HINGHAM INSTITUTION FOR SAVINGS (NASDAQ: HIFS), Hingham,

Massachusetts announced second quarter results for 2020.

Earnings

Net income for the quarter ended June 30, 2020

was $16,338,000 or $7.65 per share basic and $7.50 per share

diluted, as compared to $8,706,000 or $4.08 per share basic and

$3.99 per share diluted for the same period last year. The

Bank’s annualized return on average equity for the second quarter

of 2020 was 25.28%, and the annualized return on average assets was

2.41%, as compared to 15.32% and 1.37% for the same period in

2019. Net income per share (diluted) for the second quarter

of 2020 increased by 88% over the same period in 2019.

Excluding the after-tax gains and losses on

securities, both realized and unrealized, core net income for the

second quarter of 2020 was $10,936,000 or $5.12 per share basic and

$5.03 per share diluted, as compared to $7,794,000 or $3.65 per

share basic and $3.57 per share diluted for the same period last

year. The Bank’s annualized core return on average equity for

the second quarter of 2020 was 16.92%, and the annualized core

return on average assets was 1.61%, as compared to 13.71% and 1.23%

for the same period in 2019. Core net income per share

(diluted) for the second quarter of 2020 increased by 41% over the

same period in 2019.

Net income for the six months ended June 30,

2020 was $18,523,000 or $8.67 per share basic and $8.50 per share

diluted, as compared to $18,530,000 or $8.69 per share basic and

$8.49 per share diluted for the same period last year. The

Bank’s annualized return on average equity for the first six months

of 2020 was 14.50%, and the annualized return on average assets was

1.39%, as compared to 16.62% and 1.50% for the same period in

2019. Net income per share (diluted) for the first six months

of 2020 was stable when compared to the same period in 2019.

Excluding the after-tax gains on securities,

both realized and unrealized, core net income for the six months

ended June 30, 2020 was $19,415,000 or $9.09 per share basic and

$8.91 per share diluted, as compared to $15,381,000 or $7.21 per

share basic and $7.05 per share diluted for the same period last

year. The Bank’s annualized core return on average equity for

the first six months of 2020 was 15.20%, and the annualized core

return on average assets was 1.46%, as compared to 13.80% and 1.25%

for the same period in 2019. Core net income per share

(diluted) for the first six months of 2020 increased by 26% over

the same period in 2019.

See page 10 for a Non-GAAP reconciliation

between net income and core net income. In calculating core

net income, the Bank does not make any adjustments other than those

relating to after-tax gains and losses on securities, realized and

unrealized.

Balance Sheet

Balance sheet growth was strong, as total assets

increased to $2.724 billion, representing 10% annualized growth

year-to-date and 4% growth from June 30, 2019. Asset growth

was below loan growth in both periods as the Bank continued to

manage the balance sheet to minimize the carrying cost of its

on-balance sheet liquidity.

Net loans increased to $2.382 billion,

representing 14% annualized growth year-to-date and 10% growth from

June 30, 2019. Growth was concentrated in the Bank’s

commercial real estate portfolio. The Bank participated in

the Small Business Administration’s Paycheck Protection Program

during the quarter and originated 48 loans to a mix of new and

existing customers for a total of $9.3 million. The Bank does

not anticipate any additional originations under the Paycheck

Protection Program and does not plan to participate in the Federal

Reserve’s Main Street Lending Program.

Total deposits, including wholesale deposits,

increased to $2.054 billion at June 30, 2020, representing 26%

annualized growth year-to-date and 24% growth from June 30,

2019. Total retail and business deposits increased to $1.571

billion at June 30, 2020, representing 20% annualized growth

year-date and 21% growth from June 30, 2019. Non-interest

bearing deposits, included in retail and business deposits,

increased to $289.6 million at June 30, 2020, representing 44%

annualized growth year-to-date and 27% growth from June 30,

2019. During the first six months of 2020, the Bank

reallocated its wholesale funding mix between wholesale time

deposits and Federal Home Loan Bank advances in order to reduce the

cost of funds.

