Comera Life Sciences Holdings, Inc. (Nasdaq: CMRA), a life sciences

company developing a new generation of biologic medicines to

improve patient access, safety, and convenience, today reported

financial results for the third quarter ended September 30, 2023,

and provided a business update.

“Comera continues to generate significant

momentum, by expanding our patent portfolio, strengthening our cash

position and advancing key partnerships. These accomplishments

allow us to continue executing on our core value drivers, and

increase value for our shareholders and partners,” said Jeffrey

Hackman, Chairman and Chief Executive Officer of Comera. “As our

business advances and we execute our goals and drive our value

proposition, we remain focused on our mission to improve patient

quality of life and reduce healthcare costs by leveraging our

SQore™ platform to transform the delivery of biologics from

intravenous to self-administered subcutaneous forms.”

Recent Business Highlights

- Final stage of

technical evaluation is near completion as part of an ongoing

research collaboration with Regeneron, a leading U.S. biotechnology

company. The partnership includes a right to negotiate a license

after the technical evaluation is complete. Technical evaluation is

expected to be completed in Q4 2023.

- Presented

research demonstrating SQore platform’s capabilities in the

development of subcutaneous monoclonal antibody formulations at the

PODD: Partnerships in Drug Delivery conference in Boston, Mass. The

data presented highlighted that the SQore platform has successfully

reduced the viscosity of a diverse range of monoclonal antibodies,

demonstrating the platform’s versatility and remarkable

capabilities.

- Completed

previously announced $4.1 million private placement of shares of

its common stock, and accompanying warrants to purchase shares of

its common stock, to existing stockholders at a purchase price of

$0.51125 per share.

- Published data

in the Journal of Pharmaceutical Sciences that supports further

development of caffeine as a viscosity reducing agent for

subcutaneous formulations of monoclonal antibodies. The results

show the rapid dissociation of caffeine upon subcutaneous injection

and that caffeine does not affect pharmacokinetic profiles of the

model monoclonal antibody, both of which are critical features of a

successful subcutaneous formulation.

- Received a

Notice of Intention to Grant a European patent by the European

Patent Office, which would represent the first granted patent in

Europe for Comera’s SQore platform technology.

- Expanded SQore

platform patent portfolio with the issuance of four new patents and

two new notices of allowance. The six new patents, three issued in

the United States and three covering Canada, Korea and India,

expand the number of proprietary viscosity reducing excipients in

Comera’s SQore platform and significantly broaden claims covered by

previously issued patents.

- Entered into a

partnership with Quality Chemical Laboratories, Inc. to manufacture

one of Comera’s lead SQore excipients, as part of a broader

strategy to secure the GMP manufacturing and supply chain of key

proprietary technology owned by the Company. The collaboration

gives Comera full control over supply chain and greater flexibility

to support product development needs.

Third Quarter 2023 Financial Results

Comera reported revenues of $136 thousand for

the three months ended September 30, 2023, compared to $235

thousand for the same period in 2022, with the decrease primarily

related to a reduction in hours incurred on the ongoing research

collaboration with Regeneron, which is now in its final stages.

Cost of revenue totaled $42 thousand for the

three months ended September 30, 2023, compared to $61 thousand for

the same period in 2022, with the decrease primarily related to the

hours incurred on the Regeneron project during the three months

ending September 30, 2023.

R&D expenses totaled $366 thousand for the three months

ended September 30, 2023, compared to $395 thousand for the same

period in 2022. The overall decrease of approximately $29 thousand

is primarily related to a reduction in employee compensation

expense in the three months ended September 30, 2023.

General and administrative expenses totaled $1.9

million, inclusive of $260 thousand of non-cash stock compensation

expense, for the three months ended September 30, 2023, compared to

$2.3 million for the same period in 2022. The overall decrease of

approximately $429 thousand is primarily related to expenses in

connection with the Company’s transition to operating a public

company in the three months ended September 30, 2022, and an

overall reduction in general and administrative spending.

Comera reported a net loss of $2.2 million, or

$0.10 loss per share for the three months ended September 30, 2023,

compared to a net loss of $3.2 million, or $0.20 loss per share,

for the same period in 2022. The decrease was primarily due to an

overall reduction in spending in the current year and higher

non-operating expense in the prior year.

Comera had approximately $1.8 million in cash at

September 30, 2023.

About Comera Life Sciences

Leading a compassionate new era in medicine,

Comera Life Sciences is applying a deep knowledge of formulation

science and technology to transform essential biologic medicines

from intravenous (IV) to subcutaneous (SQ) forms. The goal of this

approach is to provide patients with the freedom of self-injectable

care, reduce institutional dependency and to put patients at the

center of their treatment regimen.

