--Q4 Net Sales, Gross Margin and Adjusted

EBITDA at Upper End of Expectations, Driven by Strong DTC Growth

and Continued Operational Improvement--

Funko, Inc. (Nasdaq: FNKO), a leading pop culture lifestyle

brand, today reported its consolidated financial results for the

fourth quarter and full year ended December 31, 2023. The company

also provided financial guidance for the 2024 first quarter and

full year.

Fourth-Quarter Financial Results Summary: 2023 vs

2022

- Net sales were $291.2 million versus $333.0 million

- Gross profit was $109.4 million, equal to gross margin of

37.6%, compared with $94.3 million, equal to gross margin of

28.3%

- SG&A expenses were $97.4 million, which included $8.0

million of non-recurring charges primarily related to fair market

value adjustments for assets held for sale. This compares with

$139.2 million, which included $32.5 million of non-recurring

charges related to the write down of an enterprise resource

planning system, for the fourth quarter of 2022

- Net loss was $10.8 million, or $0.21 per share, versus $42.2

million, or $0.89 per diluted share

- Adjusted net income* was $0.5 million, or $0.01 per diluted

share, versus adjusted net loss of $17.9 million, or $0.35 per

share

- Adjusted EBITDA* was $23.5 million versus negative adjusted

EBITDA* of $6.3 million

Full-Year Financial Results Summary: 2023 vs 2022

- Net sales were $1.1 billion versus $1.3 billion

- Gross profit was $333.0 million, equal to gross margin of

30.4%, which included $39.0 million of non-recurring charges

related to the disposal of excess inventory and finished and

unfinished goods held at offshore factories. This compares with

$434.0 million, equal to gross margin of 32.8%

- SG&A expenses were $377.1 million, which included $20.7

million of non-recurring charges primarily related to the

termination of a lease agreement, fair market value adjustments for

assets held for sale and severance and related charges. This

compares with $398.3 million for the 2022 full year, which included

$32.5 million of non-recurring charges related to the write-down of

an enterprise resource planning system

- Net loss was $154.1 million, or $3.19 per share, compared with

$8.0 million, or $0.18 per share

- Adjusted net loss* was $45.4 million, or $0.87 per share,

versus adjusted net income* of $29.6 million, or $0.57 per diluted

share

- Adjusted EBITDA* was $27.2 million compared with $97.4

million

“In 2023, we implemented a comprehensive plan to significantly

reduce costs, improve operational efficiencies and focus on our

core product offerings,” said Michael Lunsford, Funko’s Interim

Chief Executive Officer. “The major elements of that plan, which

addressed the company's inventory issues, unprofitable product

lines and SKUs, workforce size, and several other factors, were

successfully completed, and we believe our company is now on a

significantly more solid foundation upon which we intend to build

and grow.

“For the 2023 fourth quarter, net sales and adjusted EBITDA were

at the upper end of our guidance range, fueled in part by growth in

our direct-to-consumer (DTC) business, which accounted for 26

percent of our revenue and increased nearly 30 percent compared

with the same quarter of the prior year. Gross margin of 38 percent

was the highest of any quarter in 2023.

“Turning to our balance sheet, we substantially lowered our

inventory levels to $119 million at December 31, 2023 from $246

million at the end of last year and $162 million at September 30,

2023. We also paid down our debt by $26 million in the fourth

quarter and used the proceeds from a transaction related to our

Games business to further reduce our debt in the first quarter of

2024.

“Looking ahead, we face a softer content schedule following the

recent Hollywood strikes and uncertainty around shipping costs

caused by the Red Sea situation. Despite these headwinds, we expect

our bottom line to significantly improve in 2024 compared with

2023. Our belief is based on the actions we are taking to, among

other things, further expand our DTC business and increase sales of

Pop! Yourself and limited-edition products – areas we control and

can grow profitably.”

