Cellectar Biosciences Reports Financial Results for Year Ended 2023 and Provides a Corporate Update

March 27 2024 - 5:40AM

Cellectar Biosciences, Inc. (NASDAQ: CLRB), a late-stage clinical

biopharmaceutical company focused on the discovery, development,

and commercialization of drugs for the treatment of cancer, today

announced financial results for the year ended December 31,

2023, and provided a corporate update.

“2023 was a year of significant progress for

Cellectar, culminating in the January announcement of the positive

data from our pivotal study of iopofosine I 131 in Waldenstrom’s

macroglobulinemia,” said James Caruso, president, and CEO of

Cellectar. “We continue to focus on the preparation of our NDA,

which we plan to submit in the second half of 2024 and in parallel

request accelerated approval, which if granted, would provide a

six-month review period for the NDA. Our data in WM is truly

impressive and we look forward to providing this meaningful new

therapeutic for patients in a disease with limited treatment

options.”

Fourth Quarter and Recent Corporate

Highlights

- Announced positive topline data

achieving its primary endpoint in its CLOVER WaM pivotal study,

evaluating iopofosine I 131, a potentially first-in-class, targeted

radiotherapy candidate for the treatment of relapsed/refractory

Waldenstrom’s macroglobulinemia (WM) patients that have received at

least two prior lines of therapy, including Bruton tyrosine kinase

inhibitors (BTKi). CLOVER WaM is the largest study to date in

relapsed or refractory WM patients post-BTKi therapy and represents

the most refractory population ever tested in clinical studies

based upon a review of published literature. The CLOVER WaM study

met its primary endpoint with a major response rate (MRR) of 61%

(95% confidence interval [44.50%, 75.80%, two-sided p value <

0.0001]). The overall response rate (ORR) in evaluable patients was

75.6%, and 100% of patients experienced disease control. Responses

were durable, with median duration of response not reached and 76%

of patients remaining progression free at a median follow-up of

eight months. Notably, iopofosine monotherapy achieved a 7.3%

complete remission (CR) rate in this highly refractory WM

population. A study data update is planned for Q2 of 2024.

- Reported a Complete Remission rate

of 64% and Overall Response Rate of 73% in highly refractory

patients in an Investigator Initiated Phase I Study of Iopofosine

in Combination with External Beam Radiotherapy in Recurrent Head

and Neck Cancer. In addition to the High Rate of Complete Remission

Durability of clinical activity achieved a 67% Overall Survival and

42% Progression Free Survival at One Year.

- Announced that iopofosine I 131

demonstrated a pathological response with complete clonal clearance

in a relapsed/refractory Waldenstrom’s macroglobulinemia (WM)

patient with CNS involvement, also known as Bing-Neel Syndrome

(BNS), enrolled in its Phase 2b CLOVER WaM pivotal trial.

- Enrolled the first patient in the

company’s Phase 1b clinical study of iopofosine I 131 in pediatric

high-grade gliomas (pHGG). The open-label study will evaluate

efficacy, safety, and tolerability assessing two dosing regimens to

identify the optimal recommended dose and schedule of iopofosine I

131 in pHGG patients for a Phase 2 study. The study is supported by

a $2 million Fast Track SBIR grant from the National Institute of

Health’s National Cancer Institute (NCI), which was awarded based

in part on the promising Phase 1a trial data.

- Announced promising preclinical

data for its proprietary novel alpha-emitting phospholipid

radiotherapeutic conjugate, CLR 121255 (255Ac-CLR 121225) an

actinium-labeled phospholipid ether (PLE), in pancreatic cancer

models. The development of this compound expands the company’s

clinical pipeline of PLE cancer targeting compounds to include

targeted alpha therapies (TATs).

- Announced strategic partnerships

with leading physician-led, community-based oncology networks

Florida Cancer Specialists and American Oncology Network (AON) to

advance the treatment of WM in the community setting.

- Announced a new licensing agreement

with the Wisconsin Alumni Research Foundation (WARF) for

intellectual property that was the result of collaborative research

conducted at the University of Wisconsin-Madison (UW) with

iopofosine I 131 in pediatric cancers. Under terms of the

agreement, Cellectar has an exclusive license to develop and

commercialize iopofosine in various pediatric solid cancers, such

as high-grade glioma, neuroblastoma, and sarcoma.

- Expanded the Intellectual Property

protection for its PDC Platform to deliver flavaglines as targeted

anticancer payloads. The company received the Notice of Allowance

for the patent entitled, “Phospholipid-flavagline conjugates and

methods of using the same for targeted cancer therapy,” from the

Japanese, Chinese, Eurasian, Brazilian, and Mexican patent

authorities. These patent allowances in key global regions follow

prior allowances for the same patent in the U.S., Europe,

Australia, and Canada.

