AGT Food and Ingredients Inc. (“

AGT”) is pleased

to announce the sale of all shares of AGT’s shortline rail and bulk

handling infrastructure, comprising Mobil Grain Ltd.,

(“

MobilGrain”) to GCM Grosvenor (

NASDAQ:

GCMG), a global alternative asset management firm, through

the firm’s Infrastructure Advantage Strategy. Financial terms and

details of the sale and subsequent agreement have not been

disclosed. Northborne Partners acted as the sole lead advisor to

AGT on the transaction.

The sale includes MobilGrain and its operating

subsidiaries: Last Mountain Rail, with 140 kms (87 miles) running

from the Regina Plains to Central Saskatchewan, including 160 kms

(100 miles) of running rights on CN; Big Sky Rail, with 431 kms

(258 miles) running from Central Saskatchewan through West Central

Saskatchewan; MobilEx Terminal Ltd., a port and loading facility

for grain and potash located in Thunder Bay, Ontario; and

Intermobil, a privately-operated, state-of-the-art intermodal

terminal located in Regina, SK, featuring CN service to the

Atlantic, Pacific and Gulf Coasts and CN’s intermodal terminals.

Bulk loading infrastructure includes Saskatchewan facilities in

Condie, Aylesbury, Delisle, Dinsmore, Lucky Lake, Beechy, Elrose,

Kyle, Eston and Laporte for the receiving of grains, canola and

pulses from farmers in the region.

The assets included in the sale of shares to GCM

Grosvenor are critical infrastructure for the growth of the

Saskatchewan agricultural sector, with transportation of

agri-products from the Regina Plains, West Central and Central

Saskatchewan regions, an area that is one of the most important

grain, canola and pulse growing regions of the world. This

infrastructure connects to CN main rail lines, moving Saskatchewan

agri-products to coastal ports and markets around the globe. To

ensure that the rail and bulk infrastructure included in this sale

continues to grow and improve for producers and communities along

the line and corridor, AGT has signed a 20-year agreement with

MobilGrain to continue to utilize this infrastructure for its

global origination and supply chain programs for export, providing

Saskatchewan farmers options for marketing their grains, canola and

pulses to world markets through this critical and unique collection

of community-based assets.

“AGT is thrilled to enter this partnership with

GCM Grosvenor, a key infrastructure investor who wants to hold the

infrastructure for the long term, improve and grow it to build on

the work that MobilGrain and AGT have done over the past two

decades operating these assets. With the planned Lake Diefenbaker

Irrigation Project adding growth to the already strong Regina

Plains, West Central and Central growing regions, there are great

opportunities ahead for all involved, including GCM Grosvenor, AGT,

CN and farmers and producers who depend on this rail service. This

sale returns significant capital to AGT, which presently generates

over $3 billion in revenue annually. We will continue building on

the strength of our partnership with Fairfax Financial Holdings

Ltd. in creating a global agriculture growth story, including

expanding our global packaged foods business. The long-term

agreement with GCM Grosvenor and MobilGrain means AGT will remain a

mainstay in the communities along the railway in which we operate

today,” said Murad Al-Katib, President and CEO of AGT.

“This transaction underscores Saskatchewan’s

essential role in the global economy as a key producer of critical

minerals and agricultural products. Integrating MobilGrain’s

shortline rail with CN’s network creates significant growth

potential, while Intermobil and MobilEx terminals will continue

supporting agricultural and potash exports. In line with GCM

Grosvenor’s responsible contracting principles, all employees at

these facilities will remain with MobilGrain. We look forward to

supporting Kent Affleck and his team’s growth plans,” said Matthew

Rinklin, Managing Director, Infrastructure at GCM Grosvenor. “In

addition, partnering with Bluejay Capital Partners, whose

transportation and shortline rail expertise is vital, will further

strengthen MobilGrain’s future success.”

“CN is pleased with the long and successful

partnership with AGT and MobilGrain in this important Saskatchewan

shortline railway corridor. We look forward to building on this

successful collaboration to grow our business by working with GCM

Grosvenor and MobilGrain to further improve first-mile service, and

to bring more of Saskatchewan’s potash and agricultural products to

the world,” said Remi G. Lalonde, Executive Vice-President and

Chief Commercial Officer at CN.

The transaction is subject to regulatory

approvals and customary closing conditions and is expected to close

in late 2024 or early 2025.

About AGT Food and Ingredients Inc.

AGT Food and Ingredients Inc. (AGT Foods),

majority owned by Fairfax Financial Holdings Limited, is a

Saskatchewan-based global leader in plant-based proteins and

value-added processing of pulses, grains, staple foods and

ingredients for export and domestic markets. AGT Foods was founded

on the principle “From Producer to the World”, buying pulses,

grains, oilseeds and specialty crops from farmers around its

facilities and offices in Canada, Türkiye, the U.S., Australia,

South Africa, India, China and Europe and processing and exporting

its pulses, milled durum wheat and canola products, pulse

ingredient flours, starches, fibres, proteins and extruded products

and retail packaged foods to customers in over 120 countries around

the world. AGT Foods operates a strong network of grain origination

and processing facilities in the heart of Saskatchewan’s canola,

pulses and wheat growing areas. More information about AGT Foods is

available at www.agtfoods.com.

About GCM GrosvenorGCM

Grosvenor (Nasdaq: GCMG) is a global alternative asset management

solutions provider with approximately $80 billion in assets under

management across private equity, infrastructure, real estate,

credit, and absolute return investment strategies. The firm has

specialized in alternatives for more than 50 years and is dedicated

to delivering value for clients by leveraging its cross-asset class

and flexible investment platform. GCM Grosvenor’s experienced team

of approximately 550 professionals serves a global client base of

institutional and individual investors. The firm is headquartered

in Chicago, with offices in New York, Toronto, London, Frankfurt,

Tokyo, Hong Kong, Seoul and Sydney. For more information, visit:

gcmgrosvenor.com.

About Bluejay

Capital Bluejay Capital (“Bluejay”) is an

operationally focused private equity firm investing exclusively in

transportation and logistics businesses. The team has more than 120

years of combined operating experience in the sector and is

comprised of industry experts with a strong track record of growth

and value creation. Bluejay brings deep railroad industry knowledge

and significant experience in driving transformational growth in

this highly specialized sector. Learn more about Bluejay Capital at

www.bluejay-capital.com.

About CN CN powers the economy

by safely transporting more than 300 million tons of natural

resources, manufactured products, and finished goods throughout

North America every year for its customers. With its nearly

20,000-mile rail network and related transportation services, CN

connects Canada’s Eastern and Western coasts with the U.S. Midwest

and the Gulf of Mexico, contributing to sustainable trade and the

prosperity of the communities in which it operates since 1919.

For further information:Omer

Al-KatibManaging Director, Corporate

Affairs(306) 525-4490corporateaffairs@agtfoods.com

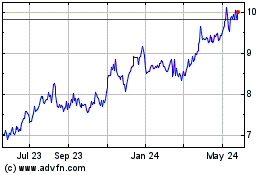

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Dec 2024 to Jan 2025

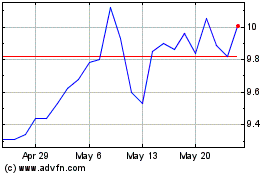

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Jan 2024 to Jan 2025