Gevo, Inc. (NASDAQ: GEVO) (“Gevo”, the “Company”, “we”, “us” or

“our”), a leading developer of cost-effective, renewable

hydrocarbon fuels and chemicals with reduced greenhouse gas

emissions, today reiterated the substantial potential Adjusted

EBITDA1 growth we are targeting in 2025, and provided a business

update. Gevo also announced that it ended the fourth quarter with

cash, cash equivalents and restricted cash of $259.0 million2.

Business Update – Path to Positive Run-Rate Adjusted

EBITDA1

- Gevo North Dakota: Carbon Capture and Sequestration

(“CCS”) and Low-Carbon Ethanol Assets generated $150 million in

revenue in its last fiscal year3

and we expect it to immediately contribute $30 million to

$60 million of Adjusted EBITDA1

annually to Gevo’s carbon business. This facility

in North Dakota, which was recently acquired from Red Trail Energy,

LLC, is one of two low-carbon ethanol plants with operational CCS

that exist today. The site has an operating, fully permitted Class

VI CCS well, which captures over 160,000 tons of biogenic carbon

dioxide annually; generates multiple times that amount in total

carbon abatement; produces approximately 67 million gallons of

low-carbon ethanol, including 2 million gallons of corn fiber

ethanol with an ultra-low carbon intensity; and more than 230,000

tons of low-carbon animal feed and vegetable oil. As a result, this

facility has one of the lowest carbon intensity scores in the

industry, at 19 gCO2e/MJ (from British Columbia) or an estimated 21

gCO2e/MJ (under the Argonne-R&D-GREET model). We note that the

ethanol 45Z tax credit, which takes effect in 2025 and expires in

2027 (unless renewed by legislation), provides a statutory $0.02

per gallon per carbon intensity point below approximately 50

gCO2e/MJ. In addition, we are developing an additional

alcohol-to-jet (“ATJ”) project at this location for further future

growth, leveraging our existing ATJ designs associated with the

ATJ-60 project in South Dakota. The high quality carbon abatement

credits generated at this plant are expected to further catalyze

the development of the emerging market for carbon abatement

products.

- Renewable Natural Gas (“RNG”): We

have achieved excellent operational results that are expected to

improve further in 2025 and generate meaningful Adjusted

EBITDA1. RNG produced in 2024 was 367,000

MMBtu, which was a 17% increase over the prior year, because of a

successful gas upgrade capacity expansion. 2025 production is

expected to further increase to over 400,000 MMBtu as a result of

compressor and reliability upgrades. Our RNG facility has been

approved by the Internal Revenue Service (“IRS”) to generate biogas

45Z tax credits. Based on the expected carbon intensity (“CI”)

score for California LCFS of (339) gCO2e/MJ, a negative number, and

depending on LCFS prices, monetization of the biogas 45Z tax

credit, D3 RIN prices, and price of fossil based natural gas, we

expect Adjusted EBITDA1 of $9 – 18 million in 2025.

- Alcohol-to-Jet 603

(“ATJ-60”) Project: The ATJ-60 project in Lake Preston,

South Dakota continues to proceed towards financial close in

2025. In 2024, we received a conditional commitment for a

loan guarantee with disbursements totaling $1.462 billion

(excluding capitalized interest during construction) from the U.S.

Department of Energy (“DOE”) Loan Programs Office (“LPO”) for our

ATJ-60 project. With capitalized interest during construction, the

DOE loan facility has a borrowing capacity of $1.63 billion. We are

actively engaged with the DOE on the closing process for the

conditional commitment. Our ATJ-60 project is expected to leverage

American agriculture to produce both cost-effective fuels and food,

which are integral for energy and food security of the United

States. We believe our ATJ-60 project integrates seamlessly with

existing energy infrastructure and catalyzes the development of the

rural economy. The project is expected to generate 100 jobs at the

facility, as well as 700 indirect positions in support, plus 1,000

high-paying trades jobs for the three years of construction5. This

project is expected to have regional economic impact greater than

$110 million per year. We are currently engaged with the DOE LPO on

due diligence, definitive documentation, completing the

environmental review process, and satisfaction of all conditions

precedent that are required for financial close. We expect to incur

$40 million of additional spend on ATJ-60 from January 1, 2025,

until financial close. Our cumulative ATJ-60 development spending

is expected to be partially reimbursed at project financial close.

We may invest some or all of the reimbursed funds back into ATJ-60

as equity.

