Fourth Quarter Highlights

- Net sales of $1.17 billion

- GAAP loss from continuing operations of $65.2 million

- Non-GAAP adjusted EBITDA of $223.1 million (1)

- Core non-GAAP adjusted EBITDA of $240.4 million* (1)

- Cash flow generated by operations of $277.8 million and free

cash flow of $270.5 million (1) (2)

Full Year Highlights

- Net sales of $4.21 billion

- GAAP loss from continuing operations of $461.0 million

- Non-GAAP adjusted EBITDA of $700.2 million (1)

- Core non-GAAP adjusted EBITDA of $756.4 million* (1)

- Cash flow generated by operations of $273.1 million and free

cash flow of $247.8 million (1) (2)

* Core financial measures reflect the results of the

Connectivity and Cable Solutions (CCS), Networking, Intelligent

Cellular and Security Solutions (NICS), and Access Network

Solutions (ANS) segments, in the aggregate, and exclude general

corporate costs that were previously allocated to the Outdoor

Wireless Networks (OWN) segment, Distributed Antenna Systems (DAS)

business unit and Home Networks (Home) segment. These indirect

costs are classified as continuing operations, since they were not

directly attributable to these discontinued operations. See the

segment comparison tables below showing the aggregation of the Core

financial measures.

(1) See “Non-GAAP Financial Measures” and “Reconciliation of

GAAP Measures to Non-GAAP Adjusted Measures” below. (2) The cash

flows related to discontinued operations have not been segregated.

Accordingly, this cash flow information includes the results of

continuing and discontinued operations.

CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader

in network connectivity solutions, today reported results for the

quarter and year ended December 31, 2024.

Summary of Consolidated

Results

Q4

Q4

% Change

2024

2023 (1)

YOY

(in millions, except per share

amounts)

Net sales

$

1,169.1

$

923.1

26.6

%

GAAP loss from continuing operations

(65.2

)

(414.0

)

(84.2

)

GAAP loss from continuing operations per

share

(0.38

)

(2.02

)

(81.2

)

Non-GAAP adjusted EBITDA (2)

223.1

119.4

86.9

Core non-GAAP adjusted EBITDA (2) (3)

240.4

142.5

68.7

Non-GAAP adjusted net income (loss) per

diluted share (2)

0.18

(0.34

)

NM

Full Year

Full Year

% Change

2024

2023 (1)

YOY

(in millions, except per share

amounts)

Net sales

$

4,205.8

$

4,565.2

(7.9

)%

GAAP loss from continuing operations

(461.0

)

(1,095.8

)

(57.9

)

GAAP loss from continuing operations per

share

(2.46

)

(5.49

)

(55.2

)

Non-GAAP adjusted EBITDA (2)

700.2

664.3

5.4

Core non-GAAP adjusted EBITDA (2) (3)

756.4

756.4

—

Non-GAAP adjusted net loss per diluted

share (2)

(0.03

)

(0.37

)

(91.9

)

NM – Not meaningful

(1) Certain amounts have been adjusted to

reflect the correction of immaterial errors as described in the

Annual Report on Form 10-K.

(2) See “Non-GAAP Financial Measures”

below.

(3) Core financial measures reflect the

results of the CCS, NICS (excluding DAS) and ANS segments, in the

aggregate, and exclude general corporate costs that were previously

allocated to the OWN segment, DAS business unit and Home segment,

since these costs were not directly attributable to these

discontinued operations. Beginning in the first quarter of 2024,

these costs related to the Home segment have been reallocated to

the remaining segments. These costs related to the OWN segment and

DAS business unit will be reallocated to the remaining segments

beginning in the first quarter of 2025.

“2024 marked a transitional year for CommScope. Despite a

challenging start, and volatile market conditions, we stayed

committed to what we could control to improve company performance

and profitability with sequential Core quarterly adjusted EBITDA

improvement throughout the year. For the fourth quarter, Core

CommScope reported net sales of $1.17 billion, an increase of 27%

from the prior year and delivered adjusted EBITDA of $240 million,

an improvement of 69% year-over-year. Fourth quarter adjusted

EBITDA as a percentage of revenues was 20.6%, a year-over-year

improvement of 510 basis points. Supported by our investments in

production capacity, the CCS segment led the way with growth in all

businesses, with the strongest growth in hyperscale and cloud data

centers to support GenAI datacenter builds across the world,” said

Chuck Treadway, President and Chief Executive Officer.

