Territorial Bancorp Shareholders Approve Hope Bancorp Merger

November 06 2024 - 1:15PM

Territorial Bancorp Inc. (NASDAQ: TBNK) (“Territorial” or the

“Company”) announced that its shareholders voted to approve the

Company’s proposed merger with Hope Bancorp, Inc. (“Hope Bancorp”)

(NASDAQ: HOPE) at the Special Meeting of Territorial Stockholders

held today.

Territorial shareholders’ support for the Hope Bancorp merger

underscores the value it delivers and the benefits it creates for

customers, employees and communities across Hawai‘i. Through this

all-stock merger, Territorial shareholders will be able to

participate in the significant upside value creation of a scaled,

more diversified regional bank with an attractive dividend and

compelling growth opportunities. Territorial customers can expect a

seamless transition, with a continued focus on relationship

banking, personalized service and tailored financial solutions.

“We expect our combination with Bank of Hope to strengthen

Territorial for the long term, providing many advantages for our

customers and employees as we become part of a larger organization

with greater resources, enhanced technology platforms, and an

expanded array of banking products and services,” said Allan S.

Kitagawa, Chairman, CEO and President of Territorial. “We greatly

appreciate the hard work of our employees and their unwavering

commitment to delivering outstanding service as we progress toward

the closing of this transaction.”

As previously announced, closing of the transaction remains

subject to customary regulatory approvals and closing

conditions.

About Us

Territorial Bancorp Inc., headquartered in Honolulu, Hawaiʻi, is

the stock holding company for Territorial Savings Bank. Territorial

Savings Bank is a state-chartered savings bank which was originally

chartered in 1921 by the Territory of Hawaiʻi. Territorial Savings

Bank conducts business from its headquarters in Honolulu, Hawaiʻi,

and has 28 branch offices in the state of Hawaiʻi. For additional

information, please visit https://www.tsbhawaii.bank/.

Forward-Looking Statements

Some statements in this news release may constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include, but are not limited to, statements preceded by,

followed by or that include the words “will,” “believes,”

“expects,” “anticipates,” “intends,” “plans,” “estimates” or

similar expressions. With respect to any such forward-looking

statements, Territorial Bancorp claims the protection provided for

in the Private Securities Litigation Reform Act of 1995. These

statements involve risks and uncertainties. Hope Bancorp’s actual

results, performance or achievements may differ significantly from

the results, performance or achievements expressed or implied in

any forward-looking statements. The closing of the proposed

transaction is subject to regulatory approvals, the approval of

Territorial Bancorp stockholders, and other customary closing

conditions. There is no assurance that such conditions will be met

or that the proposed merger will be consummated within the expected

time frame, or at all. If the transaction is consummated, factors

that may cause actual outcomes to differ from what is expressed or

forecasted in these forward-looking statements include, among

things: difficulties and delays in integrating Hope Bancorp and

Territorial Bancorp and achieving anticipated synergies, cost

savings and other benefits from the transaction; higher than

anticipated transaction costs; deposit attrition, operating costs,

customer loss and business disruption following the merger,

including difficulties in maintaining relationships with employees

and customers, may be greater than expected; and required

governmental approvals of the merger may not be obtained on its

proposed terms and schedule, or without regulatory constraints that

may limit growth. Other risks and uncertainties include, but are

not limited to: possible further deterioration in economic

conditions in Hope Bancorp’s or Territorial Bancorp’s areas of

operation or elsewhere; interest rate risk associated with volatile

interest rates and related asset-liability matching risk; liquidity

risks; risk of significant non-earning assets, and net credit

losses that could occur, particularly in times of weak economic

conditions or times of rising interest rates; the failure of or

changes to assumptions and estimates underlying Hope Bancorp’s or

Territorial Bancorp’s allowances for credit losses; potential

increases in deposit insurance assessments and regulatory risks

associated with current and future regulations; the outcome of any

legal proceedings that may be instituted against Hope Bancorp or

Territorial Bancorp; the risk that any announcements relating to

the proposed transaction could have adverse effects on the market

price of the common stock of either or both parties to the proposed

transaction; and diversion of management’s attention from ongoing

business operations and opportunities. For additional information

concerning these and other risk factors, see Hope Bancorp’s and

Territorial Bancorp’s most recent Annual Reports on Form 10-K. Hope

Bancorp and Territorial Bancorp do not undertake, and specifically

disclaim any obligation, to update any forward-looking statements

to reflect the occurrence of events or circumstances after the date

of such statements except as required by law.

Investor / Media Contacts:Walter IdaSVP,

Director of Investor

Relations808-946-1400walter.ida@territorialsavings.net

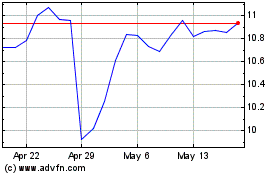

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Oct 2024 to Nov 2024

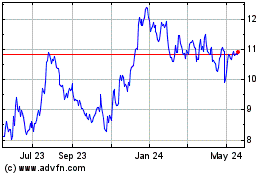

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Nov 2023 to Nov 2024