false

0001485003

0001485003

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 7, 2024

Carisma Therapeutics Inc.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

|

001-36296 |

|

26-2025616 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

3675 Market Street, Suite 401

Philadelphia, PA |

|

|

|

19104 |

| (Address of Principal Executive Offices) |

|

|

|

( Zip Code) |

Registrant’s telephone number, including

area code: (267) 491-6422

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of exchange

on which registered |

| Common Stock, $0.001 par value |

|

CARM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

2.02. Results of Operations and Financial Condition.

On November 7, 2024, Carisma Therapeutics Inc. (the “Company”)

announced its financial results for the quarter ended September 30, 2024. The full text of the press release issued in connection

with the announcement is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1 attached

hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by

specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CARISMA THERAPEUTICS INC. |

| |

|

|

| |

By: |

/s/ Steven Kelly |

| Date: November 7, 2024 |

|

Steven Kelly |

| |

|

President and Chief Executive Officer |

Exhibit 99.1

Carisma Therapeutics

Reports Third Quarter 2024 Financial Results and Recent Business Highlights

Initial results from

the Phase 1 study of CT-0525, lead product candidate, expected in the first quarter of 2025

Nomination of a development

candidate for liver fibrosis program expected in the first quarter of 2025

New preclinical efficacy

data from the anti-GPC3 in vivo CAR-M therapy to be presented on November 8 at SITC 2024 Annual Meeting

New preclinical efficacy

data in liver fibrosis to be presented on November 17 at AASLD - The Liver Meeting ® 2024

Cash and cash equivalents

of $26.9 million expected to fund the Company into the third quarter of 2025

PHILADELPHIA, PA –

November 7, 2024 – Carisma Therapeutics Inc. (Nasdaq: CARM) (“Carisma” or the “Company”), a clinical-stage

biopharmaceutical company focused on discovering and developing innovative immunotherapies, today reported financial results for the

quarter ended September 30, 2024, and highlighted recent business updates.

“Our recent progress

across clinical and preclinical programs demonstrates our commitment to pioneering therapies that address significant unmet medical needs,”

said Steven Kelly, President and CEO of Carisma Therapeutics. “We are advancing on multiple fronts. We expect to report initial

data from the Phase 1 study of CT-0525 in the first quarter of 2025. We also recently nominated our first development candidate in hepatocellular

carcinoma with Moderna and are excited to bring additional in vivo CAR-M therapies forward, including autoimmune targets. Our liver

fibrosis program is progressing as well, with the nomination of a development candidate anticipated in the first quarter of 2025. These

key milestones move us closer to delivering transformative treatments for patients in need.”

Third Quarter 2024

Highlights and Upcoming Milestones

Ex Vivo Oncology

| · | CT-0525 (Anti-HER2 chimeric antigen receptor

monocyte (CAR-Monocyte)) |

| o | On November 5, 2024, Carisma announced the upcoming presentation of a trial in progress (TIP) poster for

its Phase 1 clinical trial evaluating CT-0525, an autologous CAR-Monocyte therapy for the treatment of HER2+ solid tumors. The poster

will be presented at the Society for Immunotherapy of Cancer (SITC) Annual Meeting in Houston, Texas, on November 8, 2024. |

| o | In September 2024, Carisma submitted a protocol amendment for its Phase 1 study of CT-0525 to allow for

the expansion of the study to include repeat dosing (up to two billion CAR positive cells administered every three weeks for up to five

cycles) in combination with pembrolizumab, bolus dosing (up to10 billion CAR positive cells in a single dose) in combination with pembrolizumab,

or either of these two dosing schedules as monotherapy (without checkpoint inhibitor). Repeat dosing in combination with pembrolizumab

will be prioritized and the other three study arms may be activated as data indicates. |

| o | Carisma expects to report initial data for Cohorts 1 and 2 of its Phase 1 study of CT-0525 in the first quarter of 2025. |