Book value per share was $123.57 as of June 30,

2020, representing 14% annualized growth year-to-date and 15%

growth from June 30, 2019. In addition to the increase in

book value per share, the Bank has declared $2.26 in dividends per

share since June 30, 2019, including a special dividend of $0.60

per share declared during the fourth quarter of 2019.

Operational Performance

Metrics

The net interest margin for the quarter ended

June 30, 2020 increased 53 basis points to 3.15%, as compared to

2.62% for the same period last year. The Bank has benefited

from a sharp decline in the cost of interest-bearing liabilities,

including both interest-bearing retail and commercial deposits, as

well as wholesale funding from the Federal Home Loan Bank, brokered

time deposits and listing services time deposits. This

benefit was partially offset by a decline in the yield on

interest-earning assets, driven primarily by the decline in the

interest on excess reserves held at the Federal Reserve Bank of

Boston and a lower yield on loans during the same period.

Key credit and operational metrics remained

strong in the second quarter. At June 30, 2020, non-performing

assets totaled 0.24% of total assets, compared to 0.22% at December

31, 2019 and 0.02% at June 30, 2019. Non-performing loans as

a percentage of the total loan portfolio totaled 0.11% at June 30,

2020, compared to 0.25% at December 31, 2019 and 0.03% at June 30,

2019.

In the first quarter of 2020, the Bank

foreclosed on a residential property on Nantucket and purchased it

at auction for $3.6 million. This collateral secured a

non-performing loan which comprised the substantial majority of

non-performing assets at December 31, 2019. At June 30, 2020,

the Bank owned $3.8 million in foreclosed property, consisting

entirely of this property, including repairs and improvements

completed by the Bank following acquisition. The Bank has

listed the property located at 14 Orange Street for sale. Potential

buyers are encouraged to contact our broker Ms. Gloria Grimshaw of

Jordan Real Estate at 508-228-4449 (extension 109) or at

gloria@jordanre.com directly. At December 31, 2019 and June

30, 2019, the Bank did not own any foreclosed property.

The Bank recorded $681,000 of net charge-offs

for the first six months of 2020, composed entirely of the

charge-off related to the Nantucket property mentioned above, as

compared to $1,000 in net charge-offs for the same period last

year. The Bank is pursuing litigation against the borrowers

for breach of contract and bank fraud in an attempt to collect on

the deficiency owed. The Bank has litigation pending in state

court with respect to this matter, including a motion for summary

judgement, but the Massachusetts Supreme Judicial Court has imposed

certain tolling periods as a result of COVID-19 which have delayed

our recovery efforts.

At June 30, 2020, the Bank had modified 1% of

the Bank’s total loan portfolio by number and less than 3% by

dollar in response to COVID-19. The table presented on page 10

categorizes these modifications, by number and dollar volume, with

respect to the residential real estate, commercial real estate and

construction loan portfolios. With respect to the commercial

real estate portfolio, the Bank has modified a limited number of

loans from amortizing to interest-only for a limited period and has

generally required the borrowers to pre-fund all interest payments

for the period of modification. The Bank has not deferred

interest payments on any commercial mortgages. The Bank has

not modified any construction loans as a result of COVID-19.

To the extent required by law in the Commonwealth of Massachusetts,

the Bank has granted short-term interest-only modifications to a

limited number of residential mortgage customers that have been

impacted by COVID-19. The Bank has also deferred the

collection of interest on 4 residential loans, with total

outstanding loan balances of $504,000. One of these loans has

subsequently resumed full contractual payments.

The efficiency ratio was 25.28% for the second

quarter of 2020, as compared to 31.10% for the same period last

year. Operating expenses as a percentage of average assets fell to

0.79% in the second quarter of 2020, as compared to 0.82% for the

same period last year. The Bank remains focused on reducing

waste through an ongoing process of continuous improvement.

