Axxes Capital Inc. (together with its affiliates, “Axxes”), a

private markets investment firm dedicated to providing wealth

advisors and their clients access to private markets solutions,

today announced that it has launched the Axxes Private Markets Fund

(the “Fund”), a registered interval fund that seeks to provide

accredited investors with a portfolio of direct access

co-investments and secondaries through an investor-friendly vehicle

that can be purchased on a daily basis.

The Axxes Private Markets Fund aims to leverage the

expertise of two established institutional asset managers, GCM

Grosvenor (“GCM”) and Fisher Lynch Capital (“FLC”), to identify and

comprehensively evaluate investment opportunities. Their extensive

GP sponsor relationships will help ensure that the Fund will have

consistent access to high-quality private equity investments.

Axxes, through its experienced investment team, will seek to build

a portfolio of high quality private equity investments presented by

GCM and FLC.

The Fund’s investment program is managed by Chief Executive

Officer Joseph DaGrosa, Jr., a seasoned private equity investor

with over 30 years of experience across sectors and industries, and

Chief Investment Officer (“CIO”) Ray Joseph, a veteran portfolio

manager and institutional allocator who most recently served as the

CIO for the $31 billion Los Angeles Fire and Police

Pensions. “The launch of the Axxes Private Markets Fund

is an important step in our mission to bring private market

opportunities to an expanded group of investors who, for too long,

have been shut out of this important asset class,” said Mr.

DaGrosa. “Developed to address the limitations inherent to the

traditional 60/40 portfolio, the Fund offers wealth advisors and

their clients a private investment solution designed to better

diversify portfolios while also seeking to achieve higher overall

risk-adjusted returns. Alongside GCM Grosvenor and Fisher Lynch

Capital, we look forward to providing accredited investors access

to a portfolio of private equity co-investments and secondaries

typically available only to the largest institutions and the

ultrawealthy.”

The Fund is offered as an SEC-registered evergreen interval fund

with low investment minimums of $25,000, no capital calls,

simplified 1099 tax reporting, liquidity through quarterly

redemptions of 5% of the Fund’s NAV, daily NAV investing, and

multiple share classes available under the tickers AXEAX, AXECX,

and AXEIX. The Fund’s interval fund structure is highly efficient

for wealth advisors and their clients, ultimately eliminating the

complexity and administrative burden of the subscription document

process and avoiding multiple layers of fees. For a copy of the

prospectus, please visit axxesfundsolutions.com.

“We are excited to partner with Axxes Capital to provide an

expanded range of investors with an efficient and cost-effective

way to participate in private markets,” said Brett Fisher, Founder

and Managing Director of Fisher Lynch Capital. “Our deep

relationships and decades of experience working alongside top

private equity firms enable us to access co-investments in what we

view to be the best and most promising deals across geographies and

sectors, and we look forward to providing exposure to the

co-investment market to wealth advisors and their clients through

the Axxes Private Markets Fund.”

“Our team looks forward to launching our partnership with

Axxes,” said Jon Levin, President of GCM Grosvenor. “We believe the

Axxes Private Markets Fund will offer an institutional-quality

private equity product to a broad range of investors. We are

excited to deliver a transformative investment solution through

this initiative.”

After its first closing, the Axxes Markets Fund will be

available through select mutual fund platforms via ticker symbol

and otherwise purchased by subscription agreements for platforms

that prefer them.

For more information, please visit axxescapital.com.

About Axxes CapitalAxxes Capital is a private

markets asset management firm seeking to provide wealth advisors

and their clients access to private investment opportunities

through a series of vehicles and co-investments. Axxes Capital is

looking to be the go-to partner for wealth advisors seeking to

broaden and enhance their clients’ portfolios through private

investments. Discover more about Axxes Capital at

axxescapital.com.

About GCM GrosvenorGCM Grosvenor (Nasdaq: GCMG)

is a global alternative asset management solutions provider with

approximately $79 billion in assets under management across private

equity, infrastructure, real estate, credit, and absolute return

investment strategies. The firm has specialized in alternatives for

more than 50 years and is dedicated to delivering value for clients

by leveraging its cross-asset class and flexible investment

platform. GCM Grosvenor’s experienced team of approximately 540

professionals serves a global client base of institutional and

individual investors. The firm is headquartered in Chicago, with

offices in New York, Toronto, London, Frankfurt, Tokyo, Hong Kong,

Seoul and Sydney. For more information, visit gcmgrosvenor.com.

About Fisher Lynch CapitalFisher Lynch Capital

is a leading independent private equity co-investment firm. FLC was

founded in 2003 with a mission to bring private equity

co-investment solutions to investors who were previously unable to

access the strategy. Today, it is one of the few major private

equity firms with an exclusive focus on co-investing. FLC has grown

to manage over $7.7 billion in investor commitments across multiple

co-investment funds and separate accounts. FLC believes that it is

distinguished by its co-investment focus, its broad set of private

equity sponsor relationships, its robust deal flow, and its

established track record. FLC’s investors include some of the

world’s largest and most sophisticated institutional investors as

well as family offices and individual investors. FLC operates from

three offices in Boston, the San Francisco Bay area, and London.

More information at fisherlynch.com.

Important Information

INVESTORS SHOULD CAREFULLY CONSIDER THE

INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES OF THE FUND

BEFORE INVESTING. THIS AND OTHER IMPORTANT INFORMATION ABOUT THE

FUND IS CONTAINED IN THE FUND’S PROSPECTUS WHICH CAN BE OBTAINED

HERE: AXXESFUNDSOLUTIONS.COM. THE PROSPECTUS

SHOULD BE READ CAREFULLY BEFORE INVESTING.

The fund is suitable only for investors who can

bear the risks associated with the limited liquidity of the Fund

and should be viewed as a long-term investment. The amount of

distributions that the Fund may pay, if any, is

uncertain. The Fund primarily invests in private equity

investments. The securities of private equity funds, as well as the

underlying companies these funds invest in, tend to be illiquid,

and highly speculative. Investing in the Fund’s shares may be

speculative and involves a high degree of risk, including the risks

associated with leverage.

The shares have no history of public trading,

nor is it intended that the shares will be listed on a public

exchange at this time. No secondary market is expected to develop

for the Fund’s shares. Liquidity for the Fund’s shares will be

provided only through quarterly repurchase offers for no less than

5% of Fund’s shares at NAV, and there is no guarantee that an

investor will be able to sell all the shares that the investor

desires to sell in the repurchase offer. Due to these restrictions,

an investor should consider an investment in the Fund to be of

limited liquidity. The securities in which an investment manager

may invest may be among the most junior in an operating company’s

capital structure and, thus, subject to the greatest risk of loss.

Generally, there will be no collateral to protect such investments.

Subject to the limitations and restrictions of the Investment

Company Act of 1940, the Fund may use leverage by borrowing money

to satisfy repurchase requests and for other temporary purposes,

which may increase the Fund’s volatility.

The Fund is distributed by Ultimus Fund Distributors, LLC, an

SEC registered broker-dealer and member of FINRA.

Media Contact:Zach Kouwe/Christian Healy, Dukas

Linden Public Relations1-646-808-3600axxes@dlpr.com

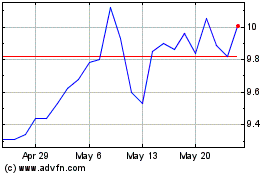

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

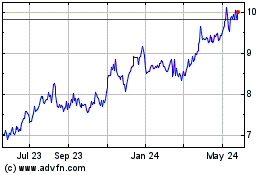

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Dec 2023 to Dec 2024