“For the full year 2024, Core CommScope reported net sales of

$4.21 billion declining 8% from the prior year but delivered

adjusted EBITDA of $756 million which remained flat year over year.

With improvement throughout the year, we are well positioned as we

move into 2025. Our 2025 annual guideposts of Core adjusted EBITDA

are in the range of $1.00 to $1.05 billion,” said Kyle Lorentzen,

Chief Financial Officer.

Free cash flow for the fourth quarter was $271 million driven by

stronger EBITDA. For the full year 2024, free cash flow was $248

million. We ended the year with a strong liquidity position of $1.1

billion including $663 million of Cash and approximately $449

million of ABL availability.

As previously announced, in the fourth quarter of 2024,

CommScope made significant progress on our debt position by

refinancing a portion of our debt resulting in pushing out our 2025

and a portion of the 2026 debt maturities to 2029 and 2031. The

debt refinancing, coupled with the sale of our OWN and DAS

businesses that closed on January 31, 2025 and subsequent repayment

of approximately $2 billion of debt with the proceeds, clearly puts

us in a stronger position to focus on business growth, free cash

flow generation and deleveraging.

On January 31, 2025, the Company completed the previously

announced sale of the OWN segment and the DAS business unit of the

NICS segment to Amphenol Corporation. As a result of the

transaction, unless otherwise noted, these financial results relate

to CommScope’s continuing operations based on the following

remaining three operating segments: CCS, NICS and ANS. For all

periods presented, amounts have been recast to reflect these

changes.

Certain amounts have been adjusted to reflect the correction of

immaterial errors as described in the Annual Report on Form 10-K

and are labeled “As Adjusted” within the tables below.

Fourth Quarter Results and Comparisons

Net sales in the fourth quarter of 2024 increased 26.6%

year-over-year to $1.17 billion due to higher net sales in all

segments. Net sales increased across all regions, except the

Caribbean and Latin America (CALA) region, in the fourth quarter of

2024.

Loss from continuing operations of $65.2 million, or $(0.38) per

share, in the fourth quarter of 2024, was less of a loss compared

to the prior year period's loss from continuing operations of

$414.0 million, or $(2.02) per share. In the fourth quarter of

2023, the Company recorded goodwill impairment charges in the ANS

and CCS segments of $46.3 million and $99.1 million, respectively,

related to the ANS and BDCC reporting units, respectively. Asset

impairment charges are not reflected in non-GAAP adjusted results.

Non-GAAP adjusted net income (loss) for the fourth quarter of 2024

was $48.3 million, or $0.18 per share, versus $(73.1) million, or

$(0.34) per share, in the fourth quarter of 2023.

Core non-GAAP adjusted EBITDA increased 68.7% to $240.4 million

in the fourth quarter of 2024 compared to the same prior year

period. Core non-GAAP adjusted EBITDA as a percentage of net sales

increased to 20.6% in the fourth quarter of 2024 compared to 15.4%

in the same prior year period. Non-GAAP adjusted EBITDA increased

86.9% to $223.1 million in the fourth quarter of 2024 compared to

the same period last year. Non-GAAP adjusted EBITDA as a percentage

of net sales increased to 19.1% in the fourth quarter of 2024

compared to 12.9% in the same prior year period.

Reconciliations of the reported GAAP results to non-GAAP

adjusted results are included below.

Fourth Quarter Comparisons

Sales by

Region

% Change

Q4 2024

Q4 2023

YOY

United States

$

776.0

$

595.6

30.3

%

Europe, Middle East and Africa

167.2

117.3

42.5

Asia Pacific

139.8

122.5

14.1

Caribbean and Latin America

50.2

61.3

(18.1

)

Canada

35.9

26.4

36.0

Total net sales

$

1,169.1

$

923.1

26.6

%

Segment Net

Sales

% Change

Q4 2024

Q4 2023

YOY

CCS

$

754.0

$

553.3

36.3

%

NICS

154.2

136.4

13.0

ANS

260.9

233.4

11.8

Total net sales

$

1,169.1

$

923.1

26.6

%

Segment Operating

Income (Loss)

% Change

Q4 2024

Q4 2023 (1)

YOY

CCS

$

138.4

$

(53.9

)

