- Current report filing (8-K)

February 23 2010 - 4:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 19, 2010

ValueVision Media, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Minnesota

|

|

0-20243

|

|

41-1673770

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

6740 Shady Oak Road, Eden Prairie,

|

|

|

|

Minnesota

|

|

55344-3433

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 952-943-6000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangements of Certain Officers.

(a) Resignation of Chief Financial Officer.

On February 23, 2010, we announced that Senior Vice President and Chief Financial Officer Frank P.

Elsenbast has resigned as of February 22, 2010 and is leaving

the Company to accept a chief financial officer position at another public company. Global executive search firm Spencer Stuart will

begin searching immediately for Mr. Elsenbast’s replacement. Mr. Elsenbast will remain with ShopNBC

for an interim period to ensure an orderly transition in responsibilities.

(b) Appointment of Interim Chief Financial Officer.

On

February 23, 2010, we announced that we have appointed William

McGrath as our Interim Chief

Financial Officer. Mr. McGrath will assume financial management functions until a new Chief

Financial Officer is named.

Mr. McGrath, age 52, has been our Vice President of Quality Assurance since January 7, 2010.

Previously, he was Vice President, Global Sourcing Operations and

Finance of QVC from May 2009 to November 2009. Prior to that

time, he was Vice President Corporate Quality Assurance and Quality

Control of QVC from December 1999 to May 2009. At

QVC, Mr. McGrath also held the positions of Vice President Merchandise Operations and Inventory

Control, Vice President Market Research and Sales Analysis, and Director Financial Planning and

Analysis. Prior to QVC, Mr. McGrath served at Subaru of America as Assistant Corporate Controller

and Arthur Andersen as Senior Auditor. He earned an MBA in Finance from Drexel University and a BS

in Accounting from St. Joseph’s University.

On

December 1, 2009, we provided an offer letter to

Mr. McGrath effective January 7, 2010, relating to the compensatory terms

of his services to us as Vice President Quality Assurance, the terms of which remain in effect

while he is serving as Interim Chief Financial Officer. His current annualized base salary is $175,000, and he received a signing bonus of $20,000.

He received stock options to purchase 45,000 shares of common stock at an exercise price of $4.97,

equal to the closing fair market value per share as of the date of grant. The

options vest in equal installments over three years and are exercisable for a period of ten years

from the date of grant. We also paid certain relocation costs for Mr. McGrath. He is eligible to

receive 6 months base salary due to lay-off, job elimination, restructuring or other reasons other

than for cause. The offer letter is included as Exhibit 10.1 to this current report and is

incorporated by reference into this Item 5.02.

A copy of the press release announcing Mr. Elsenbast’s resignation and Mr. McGrath’s appointment is

filed as Exhibit 99.1 and incorporated by reference into this Item 5.02.

(c) Amended and restated employment agreement with Chief Executive Officer.

On February 19, 2010, we entered into an amended and restated employment agreement (the “amended

agreement”) with Mr. Keith Stewart, relating to the terms of his employment as Chief Executive

Officer. Mr. Stewart’s employment agreement, as previously in effect, was entered into on March 18,

2009 and established the terms under which Mr. Stewart served as our President and Chief Executive

Officer. As previously reported on Form 8-K filed on February 3, 2010, Mr. Stewart voluntarily

relinquished his title as President, effective February 1, 2010, in connection with the appointment

of Mr. G. Robert Ayd as our President.

In addition to amending the terms of the agreement as previously in effect, the amended agreement

continues in effect the change in control severance provisions of Mr. Stewart’s Key Employee

Agreement dated December 12, 2008, the term of which agreement ended as of December 12, 2009.

The terms of Mr. Stewart’s amended agreement include the following:

Term:

Until January 26, 2011, to be automatically extended for successive one-year periods unless

terminated by either party by written notice at least 90 days prior to the end of the term or any

extension thereof.

Annualized base salary

: A minimum of $650,000 through the original term of the amended agreement

that ends January 26, 2011. The base salary will be subject to annual review by the board of

directors.

2

Annual cash incentive

: Mr. Stewart will participate in our annual cash incentive plan. He will have

a target bonus opportunity equal to 75% of his base salary based on our management incentive plan.

The annual incentive plan financial goal(s) are established annually and approved by our

compensation committee.

