(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

(Amendment No. ______)

Filed by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

ASSURE HOLDINGS CORP.

| (Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ASSURE HOLDINGS CORP.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To all Stockholders of Assure Holdings Corp.: |

|

You are invited to attend a Special Meeting of Stockholders (the “Special

Meeting”) of Assure Holdings Corp. (the “Company”). The Special Meeting will be held at the Las Vegas Marriott

Laughlin Conference Center, 17th Floor, 325 Convention center Drive, Las Vegas, Nevada, 89109 on July 19, at 10:00

a.m. Pacific Standard Time (“PST”). The purposes of the Special Meeting are:

| 1. |

To approve the amendment of the Company’s Articles of Incorporation, to increase the number of authorized shares (the “Authorized Share Increase”) in the Company’s common stock from 250,000,000 (13,888,888 after a planned reverse stock split) to 2,000,000,000; |

| 2. |

To approve the amendment of the Company’s Articles of Incorporation to permit the issuance of 10,000,000 shares of preferred stock with rights and preferences to be determined by the Company’s Board of Directors from time to time (the “Blank Check Preferred Amendment”); |

| 3. |

To authorize the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1 or Proposal No. 2 (the “Adjournment Proposal”); and |

| 4. | To conduct any other business that may properly come before the Special Meeting. |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR”

EACH PROPOSAL.

The Board of Directors has fixed July 1, 2024, as the record date for

the Special Meeting. Only stockholders of the Company of record at the close of business on that date will be entitled to notice of, and

to vote at, the Special Meeting. A list of stockholders as of July 1, 2024, will be available at the Special Meeting for inspection by

any stockholder. Stockholders will need to register online as provided below to attend and vote at the Special Meeting. Each share of

our common stock is entitled to one vote on each of the matters before the stockholders. If your shares of common stock are not registered

in your name, you will need to obtain a proxy from the broker, bank or other institution that holds your shares of common stock in order

to register to attend and vote at the Special Meeting. You should ask the broker, bank or other institution that holds your shares to

provide you with a proxy to vote your shares of common stock at the Special Meeting.

Your vote is important. You are requested to carefully read the accompanying

Proxy Statement for the Special Meeting for a more complete statement of matters to be considered at the Special Meeting. Whether or not

you expect to attend the Special Meeting, please sign and return the enclosed proxy card or vote your proxy online pursuant to the instructions

thereon, promptly. If you decide to attend the Special Meeting, you may, if you wish, revoke the proxy and vote your shares of common

stock using a ballot during the Special Meeting. Additional details concerning the matters to be put before the Special Meeting are set

forth in the Company’s Proxy Statement for the Special Meeting of Stockholders which accompanies this Notice of Meeting.

IF YOU

RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED “FOR”

EACH MATTER AT THE SPECIAL MEETING.

By Order of the Board of Directors,

| ASSURE HOLDINGS CORP. |

|

| |

|

| /s/ John Farlinger |

|

| Executive Chairman and Chief Executive Officer |

|

| July 5, 2024 |

|

THIS PAGE INTENTIONALLY LEFT BLANK

ASSURE HOLDINGS CORP.

7887 E. BELLEVIEW AVENUE, SUITE 240

DENVER • COLORADO • USA • 80111

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD JULY 19, 2024

Unless the context requires otherwise, references in this Proxy Statement

to “Assure Holdings”, “Assure”, the “Company”, “we”, “us”

or “our” refer to Assure Holdings Corp.

The Special Meeting of Stockholders of Assure Holdings (the “Special

Meeting”) will be at the Las Vegas Marriott Laughlin Conference Center, 17th Floor, 325 Convention center Drive,

Las Vegas, Nevada, 89109 on July 19, 2024, at 10:00 a.m. Pacific Standard Time (“PST”).