NM

NICS

8.0

(15.7

)

NM

ANS

0.7

(25.8

)

NM

Core operating income (2)

147.1

(95.4

)

NM

Corporate and other (3)

(29.6

)

(25.3

)

17.2

Total operating income (loss)

$

117.5

$

(120.7

)

NM

Segment Adjusted

EBITDA (See “Non-GAAP Financial Measures,” below)

% Change

Q4 2024

Q4 2023 (1)

YOY

CCS

$

176.4

$

84.0

110.0

%

NICS

26.1

6.8

283.8

ANS

37.9

51.7

(26.7

)

Core adjusted EBITDA (2)

240.4

142.5

68.7

Corporate and other (3)

(17.3

)

(23.1

)

(25.1

)

Total segment adjusted EBITDA

$

223.1

$

119.4

86.9

%

NM – Not meaningful

(1) Certain amounts have been adjusted to

reflect the correction of immaterial errors as described in the

Annual Report on Form 10-K.

(2) Core financial measures reflect the

results of the CCS, NICS and ANS segments, in the aggregate, and

exclude general corporate costs that were previously allocated to

the OWN segment, DAS business unit and Home segment, since these

costs were not directly attributable to these discontinued

operations.

(3) The corporate and other line item

above reflects general corporate costs that were previously

allocated to the OWN segment, DAS business unit and Home segment.

These indirect expenses have been classified as continuing

operations, since the costs were not directly attributable to these

discontinued operations. Beginning in the first quarter of 2024,

the corporate and other costs related to the Home segment have been

reallocated to the remaining segments and partially offset by

income from the Vantiva TSA. The corporate and other costs related

to the OWN segment and DAS business unit will be reallocated to the

remaining segments beginning in the first quarter of 2025.

- CCS - Net sales of $754.0 million increased 36.3% from

the prior year period primarily driven by increases in the

Enterprise business.

- NICS - Net sales of $154.2 million increased 13.0% from

the prior year period primarily driven by increases in Ruckus.

- ANS - Net sales of $260.9 million increased 11.8% from

the prior year period driven by increases in Access

Technologies.

Full Year Results and Comparison

Net sales in 2024 decreased 7.9% year-over-year to $4.21 billion

primarily due to lower net sales in the NICS and ANS segments,

partially offset by stronger net sales in the CCS segment. Net

sales decreased across all regions, except Canada and the Asia

Pacific region, in 2024.

In 2024, loss from continuing operations of $461.0 million, or

$(2.46) per share, compares to the prior year loss from continuing

operations of $1.10 billion, or $(5.49) per share, excluding the

prior year impact from goodwill impairment charges. In 2023, the

Company recorded goodwill impairment charges in the ANS and CCS

segments of $472.3 million and $99.1 million, respectively, related

to the ANS and BDCC reporting units, respectively. Asset impairment

charges are not reflected in non-GAAP adjusted results. Non-GAAP

adjusted net loss for 2024 decreased to $(7.2) million, or $(0.03)

per share, compared to $(78.3) million, or $(0.37) per share, in

2023.

Non-GAAP adjusted EBITDA increased 5.4% to $700.2 million in

2024 compared to the prior year. Non-GAAP adjusted EBITDA as a

percentage of net sales increased to 16.6% in 2024 compared to

14.6% in 2023. Core non-GAAP adjusted EBITDA remained flat at

$756.4 million in 2024 compared to the prior year. Core non-GAAP

adjusted EBITDA as a percentage of net sales increased to 18.0% in

2024 compared to 16.6% in the prior year.

Reconciliations of the reported GAAP results to non-GAAP

adjusted results are included below.

Cash Flow and Balance Sheet

- GAAP cash flow generated by operations in 2024 was $273.1

million.

- Free cash flow in 2024 was $247.8 million after adjusting

operating cash flow for $25.3 million of additions to property,

plant and equipment. The cash flows related to discontinued

operations have not been segregated. Accordingly, this cash flow

information includes the results of continuing and discontinued

operations.

- The Company ended the year with $663.3 million in cash and cash

equivalents which include $98.4 million in cash and cash

equivalents in assets held for sale.

- As of December 31, 2024, the Company had $200.0 million of

outstanding borrowings under its asset-based revolving credit

facility and had availability of $449.3 million, after giving

effect to borrowing base limitations and outstanding letters of

credit. The Company ended the quarter with total liquidity of

approximately $1,112.6 million.

