Dollar-Store Chains Post Stronger Sales, But Tariffs Cloud Outlook -- Update

May 30 2019 - 6:16PM

Dow Jones News

By Aisha Al-Muslim and Sarah Nassauer

Sales at Dollar General Corp. and Dollar Tree Inc. rose in the

latest quarter, but both discount retailers said the prospect of

tariffs being imposed on more products imported from China cast

uncertainty on their businesses.

Dollar Tree on Thursday cut its profit forecast for the year as

it works to trim its store count and deals with

higher-than-expected import-freight costs. Dollar General

maintained its financial guidance and store-growth outlook.

Both companies said their outlooks include current tariffs on

certain Chinese imports, which the chains have been trying to

mitigate. However, neither company adjusted its forecasts for a

potential next round of tariffs on nearly all remaining goods from

China, which could include many consumer goods such as additional

apparel categories and toys.

If a further tariffs are implemented, "we expect that it will be

impactful to both our business, and especially to consumers in

general," said Gary Philbin, chief executive of Dollar Tree, which

also owns the Family Dollar chain. Company merchants have mitigated

the cost of most tariffs so far, he said on a call with analysts.

In January the company moved about $100 million of seasonal

purchases out of China, he said.

Dollar Tree, based in Chesapeake, Va., now expects earnings per

share for the fiscal year to be $4.77 to $5.07, off from its

previously forecast range of $4.85 to $5.25.

Shares in Dollar General rose 7.2% to $127 on Thursday, while

Dollar Tree's stock rose 3.1% to $98.31.

Many other retailers are formulating plans to manage the impact

of higher tariffs on merchandise imported from China because of the

continuing U.S.-China trade dispute.

The Trump administration this month imposed a 25% tariff on $200

billion in Chinese goods, up from a 10% duty put in place in

October.

For the first quarter ended May 3, Dollar General said new

stores and sales gains at existing locations helped sales growth.

Net sales rose 8.3% to $6.62 billion and same-store sales increased

3.8%, both above analysts' expectations. Profit at the company,

based in Goodlettsville, Tenn., rose 5.5% to $385 million, from

$364.9 million a year earlier.

Dollar General has been expanding its store footprint and

working to become a bigger seller of food and home goods to grab

more shoppers. During the quarter, it opened 240 new stores,

remodeled 330 stores and relocated 27 stores.

Dollar Tree said its sales increased in the first quarter ended

May 4 as the performance at its Family Dollar stores began to turn

around.

Net sales rose 4.6% to $5.81 billion and overall same-store

sales increased 2.2%, both above analysts' expectations. Same-store

sales rose 2.5% at Dollar Tree, while sales at stores open at least

a year under the Family Dollar banner rose 1.9%. Although the

average amount spent rose at Family Dollar, boosting sales, the

number of shoppers fell in the quarter.Dollar Tree's profit rose

67% to $267.9 million from $160.5 million a year earlier.

Dollar Tree has worked to turn around Family Dollar after

purchasing the struggling budget retailer in 2015. However, the

Family Dollar chain has lagged behind competitors, which led

activist investor Starboard Value LP to take a stake in the parent

company, advocate for a sale of Family Dollar, and nominate a slate

of new board directors.

Dollar Tree said earlier this year that it would close hundreds

of Family Dollar stores and marked down the value of the chain

while testing higher price points at Dollar Tree. Starboard

withdrew its director nominations in April, saying the company

showed improvement.

In the quarter, the company closed 16 Family Dollar stores and

opened 45 Dollar Tree stores that had previously been Family Dollar

locations.

"Our Family Dollar turnaround is gaining traction," Mr. Philbin

said. Dollar Tree started testing a new line of products that cost

more than $1 earlier this month, he said, and would add the test to

100 stores initially.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

May 30, 2019 19:01 ET (23:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

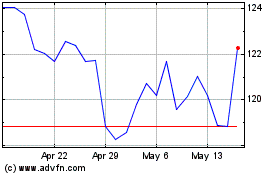

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Dec 2024 to Jan 2025

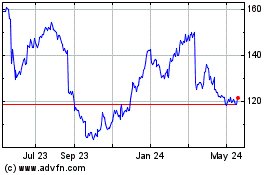

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Jan 2024 to Jan 2025