BlackRock Announces Product Updates to Two iShares ETFs

April 22 2021 - 4:00PM

Business Wire

BlackRock, Inc. (NYSE: BLK) today announced product enhancements

to two iShares ETFs as part of an ongoing process to periodically

review its product lineup.

No action is necessary for investors in the impacted ETFs and no

capital gains distributions are currently expected as a result of

the transition.

iShares Nasdaq Biotechnology ETF (IBB)

Effective on or around June 21, 2021, the iShares Nasdaq

Biotechnology ETF (Nasdaq: IBB) will seek to track the ICE

Biotechnology Index. The fund will also undergo changes to its name

and investment objective.

Current

New

Fund Name

iShares Nasdaq Biotechnology ETF

iShares Biotechnology ETF

Underlying

Index

Nasdaq Biotechnology Index

ICE Biotechnology Index

Investment

Objective

Seeks to track the investment results of

an index composed of biotechnology and pharmaceutical equities

listed on the NASDAQ.

Seeks to track the investment results of

an index composed of U.S.-listed equities in the biotechnology

sector.

iShares PHLX Semiconductor ETF (SOXX)

Effective on or around June 21, 2021, the iShares Semiconductor

ETF (Nasdaq: SOXX) will seek to track the ICE Semiconductor Index.

The fund will also undergo changes to its name and investment

objective.

Current

New

Fund Name

iShares PHLX Semiconductor ETF

iShares Semiconductor ETF

Underlying

Index

PHLX SOX Semiconductor Sector Index

ICE Semiconductor Index

Investment

Objective

Seeks to track the investment results of

an index composed of U.S. equities in the semiconductor sector.

Seeks to track the investment results of

an index composed of U.S.-listed equities in the semiconductor

sector.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 900+ exchange traded funds (ETFs) and $2.81

trillion in assets under management as of March 31, 2021, iShares

continues to drive progress for the financial industry. iShares

funds are powered by the expert portfolio and risk management of

BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or www.blackrock.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible loss of

principal.

Funds that concentrate investments in specific industries,

sectors, markets or asset classes may underperform or be more

volatile than other industries, sectors, markets or asset classes

than the general securities market.

The iShares and BlackRock Funds are distributed by BlackRock

Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or

promoted by ICE Data Services, LLC, or The NASDAQ OMX Group, Inc.

None of these companies make any representation regarding the

advisability of investing in the Funds. BlackRock Investments, LLC

is not affiliated with the companies listed above.

©2021 BlackRock, Inc. All rights reserved. iSHARES and

BLACKROCK are trademarks of BlackRock, Inc., or its

subsidiaries in the United States and elsewhere. All other marks

are the property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210422006109/en/

Soogyung Jordan Soogyung.Jordan@BlackRock.com

646.276.5403

Federico Serrano Federico.Serrano@BlackRock.com

646.352.2218

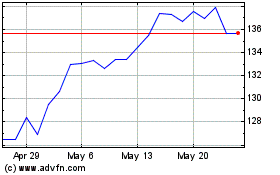

iShares Biotechnology ETF (NASDAQ:IBB)

Historical Stock Chart

From Feb 2025 to Mar 2025

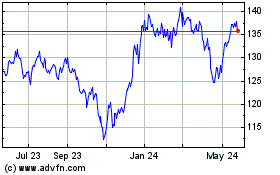

iShares Biotechnology ETF (NASDAQ:IBB)

Historical Stock Chart

From Mar 2024 to Mar 2025