In Vivo Program

(Moderna Collaboration)

| · | Autoimmune disease (CAR-M + mRNA/LNP) |

| o | On September 10, 2024, Carisma announced the expansion of its in vivo chimeric antigen receptor

macrophage and monocyte ("CAR-M") collaboration with Moderna, Inc. (“Moderna”) to include the nomination of two

research targets for the treatment of autoimmune diseases. Carisma retains all rights in autoimmune disease beyond the two nominated targets,

which will be exclusively partnered with Moderna. |

| · | GPC3+ solid tumors (CAR-M + mRNA/LNP) |

| o | On November 5, 2024, Carisma announced the upcoming presentation of new pre-clinical data for its anti-GPC3

in vivo CAR-M therapy for the treatment of hepatocellular carcinoma (HCC), developed in collaboration with Moderna. These data

will be presented in a poster session at the SITC Annual Meeting in Houston, Texas, on November 8, 2024. These preclinical data demonstrate

robust anti-tumor activity and introduce a novel, off-the-shelf approach for GPC3+ solid tumors. |

Fibrosis

| o | On August 6, 2024, Carisma announced that new preclinical data for liver fibrosis will be highlighted

in a poster presentation at the American Association for the Study of Liver Diseases (AASLD) - The Liver Meeting®

2024, to be held November 15 through 19, 2024, in San Diego, California. |

| o | Carisma expects to nominate a development candidate for its liver fibrosis program in the first quarter

of 2025. |

Corporate Update

| · | On October 30, 2024, Carisma announced the appointment

of Sohanya Cheng to the Board of Directors of the Company, effective October 31, 2024. Ms. Cheng brings over 20 years of experience in

biopharmaceutical commercialization and research, with a strong focus on oncology. The Company concurrently announced the resignation

of Michael Torok from Carisma's Board of Directors, also effective October 31, 2024. |

Third Quarter 2024 Financial Results

| · | Cash and cash equivalents as of September

30, 2024, were $26.9 million, compared to $40.4 million as of June 30, 2024. |

| · | Research and development expenses for the three

months ended September 30, 2024 were $11.3 million, compared to $19.6 million for the three months ended September 30, 2023. The decrease

of $8.3 million was primarily due to implementation of our revised operating plan in the second quarter of 2024 in which we halted further

development of CT-0508, paused development of CT-1119 and implemented a workforce reduction. As result of the revised operating plan,

we experienced a decrease of $2.4 million related to halting development of CT-0508 and a $0.1 million decrease from pausing the development

of CT-1119. In addition, the implementation of the revised operating plan resulted in a decrease in facilities and other expenses of $3.1

million due to less laboratory supplies and laboratory space needs and a $0.9 million decrease in direct personnel costs due to a reduction

in headcount. Further, we experienced a $0.9 million decrease in direct costs associated with pre-clinical development of CT-0525 due

to the timing of the development program and a decrease of $0.9 million in other clinical and pre-clinical development expenses resulting

from the timing of certain studies in our in vivo collaboration with Moderna. |

| · | General and administrative expenses for the three

months ended September 30, 2024 were $5.2 million, compared to $6.6 million for the three months ended September 30, 2023. The decrease

of $1.4 million was primarily due to our revised operating plan in which we recognized a $1.3 million decrease in professional

fees as a result of our patent portfolio and expanding infrastructure in 2023, a $0.3 million decrease in facilities and supplies due

to a decrease in office expenditures, a $0.2 million decrease in insurance costs, and a $0.1 million decrease in other expenses related

to a decline in travel costs, partially offset by a $0.5 million increase in personnel costs driven by an increase in stock-based compensation. |

| · | Net loss was $12.7 million for the

third quarter of 2024, compared to a $21.4 million net loss for the same period in 2023. |

Outlook

Carisma anticipates that its cash and cash equivalents

of $26.9 million as of September 30, 2024 are sufficient to sustain its planned operations into the third quarter of 2025. The Company’s

cash forecast contains estimates and assumptions, and management cannot predict the timing of all cash receipts and expenditures with

certainty. Variances from management’s estimates and assumptions could impact the Company’s liquidity prior to the third quarter

of 2025.

