months ended August 31, 2024 are not necessarily indicative of results for the full fiscal year. These interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and accompanying notes included in our Annual Report on Form 10-K for the year ended November 25, 2023.

Income Taxes

We calculate an anticipated effective tax rate for the year based on our annual estimates of pretax income or loss and use that effective tax rate to record our year-to-date income tax provision. Any change in annual projections of pretax income or loss could have a significant impact on our effective tax rate for the respective quarter.

Our effective tax rate was 22.0% and 17.3% for the three and nine months ended August 31, 2024, respectively. The effective rates for the three and nine months ended August 31, 2024 differ from the federal statutory rate of 21% primarily due to increases in the valuation allowance placed on deferred tax assets associated with Noa Home Inc. (“Noa Home”), the effects of state income taxes and various permanent differences.

Our effective tax rate was 18.8% and 43.3% for the three and nine months ended August 26, 2023, respectively. The effective rates for the three and nine months ended August 26, 2023 differ from the federal statutory rate of 21% primarily due to the non-taxable gain on revaluation of contingent consideration associated with the acquisition of Noa Home (see Note 9), increases in the valuation allowance placed on deferred tax assets associated with Noa Home and the effects of state income taxes and various permanent differences.

Non-cash Investing and Financing Activity

During the nine months ended August 31, 2024 and August 26, 2023, $3,476 and $6,026, respectively, of lease right-of-use assets were added through the recognition of the corresponding lease obligations.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

3. Financial Instruments and Investments

Financial Instruments

Our financial instruments include cash and cash equivalents, short-term investments in certificates of deposit (CDs), accounts receivable, and accounts payable. Because of their short maturities, the carrying amounts of cash and cash equivalents, short-term investments in CDs, accounts receivable, and accounts payable approximate fair value.

Investments

Our short-term investments of $17,834 and $17,775 at August 31, 2024 and November 25, 2023, respectively, consisted of CDs. At August 31, 2024, the CDs had original terms averaging seven months, bearing interest at rates ranging from 0.7% to 5.4% and the weighted average remaining time to maturity was approximately five months and the weighted average yield of the CDs was approximately 4.69%. Each CD is placed with a federally insured financial institution and all deposits are within federal deposit insurance limits. Due to the nature of these investments and their relatively short maturities, the carrying amount of the short-term investments at August 31, 2024 and November 25, 2023 approximates their fair value.

4. Accounts Receivable

Accounts receivable consists of the following:

| |

|

August 31, 2024

|

|

|

November 25, 2023

|

|

|

Gross accounts receivable

|

|

$ |

14,026 |

|

|

$ |

14,271 |

|

|

Allowance for doubtful accounts

|

|

|

(1,052 |

) |

|

|

(535 |

) |

|

Accounts receivable, net

|

|

$ |

12,974 |

|

|

$ |

13,736 |

|

We maintain an allowance for credit losses for estimated losses resulting from the inability of our customers to make required payments. The allowance for credit losses is based on a review of specifically identified accounts in addition to an overall aging analysis which is applied to accounts pooled on the basis of similar risk characteristics. Judgments are made with respect to the collectability of accounts receivable within each pool based on historical experience, current payment practices and current economic trends based on our expectations over the expected life of the receivables, which is generally ninety days or less. Actual credit losses could differ from those estimates.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

Activity in the allowance for credit losses for the nine months ended August 31, 2024 was as follows:

|

Balance at November 25, 2023

|

|

$ |

535 |

|

|

Additions charged to expense

|

|

|

595 |

|

|

Write-offs against allowance

|

|

|

(78 |

) |

|

Balance at August 31, 2024

|

|

$ |

1,052 |

|

We believe that the carrying value of our net accounts receivable approximates fair value. The inputs into these fair value estimates reflect our market assumptions and are not observable. Consequently, the inputs are considered to be Level 3 as specified in the fair value hierarchy in ASC Topic 820, Fair Value Measurements and Disclosures.

5. Inventories

Domestic furniture inventories are valued at the lower of cost, which is determined using the last-in, first-out (LIFO) method, or market. Imported inventories and those applicable to our Lane Venture and Bassett Outdoor lines are valued at the lower of cost, which is determined using the first-in, first-out (FIFO) method, or net realizable value.