We are providing the enclosed proxy materials and form of proxy (the

“Proxy Statement”) in connection with the solicitation by the Company’s Board of Directors (the “Board”)

of proxies for this Special Meeting. The Company anticipates that this Proxy Statement and the form of proxy will be made available to

holders of the Company’s shares of common stock (the Company’s shares of common stock will be referred to as “shares”

and the whole class of common stock referred to as the “common stock”) on or about July 9, 2024.

You are invited to attend the Special Meeting at the above stated time

and location. If you plan to attend and your shares are held in “street name” – in an account with a bank, broker or

other nominee – you must obtain a proxy issued in your name from such broker, bank or other nominee. Please bring that documentation

to the Special Meeting.

You can vote your shares by completing and returning the proxy card

or, if you hold shares in “street name,” by completing the voting form provided by the broker, bank or other nominee.

A returned

signed proxy card without an indication of how shares should be voted will be voted “FOR” each matter

at the Special Meeting.

Our corporate bylaws define a quorum as 33-1/3% of the common stock

entitled to vote at any meeting of stockholders. The affirmative vote of a majority of Company’s outstanding voting shares is required

to approve the Authorized Shares Increase. The affirmative vote of the shares cast on the proposal by stockholders present at the Special

Meeting, whether in person or by proxy, and entitled to vote thereon is required to approve the Adjournment Proposal.

Important Notice Regarding the Availability

of Proxy Materials for the Meeting to be Held on July 19, 2024

The proxy materials, which include the Notice of Special Meeting,

this Proxy Statement and the accompanying Proxy Card, can be found at http://www.proxyvote.com. Information contained on

or connected to the website is not incorporated by reference into this Proxy Statement and should not be considered a part of this Proxy

Statement or any other filing that we make with the Securities and Exchange Commission.

This Proxy Statement is also available on the Company’s website

at https://ir.assureneuromonitoring.com or will be provided by the Company, upon request, by mail at Assure Holdings Corp., 7887 E. Belleview

Ave., Suite 240, Denver, Colorado, USA 80111, Attention: John Farlinger, Chief Executive Officer; or by email at ir@assureiom.com,

free of charge to stockholders. The Company may require the payment of a reasonable charge from any person or corporation who is not a

stockholder and who requests a copy of any such document. Financial information relating to the Company is provided in the Company’s

comparative consolidated financial statements and management’s discussion and analysis for its most recently completed fiscal year

which are contained in its Annual Report on Form 10-K. Additional information relating to the Company is available electronically on EDGAR

at www.sec.gov/edgar.

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS

AND VOTING

Why am I receiving this Proxy Statement and Proxy Card?

You are receiving this Proxy Statement and the accompanying Proxy Card

because you were a stockholder of record at the close of business of July 1, 2024, and are entitled to vote at the Special Meeting. This

Proxy Statement describes issues on which the Company would like you, as a stockholder, to vote. It provides information on these issues

so that you can make an informed decision. You do not need to attend the Special Meeting to vote your shares.

When you sign the Proxy Card, you appoint John Farlinger, Chief Executive

Officer and Executive Chairman of the Board of the Company, and Paul Webster, Chief Financial Officer of the Company, as your representatives

at the Special Meeting. As your representatives, they will vote your shares at the Special Meeting (or any adjournments or postponements)

in accordance with your instructions on your Proxy Card. With proxy voting, your shares will be voted whether or not you attend the Special

Meeting. Even if you plan to attend the Special Meeting, it is a good idea to complete, sign and return your Proxy Card or vote your Proxy

Card online pursuant to the instructions thereon in advance of the Special Meeting just in case you change your plans.

If an issue comes up for vote at the Special Meeting (or any adjournments

or postponements) that is not described in this Proxy Statement, your representatives will vote your shares, under your proxy, in their

discretion, subject to any limitations imposed by law.

When is the record date?

The Board has fixed July 1, 2024, as the record date for the Special

Meeting. Only holders of shares of the Company’s common stock as of the close of business on that date will be entitled to vote

at the Special Meeting.

How many shares are outstanding?