About CT-0525

CT-0525 is a first-in-class, ex vivo gene-modified

autologous chimeric antigen receptor-monocyte (CAR-Monocyte) cellular therapy intended to treat solid tumors that overexpress human epidermal

growth factor receptor 2 (HER2). It is being studied in a multi-center, open label, Phase 1 clinical trial for patients with advanced/metastatic

HER2-overexpressing solid tumors that have progressed on available therapies. The CAR-Monocyte approach has the potential to address some

of the challenges of treating solid tumors with cell therapies, including tumor infiltration, immunosuppression within the tumor microenvironment,

and antigen heterogeneity. CT-0525 has the potential to enable significant dose escalation, enhance tumor infiltration, increase persistence,

and reduce manufacturing time compared to macrophage therapy.

About Carisma Therapeutics

Carisma Therapeutics Inc. is a clinical-stage

biopharmaceutical company focused on utilizing our proprietary macrophage and monocyte cell engineering platform to develop transformative

immunotherapies to treat cancer and other serious diseases. We have created a comprehensive, differentiated proprietary cell therapy

platform focused on engineered macrophages and monocytes, cells that play a crucial role in both the innate and adaptive immune response.

Carisma is headquartered in Philadelphia, PA. For more information, please visit www.carismatx.com.

Cautionary Note on Forward-Looking Statements

Statements in this press

release about future expectations, plans and prospects, as well as any other statements regarding matters that are not historical facts,

may constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. These

statements include, but are not limited to, statements relating to Carisma’s business, strategy, future operations, cash runway,

the advancement of Carisma’s product candidates and product pipeline, and clinical development of Carisma’s product candidates,

including expectations regarding timing of initiation and results of clinical trials. The words “anticipate,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “goals,”

“intend,” “may,” “might,” “outlook,” “plan,” “project,” “potential,”

“predict,” “target,” “possible,” “will,” “would,” “could,” “should,”

and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these

identifying words.

Any forward-looking statements are based on management’s

current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ

materially and adversely from those set forth in, or implied by, such forward-looking statements. These risks and uncertainties include,

but are not limited to, (i) Carisma’s ability to realize the anticipated benefits of its pipeline reprioritization and corporate

restructuring, (ii) Carisma’s ability to obtain, maintain and protect its intellectual property rights related to its product candidates;

(iii) Carisma’s ability to advance the development of its product candidates under the timelines it anticipates in planned and future

clinical trials and with its current financial and human resources; (iv) Carisma’s ability to replicate in later clinical trials

positive results found in preclinical studies and early-stage clinical trials of its product candidates; (v) Carisma’s ability to

realize the anticipated benefits of its research and development programs, strategic partnerships, research and licensing programs and

academic and other collaborations; (vi) regulatory requirements or developments and Carisma’s ability to obtain and maintain necessary

approvals from the U.S. Food and Drug Administration and other regulatory authorities related to its product candidates; (vii) changes

to clinical trial designs and regulatory pathways; (viii) risks associated with Carisma’s ability to manage expenses; (ix) changes

in capital resource requirements; (x) risks related to the inability of Carisma to obtain sufficient additional capital to continue to

advance its product candidates and its preclinical programs; and (xi) legislative, regulatory, political and economic developments.

For a discussion of these risks and uncertainties,

and other important factors, any of which could cause Carisma’s actual results to differ from those contained in the forward-looking

statements, see the “Risk Factors” set forth in the Company’s Annual Report on Form 10-K for the year ended December

31, 2023, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, as well as discussions of potential risks, uncertainties,

and other important factors in Carisma’s other recent filings with the Securities and Exchange Commission. Any forward-looking statements

that are made in this press release speak as of the date of this press release. Carisma undertakes no obligation to revise the forward-looking

statements or to update them to reflect events or circumstances occurring after the date of this press release, whether as a result of

new information, future developments or otherwise, except as required by the federal securities laws

Investors:

Shveta Dighe

Head of Investor Relations

investors@carismatx.com

Media Contact:

Julia Stern

(763) 350-5223

jstern@realchemistry.com

CARISMA THERAPEUTICS INC.