Leadership Update

The company also announced today that Steve Nave, Funko’s Chief

Financial Officer (CFO) and Chief Operating Officer, is resigning

effective March 15, 2024. Yves LePendeven, the company’s Deputy

CFO, will serve as Acting CFO as of the same date.

“Steve joined us a year ago to help with our cost reduction and

operational improvement plan,” said Lunsford. “We have made

significant progress against that plan and thank Steve for his

contributions. We wish Steve success in his future endeavors.

“I have worked with Yves for several years now, as both a board

member and as the interim CEO. I have complete faith in Yves to

lead our Finance and Accounting functions. We believe we now have

in place a strong, lean, aligned senior leadership team to support

the arrival of a new CEO and the growth of Funko.”

Fourth Quarter 2023 Net Sales by Category and

Geography

The tables below show the breakdown of net sales on a brand

category and geographical basis (in thousands):

Three Months Ended December

31,

Period Over Period

Change

2023

2022

Dollar

Percentage

Net sales by product brand:

Core Collectibles

$

212,776

$

243,340

$

(30,564

)

(12.6

)%

Loungefly Branded Products

54,908

73,346

(18,438

)

(25.1

)%

Other

23,552

16,354

7,198

44.0

%

Total net sales

$

291,236

$

333,040

$

(41,804

)

(12.6

)%

Three Months Ended December

31,

Period Over Period

Change

2023

2022

Dollar

Percentage

Net sales by geography:

United States

$

197,368

$

240,647

$

(43,279

)

(18.0

)%

Europe

78,138

61,869

16,269

26.3

%

Other International

15,730

30,524

(14,794

)

(48.5

)%

Total net sales

$

291,236

$

333,040

$

(41,804

)

(12.6

)%

Balance Sheet Highlights - At December 31, 2023 vs December

31, 2022

- Total cash and cash equivalents were $36.5 million at December

31, 2023 versus $19.2 million at December 31, 2022

- Inventories were $119.5 million at December 31, 2023 versus

$246.4 million at December 31, 2022

- Total debt was $273.6 million at December 31, 2023 versus

$245.8 million at December 31, 2022. Total debt includes the amount

outstanding under the company's term loan facility, net of

unamortized discounts, revolving line of credit and the company's

equipment finance loan

Outlook for 2024

Based on its current outlook, the company provided its 2024

full-year outlook and 2024 first-quarter guidance, as follows:

Current Outlook

2024 Full Year

Net Sales

$1.047 billion to $1.103 billion

Adjusted EBITDA*

$65 million to $85 million

2024 First Quarter

Net sales

$214 million to $227 million

Gross margin %

~37%

SG&A expense, in dollars

$87 million to $88 million

Adjusted net loss*

$17 million to $13 million

Adjusted net loss per share*

$0.32 to $0.24

Adjusted EBITDA*

$0 million to $5 million

*Adjusted net loss, adjusted net loss per diluted share and

adjusted EBITDA are non-GAAP financial measures. For a

reconciliation of historical adjusted net loss, adjusted loss per

diluted share, and adjusted EBITDA, to the most directly comparable

U.S. GAAP financial measures, please refer to the “Non-GAAP

Financial Measures” section of this press release. A reconciliation

of adjusted net loss, adjusted net loss per diluted share and

adjusted EBITDA outlook to the corresponding GAAP measure on a

forward-looking basis cannot be provided without unreasonable

efforts, as we are unable to provide reconciling information with

respect to certain items. However, for the first quarter of 2024

the company expects equity-based compensation of approximately $4

million, depreciation and amortization of approximately $16 million

and interest expense of approximately $6 million. For the full year

2024, the company expects equity-based compensation of

approximately $15 million, depreciation and amortization of

approximately $64 million and interest expense of approximately $18

million, each of which is a reconciling item to net loss. See "Use

of Non-GAAP Financial Measures" and the attached reconciliations

for more information.