Chairman Robert H. Gaughen Jr. stated, “During

this rapidly developing period of economic uncertainty, there may

be unusual opportunities - to deploy capital on attractive terms,

to develop new relationships with strong customers, to recruit

talented staff, and to invest in digital tools to reduce costs and

deliver more value for our customers. We plan to capitalize

on these opportunities. In doing so, we remain focused on

careful capital allocation, defensive underwriting and disciplined

cost control - the building blocks for compounding shareholder

capital through all stages of the economic cycle. These

remain constant, regardless of the macroeconomic environment in

which we operate.”

The Bank’s quarterly financial results are

summarized in the earnings release, but shareholders are encouraged

to read the Bank’s quarterly reports on Form 10-Q, which are

generally available several weeks after the earnings release.

The Bank expects to file Form 10-Q for the quarter ended June 30,

2020 with the FDIC on or about August 5th, 2020.

Hingham Institution for Savings is a

Massachusetts-chartered savings bank headquartered in Hingham,

Massachusetts. Incorporated in 1834, it is one of America’s

oldest banks. The Bank’s Main Office is located in Hingham

and the Bank maintains offices on the South Shore, in Boston (South

End and Beacon Hill), and on the island of Nantucket. The

Bank also maintains a commercial lending office in Washington,

D.C.

The Bank’s shares of common stock are listed and

traded on The NASDAQ Stock Market under the symbol HIFS.

|

|

|

HINGHAM INSTITUTION FOR SAVINGS |

|

Selected Financial Ratios |

|

|

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

| |

2019 |

|

2020 |

|

2019 |

|

2020 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Key Performance

Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets

(1) |

1.37 |

% |

|

2.41 |

% |

|

1.50 |

% |

|

1.39 |

% |

| Return on average equity

(1) |

15.32 |

|

|

25.28 |

|

|

16.62 |

|

|

14.50 |

|

| Core return on average assets

(1) (5) |

1.23 |

|

|

1.61 |

|

|

1.25 |

|

|

1.46 |

|

| Core return on average equity

(1) (5) |

13.71 |

|

|

16.92 |

|

|

13.80 |

|

|

15.20 |

|

| Interest rate spread (1)

(2) |

2.28 |

|

|

2.97 |

|

|

2.32 |

|

|

2.74 |

|

| Net interest margin (1)

(3) |

2.62 |

|

|

3.15 |

|

|

2.65 |

|

|

2.99 |

|

| Operating expenses to average

assets (1) |

0.82 |

|

|

0.79 |

|

|

0.84 |

|

|

0.83 |

|

| Efficiency ratio (4) |

31.10 |

|

|

25.28 |

|

|

31.47 |

|

|

27.61 |

|

| Average equity to average

assets |

8.97 |

|

|

9.52 |

|

|

9.03 |

|

|

9.59 |

|

| Average interest-earning

assets to average interest- bearing liabilities |

119.92 |

|

|

122.79 |

|

|

120.22 |

|

|

122.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2019 |

|

December 31,2019 |

|

June 30, 2020 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses/total loans |

|

0.68 |

% |

|

|

0.69 |

% |

|

|

0.69 |

|

|

Allowance for loan losses/non-performing loans |

|

2,130.47 |

|

|

|

274.57 |

|

|

|

615.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-performing loans/total loans |