Inventories were comprised of the following:

| |

|

August 31, 2024

|

|

|

November 25, 2023

|

|

|

Wholesale finished goods

|

|

$ |

24,188 |

|

|

$ |

27,521 |

|

|

Work in process

|

|

|

453 |

|

|

|

637 |

|

|

Raw materials and supplies

|

|

|

16,223 |

|

|

|

18,655 |

|

|

Retail merchandise

|

|

|

33,285 |

|

|

|

33,090 |

|

|

Total inventories on first-in, first-out method

|

|

|

74,149 |

|

|

|

79,903 |

|

|

LIFO adjustment

|

|

|

(11,942 |

) |

|

|

(11,738 |

) |

|

Reserve for excess and obsolete inventory

|

|

|

(6,069 |

) |

|

|

(5,183 |

) |

| |

|

$ |

56,138 |

|

|

$ |

62,982 |

|

We estimate an inventory reserve for excess quantities and obsolete items based on specific identification and historical write-offs, taking into account future demand, market conditions and the respective valuations at LIFO. The need for these reserves is primarily driven by the normal product life cycle. As products mature and sales volumes decline, we rationalize our product offerings to respond to consumer tastes and keep our product lines fresh. If actual demand or market conditions in the future are less favorable than those estimated, additional inventory write-downs may be required. In determining reserves, we calculate separate reserves on our wholesale and retail inventories. Our wholesale inventories tend to carry the majority of the reserves for excess quantities and obsolete inventory due to the nature of our distribution model. These wholesale reserves primarily represent design and/or style obsolescence. Typically, product is not shipped to our retail warehouses until a consumer has ordered and paid a deposit for the product. We do not typically hold retail inventory for stock purposes. Consequently, floor sample inventory and inventory for delivery to customers account for the majority of our inventory at retail. Retail reserves are based on accessory and clearance floor sample inventory in our stores and any inventory that is not associated with a specific customer order in our retail warehouses.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

Activity in the reserves for excess quantities and obsolete inventory by segment are as follows:

| |

|

Wholesale

Segment

|

|

|

Retail Segment

|

|

|

Corporate

& Other (1)

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at November 25, 2023

|

|

$ |

4,145 |

|

|

$ |

1,038 |

|

|

$ |

- |

|

|

$ |

5,183 |

|

|

Additions charged to expense

|

|

|

3,930 |

|

|

|

524 |

|

|

|

500 |

|

|

|

4,954 |

|

|

Write-offs

|

|

|

(3,700 |

) |

|

|

(368 |

) |

|

|

- |

|

|

|

(4,068 |

) |

|

Balance at August 31, 2024

|

|

$ |

4,375 |

|

|

$ |

1,194 |

|

|

$ |

500 |

|

|

$ |

6,069 |

|

| |

(1)

|

Consists of a $500 reserve established against the retail inventory held by Noa Home due to our decision to cease operations by selling the remaining inventory in an orderly fashion over the next several months.

|

Our estimates and assumptions have been reasonably accurate in the past. We have not made any significant changes to our methodology for determining inventory reserves in 2024 and do not anticipate that our methodology is likely to change in the future.

6. Goodwill and Other Intangible Assets

Goodwill and other intangible assets consisted of the following:

| |

|

August 31, 2024

|

|

| |

|

Gross Carrying

Amount

|

|

|

Accumulated

Amortization

|

|

|

Intangible

Assets, Net

|

|

|

Intangibles subject to amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer relationships

|

|

$ |

512 |

|

|

$ |

(379 |

) |

|

$ |

133 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangibles not subject to amortization:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade names

|

|

|

|

|

|

|

|

|

|

|

6,849 |

|

|

Goodwill

|

|

|

|

|

|

|

|

|

|

|

7,217 |

|

|

Total goodwill and other intangible assets

|

|

|

|

|

|

|

|

|

|

$ |

14,199 |

|

| |

|

November 25, 2023

|

|

| |

|

Gross Carrying

Amount

|

|

|

Accumulated

Amortization

|

|

|

Intangible

Assets, Net

|

|

|

Intangibles subject to amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer relationships

|

|

$ |

512 |

|

|

$ |

(337 |

) |

|

$ |

175 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangibles not subject to amortization:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade names

|

|

|

|

|

|

|

|

|

|

|

8,675 |

|

|

Goodwill

|

|

|

|

|

|

|

|

|

|

|

7,217 |

|

|

Total goodwill and other intangible assets

|

|

|

|

|

|

|

|

|

|

$ |

16,067 |

|

See Note 9 regarding the impairment of the trade name intangible asset for Noa Home.

