Alpha Tau Medical Announces First Quarter 2024 Financial Results and Provides Corporate Update

May 20 2024 - 3:01PM

Alpha Tau Medical Ltd. ("Alpha Tau", or the “Company”) (NASDAQ:

DRTS, DRTSW), the developer of the innovative alpha-radiation

cancer therapy Alpha DaRT™,

reported first quarter 2024

financial results and provided a corporate update.

"This year we remain focused on advancing our

ReSTART U.S. multi-center pivotal trial in recurrent cutaneous

squamous cell carcinoma, but in parallel we have seen very

encouraging initial results from our internal organ trials over the

past quarter, which remind us of the broader opportunity set ahead

of us,” stated Alpha Tau CEO Uzi Sofer. "Alongside our focus on

completing our pivotal trial and feasibility programs, we also

continue to make good progress in preparing for potential future

product launches by advancing our commercial planning activities

and solidifying our supply chain, with a focus on building out our

new planned manufacturing facility in Hudson, New Hampshire. Alpha

Tau anticipates remaining adequately capitalized to support all of

these programs over the coming years," he concluded.

Recent Corporate

Highlights:

- In May, preclinical data demonstrating an abscopal immune

effect in pancreatic murine tumor models was presented at ESTRO

2024 Congress in Glasgow. Initial data demonstrates significant

reduction in distant pancreatic cancer tumor growth rate starting

from three weeks after first tumor is treated with Alpha DaRT

alone. The effect was seen across both Panc02 and KPC tumor

models.

- In May, the first patient with liver cancer metastases was

treated in a feasibility and safety study of Alpha DaRT at McGill

University Health Center in Montreal, Canada. The trial aims to

recruit up to 10 patients who are eligible for a two-staged

hepatectomy to resect liver metastases of colorectal cancer. For

more information, please refer to

https://clinicaltrials.gov/study/NCT05829291.

- In May, the first patient was treated in a clinical trial at

the Rambam Health Care Campus in Haifa, Israel examining the use of

Alpha DaRT for focal treatment of recurrent prostate cancer tumors.

The trial aims to recruit up to 10 patients with recurrent,

non-metastatic prostate adenocarcinoma. For more information,

please refer to

https://www.clinicaltrials.gov/study/NCT06202248.

Upcoming 2024 Milestones

- Planning treatment of the first patient in the Israeli

recurrent lung cancer safety and feasibility trial in Q2 2024. The

trial is currently open for recruitment; for more information

please see here:

https://www.clinicaltrials.gov/study/NCT05632913

- Targeting first brain cancer treatment in H2 2024.

- Targeting completion of patient recruitment in the ReSTART U.S.

multi-center pivotal trial in recurrent cutaneous squamous cell

carcinoma in H2 2024. The trial is currently open for recruitment;

for more information please see here:

https://www.clinicaltrials.gov/study/NCT05323253

- Targeting completion of patient recruitment in the Canadian

advanced inoperable pancreatic cancer study in Montreal in H2 2024.

The trial is currently open for recruitment; for more information

please see here:

https://www.clinicaltrials.gov/study/NCT04002479

- Anticipating response from PMDA in Japan by year-end 2024 for

pre-market approval for Alpha DaRT in patients with recurrent head

and neck cancer.

Financial results for quarter ended March 31,

2024

R&D expenses for the quarter ended March 31,

2024 were $6.4 million, compared to $6.3 million for the same

period in 2023, due to increased employee compensation and

benefits, including share-based compensation, and increased

preclinical study and clinical trial expenses, particularly as

related to its ReSTART U.S. multi-center pivotal trial, offset by

increased government grants.

Marketing expenses for the quarter ended March

31, 2024 were $0.5 million, compared to $0.4 million for the same

period in 2023, due to increased employee compensation and benefits

and increased marketing expenses.

G&A expenses for the quarter ended March 31,

2024 were $1.4 million, compared to $1.9 million for the same

period in 2023, due primarily to a reduction in D&O insurance

costs.

Financial income, net, for the quarter ended

March 31, 2024 was $0.4 million, compared to $0.4 million for the

same period in 2023, as an increase in interest from bank deposits

was offset by a higher expense from remeasurement of warrants.