- Announced the Tranche A warrants

issued as part of the private placement announced in September 2023

were fully exercised. All participants in the previous financing,

led by Rosalind Advisors, exercised their warrants with gross

proceeds totaling approximately $44.1 million.

2023 Financial Highlights

- Cash and Cash

Equivalents: As of December 31, 2023, the company had cash

and cash equivalents of $9.6 million, compared to $19.9 million as

of December 31, 2022. The decrease in cash was primarily a result

of research and development expenses, and general and

administrative expenses. Net cash used in operating activities

during the twelve months ended December 31, 2023, was approximately

$32.4 million. Net cash proceeds from the issuance of common stock,

preferred stock, and warrants during 2023 was approximately $22.9

million. We believe our cash balance as of December 31, 2023, in

combination with the funds generated by the warrants exercised by

investors in January 2024 is adequate to fund our basic budgeted

operations into the fourth quarter of 2024.

- Research and Development

Expense: R&D expense for the year ended

December 31, 2023, was approximately $28.2 million, compared

to approximately $19.2 million for the year ended December 31,

2022. The overall increase in R&D expense was primarily a

result of an increase in manufacturing and related costs related to

greater production sourcing necessary to support clinical trials

and establish commercial production capabilities.

- General and Administrative

Expense: G&A expense for the year ended

December 31, 2023, was $10.7 million, compared to $9.6 million

for the year ended December 31, 2022. The increase in G&A costs

was primarily a result of an increase in personnel costs partially

offset by a reduction in professional fees.

- Net Loss: The net

loss attributable to common stockholders for the year ended

December 31, 2023, was ($38.0) million, or $(3.11) per share,

compared to $(28.6) million, or ($4.05) per share in the year ended

December 31, 2022.

Conference call & Webcast DetailsCellectar

management will host a conference call for investors today, March

14, 2024, beginning at 8:30 am Eastern Time to discuss these

results and answer questions. Stockholders and other interested

parties may participate in the conference call by dialing

1-888-886-7786 (in the U.S.) or 1-416-764-8658 (outside the U.S.).

The call will be available via webcast by clicking HERE or on the

Events page of the company’s website.

About Cellectar Biosciences,

Inc.Cellectar Biosciences is a late-stage clinical

biopharmaceutical company focused on the discovery and development

of proprietary drugs for the treatment of cancer, independently and

through research and development collaborations. The company’s core

objective is to leverage its proprietary Phospholipid Drug

Conjugate™ (PDC) delivery platform to develop the next-generation

of cancer cell-targeting treatments, delivering improved efficacy

and better safety as a result of fewer off-target effects.

The company’s product pipeline includes lead

asset iopofosine I 131, a small-molecule PDC designed to provide

targeted delivery of iodine-131 (radioisotope), proprietary

preclinical PDC chemotherapeutic programs and multiple partnered

PDC assets.

For more information, please

visit www.cellectar.com and www.wmclinicaltrial.com or join

the conversation by liking and following us on the company’s social

media channels: Twitter, LinkedIn, and Facebook.

Forward-Looking Statement DisclaimerThis news

release contains forward-looking statements. You can identify these

statements by our use of words such as "may," "expect," "believe,"

"anticipate," "intend," "could," "estimate," "continue," "plans,"

or their negatives or cognates. These statements are only estimates

and predictions and are subject to known and unknown risks and

uncertainties that may cause actual future experience and results

to differ materially from the statements made. These statements are

based on our current beliefs and expectations as to such future

outcomes including our expectations regarding the CLOVER WaM

pivotal trial. Drug discovery and development involve a high degree

of risk. Factors that might cause such a material difference

include, among others, uncertainties related to the ability to

raise additional capital, uncertainties related to the disruptions

at our sole source supplier of iopofosine, the ability to attract

and retain partners for our technologies, the identification of

lead compounds, the successful preclinical development thereof,

patient enrollment and the completion of clinical studies, the FDA

review process and other government regulation, our ability to

maintain orphan drug designation in the United States for

iopofosine, the volatile market for priority review vouchers, our

pharmaceutical collaborators' ability to successfully develop and

commercialize drug candidates, competition from other

pharmaceutical companies, product pricing and third-party

reimbursement. A complete description of risks and uncertainties

related to our business is contained in our periodic reports filed

with the Securities and Exchange Commission including our Form 10-K

for the year ended December 31, 2023, and our Form 10-Q for the

quarter ended September 30, 2023. These forward-looking statements

are made only as of the date hereof, and we disclaim any obligation

to update any such forward-looking statements.