There were no changes in the carrying amounts of goodwill during the nine months ended August 31, 2024.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

The carrying amounts of goodwill by reportable segment, including accumulated impairment losses, at both August 31, 2024 and November 25, 2023 were as follows:

| |

|

Original

|

|

|

Accumulated

|

|

|

|

|

|

| |

|

Recorded

|

|

|

Impairment

|

|

|

Carrying

|

|

| |

|

Value

|

|

|

Losses

|

|

|

Amount

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale

|

|

$ |

9,188 |

|

|

$ |

(1,971 |

) |

|

$ |

7,217 |

|

|

Retail

|

|

|

1,926 |

|

|

|

(1,926 |

) |

|

|

- |

|

|

Corporate and other

|

|

|

5,409 |

|

|

|

(5,409 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total goodwill

|

|

$ |

16,523 |

|

|

$ |

(9,306 |

) |

|

$ |

7,217 |

|

Amortization expense associated with intangible assets during the three and nine months ended August 31, 2024 and August 26, 2023 was as follows:

| |

|

Quarter Ended

|

|

|

Nine Months Ended

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

August 31, 2024

|

|

|

August 26, 2023

|

|

|

August 31, 2024 |

|

|

August 26, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible asset amortization expense

|

|

$ |

14 |

|

|

$ |

14 |

|

|

$ |

43 |

|

|

$ |

43 |

|

Estimated future amortization expense for intangible assets that exist at August 31, 2024 is as follows:

|

Remainder of fiscal 2024

|

|

$ |

14 |

|

|

Fiscal 2025

|

|

|

57 |

|

|

Fiscal 2026

|

|

|

57 |

|

|

Fiscal 2027

|

|

|

5 |

|

|

Fiscal 2028

|

|

|

- |

|

|

Fiscal 2029

|

|

|

- |

|

|

Total

|

|

$ |

133 |

|

7. Bank Credit Facility

On May 15, 2024, we entered into the Eighth Amended and Restated Credit Agreement with our bank (the “Credit Facility”). This credit facility provides for a line of credit of up to $25,000. At August 31, 2024, we had $6,013 outstanding under standby letters of credit against our line. The line bears interest at the One-Month Term Secured Overnight Financing Rate (“One-Month Term SOFR”) plus 1.75% and is secured by our accounts receivable and inventory. Our bank charges a fee of 0.25% on the daily unused balance of the line, payable quarterly. Under the terms of the Credit Facility, Consolidated Minimum Tangible Net Worth (as defined in the Credit Facility) shall at no time be less than $120,000. In addition, we must maintain the following financial covenants, measured quarterly on a rolling twelve-month basis and commencing as of the end of the first fiscal quarter after the first date that the used commitment (the sum of any outstanding advances plus standby letters of credit) equals or exceeds $8,250:

| |

●

|

Consolidated Fixed Charge Coverage Ratio (as defined in the Credit Facility) of not less than 1.2 times and

|

| |

●

|

Consolidated Lease Adjusted Leverage to EBITDAR Ratio (as defined in the Credit Facility) not to exceed 3.35 times.

|

Since our used commitment was less than $8,250 at August 31, 2024, we were not required to test the Consolidated Fixed Charge Coverage Ratio or the Consolidated Lease Adjusted Leverage to EBITDAR Ratio. Had we been required to test those ratios, we would not have been able to achieve the required levels for either of these ratios. Consequently, our availability under the Credit Facility is currently limited to an additional $2,237.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

8. Post Employment Benefit Obligations

Defined Benefit Plans

We have an unfunded Supplemental Retirement Income Plan (the “Supplemental Plan”) that covers one current and certain former executives. The liability for the Supplemental Plan was $5,851 and $5,778 as of August 31, 2024 and November 25, 2023, respectively.