As of July 1, 2024, the Company had 10,602,306 shares of common stock

issued and outstanding. The Company’s common stock is the only outstanding voting security of the Company.

What am I voting on?

You are being asked to vote on the following:

| 1. |

To approve the amendment of the Company’s Articles of Incorporation, to increase the number of authorized shares (the “Authorized Share Increase”) in the Company’s common stock from 250,000,000 (13,888,888 after a planned reverse stock split) to 2,000,000,000; |

| 2. |

To approve the amendment of the Company’s Articles of Incorporation to permit the issuance of 10,000,000 shares of preferred stock with rights and preferences to be determined by the Company’s Board of Directors from time to time (the “Blank Check Preferred Amendment”); |

| 3. |

To authorize the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1 (the “Adjournment Proposal”); and |

| 4. |

To conduct any other business that may properly come before the Special Meeting. |

How many votes do I get?

Each share of our common stock is entitled to one vote on each of the

matters before the stockholders. No cumulative rights are authorized, and dissenters’ rights are not applicable to any of the matters

being voted upon.

The Board recommends a vote “FOR” the amendment

for the Authorized Share Increase and “FOR” the Adjournment Proposal, in each case, as disclosed in this Proxy

Statement.

How do I vote?

You have several voting options. You may vote by:

| · | by using the 11-digit control number located at the bottom of your Proxy Card at the following website: www.proxyvote.com; |

| · | calling 1-800-690-6903 (toll free in North America); |

| · | marking, signing and mailing your Proxy Card in the postage-paid envelope provided with the Proxy Card; or |

| · | attending the Special Meeting and voting in person. |

Are you a non-registered holder?

The information set out in this section is important to many stockholders

as a substantial number of stockholders do not hold their shares in their own name. Only registered stockholders or duly appointed proxyholders

for registered stockholders are permitted to vote in person at the Special Meeting. Most of the stockholders are “non-registered”

stockholders (each a “Non-Registered Holder”) because the shares they own are not registered in their names but are instead

registered in the name of the brokerage firm, bank or trust company through which they purchased the shares.

More particularly, a person is a Non-Registered Holder in respect of

shares which are held on behalf of that person but which are registered either (a) in the name of an intermediary (the “Intermediary”)

that the Non-Registered Holder deals with in respect of the shares (Intermediaries include, among others, banks, trust companies, securities

dealers or brokers and trustees or administrators of self-administered RRSP’s, RRIF’s, RESP’s and similar plans), or

(b) in the name of a clearing agency (such as, in the United States, shares registered in the name of “Cede & Co.”, the

registration name of The Depository Trust Company (“DTC”), or in Canada, shares registered in the name of “CDS

& Co.”, the registration name of The Canadian Depository for Securities Limited (“CDS”)) of which the Intermediary

is a participant. As noted below, in accordance with Regulation 14A under the United States Securities Exchange Act of 1934, as amended

(the “Exchange Act”) and the requirements of National Instrument 54-101 – Communication with Beneficial Owners

of Securities of a Reporting Issuer (“NI 54-101”) of the Canadian Securities Administrators, the Company will be

mailing the Notice of Special Meeting, this Proxy Statement and the form of Proxy Card/voting instruction form (collectively, the “Special

Meeting Materials”), directly to certain non-objecting Non-Registered Holders and in certain instances has distributed the Special

Meeting Materials to the clearing agencies and Intermediaries for onward distribution to objecting Non-Registered Holders. Intermediaries

are required to provide the Special Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to

receive them. Very often, Intermediaries will use service companies to forward the Special Meeting Materials to Non-Registered Holders.