|

0.03 |

|

|

|

0.25 |

|

|

|

0.11 |

|

|

Non-performing loans/total assets |

|

0.02 |

|

|

|

0.22 |

|

|

|

0.10 |

|

|

Non-performing assets/total assets |

|

0.02 |

|

|

|

0.22 |

|

|

|

0.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Related |

|

|

|

|

|

|

|

|

|

|

|

| Book

value per share |

$ |

107.59 |

|

|

$ |

115.75 |

|

|

$ |

123.57 |

|

| Market

value per share |

$ |

198.01 |

|

|

$ |

210.20 |

|

|

$ |

167.78 |

|

| Shares

outstanding at end of period |

|

2,133,750 |

|

|

|

2,135,750 |

|

|

|

2,136,900 |

|

|

(1) |

Annualized. |

| (2) |

Interest rate spread represents

the difference between the yield on interest-earning assets and the

cost of interest-bearing liabilities. |

| (3) |

Net interest margin represents

net interest income divided by average interest-earning

assets. |

| (4) |

The efficiency ratio represents

total operating expenses, divided by the sum of net interest income

and total other income (loss), excluding gain (loss) on equity

securities, net. |

| (5) |

Non-GAAP measurements that

represent return on average assets and return on average equity,

excluding the after-tax gain (loss) on equity securities, net. |

|

|

|

HINGHAM INSTITUTION FOR SAVINGS |

|

Consolidated Balance Sheets |

|

|

| (In thousands, except share

amounts) |

June 30, 2019 |

|

December 31,2019 |

|

June 30, 2020 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

| ASSETS |

|

| |

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |

9,951 |

|

$ |

9,057 |

|

$ |

7,365 |

| Federal Reserve and other

short-term investments |

|

318,356 |

|

|

243,090 |

|

|

214,489 |

|

Cash and cash equivalents |

|

328,307 |

|

|

252,147 |

|

|

221,854 |

| |

|

|

|

|

|

|

|

|

| CRA investment |

|

7,888 |

|

|

7,910 |

|

|

8,604 |

| Debt securities available for

sale |

|

12 |

|

|

11 |

|

|

9 |

| Other marketable equity

securities |

|

36,960 |

|

|

39,265 |

|

|

46,191 |

|

Securities, at fair value |

|

44,860 |

|

|

47,186 |

|

|

54,804 |

| Federal Home Loan Bank stock, at

cost |

|

31,231 |

|

|

24,890 |

|

|

20,390 |

| Loans, net of allowance for loan

losses of $14,787 at June 30, 2019, $15,376 at December 31,

2019 and $16,458 at June 30, 2020 |

|

2,171,130 |

|

|

2,227,062 |

|

|

2,381,780 |

| Foreclosed assets |

|

— |

|

|

— |

|

|

3,811 |

| Bank-owned life insurance |

|

12,600 |

|

|

12,727 |

|

|

12,844 |

| Premises and equipment, net |

|

14,410 |

|

|

14,548 |

|

|

15,358 |

| Accrued interest receivable |

|

5,691 |

|

|

4,926 |

|

|

5,054 |

| Deferred income tax asset,

net |

|

1,368 |

|

|

1,213 |

|

|

1,729 |

| Other assets |

|

4,874 |

|

|

5,647 |

|

|

6,215 |

|

Total assets |

$ |

2,614,471 |

|

$ |

2,590,346 |

|

$ |

2,723,839 |

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

$ |

1,429,998 |

|

$ |

1,583,280 |

|

$ |

1,764,714 |

| Non-interest-bearing

deposits |

|

228,306 |

|

|

237,554 |

|

|

289,574 |

|

Total deposits |

|

1,658,304 |

|

|

1,820,834 |

|

|

2,054,288 |

| Federal Home Loan Bank and

Federal Reserve Bank advances |

|

710,300 |

|

|

505,200 |

|

|

385,431 |

| Mortgage payable |

|

720 |

|

|

687 |

|

|

— |

| Mortgagors’ escrow

accounts |

|

7,274 |

|

|

7,815 |

|

|

8,185 |

| Accrued interest payable |

|

1,991 |

|

|

960 |

|

|

282 |

| Other liabilities |

|

6,302 |

|

|

7,627 |

|

|

11,605 |

|

Total liabilities |

|

2,384,891 |

|

|

2,343,123 |

|

|

2,459,791 |

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $1.00 par value, 2,500,000 shares

authorized, none issued |

|

— |

|

|

— |

|

|

— |

|

Common stock, $1.00 par value, 5,000,000 shares authorized;