- Verity: We are continuing to grow our Verity business,

delivering our tracking and tracing solution to the market,

expanding the customer base, and achieving revenue. Verity

is a software-as-a-service (“SaaS”) business that achieved its goal

of first customer revenue in 2024 and our grower program has grown

to more than 200,000 acres, which is more than double the acreage

in the program since the second quarter of 2024, with 100% farmer

retention. Verity is a digital measure, report and verify (“MRV”)

software platform for end-to-end traceability of the regenerative

attributes of agricultural and low-carbon fuel products. This

enables producers and customers to measure and track those

attributes and create value in the marketplace, where demand for

regenerative agriculture and fuels is increasing but visibility is

lacking. Verity currently has agreements with seven agriculture

processing plant customers, including five ethanol plants and two

soybean processing facilities, to assist in tracking environmental

attributes of corn, ethanol, animal feed, corn oil, soybean oil and

renewable diesel. We believe Verity can provide substantial value

to growers and processors of a wide variety of agricultural

products globally, in markets valued at billions of dollars.

- Ethanol to Olefins (“ETO”): We continue to advance our

breakthrough, patented ETO technology. Our patented ETO

process is designed to lower capital and operating costs of

drop-in, bio-based hydrocarbon fuels and chemicals from ethanol,

and adds to Gevo’s global portfolio of more than 300 patents, as

well as proprietary processes and know-how concerning processes to

convert carbohydrates to hydrocarbons. In October 2024, we signed a

development agreement and licensed our ETO technology to Axens with

the goal of accelerating the commercialization of our ETO

technology for fuels. The alliance between Axens and Gevo was

further broadened for ATJ commercialization in December 2024 under

a new collaboration agreement. The goal of the alliance is to

leverage the most advantaged technologies, which includes Axens

Jetanol™ technology combined with Gevo’s plant designs,

engineering, know-how, carbon tracking and complete business

system. The alliance brings each partner’s complementary value

propositions, real-world experience, substantially de-risked

technologies, plant integrations, and pre-engineered systems to the

ATJ space. We also extended a joint development agreement with LG

Chem to accelerate the commercialization of bio-based chemicals

using ETO. The global market for drop-in, low-carbon chemicals and

materials is estimated to be $400 – 500 billion per year.

Management Comment

“Our strategic acquisition of Gevo North Dakota is

transformative for our company,” commented Dr. Patrick Gruber,

Gevo’s Chief Executive Officer. “The CCS and low-carbon ethanol

provides us with an immediate pathway to monetize carbon abatement

through the ethanol 45Z tax credit and by selling carbon abatement

in the growing market and the available pore space provides

additional opportunities for CCS expansion.”

“In addition, our RNG business is poised for significant growth

as we secure a permanent CARB LCFS carbon intensity score and

monetize the biogas 45Z tax credit. Taken together, we see a path

to achieving a potential run-rate positive Adjusted EBITDA in 2025,

even before considering our ATJ-60 project. This is based on the

hundreds of thousands of tons of carbon abatement per year that we

are currently generating from this diversified, low-carbon asset

base,” Dr. Gruber continued.

Dr. Gruber added: “We are pleased that our DOE conditional

commitment is progressing towards financial close. We are pleased

to see that biofuels, ethanol, and aviation fuels are listed in

President Trump’s Executive order “Declaring a National Energy

Emergency”. Our ATJ-60 project, targeted for Lake Preston, South

Dakota, is expected to create 100 direct jobs, and more than an

estimated 700 indirect jobs. The project is expected to employ more

than 1,000 construction workers for the three years needed to build

the plant. It would draw corn from more than 230 farmers, and we

would expect to pay farmers a premium for their regenerative

agricultural practices.”

“We never lose sight that we expect that Gevo’s proprietary,

integrated ATJ process can deliver sustainable aviation fuel

(“SAF”) with production cost similar to jet fuel made from crude

oil,” Dr. Gruber said. “But our process can do this while also

eliminating the carbon emission footprint across the whole life

cycle of the fuel. It’s about addressing a growing market need,

where customers will pay for carbon abatement, in addition to the

jet fuel.”

For more information on our business and plans, please refer to

our updated corporate presentation, in the investor section of our

website: www.gevo.com

About Gevo

Gevo is a next-generation diversified energy company committed

to fueling America’s future with cost-effective, drop-in fuels that

contribute to energy security, abate carbon, and strengthen rural

communities to drive economic growth. Gevo’s innovative technology

can be used to make a variety of renewable products, including

synthetic aviation fuel ("SAF"), motor fuels, chemicals, and other

materials that provide U.S.-made solutions. By investing in the

backbone of rural America, Gevo’s business model includes

developing, financing, and operating production facilities that

create jobs and revitalize communities. Gevo owns and operates one

of the largest dairy-based renewable natural gas (“RNG”) facilities

in the United States, turning by-products into clean, reliable

energy. We also operate an ethanol plant with an adjacent carbon

capture and sequestration (“CCS”) facility, further solidifying

America’s leadership in energy innovation. Additionally, Gevo owns

the world’s first production facility for specialty alcohol-to-jet

(“ATJ”) fuels and chemicals. Gevo’s market-driven “pay for

performance” approach regarding carbon and other sustainability

attributes, helps ensure value is delivered to our local economy.