Generally, if you are a Non-Registered Holder and you have not waived the right to receive the Special Meeting Materials you will either:

| (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is

restricted to the number of shares beneficially owned by you, but which is otherwise not complete. Because the Intermediary has already

signed the proxy, this proxy is not required to be signed by you when submitting it. In this case, if you wish to submit a proxy you should

otherwise properly complete the executed proxy provided and mail it as provided in the instructions of the Intermediary or its service

company; or |

| (b) | more typically, a Non-Registered Holder

will be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the

Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “proxy”,

“proxy authorization form” or “voting instruction form”) which the Intermediary must follow. Typically,

the voting instruction form will consist of a one-page pre-printed form. Sometimes, instead of the one-page printed form, the voting instruction

form will consist of a regular printed proxy accompanied by a page of instructions that contains a removable label containing a bar-code

and other information. In order for the proxy to validly constitute a voting instruction form, the Non-Registered Holder must remove the

label from the instructions and affix it to the proxy, properly complete and sign the proxy and return it to the Intermediary or its service

company in accordance with the instructions of the Intermediary or its service company. |

In either case, the purpose of this procedure is to permit Non-Registered

Holders to direct the voting of the shares that they beneficially own. If you are a Non-Registered Holder and you wish to vote at the

Special Meeting as proxyholder for the shares owned by you, you should strike out the names of the designated proxyholders named in the

proxy authorization form or voting instruction form and insert your name in the blank space provided. In either case, you should carefully

follow the instructions of your Intermediary, including when and where the proxy, proxy authorization or voting instruction form is to

be delivered.

The Special Meeting Materials are being made available to both registered

stockholders and Non-Registered Holders. The Company is sending the Special Meeting Material directly to Non-Registered Holders who have

not objected to the Intermediary through which their shares are held disclosing ownership information about themselves to the Company

(“NOBO’s”) under Regulation 14A of the Exchange Act. If you are a NOBO, and the Company or its agent has

sent you the Special Meeting Materials, your name and address and information about your holdings of securities have been obtained in

accordance with applicable securities regulatory requirements from the Intermediary on your behalf. If you are a Non-Registered Holder

who has objected to the Intermediary through which your shares are held disclosing ownership information about you to the Company (an

“OBO”), your Intermediary will be forwarding you the Special Meeting Materials in accordance with the requirements

of Regulation 14A and the Company will be covering the cost of such mailings.

Can stockholders vote at the Special Meeting?

Registered stockholders and appointed proxyholders will be given a

ballot to vote at the Special Meeting. Stockholders who wish to appoint a third-party proxyholder to attend the Special Meeting and submit

votes during the Special Meeting must provide their third-party proxyholders with a valid, signed proxy for submission at the Special

Meeting to receive a ballot. If you are a Non-Registered Holder and wish to vote your shares at Special Meeting, you will need to obtain

a valid, signed proxy naming yourself as proxyholder from your Intermediary. By doing so, you are instructing your Intermediary to appoint

you as proxyholder.

What if I share an address with another stockholder and we received

only one copy of the Special Meeting Materials?

If certain requirements are met under relevant U.S. securities law,

including in some circumstances the stockholders’ prior written consent, we are permitted to deliver one Proxy Statement to a group

of stockholders who share the same address. If you share an address with another stockholder and have received only one copy of the Special

Meeting Materials, but desire another copy or desire to receive separate copies in relation to future meetings of the stockholders, please

send a written request to our offices at the address below or call us at 720-287-3093 to request another copy of the materials or separate

delivery of materials. Please note that each stockholder should receive a separate Proxy Card to vote the shares they own.

Send requests to:

Assure Holdings Corp.

7887 E. Belleview Ave., Suite 240

Denver, Colorado, USA 80111

Attention: John Farlinger, Chief Executive Officer

Stockholders who hold shares in street name (as described below) may

contact their brokerage firm, bank, broker-dealer, or other similar organization to request information about householding.

What if I change my mind after I vote?