Conference Call and Webcast

The company will host a conference call at 4:30 p.m. Eastern

Time (1:30 p.m. Pacific Time) today, March 7, 2024, to further

discuss its fourth-quarter and full-year results and business

update. A live webcast, presentation materials and a replay of the

event will be available on the Investor Relations section on the

Company’s website at investor.funko.com. The replay of the webcast

will be available for one year.

Use of Non-GAAP Financial Measures

This release contains references to non-GAAP financial measures,

including adjusted net income (loss), including per share amounts,

adjusted EBITDA, and adjusted EBITDA margin, which are financial

measures that are not prepared in conformity with United States

generally accepted accounting principles (U.S. GAAP). Management

uses these measures internally for evaluating its operating

performance, for planning purposes, including the preparation of

our annual operating budget and financials projections, and to

assess incentive compensation for our employees, and to evaluate

our capacity to expand our business. In addition, our senior

secured credit facilities use adjusted EBITDA to measure our

compliance with covenants such as senior leverage ratio. The

company's management believes that the presentation of non-GAAP

financial measures provides useful supplementary information

regarding operational performance, because it enhances an

investor's overall understanding of the financial results for the

company's core business. Additionally, it provides a basis for the

comparison of the financial results for the company's core business

between current, past and future periods as they remove the impact

of items not directly resulting from our core operations. The

company also believes that including Adjusted EBITDA and the other

non-GAAP financial measures presented in this release is

appropriate to provide additional information to investors and help

to compare against other companies in our industry. Non-GAAP

financial measures have limitations as analytical tools and should

be considered only as a supplement to, and not as a substitute for

or as a superior measure to, financial measures prepared in

accordance with U.S. GAAP. We caution investors that amounts

presented in accordance with our definitions of adjusted net income

(loss), including per share amounts, adjusted EBITDA and adjusted

EBITDA margin may not be comparable to similar measures disclosed

by our competitors, because not all companies and analysts

calculate these measures in the same manner.

Detailed reconciliations of non-GAAP financial measures to the

most directly comparable GAAP financial measures are included in

the financial tables following this release.

About Funko

Headquartered in Everett, Washington, Funko is a leading pop

culture lifestyle brand. Funko designs, sources and distributes

licensed pop culture products across multiple categories, including

vinyl figures, action toys, plush, apparel, housewares and

accessories for consumers who seek tangible ways to connect with

their favorite pop culture brands and characters. Learn more at

www.funko.com, and follow us on Twitter (@OriginalFunko) and

Instagram (@OriginalFunko).

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including statements regarding our

anticipated financial results and financial position, the

underlying trends in our business and the retail industry,

including ongoing impacts from the Hollywood strikes and

uncertainty relating to the situation in the Red Sea, our potential

for growth, expectations regarding annualized cost savings and the

impact of restructuring initiatives; and our strategic growth

priorities. These forward-looking statements are based on

management’s current expectations. These statements are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements, including, but not

limited to, the following: our ability to execute our business

strategy; our ability to manage our inventories and growth; our

ability to maintain and realize the full value of our license

agreements; impacts from economic downturns; changes in the retail

industry and markets for our consumer products; our ability to

maintain our relationships with retail customers and distributors;

risks related to the impact of COVID-19 on our business, financial

results and financial condition; our ability to compete

effectively; fluctuations in our gross margin; our dependence on

content development and creation by third parties; the ongoing

level of popularity of our products with consumers; our ability to

develop and introduce products in a timely and cost-effective

manner; our ability to obtain, maintain and protect our

intellectual property rights or those of our licensors; potential

violations of the intellectual property rights of others; risks

associated with counterfeit versions of our products; our ability

to attract and retain qualified employees and maintain our

corporate culture; our use of third-party manufacturing; risks

associated with climate change; increased attention to

sustainability and environmental, social and governance

initiatives; geographic concentration of our operations; risks

associated with our international operations; changes in effective

tax rates or tax law; our dependence on vendors and outsourcers;

