The agreement will unite two

relationship-driven organizations and expand Rockland Trust’s

footprint into northern Massachusetts and southern New

Hampshire.

Independent Bank Corp. (NASDAQ Global Select Market : INDB)

(“Independent”), parent of Rockland Trust Company (“Rockland

Trust”), and Enterprise Bancorp, Inc. (NASDAQ Global Select Market:

EBTC) (“Enterprise”), parent of Enterprise Bank and Trust Company

(“Enterprise Bank”), have signed a definitive merger agreement

pursuant to which Enterprise will merge into Independent and

Enterprise Bank will merge into Rockland Trust in a cash and stock

transaction for total consideration valued at approximately $562

million in aggregate, or $45.06 per share based on the Independent

closing price of $71.77 on December 6, 2024.

The merger agreement provides that Enterprise shareholders will

receive 0.60 shares of Independent common stock and $2.00 in cash

for each share of Enterprise common stock they hold. The

transaction is intended to qualify as a tax-free reorganization for

federal income tax purposes and to provide a tax-free exchange for

Enterprise shareholders for the Independent common stock portion of

the merger consideration they will receive.

Independent anticipates issuing approximately 7.5 million shares

of its common stock and paying an aggregate amount of $27.1 million

in cash in the merger. The merger is expected to close in the

second half of 2025 subject to customary closing conditions,

including regulatory approvals and approval of Enterprise

shareholders. No vote of Independent shareholders is required.

“Enterprise Bank is the perfect merger partner for Rockland

Trust, consistent with all aspects of our outstanding long-term

merger track record. Rockland Trust and Enterprise Bank share a

deep commitment to strengthening our local communities by putting

people and relationships first. Both institutions believe that

banking is about making a meaningful, positive difference in the

lives of local families and businesses,” said Jeffrey Tengel, the

President and Chief Executive Officer of Independent Bank Corp. “We

look forward to extending Rockland Trust’s footprint in northern

Massachusetts, as well as entering the New Hampshire market.

Together, our combined institution will bring expanded convenience

and additional products and services to the communities we are

proud to serve.”

“From the very start, Enterprise Bank has been dedicated to

helping our communities succeed. That vision has inspired our

long-standing commitment to our customers’ success, product

innovation and community service,” said Steven Larochelle, the

Chief Executive Officer of Enterprise Bancorp, Inc. “We are excited

to join an organization that lives these same values. Our customers

will benefit from the additional products, services and technology

Rockland Trust offers while continuing to experience the personal

relationships they deserve.”

Enterprise Bank was founded in 1989 in Lowell, MA and conducts

its business from 27 full-service branches in Massachusetts and New

Hampshire. Rockland Trust does not plan to close any Enterprise

Bank branches and intends to maintain a significant presence in

Lowell. As of September 30, 2024, Enterprise Bank had $4.7 billion

in total assets, $3.8 billion in net loans, $4.2 billion in

deposits and $1.5 billion in wealth assets under management and

administration.

“Following this merger, Rockland Trust will have approximately

$25 billion in assets and $8.7 billion in wealth assets under

administration. In addition to expanding our branch footprint north

and into New Hampshire, this acquisition will further enhance our

core deposit franchise and provide opportunities for us to

introduce our full suite of banking solutions, wealth management

services, and comprehensive financial advice to new businesses and

households,” said Tengel.

The merger is expected to be approximately 16% accretive to

Independent’s earnings per share in 2026, the first full year of

combined operations, assuming full phase-in of cost savings.

Independent anticipates the transaction will meet its three year or

less tangible book value earn back hurdle rate. Combined

merger-related charges are expected to be approximately $61.2

million before tax, in the aggregate. As part of the transaction,

Independent plans to raise approximately $250 million in

subordinated debt prior to the transaction closing. Post close,

Board Chair and Enterprise Bank founding member, George Duncan,

will become an advisor to the Independent Board and Larochelle will

serve as a consultant for Rockland Trust for one year.

Additionally, Independent will appoint two Enterprise directors to

its board following the merger.

The boards of directors of each company have unanimously

approved the transaction. Enterprise’s directors and executive

officers who currently own, in the aggregate, about 20.4% of

Enterprise’s outstanding shares have signed voting agreements

pursuant to which they have agreed to vote their shares in favor of

the merger.