You may revoke your vote/proxy and change your vote at any time before

the polls close at the Special Meeting. You may do this by:

| · | going online and completing

a new proxy at www.proxyvote.com; |

| · | calling 1-800-690-6903 and

changing your vote; |

| · | requesting and signing another Proxy Card with a later date and mailing it using the postage-paid envelope provided, so long as it

is received prior to 5 p.m. Eastern Standard Time on July 18, 2024; |

| · | signing and delivering a written notice of revocation (in the same manner as a proxy is required to be executed as set out in the

notes to the Proxy Card) to the Company’s Secretary, at Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240, Denver, Colorado,

USA 80111 prior to 5 p.m. Eastern Standard Time on July 18, 2024 or with the Chair of the Special Meeting on the day of the Special Meeting

prior to the commencement of the Special Meeting; or |

| · | attending the Special Meeting and voting in person through a ballot. |

Beneficial stockholders should refer to the instructions received from

their broker, bank or intermediary or the registered holder of the shares if they wish to change their vote.

How many votes do you need to hold the meeting?

To conduct the Special Meeting, the Company must have a quorum, which

means 33-1/3% of the common stock entitled to vote at any meeting of stockholders. The common stock is the only outstanding voting stock

of the Company. Based on 10,602,306 shares outstanding as of the record date of July 1, 2024, 3,534,102 shares must be present in person

or by proxy for the quorum to be reached. Your shares will be counted as present at the Special Meeting if you:

| · | submit a properly executed Proxy Card (even if you do not provide voting instructions); or |

| · | attending the Special Meeting and voting in person through a ballot. |

What if I abstain from voting?

Abstentions with respect to a proposal are counted for the purposes

of establishing a quorum but are not counted as votes “cast” on the proposal. Since the Company’s bylaws state that

matters presented at a meeting of the stockholders must be approved by the majority of the votes “cast” on the matter, a properly

executed proxy card marked “ABSTAIN” with respect to a proposal will not be considered a vote “cast”

and will have no effect on the outcome of the Adjournment Proposal; provided however that approval of the Authorized Share Increase and

the approval of the Blank Check Preferred Amendment requires the affirmative vote of a majority of the issued and outstanding shares of

common stock as of the Record Date and therefore any proxy card marked “ABSTAIN” in relation to such proposal

will have the same effect as a vote “AGAINST” such proposal.

What effect does a broker non-vote have?

Brokers and other Intermediaries holding shares for Non-Registered

Holders are generally required to vote the shares in the manner directed by the Non-Registered Holders. If the Non-Registered Holders

do not give any direction, brokers may vote the shares on routine matters but may not vote the shares on non-routine matters. Each of

the Authorized Share Increase, the Blank Check Preferred Amendment and the Adjournment Proposal are expected to be treated as non-routine

matters.

The absence of a vote on a non-routine matter is referred to as a broker

non-vote. Broker non-votes are considered present at the Special Meeting for quorum requirements but are not considered votes “cast”

on non-routine matters. Any shares represented at the Special Meeting but not “cast” as a result of a broker non-vote will

have the same effect as a vote “AGAINST” each of the Authorized Share Increase and the Blank Check Preferred

Amendment and will have no effect on the Adjournment Proposal.

How many votes are needed to approve the Authorized Share Increase?

Approval of the Authorized Share Increase requires the affirmative

vote of a majority of the issued and outstanding shares of common stock as of the Record Date. Broker non-votes and proxy cards marked

“ABSTAIN” will have the same effect as a vote “AGAINST” the Authorized Share Increase.

How many votes are needed to approve the Blank Check Preferred

Amendment?

Approval of the Blank Check Preferred Amendment requires the affirmative

vote of a majority of the issued and outstanding shares of common stock as of the Record Date. Broker non-votes and proxy cards marked

“ABSTAIN” will have the same effect as a vote “AGAINST” the Blank Check Preferred

Amendment.

How many votes are needed to approve the Adjournment Proposal?

The Adjournment Proposal will be approved by an affirmative vote of

a majority of the votes cast at the Special Meeting by stockholders present at the Special Meeting, in person or by proxy, and entitled

to vote thereon. Broker non-votes and a properly executed proxy card marked “ABSTAIN” with respect to this proposal

will not have an effect on the outcome of this proposal.

