false

2024-02-08

0000720875

Dynatronics Corp.

0000720875

2024-02-08

2024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 8, 2024

DYNATRONICS CORP.

(Exact name of registrant as specified in its charter)

|

Utah

|

000-12697

|

87-0398434

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

1200 Trapp Rd.

Eagan, Minnesota, United States

55121

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (801) 568-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common stock, no par value

|

|

DYNT

|

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 8, 2024, Dynatronics Corporation ("Company") issued a press release reporting, among other things, financial results relating to the quarter ended December 31, 2023. Also, as previously announced by a press release issued on January 25, 2024, on February 8, 2024, the Company held a conference call in which executives of the Company reviewed the fiscal 2024 second quarter results. An audio replay of the call will be available one hour after the live call until Midnight on February 15, 2024, by dialing 1-855-669-9658 (U.S./Canada callers) or +1-604-674-8052 (international callers), using replay access code 0667. The full text of the press release is furnished herewith as Exhibit 99.1.

The information under this Item 2.02 and in Exhibit 99.1, is being "furnished" and is not being "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 and is not to be incorporated by reference into any filing of the registrant under the Securities Act of 1933, whether made before or after the date hereof, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 8, 2024 |

DYNATRONICS CORPORATION |

| |

|

|

| |

By: |

/s/ Brian D. Baker |

| |

Name: |

Brian D. Baker |

| |

Title: |

Chief Executive Officer |

| |

|

|

Dynatronics Corporation Reports Second Quarter Fiscal Year 2024 Financial Results

EAGAN, MN / ACCESSWIRE / February 8, 2024 / Dynatronics Corporation (NASDAQ:DYNT) ("Dynatronics" or the "Company"), a leading manufacturer of athletic training, physical therapy, and rehabilitation products, today reported financial results for its second quarter of fiscal year 2024 ended December 31, 2023.

CEO Commentary

"We continue to make progress on achieving our sales goals and finding our path to positive EBITDA," said Brian Baker, Chief Executive Officer of Dynatronics. "We continue our focus on our fiscal year 2024 operating plan and making progress on our strategic priorities with encouraging results. Our commercial team has been working closely with our strategic customers to identify new product opportunities. We have been aggressively developing, manufacturing, and building stock to support customer demand. Our plan is to manage a limited launch of new products in the third quarter fiscal year 2024, and full launch in the fourth quarter fiscal year 2024. We are excited about the potential incremental revenue these products can contribute to our business."

Key Financial Results

Q2 Fiscal Year '24 Financial Highlights

Note: All financials referenced in this release are in conformity with U.S. Generally Accepted Accounting Principles ("GAAP") and comparisons in this release are to the same period in the prior year unless otherwise noted.

- Total net sales of $8.2 million.

- Gross profit margin of 22.3%.

- Net loss of $1.0 million compared to net loss of $0.8 million in Q2 fiscal year '23.

Notable Balance Sheet Highlights

- Net cash of $0.6 million unchanged from $0.6 million as of June 30, 2023.

- As of December 31, 2023, $1.9 million drawn, with an additional $2.5 million available on working capital asset-based line of credit established on August 1, 2023.

- Proceeds from line of credit reduced accounts payable and accrued expenses by $0.7 million and funded $0.8 million of prepaid expenses.

Guidance for Fiscal Year '24

Dynatronics estimated net sales to be in the lower range of revenue estimates of $34 to $37 million, due to slower demand in the rehabilitation space. The Company expects the distribution of net sales across the quarters in fiscal year '24 to align with historical trends, which are highest in the first quarter, lower in the second and third quarters, with a bounce back in the fourth quarter.

The Company is continuing its recent practice of not providing gross margin guidance given the recent reductions in revenue and operating costs.

The Company reaffirmed its guidance on selling, general, and administrative expenses that are anticipated to be 29% to 33% of net sales in fiscal year '24.

The Company's financial guidance for fiscal year '24 is subject to the risks identified in its safe harbor notification below. The Company continues to expect volatility due to the challenges related to the broader economic environment, including competitive pressures, inflationary pressures, supply chain disruptions, extended handling times and delays or disruption in procedure volume. Dynatronics also expects some ongoing volatility from the Company's business optimization.

Conference Call Q2 Fiscal Year '24 Results

The Company will hold a conference call, consisting of prepared remarks by management, and a question-and-answer session with analysts, at 8:00 AM ET on Thursday, February 8, 2024, to review its fiscal year '24 second quarter results.