Contacts

MEDIA:Claire LaCagninaBliss Bio

Health315-765-1462clacagnina@blissbiohealth.com

INVESTORS:Chad KoleanChief Financial

Officerinvestors@cellectar.com

|

CELLECTAR BIOSCIENCES, INC.CONSOLIDATED

BALANCE SHEETS |

| |

|

|

|

|

|

| |

December 31, |

|

|

December 31, |

|

| |

2023 |

|

|

2022 |

|

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

9,564,988 |

|

|

$ |

19,866,358 |

|

|

Prepaid expenses and other current assets |

|

888,225 |

|

|

|

663,243 |

|

|

Total current assets |

|

10,453,213 |

|

|

|

20,529,601 |

|

|

Fixed assets, net |

|

1,090,304 |

|

|

|

418,641 |

|

|

Right-of-use asset, net |

|

502,283 |

|

|

|

560,334 |

|

|

Long-term assets |

|

23,566 |

|

|

|

75,000 |

|

|

Other assets |

|

6,214 |

|

|

|

6,214 |

|

|

TOTAL ASSETS |

$ |

12,075,580 |

|

|

$ |

21,589,790 |

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ (DEFICIT)

EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

9,178,645 |

|

|

$ |

5,478,443 |

|

|

Warrant liability |

|

3,700,000 |

|

|

|

— |

|

|

Lease liability |

|

58,979 |

|

|

|

50,847 |

|

|

Total current liabilities |

|

12,937,624 |

|

|

|

5,529,290 |

|

|

Lease liability, net of current portion |

|

494,003 |

|

|

|

552,981 |

|

|

TOTAL LIABILITIES |

|

13,431,627 |

|

|

|

6,082,271 |

|

|

COMMITMENTS AND CONTINGENCIES (Note 10) |

|

|

|

|

|

|

STOCKHOLDERS’ (DEFICIT) EQUITY: |

|

|

|

|

|

|

Series D preferred stock, 111.11 shares authorized; 111.11 shares

issued and outstanding as of December 31, 2023 and 2022 |

|

1,382,023 |

|

|

|

1,382,023 |

|

|

Series E-2 preferred stock, 1,225.00 shares authorized; 319.76 and

0.00 shares issued and outstanding as of December 31, 2023 and

2022, respectively |

|

4,677,632 |

|

|

|

— |

|

|

Common stock, $0.00001 par value; 170,000,000 shares authorized;

20,744,110 and 9,385,272 shares issued and outstanding as of

December 31, 2023 and 2022, respectively |

|

207 |

|

|

|

94 |

|

|

Additional paid-in capital |

|

210,066,630 |

|

|

|

193,624,445 |

|

|

Accumulated deficit |

|

(217,482,539 |

) |

|

|

(179,499,043 |

) |

|

Total stockholders’ (deficit) equity |

|

(1,356,047 |

) |

|

|

15,507,519 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY |

$ |

12,075,580 |

|

|

$ |

21,589,790 |

|

|

CELLECTAR

BIOSCIENCES, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS |

| |

|

|

|

|

|

| |

|

Year Ended December 31, |

| |

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

| COSTS AND EXPENSES: |

|

|

|

|

|

|

Research and development |

$ |

28,211,460 |

|

|

$ |

19,219,603 |

|

|

General and administrative |

|

10,749,183 |

|

|

|

9,594,170 |

|

|

Total costs and expenses |

|

38,960,643 |

|

|

|

28,813,773 |

|

| |

|

|

|

|

|

| LOSS FROM OPERATIONS |

|

(38,960,643 |

) |

|

|

(28,813,773 |

) |

| |

|

|

|

|

|

| OTHER INCOME (EXPENSE): |

|

|

|

|

|

| Warrant issuance expense |

|

(470,000 |

) |

|

|

— |

|

|

Gain on valuation of warrants |

|

1,000,000 |

|

|

|

— |

|

|

Interest income, net |

|

387,147 |

|

|

|

152,519 |

|

|

Total other income, net |

|

917,147 |

|

|

|

152,519 |

|

| LOSS BEFORE INCOME TAXES |

|

(38,043,496 |

) |

|

|

(28,661,254 |

) |

|

|

|

|

|

|

|

| INCOME TAX BENEFIT |

|

(60,000 |

) |

|

|

(60,000 |

) |

| |

|

|

|

|

|

| NET LOSS |

$ |

(37,983,496 |

) |

|

$ |

(28,601,254 |

) |

| BASIC AND DILUTED NET LOSS

ATTRIBUTABLE TO COMMON STOCKHOLDERS PER COMMON SHARE |

$ |

(3.11 |

) |

|

$ |

(4.05 |

) |

| SHARES USED IN COMPUTING BASIC

AND DILUTED NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS PER COMMON

SHARE |

|

12,221,571 |

|

|

|

7,055,665 |

|

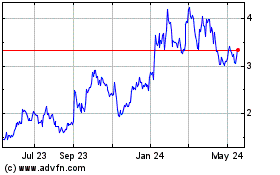

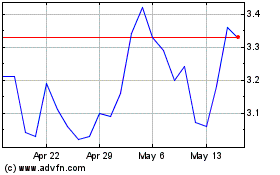

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Dec 2023 to Dec 2024