We also have the Bassett Furniture Industries, Incorporated Management Savings Plan (the “Management Savings Plan”) which was established in the second quarter of fiscal 2017. The Management Savings Plan is an unfunded, nonqualified deferred compensation plan maintained for the benefit of certain highly compensated or management level employees. As part of the Management Savings Plan, we have made Long Term Cash Awards (“LTC Awards”) totaling $2,000 to five management employees in the amount of $400 each. We are accounting for the LTC Awards as a defined benefit pension plan. Currently, two of those employees have retired and are receiving benefits. The liability for the LTC Awards was $1,221 and $1,234 as of August 31, 2024 and November 25, 2023, respectively.

The combined pension liability for the Supplemental Plan and LTC Awards is recorded as follows in the condensed consolidated balance sheets:

| |

|

August 31, 2024

|

|

|

November 25, 2023

|

|

|

Accrued compensation and benefits

|

|

$ |

792 |

|

|

$ |

792 |

|

|

Post employment benefit obligations

|

|

|

6,280 |

|

|

|

6,220 |

|

|

Total pension liability

|

|

$ |

7,072 |

|

|

$ |

7,012 |

|

Components of net periodic pension costs for our defined benefit plans for the three and nine months ended August 31, 2024 and August 26, 2023 are as follows:

| |

|

Quarter Ended

|

|

|

Nine Months Ended

|

|

| |

|

August 31, 2024

|

|

|

August 26, 2023

|

|

|

August 31, 2024

|

|

|

August 26, 2023

|

|

|

Service cost

|

|

$ |

3 |

|

|

$ |

7 |

|

|

$ |

10 |

|

|

$ |

20 |

|

|

Interest cost

|

|

|

98 |

|

|

|

93 |

|

|

|

293 |

|

|

|

278 |

|

|

Amortization of prior service costs

|

|

|

26 |

|

|

|

31 |

|

|

|

77 |

|

|

|

94 |

|

|

Amortization of loss

|

|

|

(16 |

) |

|

|

- |

|

|

|

(48 |

) |

|

|

- |

|

|

Net periodic pension cost

|

|

$ |

111 |

|

|

$ |

131 |

|

|

$ |

332 |

|

|

$ |

392 |

|

The components of net periodic pension cost other than the service cost component, which is included in selling, general and administrative expenses, are included in other loss, net in our condensed consolidated statements of operations.

Deferred Compensation Plans

We have an unfunded deferred compensation plan that covers one current executive and certain former executives and provides for voluntary deferral of compensation. This plan has been frozen with no additional participants or deferrals permitted. Our liability under this plan was $1,657 and $1,655 as of August 31, 2024 and November 25, 2023, respectively.

We also have an unfunded, nonqualified deferred compensation plan maintained for the benefit of certain highly compensated or management level employees which was established under the Management Savings Plan. Our liability under this plan, including both accrued Company contributions and participant salary deferrals, was $3,277 and $2661 as of August 31, 2024 and November 25, 2023, respectively.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

Our combined liability for all deferred compensation arrangements, including Company contributions and participant deferrals under the Management Savings Plan, is recorded as follows in the condensed consolidated balance sheets:

| |

|

August 31, 2024

|

|

|

November 25, 2023

|

|

|

Accrued compensation and benefits

|

|

$ |

329 |

|

|

$ |

329 |

|

|

Post employment benefit obligations

|

|

|

4,605 |

|

|

|

3,987 |

|

|

Total deferred compensation liability

|

|

$ |

4,934 |

|

|

$ |

4,316 |

|

We recognized expense under our deferred compensation arrangements during the three and nine months ended August 31, 2024 and August 26, 2023 as follows:

| |

|

Quarter Ended

|

|

|

Nine Months Ended

|

|

| |

|

August 31, 2024

|

|

|

August 26, 2023

|

|

|

August 31, 2024

|

|

|

August 26, 2023

|

|

|

Deferred compensation expense (benefit)

|

|

$ |

255 |

|

|

$ |

166 |

|

|

$ |

881 |

|

|

$ |

363 |

|

9. Other Gains and Losses

Fiscal 2024

During the three and nine months ended August 31, 2024, we recognized a charge of $1,240 to accrue the remaining minimum charges payable under a contract for logistical services which our wholesale segment ceased utilizing during the third fiscal quarter of 2024. These minimum payments will continue through January of 2026.