Long Term Incentive

: Under the amended agreement, Mr. Stewart will be entitled to receive a grant

of stock options to purchase 500,000 shares of common stock. if he remains employed by us through

the date during fiscal 2010 (if any) that stock options are granted generally to other executive

officers or, if earlier, the date of the public announcement of a fiscal quarter for which we

report a positive EBITDA, as adjusted, or of certain changes in control. This grant is intended to

replace 500,000 options Mr. Stewart was entitled to receive in fiscal 2009, which were not granted

at that time. The exercise price of the stock options will be equal to the closing sale price of

the common stock on the date of grant. In certain circumstances, Mr. Stewart may be entitled to

either a cash payment in addition to the stock option or a cash payment in lieu of the stock option

if certain types of change in control occur during fiscal 2010. The amounts of these payments would

be related to appreciation in the market value per share of the common stock before the relevant

event or the consideration per share paid in certain transactions, compared to the market value per

share of the common stock on the last trading day of fiscal 2009. The terms of these payments, if

these circumstances were to occur, are set forth in the amended agreement, which is included as

Exhibit 10.1 to this current report and is incorporated by reference into this Item 5.02.

Severance

: If Mr. Stewart’s employment is terminated without cause or he resigns from employment

for good reason, whether or not pursuant to a change of control, he is eligible to receive twelve

months of his base salary at the time of termination, one year of his target bonus opportunity

amount for the fiscal year in which the removal or resignation occurs, and twelve months of medical

coverage under COBRA. All transition and severance pay or benefits (including the change in control

severance benefit described below) are conditional upon his execution of an effective release in a

specified form.

The amended agreement also provides for payment of the following severance benefits in the event of

certain changes of control as described above, and if such payments are made, they will be offset

by the payments described in the preceding paragraph. Mr. Stewart will be entitled to severance pay

equal to 24 months of base salary and continued group medical and dental insurance for 24 months if

(1) an Event (as described below and defined in the amended agreement) occurs during the term of

the amended agreement, and (2) within one year after the occurrence of such Event, Mr. Stewart’s

employment is terminated involuntarily by us without Cause (as described below and defined in the

amended agreement) or voluntarily by Mr. Stewart for Good Reason (as described below and defined in

the amended agreement).

As defined in the amended agreement, the following terms, in general, have the following meanings.

An “Event” means, with certain exceptions, the acquisition by any individual, entity or group of

beneficial ownership of 30% or more of either the outstanding shares of our common stock or the

combined voting power of our outstanding voting securities; a change in a majority of our Board;

approval by the shareholders of a reorganization, merger, consolidation or statutory exchange of

our outstanding voting securities; or approval by the shareholders of a complete liquidation or

dissolution of us or the sale or other disposition of all or substantially all of our assets.

“Cause” means a material act or act of fraud which results in or is intended to result in the Mr.

Stewart’s personal enrichment at our expense; public conduct materially detrimental to our

reputation; material violation of any written policy, regulation or practice of us; failure to

adequately perform the duties of his position to our detriment; commission of conduct constituting

a felony; habitual intoxication, drug use or chemical substance use by any intoxicating or chemical

substance; or a material breach of any of the terms and conditions of the amended agreement, which

breach remains uncured 10 days after receipt by the officer of written notice of such breach. “Good

Reason” means a material reduction in Mr. Stewart’s duties, responsibilities or authority; a

material reduction (greater than 10%), in the aggregate, to the compensation and benefit plans,

programs and perquisites applicable to him; our requiring him to be based at any office or location

more than 50 miles from the previous location, or us requiring him to travel on company business to

a substantially greater extent than previously required; or any material breach of the amended

agreement by us. In addition, for any of these circumstances to constitute Good Reason the officer

must have given notice thereof to us which we failed to cure within 30 days.

Board of Directors

: Mr. Stewart is a member of our board of directors. We have agreed to nominate

Mr. Stewart for election to our board of directors at each annual shareholders meeting while he

continues to serve as an executive officer of our company. Mr. Stewart has agreed to waive any

director compensation he would otherwise be entitled while he serves as an executive officer.

3

The preceding description of Mr. Stewart’s terms of employment is only a summary. The complete

terms of his employment are set forth in the amended agreement, which is included as Exhibit 10.2

to this current report and is incorporated by reference into this Item 5.02.

Item 9.01 Financial Statements and Exhibits.

Exhibit 10.1 Offer letter to William McGrath dated December 1, 2010.

Exhibit 10.2 Amended and Restated Employment Agreement between the registrant and Keith R. Stewart

dated February 19, 2010.

Exhibit 99.1 Press Release dated February 23, 2010.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused

this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

ValueVision Media, Inc.

|

|

|

February 23, 2010

|

By:

|

/s/ Nathan E. Fagre

|

|

|

|

|

Name:

|

Nathan E. Fagre

|

|

|

|

|

Title:

|

SVP and General Counsel

|

|

|

|

5

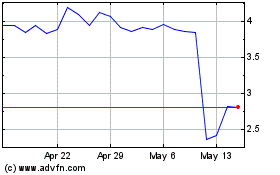

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

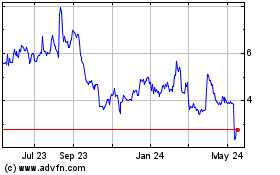

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024