Independent was advised by Keefe, Bruyette & Woods, Inc., A

Stifel Company, and used Simpson Thacher & Bartlett LLP as its

legal counsel. Enterprise was advised by Piper Sandler and used

Hunton Andrews Kurth LLP as its legal counsel.

CONFERENCE CALL INFORMATION

At 10:00 a.m. Eastern Standard Time on Monday, December 9, 2024

Jeffrey Tengel, Chief Executive Officer and Mark Ruggiero, Chief

Financial Officer and Executive Vice President of Consumer Lending,

will host a conference call to discuss the Enterprise Bank

transaction. Internet access to the call is available on the

Company’s website at www.RocklandTrust.com or via telephonic access

by dial-in at 1-888-336-7153 reference: INDB. A replay of the call

will be available by calling 1-877-344-7529, Replay Conference

Number: 6499206 and will be available through December 16, 2024.

Additionally, a webcast replay will be available until December 9,

2025.

ABOUT INDEPENDENT BANK CORP.

Independent Bank Corp. (NASDAQ Global Select Market: INDB) is

the holding company for Rockland Trust Company, a full-service

commercial bank headquartered in Massachusetts. With retail

branches in Eastern Massachusetts and Worcester County as well as

commercial banking and investment management offices in

Massachusetts and Rhode Island, Rockland Trust offers a wide range

of banking, investment, and insurance services to individuals,

families, and businesses. The Bank also offers a full suite of

mobile, online, and telephone banking services. Rockland Trust is

an FDIC member and an Equal Housing Lender.

ABOUT ENTERPRISE BANCORP, INC.

Enterprise Bancorp, Inc. (NASDAQ Global Select Market: EBTC) is

a Massachusetts corporation that conducts substantially all its

operations through Enterprise Bank and Trust Company, commonly

referred to as Enterprise Bank, and has reported 140 consecutive

profitable quarters. Enterprise Bank is principally engaged in the

business of attracting deposits from the general public and

investing in commercial loans and investment securities. Through

Enterprise Bank and its subsidiaries, the Company offers a range of

commercial, residential and consumer loan products, deposit

products and cash management services, electronic and digital

banking options, as well as wealth management, and trust services.

The Company's headquarters and Enterprise Bank's main office are

located at 222 Merrimack Street in Lowell, Massachusetts. The

Company's primary market area is the Northern Middlesex, Northern

Essex, and Northern Worcester counties of Massachusetts and the

Southern Hillsborough and Southern Rockingham counties in New

Hampshire. Enterprise Bank has 27 full-service branches located in

the Massachusetts communities of Acton, Andover, Billerica (2),

Chelmsford (2), Dracut, Fitchburg, Lawrence, Leominster, Lexington,

Lowell (2), Methuen, North Andover, Tewksbury (2), Tyngsborough and

Westford and in the New Hampshire communities of Derry, Hudson,

Londonderry, Nashua (2), Pelham, Salem and Windham.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This communication may contain forward-looking statements,

including, but not limited to, certain plans, expectations, goals,

projections, and statements about the benefits of the proposed

transaction, the plans, objectives, expectations and intentions of

Independent and Enterprise, the expected timing of completion of

the proposed transaction, and other statements that are not

historical facts. Such statements reflect the current views of

Independent and Enterprise with respect to future events and

financial performance, and are subject to numerous assumptions,

risks, and uncertainties. Statements that do not describe

historical or current facts, including statements about beliefs,

expectations, plans, predictions, forecasts, objectives,

assumptions or future events or performance, are forward-looking

statements. Forward-looking statements often, but not always, may

be identified by words such as expect, anticipate, believe, intend,

potential, estimate, plan, target, goal, or similar words or

expressions, or future or conditional verbs such as will, may,

might, should, would, could, or similar variations. The

forward-looking statements are intended to be subject to the safe

harbor provided by Section 27A of the Securities Act of 1933,

Section 21E of the Securities Exchange Act of 1934, and the Private

Securities Litigation Reform Act of 1995.