2,133,750 shares issued and outstanding at June 30, 2019, 2,135,750

shares issued and outstanding and December 31, 2019 and

2,136,900 shares issued and outstanding at June 30, 2020 |

|

2,134 |

|

|

2,136 |

|

|

2,137 |

|

Additional paid-in capital |

|

11,980 |

|

|

12,234 |

|

|

12,352 |

|

Undivided profits |

|

215,466 |

|

|

232,853 |

|

|

249,559 |

|

Accumulated other comprehensive income |

|

— |

|

|

— |

|

|

— |

|

Total stockholders’ equity |

|

229,580 |

|

|

247,223 |

|

|

264,048 |

|

Total liabilities and stockholders’ equity |

$ |

2,614,471 |

|

$ |

2,590,346 |

|

$ |

2,723,839 |

|

|

|

|

|

|

|

|

|

|

|

|

|

HINGHAM INSTITUTION FOR SAVINGS |

|

Consolidated Statements of Income |

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| (In thousands, except per

share amounts) |

|

2019 |

|

|

2020 |

|

2019 |

|

2020 |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

| Interest and dividend

income: |

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

24,816 |

|

$ |

25,856 |

|

$ |

47,896 |

|

$ |

51,566 |

|

|

Equity securities |

|

496 |

|

|

463 |

|

|

985 |

|

|

961 |

|

|

Federal Reserve and other short-term investments |

|

1,629 |

|

|

56 |

|

|

3,189 |

|

|

797 |

|

|

Total interest and dividend income |

|

26,941 |

|

|

26,375 |

|

|

52,070 |

|

|

53,324 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

7,074 |

|

|

4,392 |

|

|

13,220 |

|

|

10,333 |

|

|

Federal Home Loan Bank advances |

|

3,539 |

|

|

942 |

|

|

6,667 |

|

|

3,889 |

|

|

Mortgage payable |

|

11 |

|

|

— |

|

|

22 |

|

|

3 |

|

|

Total interest expense |

|

10,624 |

|

|

5,334 |

|

|

19,909 |

|

|

14,225 |

|

|

Net interest income |

|

16,317 |

|

|

21,041 |

|

|

32,161 |

|

|

39,099 |

|

| Provision for loan losses |

|

555 |

|

|

625 |

|

|

980 |

|

|

1,763 |

|

|

Net interest income, after provision for loan losses |

|

15,762 |

|

|

20,416 |

|

|

31,181 |

|

|

37,336 |

|

| Other income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Customer service fees on deposits |