Conference Call, Webcast and Investor Presentation

As previously announced, CommScope will host a conference call

today at 8:30 a.m. ET in which management will discuss fourth

quarter and full year 2024 results. The conference call will also

be webcast.

The live, listen-only audio of the call will be available

through a link on the Events and Presentations page of CommScope’s

Investor Relations website.

A webcast replay will be archived on CommScope’s website for a

limited period of time following the conference call.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end, including questions relating

to the sale of its OWN segment and DAS business unit. The Company’s

responses to questions, as well as other matters discussed during

the conference call, may contain or constitute information that has

not been disclosed previously.

About CommScope:

CommScope (NASDAQ: COMM) is pushing the boundaries of technology

to create the world’s most advanced wired and wireless networks.

Our global team of employees, innovators and technologists empower

customers to anticipate what’s next and invent what’s possible.

Discover more at www.commscope.com.

Follow us on X and LinkedIn. Sign up for our press releases and

blog posts.

Non-GAAP Financial Measures

CommScope management believes that presenting certain non-GAAP

financial measures enhances an investor’s understanding of our

financial performance. CommScope management further believes that

these financial measures are useful in assessing CommScope’s

operating performance from period to period by excluding certain

items that we believe are not representative of our core business.

CommScope management also uses certain of these financial measures

for business planning purposes and in measuring CommScope’s

performance relative to that of its competitors. CommScope

management believes these financial measures are commonly used by

investors to evaluate CommScope’s performance and that of its

competitors. However, CommScope’s use of certain non-GAAP terms may

vary from that of others in its industry. Non-GAAP financial

measures should not be considered as alternatives to operating

income (loss), net income (loss), cash flow from operations or any

other performance measures derived in accordance with U.S. GAAP as

measures of operating performance, operating cash flows or

liquidity. A reconciliation of each of the non-GAAP measures

discussed herein to their most comparable GAAP measures is

below.

Core Measures

CommScope believes that presenting Core financial measures

enhances the investor’s understanding of the financial performance

of the Company’s core businesses. Core financial measures are the

aggregate of the CCS, NICS, and ANS segments, and exclude general

corporate costs that were previously allocated to the OWN segment,

DAS business unit and Home segment, since these costs were not

directly attributable to the discontinued operations. The Core

results represent the business results as currently managed and

reported by CommScope. Future results and the composition of any

business divested in the future may vary and differ materially from

the presentation of the Core financial measures.

Forward Looking Statements

This press release includes certain statements that constitute

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which reflect our

current views with respect to future events and financial

performance. These forward-looking statements are generally

identified by their use of such terms and phrases as “intend,”

“goal,” “estimate,” “expect,” “project,” “projections,” “plans,”

“potential,” “anticipate,” “should,” “could,” “designed to,”

“foreseeable future,” “believe,” “think,” “scheduled,” “outlook,”

“target,” “guidance” and similar expressions, although not all

forward-looking statements contain such terms. This list of

indicative terms and phrases is not intended to be

all-inclusive.

