Current Report Filing (8-k)

December 15 2022 - 3:33PM

Edgar (US Regulatory)

0000036377

false

0000036377

2022-12-14

2022-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 14, 2022

FIRST HAWAIIAN, INC.

(Exact Name of Registrant as Specified in Its

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| 001-14585 |

|

99-0156159 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

| 999 Bishop St.,29th Floor |

|

|

| Honolulu,

Hawaii |

|

96813 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(808)

525-7000

(Registrant’s Telephone

Number, including Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol |

|

Name of each exchange on which registered: |

| Common

Stock, par value $0.01 per share |

|

FHB |

|

NASDAQ

Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(c) On December 14, 2022,

First Hawaiian, Inc. (the “Company”) announced that the Board of Directors appointed James M. Moses to serve as Vice Chairman

and Chief Financial Officer of the Company, effective January 3, 2023. Mr. Moses will replace Ralph M. Mesick, who has been serving as

Interim Chief Financial Officer on a temporary basis and will continue to serve as Vice Chairman and Chief Risk Officer.

Mr. Moses, age 46, joins the Company from First

Bank, St. Louis, Missouri, where he served as Executive Vice President and Chief Financial Officer since 2021. Prior to joining First

Bank, Mr. Moses served as Executive Vice President and Chief Financial Officer of Berkshire Hills Bancorp, Boston, Massachusetts, from

2016 to 2021. From 2011 to 2016, he served as Senior Vice President – Manager, Asset Liability Management of Webster Bank in Waterbury,

Connecticut. Mr. Moses also has experience managing multiple product lines and serving as Head Mortgage Trader at M&T Bank in Buffalo,

New York, where he was employed from 2007 to 2011.

In connection with his appointment, Mr. Moses entered

into an offer letter with the Company on December 14, 2022. Mr. Moses’s offer letter provides for a base salary of $475,000 and

an annual bonus equal to 75% of his base salary for 2023, subject to the achievement of performance goals, and based on a target of 75%

of base salary for future years. Mr. Moses will be eligible to participate in the Company’s Long-Term Incentive Plan and will be

granted an award valued at $670,000 for the 2023-2025 performance period, in the form of performance share units and restricted stock

units. In addition, Mr. Moses will be entitled to a one-time sign-on cash award of $700,000 upon joining the Company, of which $500,000

will be paid on the first regularly scheduled pay date following the commencement of employment. The remaining $200,000 will be paid in

the form of restricted stock units that vest 50% on the first anniversary of his employment start date and 50% on the second anniversary

of his employment start date. Mr. Moses will be entitled to a relocation allowance of $100,000, which will be grossed up, will receive

an annual $7,200 automobile allowance and will be eligible to participate in the Company’s benefit plans, including the Company’s

Amended and Restated Executive Severance Plan.

A copy of the Company’s press release announcing

Mr. Moses’s appointment is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FIRST HAWAIIAN, INC.

|

| |

|

| |

|

|

| Date: December 15, 2022 |

By: |

/s/ Robert S. Harrison |

| |

Name: |

Robert S. Harrison |

| |

Title: |

Chairman of the Board, President and Chief Executive Officer |

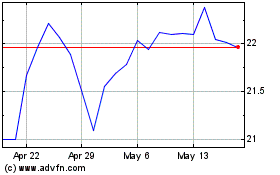

First Hawaiian (NASDAQ:FHB)

Historical Stock Chart

From Jan 2025 to Feb 2025

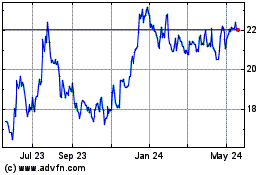

First Hawaiian (NASDAQ:FHB)

Historical Stock Chart

From Feb 2024 to Feb 2025