To learn more about the Comera Life Sciences

mission, as well as the proprietary SQore™ platform, visit

https://comeralifesciences.com/.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the federal securities laws.

These forward-looking statements generally are identified by the

words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “future,” “opportunity,” “plan,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

(including, for example, statements related to the Company’s

expectation that the technical evaluation as part of the research

collaboration with Regeneron will be completed, the Company’s

expectation that it will enter into negotiations with Regeneron for

a licensing arrangement and the extent to which that licensing

arrangement may be profitable, and dealings with the Company’s

SQore™ platform) that are based on current expectations and

assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

document, including, but not limited to: the Company’s ability to

maintain the listing of its securities on the Nasdaq Capital

Market; the price of the Company’s securities may be volatile due

to a variety of factors, including changes in the competitive and

highly regulated industries in which the Company plans to operate,

variations in performance across competitors, changes in laws and

regulations affecting the Company’s business and changes in the

capital structure; the Company’s ability to execute on its business

plans, forecasts, and other expectations and identify and realize

additional opportunities; the risk of economic downturns and the

possibility of rapid change in the highly competitive industry in

which the Company operates; the risk that the Company and its

current and future collaborators are unable to successfully develop

and commercialize the Company’s products or services, or experience

significant delays in doing so; the risk that we will be unable to

continue to attract and retain third-party collaborators, including

collaboration partners and licensors; the risk that the Company may

never achieve or sustain profitability; the risk that the Company

will need to raise additional capital to execute its business plan,

which may not be available on acceptable terms or at all; the risk

that the Company experiences difficulties in managing its growth

and expanding operations; the risk that third-party suppliers and

manufacturers are not able to fully and timely meet their

obligations; the risk that the Company is unable to secure or

protect its intellectual property; the risk that the Company is

unable to secure regulatory approval for its product candidates;

the effect of any resurgence of the COVID-19 pandemic or other

public health emergencies on the Company’s business; general

economic conditions; and other risks and uncertainties described in

Item 1A of Part I of the Company’s Annual Report on Form 10-K filed

with the SEC on March 17, 2023 under “Risk Factors” and in other

filings that have been made or will be made with the SEC. The

foregoing list of factors is not exhaustive. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and Comera assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise. Comera can give no

assurance that it will achieve its expectations.

Contacts

Comera Investor

John Woolford ICR Westwicke John.Woolford@westwicke.com

Comera Press

Jon Yu ICR WestwickeComeraPR@westwicke.com

COMERA LIFE SCIENCES HOLDINGS,

INC.CONSOLIDATED BALANCE SHEETS

(unaudited)

| |

|

|

|

|

|

|

|

September 30, |

|

December

31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,767,870 |

|

|

$ |

446,607 |

|

|

Restricted cash - current |

|

|

— |

|

|

|

1,505,625 |

|

|

Accounts receivable |

|

|

— |

|

|

|

34,320 |

|

|

Deferred issuance costs |

|

|

— |

|

|

|

90,047 |

|

|

Prepaid expenses and other current assets |

|

|

862,626 |

|

|

|

986,499 |

|

|

Total current assets |

|

|

2,630,496 |

|

|

|

3,063,098 |

|

| Restricted

cash - non-current |

|

|

50,000 |

|

|

|

50,000 |

|

| Property and

equipment, net |

|

|

186,738 |

|

|

|

257,186 |

|

| Right-of-use

asset |

|

|

161,515 |

|

|

|

313,629 |

|

| Security

deposit |

|

|

43,200 |

|

|

|

43,200 |

|

|

Total assets |

|

$ |

3,071,949 |

|

|

$ |

3,727,113 |

|

|

Liabilities, Convertible Preferred Stock and Stockholders’

Deficit |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

1,144,822 |

|

|

$ |

1,458,267 |

|

|

Accrued expenses and other current liabilities |

|

|

1,226,129 |

|

|

|

1,295,764 |

|

|

Insurance premium financing |

|

|

389,872 |

|

|

|

455,562 |

|

|

Deposit liability |

|

|

— |

|

|

|

1,505,625 |

|

|

Deferred revenue |

|

|

— |

|

|

|

144,280 |

|

|

Lease liability - current |

|

|

171,596 |

|

|

|

199,184 |

|

|

Total current liabilities |

|

|

2,932,419 |

|

|

|

5,058,682 |

|

| Derivative

warrant liabilities |

|

|

37,266 |

|

|

|

277,507 |

|

| Lease

liability - noncurrent |

|

|

— |

|

|

|

120,302 |

|

|

Total liabilities |

|

|

2,969,685 |

|

|

|

5,456,491 |

|

| Commitments

and contingencies |

|

|

|

|

| Preferred

stock, $0.0001 par value; 1,000,000 shares authorized; 3,895.53 and

4,305 shares designated Series A convertible preferred stock at

September 30, 2023 and December 31, 2022; 3,895.53 and 4,305 shares

issued and outstanding at September 30, 2023 and December 31, 2022,

respectively |

|

|

4,322,866 |

|

|

|

4,517,710 |

|

|

Stockholders’ deficit: |

|

|

|

|

|

Common stock, $0.0001 par value; 150,000,000 shares authorized;

