27% Revenue Growth for the Year on

Automotive and Consumables Growth

Data I/O Corporation (NASDAQ: DAIO), the leading global provider

of advanced security and data deployment solutions for

microcontrollers, security ICs and memory devices, today announced

financial results for the fourth quarter ended December 31,

2021.

Fourth Quarter 2021 Highlights

- Net sales of $6.4 million, up 29% from the prior year; bookings

of $6.2 million

- Quarter-end backlog of $2.9 million

- Gross margin as a percentage of sales of 54.4%

- Net loss of ($205,000) or ($0.02) per share

- Adjusted EBITDA* of $117,000

- Cash & Equivalents of $14.2 million; no debt

- Received 2021 GLOBAL Technology Award for SentriX Product

Creator™ tool suite

Full Year 2021 Highlights

- Net sales of $25.8 million, up 27% from the prior year;

bookings of $25.5 million

- Gross margin as a percentage of sales of 57.0%

- Net loss of ($555,000) or ($0.06) per share

- Adjusted EBITDA of $1.5 million

- Automotive Electronics represented 58% of bookings for

2021

- Increased SentriX® bookings and revenue over 100%

- Deployment of over 390 PSV systems worldwide

*Adjusted EBITDA is a non-GAAP financial measure. A

reconciliation is provided in the tables of this press release.

Management Comments

Commenting on the fiscal year ended December 31, 2021, Anthony

Ambrose, President and CEO of Data I/O Corporation, said, “2021 was

a bounce back year from the depths of the COVID-19 induced

automotive recession. We reported strong annual revenue growth of

27% and a doubling of sales for our new SentriX® security

provisioning platform in 2021. Our performance in the fourth

quarter and full year was driven by the continuing recovery in the

automotive electronics market, solid delivery performance of our

factories in challenging conditions, and strength in sales of

adapters.

“A critical component of our plan are increases in recurring

revenues associated with sales of consumable adapters, software and

services. Our increasing installed base of PSV machines provides

recurring and consumable revenues which supplement our capital

equipment sales. At the end of 2021, our PSV installed base

increased to over 390 systems, up from approximately 330 at the end

of the prior year. For the first time, we sold a SentriX system to

an OEM. This sale included a recurring software license. We also

announced the first upgrade of an installed PSV machine to add

secure provisioning. We have proven in 2021 that we can monetize

our software and equipment to serve the needs of our clients while

bolstering our financial position. Total consumable revenue grew

for the fourth consecutive year on the strength of adapter

sales.

“The resiliency of our supply chain has been a strong mitigating

factor that led to our improved performance, which included gross

margins increasing to 57% and our return to adjusted EBITDA

profitability in 2021. We delivered consistently despite

semiconductor shortages, supply disruptions and shipping

challenges. Inflation has picked up in 2021 and we have responded

accordingly with a December price increase across the product

lines.

“Bookings of $25.5 million in 2021 increased 23% over the prior

year and reached the highest level since 2018. The recovery in

automotive has been metered somewhat due to inadequate silicon

supply that has hampered automobile builds. As silicon shortages

ease, we see a short-term demand driver and a long term 10-15%

compounded annual growth rate for the next decade for semiconductor

content in automotive electronics. Contributing to this demand

profile is the accelerating adoption of electric vehicles (EV)

which consume an estimated three times as much semiconductor

content per vehicle as compared to an internal combustion engine

automobile. In addition to key customer wins in 2021, we have been

working very closely with EV-related technology companies and

continue to invest in our platforms to support this high growth

segment of the market.

“As we look forward to 2022, celebrating our 50th year in

business, we are confident that our industry leading secure

programming technology platform, automotive momentum, resilient

supply chain and strong balance sheet position us to capitalize on

demand supported by exciting high growth secular trends. We are

planning for double-digit bookings growth, consistent with the

long-term double-digit semiconductor growth rate in the automotive

electronics industry. We are planning for significantly higher

SentriX growth rates building off of our record 2021.”

Fourth Quarter and Full Year 2021 Financial Results

Net sales in the fourth quarter of 2021 were $6.4 million, up

29% as compared with $4.9 million in the fourth quarter of 2020.

The increase from the prior year period primarily reflects higher

overall demand for equipment, higher adapter usage and the growing

installed base of systems throughout the world. Total recurring and

consumable revenues represented $2.9 million or 46% of total

revenues in the fourth quarter 2021, as compared with $2.4 million

or 48% of the lower fourth quarter 2020 total. For all of 2021, net

sales were $25.8 million, up 27% from $20.3 million in 2020. Total

recurring and consumable revenues represented $10.8 million or 42%

of the total in 2021, an increase from $8.8 million or 44% in

2020.