risks relating to government regulation; risks relating to

litigation, including products liability claims and securities

class action litigation; any failure to successfully integrate or

realize the anticipated benefits of acquisitions or investments;

future development and acceptance of blockchain networks; risks

associated with receiving payments in digital assets; risk

resulting from our e-commerce business and social media presence;

our ability to successfully operate our information systems and

implement new technology; risks relating to our indebtedness,

including our ability to comply with financial and negative

covenants under our Credit Agreement, as amended; our ability to

secure additional financing on favorable terms or at all; the

potential for our or our third party providers’ electronic data or

the electronic data of our customers to be compromised; the

influence of our significant stockholder, TCG, and the possibility

that TCG’s interests may conflict with the interests of our other

stockholders; risks relating to our organizational structure;

volatility in the price of our Class A common stock; and risks

associated with our internal control over financial reporting.

These and other important factors discussed under the caption “Risk

Factors” in our annual report on Form 10-K for the year ended

December 31, 2023 and our other filings with the Securities and

Exchange Commission could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent

management’s estimates as of the date of this press release. While

we may elect to update such forward-looking statements at some

point in the future, we disclaim any obligation to do so, even if

subsequent events cause our views to change. These forward-looking

statements should not be relied upon as representing our views as

of any date subsequent to the date of this press release.

Funko, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

(in thousands, except per

share data)

Net sales

$

291,236

$

333,040

$

1,096,086

$

1,322,706

Cost of sales (exclusive of depreciation

and amortization shown separately below)

181,827

238,711

763,085

888,685

Selling, general, and administrative

expenses

97,380

139,229

377,065

398,272

Depreciation and amortization

15,429

13,160

59,763

47,669

Total operating expenses

294,636

391,100

1,199,913

1,334,626

(Loss) income from operations

(3,400

)

(58,060

)

(103,827

)

(11,920

)

Interest expense, net

7,419

4,480

27,970

10,334

Loss on extinguishment of debt

—

—

494

—

Gain on tax receivable agreement liability

adjustment

(603

)

—

(100,223

)

—

Other (income) expense, net

(646

)

(971

)

(127

)

787

(Loss) income before income taxes

(9,570

)

(61,569

)

(31,941

)

(23,041

)

Income tax expense (benefit)

1,638

(14,869

)

132,497

(17,801

)

Net (loss) income

(11,208

)

(46,700

)

(164,438

)

(5,240

)

Less: net (loss) income attributable to

non-controlling interests

(447

)

(4,481

)

(10,359

)

2,795

Net (loss) income attributable to Funko,

Inc.

$

(10,761

)

$

(42,219

)

$

(154,079

)

$

(8,035

)

(Loss) earnings per share of Class A

common stock:

Basic

$

(0.21

)

$

(0.89

)

$

(3.19

)

$

(0.18

)

Diluted

$

(0.21

)

$

(0.89

)

$

(3.19

)

$

(0.18

)

Weighted average shares of Class A common

stock outstanding:

Basic

50,384

47,179

48,332

44,555

Diluted

50,384

47,179

48,332

44,555

Funko, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

December 31,

2023

2022

(in thousands, except per

share data)

Assets

Current assets:

Cash and cash equivalents

$

36,453

$

19,200

Accounts receivable, net

130,831

167,895

Inventory, net

119,458

246,429

Prepaid expenses and other current

assets

56,134

39,648

Total current assets

342,876

473,172

Property and equipment, net

91,335

102,232

Operating lease right-of-use assets

61,499

71,072

Goodwill

133,795

131,380

Intangible assets, net

167,388

181,284

Deferred tax asset, net of valuation

allowance

—

123,893

Other assets

7,752

8,112

Total assets

$

804,645

$

1,091,145

Liabilities and Stockholders'

Equity

Current liabilities:

Line of credit

$

120,500

$

70,000

Current portion long-term debt, net of

unamortized discount

22,072

22,041

Current portion of operating lease

liabilities

17,486

18,904

Accounts payable

52,919

67,651

Income taxes payable

986

871

Accrued royalties

54,375

69,098

Accrued expenses and other current

liabilities

90,494

112,832

Total current liabilities

358,832

361,397

Long-term debt, net of unamortized

discount

130,986

153,778

Operating lease liabilities, net of

current portion

71,309

82,356

Deferred tax liability

402

382

Liabilities under tax receivable

agreement, net of current portion

—

99,620

Other long-term liabilities

5,076

3,923

Commitments and contingencies

Stockholders' equity:

Class A common stock, par value $0.0001

per share, 200,000 shares authorized; 50,549 shares and 47,192

shares issued and outstanding as of December 31, 2023 and 2022,

respectively

5

5

Class B common stock, par value $0.0001

per share, 50,000 shares authorized; 2,277 shares and 3,293 shares

issued and outstanding as of December 31, 2023 and 2022,

respectively

—

—

Additional paid-in-capital

326,180

310,807

Accumulated other comprehensive loss

(180

)

(2,603

)

(Accumulated deficit) retained

earnings

(94,064

)

60,015

Total stockholders' equity attributable to

Funko, Inc.

231,941

368,224

Non-controlling interests

6,099

21,465

Total stockholders' equity

238,040

389,689

Total liabilities and stockholders'

equity

$

804,645

$

1,091,145

Funko, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

Year Ended December

31,

2023

2022

2021

(in thousands)

Operating Activities

Net (loss) income

$

(164,438

)

$

(5,240

)

$

67,854

Adjustments to reconcile net income to net

cash (used in) provided by operating activities:

Depreciation, amortization and other

57,389

47,919

40,056

Equity-based compensation

10,534

16,591

12,994

Amortization of debt issuance costs and

debt discounts

1,274

902

1,118

Loss on debt extinguishment

494

—

675

Gain on tax receivable agreement liability

adjustment

(100,223

)

—

—

Deferred tax expense (benefit)

123,124

(17,414

)

(361

)

Other

4,090

5,244

1,403

Changes in operating assets and

liabilities, net of amounts acquired:

Accounts receivable, net

40,513

19,075

(56,648

)

Inventory

122,479

(82,214

)

(107,166

)

Prepaid expenses and other assets

3,242

(7,263

)

3,700

Accounts payable

(17,968

)

11,043

26,933

Income taxes payable

75

(15,018

)

15,585

Accrued royalties

(14,723

)

9,082

17,633

Accrued expenses and other liabilities

(34,927

)

(22,841

)

63,586

Net cash provided by (used in) operating

activities

30,935

(40,134

)

87,362

Investing Activities

Purchase of property and equipment

$

(35,131

)

$

(59,148

)

$

(27,759

)

Acquisitions of business and intangible

assets, net of cash acquired

(5,364

)

(19,479

)

199

Other

699

562

179

Net cash used in investing activities

(39,796

)

(78,065

)

(27,381

)

Financing Activities

Borrowings on line of credit

$

71,000

$

120,000

$

—

Payments on line of credit

(20,500

)

(50,000

)

—

Debt issuance costs

(1,957

)

(405

)

(1,055

)

Proceeds from long-term debt, net

—

20,000

180,000

Payment of long-term debt

(22,581

)

(18,000

)

(198,375

)

Contingent consideration

—

—

(2,000

)

Distributions to continuing equity

owners

(1,118

)

(10,710

)

(9,277

)

Payments under tax receivable

agreement

(4

)

(7,718

)

(1,715

)

Proceeds from exercise of equity-based

options

756

1,472

3,794

Net cash provided by (used in) financing

activities

25,596

54,639

(28,628

)

Effect of exchange rates on cash and cash

equivalents

518

(797

)

(51

)

Net change in cash and cash

equivalents

17,253

(64,357

)