Independent and Enterprise caution that the forward-looking

statements in this communication are not guarantees of future

performance and involve a number of known and unknown risks,

uncertainties and assumptions that are difficult to assess and are

subject to change based on factors which are, in many instances,

beyond Independent’s and Enterprise’s control. While there is no

assurance that any list of risks and uncertainties or risk factors

is complete, below are certain factors which could cause actual

results to differ materially from those contained or implied in the

forward-looking statements: (1) changes in general economic,

political, or industry conditions; (2) uncertainty in U.S. fiscal

and monetary policy, including the interest rate policies of the

Federal Reserve Board; (3) volatility and disruptions in global

capital and credit markets; (4) movements in interest rates; (5)

the resurgence of elevated levels of inflation or inflationary

pressures in the United States and the Enterprise and Independent

market areas; (6) increased competition in the markets of

Independent and Enterprise; (7) success, impact, and timing of

business strategies of Independent and Enterprise; (8) the nature,

extent, timing, and results of governmental actions, examinations,

reviews, reforms, regulations, and interpretations; (9) the

expected impact of the proposed transaction between Enterprise and

Independent on the combined entities’ operations, financial

condition, and financial results; (10) the failure to obtain

necessary regulatory approvals (and the risk that such approvals

may result in the imposition of conditions that could adversely

affect the combined company or the expected benefits of the

proposed transaction); (11) the failure to obtain Enterprise

shareholder approval or to satisfy any of the other conditions to

the proposed transaction on a timely basis or at all or other

delays in completing the proposed transaction; (12) the occurrence

of any event, change or other circumstances that could give rise to

the right of one or both of the parties to terminate the merger

agreement; (13) the outcome of any legal proceedings that may be

instituted against Independent or Enterprise; (14) the possibility

that the anticipated benefits of the proposed transaction are not

realized when expected or at all, including as a result of the

impact of, or problems arising from, the integration of the two

companies or as a result of the strength of the economy and

competitive factors in the areas where Independent and Enterprise

do business; (15) the possibility that the proposed transaction may

be more expensive to complete than anticipated, including as a

result of unexpected factors or events; (16) diversion of

management’s attention from ongoing business operations and

opportunities; (17) potential adverse reactions or changes to

business or employee relationships, including those resulting from

the announcement or completion of the proposed transaction; (18)

the dilution caused by Independent’s issuance of additional shares

of its capital stock in connection with the proposed transaction;

(19) cyber incidents or other failures, disruptions or breaches of

our operational or security systems or infrastructure, or those of

our third-party vendors or other service providers, including as a

result of cyber-attacks; and (20) other factors that may affect the

future results of Independent and Enterprise.

Additional factors that could cause results to differ materially

from those described above can be found in Independent’s Annual

Report on Form 10-K for the year ended December 31, 2023 and in its

subsequent Quarterly Reports on Form 10-Q, including in the

respective “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” sections of such

reports, as well as in subsequent SEC filings, each of which is on

file with the U.S. Securities and Exchange Commission (the

“SEC”) and available in the “Investor

Relations” section of Independent’s website, www.rocklandtrust.com,

under the heading “SEC Filings” and in other documents Independent

files with the SEC, and in Enterprise’s Annual Report on Form 10-K

for the year ended December 31, 2023 and in its subsequent

Quarterly Reports on Form 10-Q, including in the respective “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” sections of such reports, as

well as in subsequent SEC filings, each of which is on file with

and available in the “Investor Relations” section of Enterprise’s

website, www.enterprisebanking.com, under the heading “SEC Filings”

and in other documents Enterprise files with the SEC.

All forward-looking statements speak only as of the date they

are made and are based on information available at that time.

Neither Independent nor Enterprise assumes any obligation to update

forward-looking statements to reflect circumstances or events that

occur after the date the forward-looking statements were made or to

reflect the occurrence of unanticipated events except as required

by applicable law. As forward-looking statements involve

significant risks and uncertainties, caution should be exercised

against placing undue reliance on such statements. All

forward-looking statements, express or implied, included in the

document are qualified in their entirety by this cautionary

statement.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This communication is being made with respect to the proposed

transaction involving Independent and Enterprise. This material is

not a solicitation of any vote or approval of the Enterprise

shareholders and is not a substitute for the proxy

statement/prospectus or any other documents that Independent and

Enterprise may send to their respective shareholders in connection

with the proposed transaction. This communication does not

constitute an offer to sell or the solicitation of an offer to buy

any securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

In connection with the proposed transaction between Independent

and Enterprise, Independent will file with the SEC a Registration

Statement on Form S-4 (the “Registration Statement”) that will that

will include a proxy statement for a special meeting of

Enterprise’s shareholders to approve the proposed transaction and

that will also constitute a prospectus for the Independent common

stock that will be issued in the proposed transaction, as well as

other relevant documents concerning the proposed transaction.

BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS, INVESTORS AND

SHAREHOLDERS OF INDEPENDENT AND ENTERPRISE ARE URGED TO READ THE

REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING

THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Enterprise will mail the proxy statement/prospectus to

its shareholders. Shareholders are also urged to carefully review

and consider Independent’s and Enterprise’s public filings with the

SEC, including, but not limited to, their respective proxy

statements, Annual Reports on Form 10-K, Quarterly Reports on Form

10-Q, and Current Reports on Form 8-K. Copies of the Registration

Statement and of the proxy statement/prospectus and other filings

incorporated by reference therein, as well as other filings

containing information about Independent and Enterprise, can be

obtained, free of charge, as they become available at the SEC’s

website (http://www.sec.gov). Copies of the proxy

statement/prospectus and the filings with the SEC that will be

incorporated by reference in the proxy statement/prospectus can

also be obtained, without charge, by directing a request to

Independent Investor Relations, 288 Union Street, Rockland,

Massachusetts 02370, telephone (774) 363-9872 or to Enterprise

Bancorp, Inc., 222 Merrimack Street, Lowell, MA 01852, Attention:

Corporate Secretary, telephone (978) 656-5578.

PARTICIPANTS IN THE SOLICITATION

Independent, Enterprise, and certain of their respective

directors, executive officers and employees may, under the SEC’s

rules, be deemed to be participants in the solicitation of proxies

from the shareholders of Enterprise in connection with the proposed

transaction. Information regarding Independent’s directors and

executive officers is available in its definitive proxy statement

relating to its 2024 Annual Meeting of Shareholders, which was

filed with the SEC on March 28, 2024, and its Annual Report on Form

10-K for the year ended December 31, 2023, which was filed with the

SEC on February 28, 2024, and other documents filed by Independent

with the SEC. Information regarding Enterprise’s directors and

executive officers is available in its definitive proxy statement

relating to its 2024 Annual Meeting of Shareholders, which was

filed with the SEC on April 3, 2024, and its Annual Report on Form

10-K for the year ended December 31, 2023, which was filed with the

SEC on March 8, 2024 and other documents filed by Enterprise with

the SEC. Other information regarding the persons who may, under the

SEC’s rules, be deemed to be participants in the proxy solicitation

of Enterprise’s shareholders in connection with the proposed

transaction, and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the proxy statement/prospectus regarding the proposed transaction

and other relevant materials filed with the SEC when they become

available, which may be obtained free of charge as described in the

preceding paragraph.

Category: Merger Releases

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241208169090/en/

INDEPENDENT BANK CORP. / ROCKLAND TRUST: Investor Relations: Gerry Cronin, Director of

Investor Relations Rockland Trust Company (774) 363-9872

Gerard.Cronin@rocklandtrust.com

Media: Emily McDonald, Vice

President, Corporate Marketing Rockland Trust Company (781)

982-6650 Emily.McDonald@rocklandtrust.com

ENTERPRISE BANCORP, INC. / ENTERPRISE BANK: Investor Relations: Joe Lussier, Chief Financial

Officer & Treasurer, EVP Enterprise Bank (978) 656-5578

Joe.Lussier@ebtc.com

Media: Matthew Coggins, Chief

Marketing & Communications Officer Enterprise Bank (978)

656-5708 Matthew.Coggins@ebtc.com

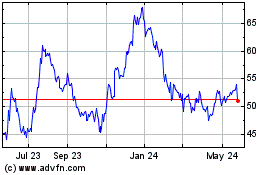

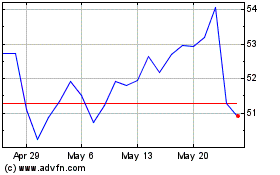

Independent Bank (NASDAQ:INDB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Independent Bank (NASDAQ:INDB)

Historical Stock Chart

From Dec 2023 to Dec 2024