These forward-looking statements are subject to various risks

and uncertainties, many of which are outside our control,

including, without limitation, our dependence on customers’ capital

spending on data, communication and entertainment equipment, which

could be negatively impacted by a regional or global economic

downturn, among other factors; the potential impact of higher than

normal inflation; concentration of sales among a limited number of

customers and channel partners; risks associated with our sales

through channel partners; changes to the regulatory environment in

which we and our customers operate; changes in technology; industry

competition and the ability to retain customers through product

innovation, introduction, and marketing; changes in cost and

availability of key raw materials, components and commodities and

the potential effect on customer pricing and timing of delivery of

products to customers; risks related to our ability to implement

price increases on our products and services; risks associated with

our dependence on a limited number of key suppliers for certain raw

materials and components; risks related to the successful execution

of CommScope NEXT and other cost saving initiatives; potential

difficulties in realigning global manufacturing capacity and

capabilities among our global manufacturing facilities or those of

our contract manufacturers that may affect our ability to meet

customer demands for products; possible future restructuring

actions; the risk that our manufacturing operations, including our

contract manufacturers on which we rely, encounter capacity,

production, quality, financial or other difficulties causing

difficulty in meeting customer demands; our substantial

indebtedness, including our upcoming maturities and evaluation of

capital structure alternatives and restrictive debt covenants; our

ability to refinance existing indebtedness prior to its maturity or

incur additional indebtedness at acceptable interest rates or at

all; our ability to generate cash to service our indebtedness; the

divestiture of the Home segment and its effect on our remaining

businesses; the expected timing of the closing of the sale of the

OWN and DAS businesses (the Transaction); the expected benefits of

the Transaction, including the expected financial performance of

CommScope following the Transaction; the ability of the parties to

obtain any required regulatory approvals in connection with the

Transaction and to complete the Transaction considering the various

closing conditions; expenses related to the Transaction and any

potential future costs; the occurrence of any event, change or

other circumstance that could give rise to the termination of the

definitive agreement governing the Transaction, or an inability to

consummate the Transaction on the terms described or at all; the

effect of the announcement of the Transaction on the ability of

CommScope to retain and hire key personnel and maintain

relationships with its key business partners and customers, and

others with whom it does business, or on its operating results and

businesses generally; the response of CommScope’s competitors,

creditors and other stakeholders to the Transaction; risks

associated with the disruption of management’s attention from

ongoing business operations due to the Transaction; the ability to

meet expectations regarding the timing and completion of the

Transaction; potential litigation relating to the Transaction;

restrictions during the pendency of the Transaction that may impact

the ability to pursue certain business opportunities, including

uncertainty regarding the timing of the separation, achievement of

the expected benefits and the potential disruption to the business;

our ability to integrate and fully realize anticipated benefits

from prior or future divestitures, acquisitions or equity

investments; possible future additional impairment charges for

fixed or intangible assets, including goodwill; our ability to

attract and retain qualified key employees; labor unrest; product

quality or performance issues, including those associated with our

suppliers or contract manufacturers, and associated warranty

claims; our ability to maintain effective management information

technology systems and to successfully implement major systems

initiatives; cyber-security incidents, including data security

breaches, ransomware or computer viruses; the use of open

standards; the long-term impact of climate change; significant

international operations exposing us to economic risks like

variability in foreign exchange rates and inflation, as well as

political and other risks, including the impact of wars, regional

conflicts and terrorism; our ability to comply with governmental

anti-corruption laws and regulations worldwide; the impact of

export and import controls and sanctions worldwide on our supply

chain and ability to compete in international markets; changes in

the laws and policies in the United States affecting trade,

including the risk and uncertainty related to tariffs or potential

trade wars and potential changes to laws and policies, that may

impact our products; the costs of protecting or defending

intellectual property; costs and challenges of compliance with

domestic and foreign social and environmental laws; the impact of

litigation and similar regulatory proceedings in which we are

involved or may become involved, including the costs of such

litigation; the scope, duration and impact of disease outbreaks and

pandemics, such as COVID-19, on our business, including employees,

sites, operations, customers, supply chain logistics and the global

economy; our stock price volatility; income tax rate variability

and ability to recover amounts recorded as deferred tax assets; and

other factors beyond our control. These and other factors are

discussed in greater detail in our 2023 Annual Report on Form 10-K

and may be updated from time to time in our annual reports,

quarterly reports, current reports and other filings we make with

the Securities and Exchange Commission. Although the information

contained in this press release represents our best judgment as of

the date of this release based on information currently available

and reasonable assumptions, we can give no assurance that the

expectations will be attained or that any deviation will not be

material. Given these uncertainties, we caution you not to place

undue reliance on these forward-looking statements, which speak

only as of the date made. We are not undertaking any duty or

obligation to update this information to reflect developments or

information obtained after the date of this press release, except

to the extent required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226430568/en/

Investor Contact: Massimo Disabato, CommScope

Massimo.Disabato@commscope.com

News Media Contact: publicrelations@commscope.com

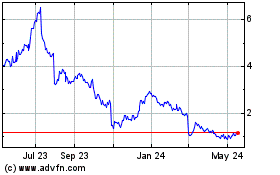

CommScope (NASDAQ:COMM)

Historical Stock Chart

From Feb 2025 to Mar 2025

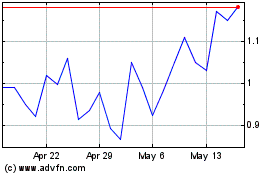

CommScope (NASDAQ:COMM)

Historical Stock Chart

From Mar 2024 to Mar 2025