Fourth quarter 2021 bookings were $6.2 million, up from $5.0

million in the third quarter 2021 and $6.0 million in the fourth

quarter of the prior year. Bookings for all of 2021 were $25.5

million, up from $20.8 million in 2020. Backlog at December 31,

2021 was approximately $2.9 million, down from approximately $3.3

million at September 30, 2021 and $3.9 million at December 31,

2020.

Gross margin as a percentage of sales was 54.4% in the fourth

quarter of 2021, as compared to 47.0% in the same period of the

prior year. The difference in gross margin as a percentage of sales

primarily reflects the impact of higher sales volume on relatively

fixed costs, improved factory variances and product mix in the 2021

period, partially offset by higher costs during the fourth quarter

of 2021. For all of 2021, gross margin was 57.0%, compared to 53.2%

for the prior year.

Net loss in the fourth quarter of 2021 was ($205,000), or

($0.02) per share, compared with a net loss of ($1,646,000), or

($0.20) per share, for the fourth quarter of 2020. Included in net

loss are foreign currency transaction losses of ($138,000) for the

fourth quarter of 2021 and ($211,000) for the fourth quarter of

2020. For the full year, a net loss of ($555,000), or ($0.06) per

share, in 2021 was down from a net loss of ($3,964,000), or ($0.48)

per share, in 2020. The primary differences between the quarterly

and annual periods reflects higher sales volumes and improved gross

margins in the 2021 periods and one-time expenses in the prior year

periods, which was partially offset by higher incentive

compensation in 2021.

Adjusted earnings before interest, taxes, depreciation and

amortization, which excludes equity compensation, impairment and

related non-cash, one-time items, (“Adjusted EBITDA”) was $117,000

in the fourth quarter of 2021, compared to Adjusted EBITDA of

($194,000) in the fourth quarter of 2020. For the full year,

Adjusted EBITDA was $1,451,000 in 2021, compared to ($366,000) in

2020.

Data I/O’s financial condition remained strong with cash of

$14.2 million at December 31, 2021, flat as compared with September

30, 2021 and December 31, 2020. Data I/O had net working capital of

$18.5 million at December 31, 2021, flat as compared to September

30, 2021 and an improvement from $18.1 million at December 31,

2020. The Company continues to have no debt.

Conference Call Information

A conference call discussing financial results for the fourth

quarter ended December 31, 2021 will follow this release today at 2

p.m. Pacific Time/5 p.m. Eastern Time. To listen to the conference

call, please dial 412-317-5788. A replay will be made available

approximately one hour after the conclusion of the call. To access

the replay, please dial 412-317-0088, access code 2966376. The

conference call will also be simultaneously webcast over the

Internet; visit the Webcasts and Presentations section of the Data

I/O Corporation website at www.dataio.com to access the call from

the site. This webcast will be recorded and available for replay on

the Data I/O Corporation website approximately one hour after the

conclusion of the conference call.

About Data I/O Corporation

Since 1972 Data I/O has developed innovative solutions to enable

the design and manufacture of electronic products for automotive,

Internet-of-Things, medical, wireless, consumer electronics,

industrial controls and other electronic devices. Today, our

customers use Data I/O security deployment and programming

solutions to reliably, securely, and cost-effectively bring

innovative new products to life. These solutions are backed by a

global network of Data I/O support and service professionals,

ensuring success for our customers.

Learn more at dataio.com

Forward Looking Statement and Non-GAAP financial

measures

Statements in this news release concerning economic outlook,

expected revenue, expected margins, expected savings, expected

results, orders, deliveries, backlog and financial positions,

silicon chip shortages, supply chain expectations, as well as any

other statement that may be construed as a prediction of future

performance or events are forward-looking statements which involve

known and unknown risks, uncertainties and other factors which may

cause actual results to differ materially from those expressed or

implied by such statements. Forward-looking statement disclaimers

also apply to the global COVID-19 pandemic, including the expected

effects on the Company’s business from COVID-19, the duration and

scope, impact on the demand for the Company’s products, and the

pace of recovery for the COVID-19 pandemic to subside. These

factors include uncertainties as to the ability to record revenues

based upon the timing of product deliveries, installations and

acceptance, accrual of expenses, coronavirus related business

interruptions, changes in economic conditions, part shortages and

other risks including those described in the Company's filings on

Forms 10-K and 10-Q with the Securities and Exchange Commission

(SEC), press releases and other communications.