|

199 |

|

|

148 |

|

|

385 |

|

|

320 |

|

|

Increase in cash surrender value of bank-owned life insurance |

|

57 |

|

|

59 |

|

|

124 |

|

|

117 |

|

|

Gain (loss) on equity securities, net |

|

1,170 |

|

|

6,930 |

|

|

4,039 |

|

|

(1,144 |

) |

|

Gain on disposal of fixed assets |

|

— |

|

|

— |

|

|

— |

|

|

218 |

|

|

Miscellaneous |

|

43 |

|

|

28 |

|

|

83 |

|

|

81 |

|

|

Total other income (loss) |

|

1,469 |

|

|

7,165 |

|

|

4,631 |

|

|

(408 |

) |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

3,177 |

|

|

3,287 |

|

|

6,324 |

|

|

6,667 |

|

|

Occupancy and equipment |

|

447 |

|

|

474 |

|

|

901 |

|

|

929 |

|

|

Data processing |

|

301 |

|

|

475 |

|

|

735 |

|

|

964 |

|

|

Deposit insurance |

|

265 |

|

|

254 |

|

|

508 |

|

|

437 |

|

|

Foreclosure |

|

44 |

|

|

28 |

|

|

67 |

|

|

154 |

|

|

Marketing |

|

177 |

|

|

104 |

|

|

309 |

|

|

284 |

|

|

Other general and administrative |

|

756 |

|

|

756 |

|

|

1,465 |

|

|

1,563 |

|

|

Total operating expenses |

|

5,167 |

|

|

5,378 |

|

|

10,309 |

|

|

10,998 |

|

| Income before income

taxes |

|

12,064 |

|

|

22,203 |

|

|

25,503 |

|

|

25,930 |

|

| Income tax provision |

|

3,358 |

|

|

5,865 |

|

|

6,973 |

|

|

7,407 |

|

|

Net income |

$ |

8,706 |

|

$ |

16,338 |

|

$ |

18,530 |

|

$ |

18,523 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends declared per

share |

$ |

0.39 |

|

$ |

0.43 |

|

$ |

0.77 |

|

$ |

0.85 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

2,134 |

|

|

2,137 |

|

|

2,133 |

|

|

2,137 |

|

|

Diluted |

|

2,182 |

|

|

2,176 |

|

|

2,182 |

|

|

2,180 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

4.08 |

|

$ |

7.65 |

|

$ |

8.69 |

|

$ |

8.67 |

|

|

Diluted |

$ |

3.99 |

|

$ |

7.50 |

|

$ |

8.49 |

|

$ |

8.50 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HINGHAM INSTITUTION FOR SAVINGS |