Interested persons may access the live conference call by dialing 1-800-319-4610 (U.S./Canada callers) or +1-604-638-5340 (international callers). It is recommended that participants call or login 10 minutes ahead of the scheduled start time to ensure proper connection. An audio replay will be available one hour after the live call until Midnight on February 15, 2024, by dialing 1-855-669-9658 (U.S./Canada callers) or +1-604-674-8052 (international callers), using replay access code 0667.

About Dynatronics Corporation

Dynatronics is a leading medical device company committed to providing high-quality restorative products designed to accelerate achieving optimal health. The Company designs, manufactures and sells a broad range of products for clinical use in physical therapy, rehabilitation, orthopedics, pain management, and athletic training. Through its distribution channels, Dynatronics markets and sells to orthopedists, physical therapists, chiropractors, athletic trainers, sports medicine practitioners, clinics, and hospitals. The Company's products are marketed under a portfolio of high-quality, well-known industry brands including Bird & Cronin®, Solaris™, Hausmann®, and PROTEAM™, among others. More information is available at www.dynatronics.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Those statements include references to the Company's expectations and similar statements. Such forward-looking statements reflect the views of management at the time such statements are made. These statements include our statements regarding the Company's planned product launches, expected overall performance, expectations regarding net sales, distribution of net sales, and selling general and administrative costs in fiscal year 2024, and uncertainties related to the broader economic environment, including higher raw material, delivery and shipment costs, supply chain disruptions, extended handling times and delays or disruption in procedure volume and volatility resulting from continued execution of the Company's business optimization strategy. These forward-looking statements are subject to a number of risks, uncertainties, estimates, and assumptions that may cause actual results to differ materially from current expectations. The contents of this release should be considered in conjunction with the risk factors, warnings, and cautionary statements that are contained in the Company's annual, quarterly, and other reports filed with the Securities and Exchange Commission. Dynatronics does not undertake to update its forward-looking statements, whether as a result of new information, future events, or otherwise.

Summary Financial Results

Following is a summary of operating results for the periods ended December 31, 2023, the balance sheet highlights at December 31, 2023 and cash flow for periods ended December 31, 2023.

Summary Selected Financial Data

Statements of Operations Highlights

In thousands, except share and per share amounts

| |

|

Quarter Ended |

|

|

Six Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

8,151 |

|

$ |

10,882 |

|

$ |

17,503 |

|

$ |

22,936 |

|

| Cost of sales |

|

6,331 |

|

|

7,820 |

|

|

13,377 |

|

|

16,231 |

|

| Gross Profit |

|

1,820 |

|

|

3,062 |

|

|

4,126 |

|

|

6,705 |

|

| |

|

22.3% |

|

|

28.1% |

|

|

23.6% |

|

|

29.2% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

2,722 |

|

|

3,862 |

|

|

5,267 |

|

|

7,980 |

|

| Other (expense) income, net |

|

(109 |

) |

|

(41 |

) |

|

(201 |

) |

|

(72 |

) |

| Net income (loss) |

$ |

(1,011 |

) |

$ |

(841 |

) |

$ |

(1,342 |

) |

$ |

(1,347 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock dividend, in common stock, issued or to be issued |