For the quarter ended March 31, 2024, the

Company had a net loss of $8.0 million, or $0.11 per share,

compared to a net loss of $8.2 million, or $0.12 per share, in the

first quarter of 2023.

Balance Sheet Highlights

As of March 31, 2024, the Company had cash and

cash equivalents, deposits and restricted deposits in the amount of

$80.7 million, compared to $84.9 million at December 31, 2023. The

Company expects that this cash balance will be sufficient to fund

anticipated operations for at least two years.

About Alpha DaRT™

Alpha DaRT (Diffusing Alpha-emitters Radiation

Therapy) is designed to enable highly potent and conformal

alpha-irradiation of solid tumors by intratumoral delivery of

radium-224 impregnated sources. When the radium decays, its

short-lived daughters are released from the sources and disperse

while emitting high-energy alpha particles with the goal of

destroying the tumor. Since the alpha-emitting atoms diffuse only a

short distance, Alpha DaRT aims to mainly affect the tumor, and to

spare the healthy tissue around it.

About Alpha Tau Medical Ltd.

Founded in 2016, Alpha Tau is an Israeli medical

device company that focuses on research, development, and potential

commercialization of the Alpha DaRT for the treatment of solid

tumors. The technology was initially developed by Prof. Itzhak

Kelson and Prof. Yona Keisari from Tel Aviv University.

Forward-Looking Statements

This press release includes "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. When used herein, words including "anticipate,"

"being," "will," "plan," "may," "continue," and similar expressions

are intended to identify forward-looking statements. In addition,

any statements or information that refer to expectations, beliefs,

plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking. All forward-looking

statements are based upon Alpha Tau's current expectations and

various assumptions. Alpha Tau believes there is a reasonable basis

for its expectations and beliefs, but they are inherently

uncertain. Alpha Tau may not realize its expectations, and its

beliefs may not prove correct. Actual results could differ

materially from those described or implied by such forward-looking

statements as a result of various important factors, including,

without limitation: (i) Alpha Tau's ability to receive regulatory

approval for its Alpha DaRT technology or any future products or

product candidates; (ii) Alpha Tau's limited operating history;

(iii) Alpha Tau's incurrence of significant losses to date; (iv)

Alpha Tau's need for additional funding and ability to raise

capital when needed; (v) Alpha Tau's limited experience in medical

device discovery and development; (vi) Alpha Tau's dependence on

the success and commercialization of the Alpha DaRT technology;

(vii) the failure of preliminary data from Alpha Tau's clinical

studies to predict final study results; (viii) failure of Alpha

Tau's early clinical studies or preclinical studies to predict

future clinical studies; (ix) Alpha Tau's ability to enroll

patients in its clinical trials; (x) undesirable side effects

caused by Alpha Tau's Alpha DaRT technology or any future products

or product candidates; (xi) Alpha Tau's exposure to patent

infringement lawsuits; (xii) Alpha Tau's ability to comply with the

extensive regulations applicable to it; (xiii) the ability to meet

Nasdaq's listing standards; (xiv) costs related to being a public

company; (xv) changes in applicable laws or regulations; and the

other important factors discussed under the caption "Risk Factors"

in Alpha Tau's annual report filed on form 20-F with the SEC on

March 7, 2024, and other filings that Alpha Tau may make with the

United States Securities and Exchange Commission. These and other

important factors could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent

management's estimates as of the date of this press release. While

Alpha Tau may elect to update such forward-looking statements at

some point in the future, except as required by law, it disclaims

any obligation to do so, even if subsequent events cause its views

to change. These forward-looking statements should not be relied

upon as representing Alpha Tau's views as of any date subsequent to

the date of this press release.

Investor Relations

Contact:

IR@alphatau.com

|

CONSOLIDATED BALANCE SHEET |

| U.S.

dollars in thousands |

|

|

|

|

December

31,2023 |

|

March

31,2024 |

|

|

Audited |

|

Unaudited |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

12,657 |

|

|

$ |

7,296 |

|

|

Short-term deposits |

|

69,131 |

|

|

|

70,257 |

|

|

Restricted deposits |

|

3,152 |

|

|

|

3,124 |

|

|

Prepaid expenses and other receivables |

|

816 |

|

|

|

527 |

|

|

|

|

|

|

| Total

current assets |

|

85,756 |

|

|

|

81,204 |

|

|

|

|

|

|

|

LONG-TERM ASSETS: |

|

|

|

|

Long term prepaid expenses |

|

471 |

|

|

|

465 |

|

|

Property and equipment, net |

|

12,798 |

|

|

|

12,592 |

|

|

Right-of-use asset |

|

8,363 |

|

|

|

8,183 |

|

|

|

|

|

|

| Total

long-term assets |

|

21,632 |

|

|

|

21,240 |

|

|

|

|

|

|

| Total

assets |

$ |

107,388 |

|

|

$ |

102,444 |

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEET |

| U.S.