Through its Verity subsidiary, Gevo provides transparency,

accountability, and efficiency in tracking, measuring and verifying

various attributes throughout the supply chain. By strengthening

rural economies, Gevo is working to secure a self-sufficient future

and to make sure value is brought to the market.

For more information, see www.gevo.com.

Forward Looking Statements

This release contains “forward-looking statements” within the

meaning of the federal securities laws. All statements other than

statements of historical fact are forward-looking statements,

including statements related to the expected operation of Gevo

North Dakota, the expected effect of the acquisition on Adjusted

EBITDA, the expected annual Adjusted EBITDA from Gevo North Dakota,

and the future prospects as a combined company, the expected CI

score for our RNG project, the expected annual Adjusted EBITDA from

the RNG project, the financing of the ATJ-60 Project, including the

DOE conditional commitment, the expected economic impact of the

ATJ-60 Project, the expected further spend on ATJ-60, the expected

growth and economics of Verity, the technical advances of the ETO

technology, the capabilities of Axens technologies, and the market

for ETO technologies. These statements relate to analyses and other

information, which are based on forecasts of future results or

events and estimates of amounts not yet determinable. We claim the

protection of The Private Securities Litigation Reform Act of 1995

for all forward-looking statements in this release.

These forward-looking statements are identified by the use of

terms and phrases such as “anticipate,” “assume,” “believe,”

“estimate,” “expect,” “goal,” “intend,” “plan,” “potential,”

“predict,” “project,” “target” and similar terms and phrases or

future or conditional verbs such as “could,” “may,” “should,”

“will,” and “would.” However, these words are not the exclusive

means of identifying such statements. Although we believe that our

plans, intentions and other expectations reflected in or suggested

by such forward-looking statements are reasonable, we cannot assure

you that we will achieve those plans, intentions or expectations.

All forward-looking statements are subject to risks and

uncertainties that may cause actual results or events to differ

materially from those that we expected.

Important factors that could cause actual results or events to

differ materially from our expectations, or cautionary statements,

include among others, the risk that anticipated benefits, including

synergies, from the acquisition of Gevo North Dakota may not be

fully realized or may take longer to realize than expected; changes

in legislation or government regulations affecting the future

operations of the acquired assets and Gevo’s other project; and

other risk factors or uncertainties identified from time to time in

Gevo’s filings with the U.S. Securities and Exchange Commission

(“SEC”). All written and oral forward-looking statements

attributable to us, or persons acting on our behalf, are expressly

qualified in their entirety by the cautionary statements identified

above and in the section entitled “Risk Factors” and elsewhere in

our Annual Report on Form 10-K for the year ended December 31, 2023

as well as other cautionary statements that are made from time to

time in our other SEC filings and public communications. You should

evaluate all forward-looking statements made in this release in the

context of these risks and uncertainties.

We caution you that the important factors referenced above may

not reflect all of the factors that could cause actual results or

events to differ from our expectations. In addition, we cannot

assure you that we will realize the results or developments we

expect or anticipate or, even if substantially realized, that they

will result in the consequences or affect us or our operations in

the way we expect. The forward-looking statements included in this

release are made only as of the date hereof. We undertake no

obligation to publicly update or revise any forward-looking

statement as a result of new information, future events or

otherwise, except as otherwise required by law.

Media ContactHeather ManuelVP of Stakeholder

Engagement & PartnershipsPR@gevo.com

Investor ContactEric Frey, PhDVice President of

Corporate DevelopmentIR@Gevo.com

1 Adjusted EBITDA is a

non-GAAP measure calculated by adding back depreciation and

amortization, allocated intercompany expenses for shared service

functions, and non-cash stock-based compensation to GAAP loss from

operations, plus monetizable tax credits (if any) such as 45Q and

45Z.

2 Includes $69.6 million

of restricted cash.

3 As reported in the SEC

filings of the previous owner, Red Trail Energy, LLC, prior to

Gevo’s acquisition of substantially all of its ethanol and CCS

assets. Based on Fiscal Year ending September 30 under the previous

owner.

4 Formerly known as our

NZ-1 Project.

5 Based on a report by

Charles River Associates, available on Gevo’s website.

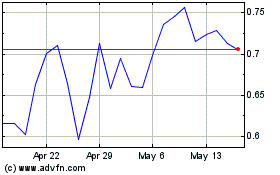

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Mar 2025