|

Net Interest Income Analysis |

|

|

| |

Three Months Ended June 30, |

|

| |

2019 |

|

|

2020 |

|

| |

AVERAGEBALANCE |

|

INTEREST |

|

YIELD/RATE (8) |

|

|

AVERAGEBALANCE |

|

INTEREST |

|

YIELD/RATE (8) |

|

|

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (1) (2) |

$ |

2,161,278 |

|

$ |

24,816 |

|

4.59 |

% |

|

$ |

2,379,132 |

|

$ |

25,856 |

|

4.35 |

% |

| Securities (3) (4) |

|

58,311 |

|

|

496 |

|

3.40 |

|

|

|

69,901 |

|

|

463 |

|

2.65 |

|

| Federal Reserve and other

short-term investments |

|

272,453 |

|

|

1,629 |

|

2.39 |

|

|

|

222,960 |

|

|

56 |

|

0.10 |

|

|

Total interest-earning assets |

|

2,492,042 |

|

|

26,941 |

|

4.32 |

|

|

|

2,671,993 |

|

|

26,375 |

|

3.95 |

|

| Other assets |

|

41,700 |

|

|

|

|

|

|

|

|

44,066 |

|

|

|

|

|

|

|

Total assets |

$ |

2,533,742 |

|

|

|

|

|

|

|

$ |

2,716,059 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits

(5) |

$ |

1,543,247 |

|

|

7,074 |

|

1.83 |

|

|

$ |

1,592,458 |

|

|

4,392 |

|

1.10 |

|

| Borrowed funds |

|

534,809 |

|

|

3,550 |

|

2.66 |

|

|

|

583,532 |

|

|

942 |

|

0.65 |

|

|

Total interest-bearing liabilities |

|

2,078,056 |

|

|

10,624 |

|

2.04 |

|

|

|

2,175,990 |

|

|

5,334 |

|

0.98 |

|

| Non-interest-bearing

deposits |

|

221,051 |

|

|

|

|

|

|

|

|

272,418 |

|

|

|

|

|

|

| Other liabilities |

|

7,271 |

|

|

|

|

|

|

|

|

9,107 |

|

|

|

|

|

|

|

Total liabilities |

|

2,306,378 |

|

|

|

|

|

|

|

|

2,457,515 |

|

|

|

|

|

|

| Stockholders’ equity |

|

227,364 |

|

|

|

|

|

|

|

|

258,544 |

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

2,533,742 |

|

|

|

|

|

|

|

$ |

2,716,059 |

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

16,317 |

|

|

|

|

|

|

|

$ |

21,041 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average spread |

|

|

|

|

|

|

2.28 |

% |

|

|

|

|

|

|

|

2.97 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (6) |

|

|

|

|

|

|

2.62 |

% |

|

|

|

|

|

|

|

3.15 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest-earning

assets to average interest-bearing liabilities (7) |

|

119.92 |

% |

|

|

|

|

|

|

|

122.79 |

% |

|

|

|

|

|

|

(1) |

Before allowance for loan losses. |

| (2) |

Includes non-accrual

loans. |

| (3) |

Excludes the impact of the

average net unrealized gain or loss on securities. |

| (4) |

Includes Federal Home Loan

Bank stock. |

| (5) |

Includes mortgagors' escrow

accounts. |

| (6) |

Net interest income divided by

average total interest-earning assets. |

| (7) |

Total interest-earning assets

divided by total interest-bearing liabilities. |

| (8) |

Annualized. |

|

|

|

HINGHAM INSTITUTION FOR SAVINGS |

|

Net Interest Income Analysis |

|

|

|

|

Six Months Ended June 30, |

|

|

|

2019 |

|

|

2020 |

|

|

|

AVERAGEBALANCE |

|

INTEREST |

|

YIELD/RATE (8) |

|

|

AVERAGEBALANCE |

|

INTEREST |

|

YIELD/RATE (8) |

|

|

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans

(1) (2) |

$ |

2,105,144 |

|

$ |

47,896 |

|

4.55 |

% |

|

$ |

2,325,075 |

|

$ |

51,566 |

|

4.44 |

% |

|

Securities (3) (4) |

|

56,602 |

|

|

985 |

|

3.48 |

|

|

|

67,601 |

|

|

961 |

|

2.84 |

|

| Federal

Reserve and other short-term investments |

|

266,348 |

|

|

3,189 |

|

2.39 |

|

|

|

225,565 |

|

|

797 |

|

0.71 |

|

|

Total interest-earning assets |

|

2,428,094 |

|

|

52,070 |

|

4.29 |

|

|

|

2,618,241 |

|

|

53,324 |

|

4.07 |

|

| Other

assets |

|

40,418 |

|

|

|

|

|

|

|

|

45,302 |

|

|

|

|

|

|

|

Total assets |

$ |

2,468,512 |

|

|

|

|

|

|

|

$ |

2,663,543 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits (5) |

$ |

1,514,553 |

|

|

13,220 |

|

1.75 |

|

|

$ |

1,552,901 |

|

|

10,333 |

|

1.33 |

|

| Borrowed

funds |

|

505,176 |

|

|

6,689 |

|

2.65 |

|

|

|

591,596 |

|

|

3,892 |

|

1.32 |

|

|

Total interest-bearing liabilities |

|

2,019,729 |

|

|

19,909 |

|

1.97 |

|

|

|

2,144,497 |

|

|

14,225 |

|

1.33 |

|

|

Non-interest-bearing deposits |

|

218,099 |

|

|

|

|

|

|

|

|

255,212 |

|

|

|

|

|

|

| Other

liabilities |

|

7,697 |

|

|

|

|

|

|

|

|

8,347 |

|

|

|

|

|

|

|

Total liabilities |

|

2,245,525 |

|

|

|

|

|

|

|

|

2,408,056 |

|

|

|

|

|

|

|

Stockholders’ equity |

|

222,987 |

|

|

|

|

|

|

|

|

255,487 |

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

2,468,512 |

|

|

|

|

|

|

|

$ |

2,663,543 |

|

|

|

|

|

|

| Net

interest income |

|

|

|

$ |

32,161 |

|

|

|

|

|

|

|

$ |

39,099 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average spread |

|

|

|

|

|

|

2.32 |

% |

|

|

|

|

|

|

|

2.74 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

interest margin (6) |

|

|

|

|

|

|

2.65 |

% |

|

|

|

|

|

|

|

2.99 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average interest-earning assets to average interest-bearing