Non-GAAP financial measures, such as EBITDA, Adjusted EBITDA

excluding equity compensation and impairment & related charges,

and Adjusted gross margin should not be considered a substitute

for, or superior to, measures of financial performance prepared in

accordance with GAAP. We believe that these non-GAAP financial

measures provide meaningful supplemental information regarding the

Company’s results and facilitate the comparison of results.

- tables follow -

DATA I/O CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share amounts)

(UNAUDITED)

Three Months Ended December

31,

Twelve Months Ended December

31,

2021

2020

2021

2020

Net Sales

$6,357

$4,941

$25,835

$20,328

Cost of goods sold

2,900

2,619

11,115

9,506

Gross margin

3,457

2,322

14,720

10,822

Operating expenses:

Research and development

1,626

1,594

6,635

6,357

Selling, general and administrative

2,026

1,567

8,358

6,891

Impairment

-

652

-

652

Total operating expenses

3,652

3,813

14,993

13,900

Operating income (loss)

(195)

(1,491)

(273)

(3,078)

Non-operating income (loss):

Interest income

-

1

11

14

Gain on sale of assets

21

-

21

-

Foreign currency transaction gain

(loss)

(138)

(211)

(202)

(513)

Total non-operating income (loss)

(117)

(210)

(170)

(499)

Income (loss) before income taxes

(312)

(1,701)

(443)

(3,577)

Income tax (expense) benefit

107

55

(112)

(387)

Net income (loss)

($205)

($1,646)

($555)

($3,964)

Basic earnings (loss) per share

($0.02)

($0.20)

($0.06)

($0.48)

Diluted earnings (loss) per share

($0.02)

($0.20)

($0.06)

($0.48)

Weighted-average basic shares

8,621

8,416

8,545

8,333

Weighted-average diluted shares

8,621

8,416

8,545

8,333

DATA I/O CORPORATION

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

(UNAUDITED)

December 31, 2021

December 31, 2020

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$14,190

$14,167

Trade accounts receivable, net of

allowance for

doubtful accounts of $89 and $66,

respectively

3,995

2,494

Inventories

6,351

5,270

Other current assets

737

1,319

TOTAL CURRENT ASSETS

25,273

23,250

Property, plant and equipment – net

946

1,216

Other assets

2,838

1,126

TOTAL ASSETS

$29,057

$25,592

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$1,373

$1,245

Accrued compensation

2,496

1,509

Deferred revenue

1,507

1,068

Other accrued liabilities

1,413

1,307

Income taxes payable

-

62

TOTAL CURRENT LIABILITIES

6,789

5,191

Operating lease liabilities

2,277

588

Long-term other payables

138

174

COMMITMENTS

-

-

STOCKHOLDERS’ EQUITY

Preferred stock -

Authorized, 5,000,000 shares,

including

200,000 shares of Series A Junior

Participating

Issued and outstanding, none

-

-

Common stock, at stated value -

Authorized, 30,000,000 shares

Issued and outstanding, 8,621,007 shares

as of December 31,

2021 and 8,416,335 shares as of December

31, 2020

20,886

20,071

Accumulated earnings (deficit)

(2,011)

(1,456)

Accumulated other comprehensive income

978

1,024

TOTAL STOCKHOLDERS’ EQUITY

19,853

19,639

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$29,057

$25,592

DATA I/O CORPORATION

NON-GAAP FINANCIAL MEASURE

RECONCILIATION

Three Months Ended December

31,

Twelve Months Ended December

31,

2021

2020

2021

2020

(in thousands)

Net Income (loss)

($205)

($1,646)

($555)

($3,964)

Interest (income)

-

(1)

(11)

(14)

Taxes

(107)

(55)

112

387

Depreciation and amortization

150

194

667

815

EBITDA earnings (loss)

($162)

($1,508)

$213

($2,776)

Equity compensation

279

371

1,238

1,467

Impairment & related

-

943

-

943

Adjusted EBITDA, excluding equity

compensation

and impairment & related charges

$117

($194)

$1,451

($366)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220224005922/en/

Joel Hatlen Chief Operating and Financial Officer Data I/O

Corporation

Darrow Associates, Inc. Jordan Darrow (512) 551-9296

jdarrow@darrowir.com

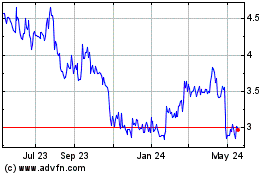

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

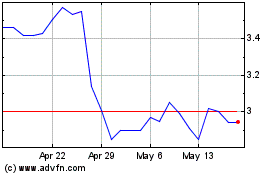

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Nov 2023 to Nov 2024