Unaudited Consolidated Balance Sheets

(in thousands, except share and par value)

| | |

September 30,

2024 | | |

December 31,

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 26,881 | | |

$ | 77,605 | |

| Prepaid expenses and other assets | |

| 7,256 | | |

| 2,866 | |

| Total current assets | |

| 34,137 | | |

| 80,471 | |

| Property and equipment, net | |

| 5,391 | | |

| 6,764 | |

| Right of use assets – operating leases | |

| 2,322 | | |

| 2,173 | |

| Deferred financing costs | |

| 208 | | |

| 146 | |

| Total assets | |

$ | 42,058 | | |

$ | 89,554 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' (Deficit) Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,728 | | |

$ | 3,933 | |

| Accrued expenses | |

| 4,542 | | |

| 7,662 | |

| Deferred revenue | |

| 682 | | |

| 1,413 | |

| Operating lease liabilities | |

| 1,386 | | |

| 1,391 | |

| Finance lease liabilities | |

| 1,074 | | |

| 544 | |

| Other current liabilities | |

| 1,146 | | |

| 965 | |

| Total current liabilities | |

| 10,558 | | |

| 15,908 | |

| Deferred revenue | |

| 41,250 | | |

| 45,000 | |

| Operating lease liabilities | |

| 761 | | |

| 860 | |

| Finance lease liabilities | |

| 96 | | |

| 328 | |

| Other long-term liabilities | |

| 519 | | |

| 926 | |

| Total liabilities | |

| 53,184 | | |

| 63,022 | |

| | |

| | | |

| | |

| Stockholders’ (deficit) equity: | |

| | | |

| | |

| Preferred stock $0.001 par value, 5,000,000 shares authorized, none issued or outstanding | |

| — | | |

| — | |

| Common stock $0.001 par value, 350,000,000 shares authorized, 41,750,109 and 40,609,915 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 41 | | |

| 40 | |

| Additional paid-in capital | |

| 276,777 | | |

| 271,594 | |

| Accumulated deficit | |

| (287,944 | ) | |

| (245,102 | ) |

| Total stockholders’ (deficit) equity | |

| (11,126 | ) | |

| 26,532 | |

| Total liabilities and stockholders’ (deficit) equity | |

$ | 42,058 | | |

$ | 89,554 | |

CARISMA THERAPEUTICS INC.

Unaudited Consolidated Statements of Operations

and Comprehensive Loss

(in thousands, except share and per share data)

| | |

Three Months Ended

September 30, | |

| | |

2024 | | |

2023 | |

| Collaboration revenues | |

$ | 3,385 | | |

$ | 3,827 | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 11,326 | | |

| 19,551 | |

| General and administrative | |

| 5,203 | | |

| 6,620 | |

| Total operating expenses | |

| 16,529 | | |

| 26,171 | |

| Operating loss | |

| (13,144 | ) | |

| (22,344 | ) |

| Change in fair value of derivative liability | |

| — | | |

| — | |

| Interest income, net | |

| 442 | | |

| 941 | |

| Pre-tax loss | |

| (12,702 | ) | |

| (21,403 | ) |

| Income tax expense | |

| — | | |

| — | |

| Net loss | |

$ | (12,702 | ) | |

$ | (21,403 | ) |

| | |

| | | |

| | |

| Share information: | |

| | | |

| | |

| Net loss per share of common stock, basic and diluted | |

$ | (0.31 | ) | |

$ | (0.53 | ) |

| Weighted-average shares of common stock outstanding, basic and diluted | |

| 41,588,035 | | |

| 40,285,858 | |

| Comprehensive loss | |

| | | |

| | |

| Net loss | |

$ | (12,702 | ) | |

$ | (21,403 | ) |

| Unrealized gain on marketable securities | |

| — | | |

| 108 | |

| Comprehensive loss | |

$ | (12,702 | ) | |

$ | (21,295 | ) |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

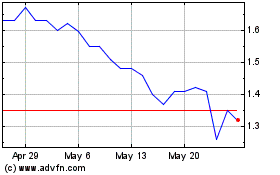

Carisma Therapeutics (NASDAQ:CARM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Carisma Therapeutics (NASDAQ:CARM)

Historical Stock Chart

From Dec 2023 to Dec 2024