liabilities (7) |

|

120.22 |

% |

|

|

|

|

|

|

|

122.09 |

% |

|

|

|

|

|

|

(1) |

Before allowance for loan losses. |

|

(2) |

Includes non-accrual loans. |

|

(3) |

Excludes the impact of the

average net unrealized gain or loss on securities. |

|

(4) |

Includes Federal Home Loan Bank

stock. |

|

(5) |

Includes mortgagors' escrow

accounts. |

|

(6) |

Net interest income divided by

average total interest-earning assets. |

|

(7) |

Total interest-earning assets

divided by total interest-bearing liabilities. |

|

(8) |

Annualized. |

HINGHAM INSTITUTION FOR

SAVINGSNon-GAAP Reconciliation

The table below presents the reconciliation

between net income and core net income, a non-GAAP measurement that

represents net income excluding the after-tax gain (loss) on equity

securities, net.

| |

Three Months

Ended |

|

Six Months

Ended |

| |

June 30, |

|

June 30, |

| (In thousands, unaudited) |

|

2019 |

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

| Non-GAAP reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

8,706 |

|

|

$ |

16,338 |

|

|

$ |

18,530 |

|

|

$ |

18,523 |

|

|

Loss (gain) on equity securities, net |

|

(1,170 |

) |

|

|

(6,930 |

) |

|

|

(4,039 |

) |

|

|

1,144 |

|

|

Income tax expense (benefit) (1) |

|

258 |

|

|

|

1,528 |

|

|

|

890 |

|

|

|

(252 |

) |

| Core net income |

$ |

7,794 |

|

|

$ |

10,936 |

|

|

$ |

15,381 |

|

|

$ |

19,415 |

|

|

(1) |

The equity securities are held in a tax-advantaged subsidiary

corporation. The income tax effect of the loss (gain) on

equity securities, net, was calculated using the effective tax rate

applicable to the subsidiary. |

COVID-19 Modifications Table

The table below presents the number and

outstanding balances of loans that the Bank has modified as a

result of COVID-19 compared as a percentage of the total number and

outstanding balances of the Bank's loan portfolio as of June 30,

2020, by loan category. This table reflects all modifications

in effect as of June 30, 2020 and as loans return to the original

contractual terms, they will no longer be reflected on this

table.

| |

Outstanding |

|

Modified |

|

% Modified |

|

| |

# of Loans |

|

Balance(2) |

|

# of Loans |

|

Balance |

|

# of Loans |

|

Balance |

| (In thousands, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residential Real Estate

(1) |

2,534 |

$ |

706,733 |

|

35 |

|

$ |

13,164 |

|

1.38 |

% |

|

1.86 |

% |

| Commercial Real Estate |

1,422 |

|

1,519,304 |

|

17 |

|

|

55,538 |

|

1.20 |

|

|

3.66 |

|

| Construction |

67 |

|

159,677 |

|

— |

|

|

— |

|

— |

|

|

— |

|

| Commercial and Consumer |

573 |

|

9,749 |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

Total Loans |

4,596 |

$ |

2,395,463 |

|

52 |

|

$ |

68,702 |

|

1.13 |

% |

|

2.87 |

% |

|

(1) |

Includes Home Equity lines of credit |

| (2) |

Gross loans, before net deferred

loan origination costs and the allowance for loan losses. |

| |

|

CONTACT: Patrick R. Gaughen, President and

Chief Operating Officer (781) 783-1761

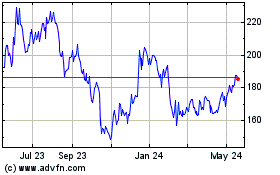

Hingham Institution for ... (NASDAQ:HIFS)

Historical Stock Chart

From Feb 2025 to Mar 2025

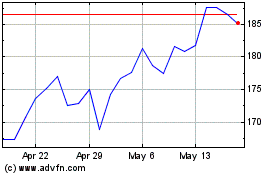

Hingham Institution for ... (NASDAQ:HIFS)

Historical Stock Chart

From Mar 2024 to Mar 2025