31,302

Cash and cash equivalents at beginning of

period

19,200

83,557

52,255

Cash and cash equivalents at end of

period

$

36,453

$

19,200

$

83,557

Supplemental Cash Flow

Information

Cash paid for interest

$

24,635

$

8,856

$

5,679

Income tax payments

1,059

22,363

1,462

Establishment of liabilities under tax

receivable agreement

—

30,034

20,691

Issuance of equity instruments for

acquisitions

—

1,487

—

Tenant allowance

—

17,236

—

The following tables reconcile the Non-GAAP Financial Measures

to the most directly comparable U.S. GAAP financial performance

measure, which is net income (loss), for the periods presented:

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

(in thousands, except per

share data)

Net (loss) income attributable to Funko,

Inc.

$

(10,761

)

$

(42,219

)

$

(154,079

)

$

(8,035

)

Reallocation of net (loss) income

attributable to non-controlling interests from the assumed exchange

of common units of FAH, LLC for Class A common stock (1)

(447

)

(4,481

)

(10,359

)

2,795

Equity-based compensation (2)

3,013

4,592

10,534

16,591

Acquisition transaction costs and other

expenses (3)

7,320

—

14,241

2,850

Certain severance, relocation and related

costs (4)

702

1,572

6,486

9,775

Loss on extinguishment of debt (5)

—

—

494

—

Foreign currency transaction (gain) loss

(6)

(641

)

(4,990

)

854

(3,232

)

Tax receivable agreement liability

adjustments (7)

(603

)

3,987

(100,223

)

3,987

One-time cloud based computing arrangement

abandonment (8)

—

32,492

—

32,492

One-time disposal costs for finished

inventory held at offshore factories (9)

135

—

6,283

—

One-time disposal costs for unfinished

inventory held at offshore factories (10)

—

—

2,404

—

Inventory write-down (11)

254

—

30,338

—

Income tax expense (9)

1,486

(8,890

)

147,630

(27,657

)

Adjusted net income (loss)

$

458

$

(17,937

)

$

(45,397

)

$

29,566

Adjusted net income (loss) margin (13)

0.2

%

(5.4

)%

(4.1

)%

2.2

%

Weighted-average shares of Class A common

stock outstanding-basic

50,384

47,179

48,332

44,555

Equity-based compensation awards and

common units of FAH, LLC that are convertible into Class A common

stock

2,808

4,335

4,021

6,967

Adjusted weighted-average shares of Class

A stock outstanding - diluted

53,192

51,514

52,353

51,522

Adjusted earnings (loss) per diluted

share

$

0.01

$

(0.35

)

$

(0.87

)

$

0.57

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

(in thousands)

Net (loss) income

$

(11,208

)

$

(46,700

)

$

(164,438

)

$

(5,240

)

Interest expense, net

7,419

4,480

27,970

10,334

Income tax expense

1,638

(14,869

)

132,497

(17,801

)

Depreciation and amortization

15,429

13,160

59,763

47,669

EBITDA

$

13,278

$

(43,929

)

$

55,792

$

34,962

Adjustments:

Equity-based compensation (2)

3,013

4,592

10,534

16,591

Acquisition transaction costs and other

expenses (3)

7,320

—

14,241

2,850

Certain severance, relocation and related

costs (4)

702

1,572

6,486

9,775

Loss on extinguishment of debt (5)

—

—

494

—

Foreign currency transaction (gain) loss

(6)

(641

)

(4,990

)

854

(3,232

)

Tax receivable agreement liability

adjustments (7)

(603

)

3,987

(100,223

)

3,987

One-time cloud based computing arrangement

abandonment (8)

—

32,492

—

32,492

One-time disposal costs for finished

inventory held at offshore factories (9)

135

—

6,283

—

One-time disposal costs for unfinished

inventory held at offshore factories (10)

—

—

2,404

—

Inventory write-down (11)

254

—

30,338

—

Adjusted EBITDA

$

23,458

$

(6,276

)

$

27,203

$

97,425

Adjusted EBITDA margin (14)

8.1

%

(1.9

)%

2.5

%

7.4

%

(1)

Represents the reallocation of net income

attributable to non-controlling interests from the assumed exchange

of common units of FAH, LLC in periods in which income was

attributable to non-controlling interests.