dollars in thousands |

|

|

|

|

December

31,2023 |

|

March 31, 2024 |

|

|

Audited |

|

Unaudited |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

Trade Payables |

$ |

2,566 |

|

|

$ |

2,459 |

|

|

Other payables and accrued expenses |

|

3,474 |

|

|

|

3,491 |

|

|

Current maturities of operating lease liabilities |

|

1,062 |

|

|

|

1,050 |

|

|

|

|

|

|

| Total

current liabilities |

|

7,102 |

|

|

|

7,000 |

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

Long-term loan |

|

5,610 |

|

|

|

5,526 |

|

|

Warrants liability |

|

3,597 |

|

|

|

4,486 |

|

|

Operating lease liabilities |

|

6,604 |

|

|

|

6,366 |

|

|

|

|

|

|

| Total

long-term liabilities |

|

15,811 |

|

|

|

16,378 |

|

|

|

|

|

|

| Total

liabilities |

|

22,913 |

|

|

|

23,378 |

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

Share capital |

|

|

|

|

Ordinary shares of no-par value per share – Authorized: 362,116,800

shares as of December 31, 2023 and March 31, 2024; Issued and

outstanding: 69,670,612 and 69,796,755 shares as of December 31,

2023 and March 31, 2024, respectively |

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

200,234 |

|

|

|

202,806 |

|

|

Accumulated deficit |

|

(115,759 |

) |

|

|

(123,740 |

) |

|

|

|

|

|

| Total

shareholders' equity |

|

84,475 |

|

|

|

79,066 |

|

|

|

|

|

|

| Total

liabilities and shareholders' equity |

$ |

107,388 |

|

|

$ |

102,444 |

|

| |

|

CONSOLIDATED STATEMENT OF OPERATIONS |

| U.S.

dollars in thousands (except share and per share

data) |

|

|

|

|

|

Three months ended March 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

2024 |

|

|

|

Unaudited |

|

|

|

|

|

| Research

and development, net |

$ |

6,306 |

|

|

$ |

6,448 |

|

|

Marketing expenses |

|

400 |

|

|

|

533 |

|

| General

and administrative expenses |

|

1,938 |

|

|

|

1,443 |

|

|

|

|

|

|

| Total

operating loss |

|

8,644 |

|

|

|

8,424 |

|

|

|

|

|

|

|

Financial income, net |

|

(478 |

) |

|

|

(444 |

) |

| Loss

before taxes on income |

|

8,166 |

|

|

|

7,980 |

|

|

|

|

|

|

| Tax on

income |

|

21 |

|

|

|

1 |

|

|

|

|

|

|

| Net

loss |

|

8,187 |

|

|

|

7,981 |

|

|

|

|

|

|

| Net

comprehensive loss |

|

8,187 |

|

|

|

7,981 |

|

|

|

|

|

|

| Net loss

per share, basic and diluted |

$ |

(0.12 |

) |

|

$ |

(0.11 |

) |

|

|

|

|

|

|

Weighted-average shares used in computing net loss per share, basic

and diluted |

|

69,205,654 |

|

|

|

69,714,250 |

|

|

|

|

|

|

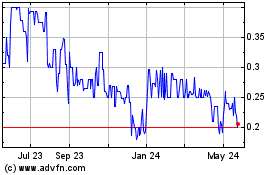

Alpha Tau Medical (NASDAQ:DRTSW)

Historical Stock Chart

From Dec 2024 to Jan 2025

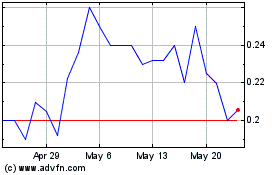

Alpha Tau Medical (NASDAQ:DRTSW)

Historical Stock Chart

From Jan 2024 to Jan 2025