30,737,796 and 16,709,221 shares issued and outstanding at

September 30, 2023 and December 31, 2022, respectively |

|

|

2,759 |

|

|

|

1,671 |

|

|

Additional paid-in capital |

|

|

36,727,205 |

|

|

|

28,655,164 |

|

|

Accumulated deficit |

|

|

(40,950,566 |

) |

|

|

(34,903,923 |

) |

|

Total stockholders’ deficit |

|

|

(4,220,602 |

) |

|

|

(6,247,088 |

) |

|

Total liabilities, convertible preferred stock and stockholders’

deficit |

|

$ |

3,071,949 |

|

|

$ |

3,727,113 |

|

| |

|

|

|

|

COMERA LIFE SCIENCES HOLDINGS,

INC.CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine months ended September 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

|

$ |

136,310 |

|

|

$ |

234,922 |

|

|

$ |

844,280 |

|

|

$ |

476,982 |

|

|

Cost of revenue |

|

|

41,961 |

|

|

|

60,963 |

|

|

|

214,520 |

|

|

|

160,030 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

366,015 |

|

|

|

394,800 |

|

|

|

945,415 |

|

|

|

1,250,570 |

|

|

General and administrative |

|

|

1,885,405 |

|

|

|

2,314,554 |

|

|

|

5,822,107 |

|

|

|

8,027,316 |

|

|

Total operating expenses |

|

|

2,251,420 |

|

|

|

2,709,354 |

|

|

|

6,767,522 |

|

|

|

9,277,886 |

|

|

Loss from operations |

|

|

(2,157,071 |

) |

|

|

(2,535,395 |

) |

|

|

(6,137,762 |

) |

|

|

(8,960,934 |

) |

|

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

Change in fair value of derivative warrant liabilities |

|

|

9,325 |

|

|

|

500,327 |

|

|

|

108,678 |

|

|

|

1,954,767 |

|

|

Reverse recapitalization issuance costs in excess of gross

proceeds |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,566,821 |

) |

|

Common stock purchase agreement issuance costs |

|

|

— |

|

|

|

(1,029,077 |

) |

|

|

— |

|

|

|

(1,029,077 |

) |

|

Interest expense |

|

|

(5,965 |

) |

|

|

(12,696 |

) |

|

|

(17,559 |

) |

|

|

(12,773 |

) |

|

Other expense, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(426,666 |

) |

|

Total other income (expense), net |

|

|

3,360 |

|

|

|

(541,446 |

) |

|

|

91,119 |

|

|

|

(6,080,570 |

) |

|

Net loss and comprehensive loss |

|

|

(2,153,711 |

) |

|

|

(3,076,841 |

) |

|

|

(6,046,643 |

) |

|

|

(15,041,504 |

) |

|

Less: accretion of convertible preferred stock to redemption

value |

|

|

(85,468 |

) |

|

|

(86,816 |

) |

|

|

(258,156 |

) |

|

|

(287,984 |

) |

|

Net loss attributable to common stockholders |

|

$ |

(2,239,179 |

) |

|

$ |

(3,163,657 |

) |

|

$ |

(6,304,799 |

) |

|

$ |

(15,329,488 |

) |

|

Net loss per share attributable to common stockholders — basic and

diluted |

|

$ |

(0.10 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.31 |

) |

|

$ |

(1.85 |

) |

|

Weighted-average number of common shares used in computing net loss

per share attributable to common stockholders — basic and

diluted |

|

|

23,113,051 |

|

|

|

16,024,011 |

|

|

|

20,448,666 |

|

|

|

8,294,938 |

|

|

|

|

|

|

|

|

|

|

|

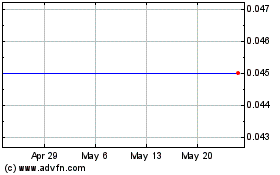

Comera Life Sciences (NASDAQ:CMRA)

Historical Stock Chart

From Apr 2024 to May 2024

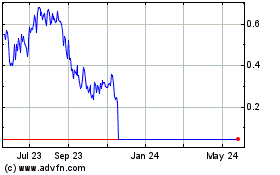

Comera Life Sciences (NASDAQ:CMRA)

Historical Stock Chart

From May 2023 to May 2024