During the nine months ended August 31, 2024, we recognized non-cash charges for asset impairments totaling $5,515 which consisted of the following:

| |

●

|

$2,887 in our retail segment which included $1,978 related to the impairment of leasehold improvements and $750 from the impairment of right-of-use assets at certain underperforming retail stores, as well as $159 for the impairment of right-of-use assets at certain warehouse locations resulting from the consolidation of our retail warehouses.

|

| |

●

|

$727 for the impairment of plant and equipment in our wholesale segment related to the consolidation of our domestic wood production facilities.

|

| |

●

|

$1,901 for the impairment of long-lived assets at Noa Home. During the second quarter we concluded that Noa Home was not likely to achieve profitability in the foreseeable future and have decided to cease operations by selling the remaining inventory in an orderly fashion over the next several months. $1,827 of these charges are for the full impairment of the Noa Home trade name intangible asset, and $74 relates to the full impairment of customized software used in the Noa Home operations.

|

Our estimates of the fair value of the impaired right-of-use assets included estimates of discounted cash flows based upon current market rents and other inputs which we consider to be Level 3 inputs as specified in the fair value hierarchy in ASC Topic 820, Fair Value Measurement and Disclosure.

Fiscal 2023

During the nine months ended August 26, 2023, we recognized a non-cash gain of $1,013 resulting from the write-down of our contingent consideration obligation to the former owners of Noa Home. Subsequent to the acquisition of Noa Home on September 2, 2022, the parties concluded that the revenue and EBITDA targets originally set forth in the purchase agreement by which the Noa Home co-founders were to earn the contingent consideration were likely not to be met within the originally anticipated time frame and therefore agreed to replace the contingent consideration payable that was recognized at the acquisition date with two fixed payments of C$200 each. The first payment was made in June of 2023 and the second payment will be made in December of 2024.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

10. Commitments and Contingencies

We are involved in various legal and environmental matters which arise in the normal course of business. Although the final outcome of these matters cannot be determined, based on the facts presently known, we believe that the final resolution of these matters will not have a material adverse effect on our financial position or future results of operations.

Lease Guarantees

We were contingently liable under licensee lease obligation guarantees in the amounts of $5,226 and $1,845 at August 31, 2024 and November 25, 2023, respectively. The remaining term under these lease guarantees extends for six years.

In the event of default by the licensee, we believe that the risk of loss is mitigated through a combination of options that include, but are not limited to, arranging for a replacement licensee or liquidating the collateral (primarily inventory). The proceeds of the above options are expected to cover the estimated amount of our future payments under the guarantee obligation, net of recorded reserves. The fair value of these lease guarantees (an estimate of the cost to the Company to perform on the guarantee) at August 31, 2024 and November 25, 2023 was not material.

PART I-FINANCIAL INFORMATION-CONTINUED

BASSETT FURNITURE INDUSTRIES, INCORPORATED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

(Dollars in thousands except share and per share data)

11. Earnings (Loss) Per Share

The following reconciles basic and diluted earnings (loss) per share:

| |

|

Net Income

(Loss)

|

|

|

Weighted Average

Shares

|

|

|

Net Income

(Loss) Per

Share

|

|

|

For the quarter ended August 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic loss per share

|

|

$ |

(4,505 |

) |

|

|

8,725,008 |

|

|

$ |

(0.52 |

) |

|

Add effect of dilutive securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted shares*

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Diluted loss per share - continuing operations

|

|

$ |

(4,505 |

) |

|

|

8,725,008 |

|

|

$ |

(0.52 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the quarter ended August 26, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

$ |

(2,591 |

) |

|

|

8,736,096 |

|

|

$ |

(0.30 |

) |

|

Add effect of dilutive securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted shares*

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Diluted earnings per share

|

|

$ |

(2,591 |

) |

|

|

8,736,096 |

|

|

$ |

(0.30 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended August 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share - continuing operations

|

|

$ |

(12,899 |

) |

|

|

8,742,766 |

|

|

$ |

(1.48 |

) |

|

Add effect of dilutive securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted shares*

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Diluted earnings per share - continuing operations

|

|

$ |

(12,899 |

) |

|

|