(2)

Represents non-cash charges related to

equity-based compensation programs, which vary from period to

period depending on timing of awards.

(3)

For the three months ended December 31,

2023, includes fair market value adjustments for assets held for

sale. For the year ended December 31, 2023, includes costs related

to the termination of a lease agreement and related expenses, fair

market value adjustments for assets held for sale, partially offset

by acquisition-related benefits. For the year ended December 31,

2022, includes acquisition-related costs related to investment

banking and due diligence fees.

(4)

Represents certain severance, relocation

and related costs. For the three months ended December 31, 2023,

includes residual charges for severance and benefit costs for

reductions-in-force. For the year ended December 31, 2023, includes

charges to remove leasehold improvements and return multiple

Washington-based warehouses, and charges related to severance and

benefit costs for reductions-in-force. For the three months ended

December 31, 2022, includes charges related to severance for the

transition of management personnel. For the year ended December 31,

2022, includes charges related to residual one-time relocation and

severance costs for U.S. warehouse personnel in connection with the

opening of a warehouse and distribution facility in Buckeye,

Arizona.

(5)

Represents write-off of unamortized debt

financing fees for the year ended December 31, 2023.

(6)

Represents both unrealized and realized

foreign currency losses (gains) on transactions other than in U.S.

dollars.

(7)

Represents recognized adjustments to the

tax receivable agreement liability. For the year ended December 31,

2023, reduction of the tax receivable agreement liability as a

result of recognizing a full valuation allowance of the Company's

deferred tax assets and anticipated inability to realize future tax

benefits.

(8)

Represents abandoned cloud computing

arrangement charge related to the enterprise resource planning

project for the three months and year ended December 31, 2022.

(9)

Represents one-time disposal costs related

to unfinished goods held at offshore factories for the year ended

December 31, 2023.

(10)

Represents one-time disposal costs related

to finished goods held at offshore factories primarily due to

customer order cancellations for the year ended December 31, 2023.

Incremental charge during the three months ended December 31, 2023

were related to a true-up of original estimate of third-party

destruction costs.

(11)

Represents an inventory write-down,

outside of normal business operations, to improve U.S. warehouse

operational efficiency for the year ended December 31, 2023.

Incremental charge during the three months ended December 31, 2023

were related to a true-up of original estimate of third-party

destruction costs.

(12)

Represents the income tax expense effect

of the above adjustments. This adjustment uses an effective tax

rate of 25% for the years ended December 31, 2023 and 2022. For the

year ended December 31, 2023, this also includes $123.2 million

recognized valuation allowance on the Company’s deferred tax

assets. For the year ended December 31, 2022, this also includes

the $11.0 million discrete benefit from the release of a valuation

allowance on the outside basis deferred tax asset.

(13)

Adjusted net income (loss) margin is

calculated as Adjusted net income (loss) as a percentage of net

sales.

(14)

Adjusted EBITDA margin is calculated as

Adjusted EBITDA as a percentage of net sales.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240307519602/en/

Investor Relations: investorrelations@funko.com

Media: pr@funko.com

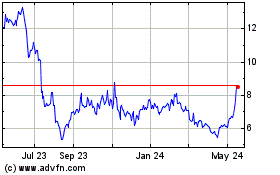

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Dec 2024 to Jan 2025

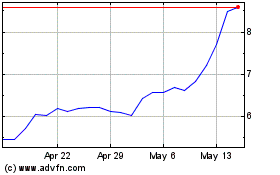

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Jan 2024 to Jan 2025