|

(191 |

) |

|

(173 |

) |

|

(388 |

) |

|

(343 |

) |

| Net income (loss) attributable to common stockholders |

$ |

(1,202 |

) |

$ |

(1,014 |

) |

$ |

(1,730 |

) |

$ |

(1,690 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders per |

|

|

|

|

|

|

|

|

|

|

|

|

| common share - basic and diluted |

$ |

(0.27 |

) |

$ |

(0.27 |

) |

$ |

(0.39 |

) |

$ |

(0.45 |

) |

| Weighted-average common shares outstanding - basic and |

|

|

|

|

|

|

|

|

|

|

|

|

| diluted |

|

4,524,965 |

|

|

3,794,333 |

|

|

4,393,279 |

|

|

3,750,930 |

|

Balance Sheet Highlights

In thousands

| |

|

December 31, 2023 |

|

|

June 30, 2023 |

|

| Cash and cash equivalents and restricted cash |

$ |

555 |

|

$ |

553 |

|

| Trade accounts receivable, net |

|

3,738 |

|

|

3,722 |

|

| Inventories, net |

|

6,753 |

|

|

7,403 |

|

| Prepaids & other |

|

1,849 |

|

|

741 |

|

| |

|

|

|

|

|

|

| Total current assets |

|

12,895 |

|

|

12,419 |

|

| |

|

|

|

|

|

|

| Non-current assets |

|

16,404 |

|

|

17,644 |

|

| Total assets |

$ |

29,299 |

|

$ |

30,063 |

|

| |

|

|

|

|

|

|

| Accounts payable |

$ |

3,975 |

|

$ |

4,530 |

|

| Accrued payroll and benefits expense |

|

603 |

|

|

878 |

|

| Accrued expenses |

|

1,094 |

|

|

891 |

|

| Other current liabilities |

|

1,605 |

|

|

1,642 |

|

| Line of credit |

|

1,897 |

|

|

- |

|

| Total current liabilities |

|

9,174 |

|

|

7,941 |

|

| |

|

|

|

|

|

|

| Non-current liabilities |

|

4,595 |

|

|

5,265 |

|

| Total liabilities |

|

13,769 |

|

|

13,206 |

|

| |

|

|

|

|

|

|

| Stockholders' equity |

|

15,530 |

|

|

16,857 |

|

| Total liabilities and stockholders' equity |

$ |

29,299 |

|

$ |

30,063 |

|

Cash Flow Highlights

In thousands

| |

|

Six Months Ended |

|

| |

|

December 31 |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Net loss |

$ |

(1,342 |

) |

$ |

(1,347 |

) |

| |

|

|

|

|

|

|

| Depreciation and amortization |

|

652 |

|

|

682 |

|

| Stock-based compensation |

|

15 |

|

|

86 |

|

| (Gain) loss on sale of property and equipment |

|

41 |

|

|

- |

|

| Receivables |

|

(16 |

) |

|

185 |

|

| Inventory |

|

650 |

|

|

1,325 |

|

| Prepaid and other assets |

|

(827 |

) |

|

134 |

|

| Accounts payable, accrued expenses, and other liabilities |

|

(697 |

) |

|

(774 |

) |

| Net cash provided by (used in) operating activities |

|

(1,524 |

) |

|

291 |

|

| |

|

|

|

|

|

|

| Net cash used in investing activities |

|

(230 |

) |

|

(126 |

) |

| |

|

|

|

|

|

|

| Payments on non-current liabilities |

|

1,756 |

|

|

(181 |

) |

| Net cash used in financing activities |

|

1,756 |

|

|

(181 |

) |

| |

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

2 |

|

|

(16 |

) |

| Cash and cash equivalents at beginning of the period |

|

553 |

|

|

701 |

|

| Cash and cash equivalents at end of the period |

$ |

555 |

|

$ |

685 |

|

Contact:

Dynatronics Corporation

Investor Relations

ir@dynatronics.com

For additional information, please visit: www.dynatronics.com

Connect with Dynatronics on LinkedIn

SOURCE: Dynatronics Corporation

v3.24.0.1

Document and Entity Information Document

|

Feb. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

Feb. 08, 2024

|

| Document Period End Date |

Feb. 08, 2024

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Dynatronics Corp.

|

| Entity Address, Address Line One |

1200 Trapp Rd.

|

| Entity Address, City or Town |

Eagan

|

| Entity Address, State or Province |

MN

|

| Entity Address, Country |

US

|

| Entity Address, Postal Zip Code |

55121

|

| Entity Incorporation, State Country Name |

UT

|

| City Area Code |

801

|

| Local Phone Number |

568-7000

|

| Entity File Number |

000-12697

|

| Entity Central Index Key |

0000720875

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

87-0398434

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, no par value

|

| Trading Symbol |

DYNT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

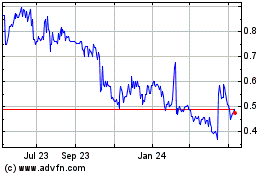

Dynatronics (NASDAQ:DYNT)

Historical Stock Chart

From Oct 2024 to Nov 2024

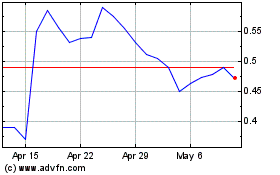

Dynatronics (NASDAQ:DYNT)

Historical Stock Chart

From Nov 2023 to Nov 2024