Will my shares be voted if I do not sign and return my Proxy Card?

If your shares

are held through a brokerage account, your brokerage firm, under certain circumstances and subject to certain legal restrictions, may

vote your shares, otherwise your shares will not be voted at the meeting. See “What effect does a broker non-vote have?”

above for a discussion of the matters on which your brokerage firm may vote your shares.

If your shares are registered in your name and you do not sign and

return your proxy card, your shares will not be voted at the Special Meeting.

What happens if I do not indicate how to vote my proxy?

If you just sign your Proxy Card without providing further instructions,

your shares will be “FOR” each matter at the Special Meeting.

Where can I find the voting results of the meeting?

Within four (4) business days of the Special Meeting, the Company will

file a current report on Form 8-K with the United States Securities and Exchange Commission (the “SEC”) announcing

the voting results of the Special Meeting.

Who will pay for the costs of soliciting proxies?

The Company will bear the cost of soliciting proxies. In an effort

to have as large a representation at the meeting as possible, the Company’s directors, officers and employees may solicit proxies

by telephone or in person in certain circumstances. These individuals will receive no additional compensation for their services other

than their regular compensation. Upon request, the Company will reimburse brokers, dealers, banks, voting trustees and their nominees

who are holders of record of the Company’s Common Stock on the record date for the reasonable expenses incurred in mailing copies

of the Special Meeting Materials to the beneficial owners of such shares. The Company may also determine to pay a proxy solicitor to solicit

proxies on behalf of the Company and will provide information on the fees paid to such solicitor upon engagement to conduct such activities.

We have engaged Advantage Proxy, Inc. as the proxy solicitor for the

Special Meeting for a base fee ranging from $7,500 to $12,500 plus fees for additional services, if any. We have also agreed to reimburse

Advantage Proxy, Inc. for its reasonable out of pocket expenses.

Are there any other matters to be handled at the Special Meeting?

We are not currently aware of any business to be acted upon at the

Special Meeting other than the proposals discussed in this Proxy Statement and the date for submission of matters under federal securities

laws and the Company’s bylaws has passed. The form of proxy accompanying this Proxy Statement confers discretionary authority upon

the named proxy holders with respect to amendments or variations to the matters identified in the accompanying Notice of Special Meeting

and with respect to any other matters which may properly come before the Special Meeting or at any adjournment(s) or postponement(s) of

the Special Meeting. If other matters do properly come before the Special Meeting, or at any adjournment(s) or postponement(s) of the

Special Meeting, shares of our common stock, represented by properly submitted proxies, will be voted by the proxy holders in accordance

with their best judgment to the extent permitted by applicable law.

Who can help answer my questions?

You can contact our Chief Executive Officer, John Farlinger, at 720-287-3093

or by sending a letter to John Farlinger at the Company’s headquarters at Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240,

Denver, Colorado, USA 80111 or by e-mail to john.farlinger@assureiom.com with any questions about the proposals described in this Proxy

Statement or how to execute your vote.

When are stockholder proposals due for the 2024 annual meeting

of stockholders?

Under the Exchange Act, the deadline for submitting stockholder proposals

for inclusion in the proxy statement for an annual meeting of the stockholders is calculated in accordance with Rule 14a-8(e) of Regulation

14A to the Exchange Act. If the proposal is submitted for a regularly scheduled annual meeting, the proposal must be received at the Company’s

principal executive offices not less than 120 calendar days before the anniversary date on which the Company’s proxy statement was

released to the stockholders in connection with the previous year’s annual meeting. However, if the Company did not hold an annual

meeting the previous year, or if the date of the current year’s annual meeting has been changed by more than 30 days from the date

of the previous year’s meeting, then the deadline is a reasonable time before the Company begins to print and mail its proxy materials.

The deadline for submitting stockholder proposals for inclusion in the proxy statement for the next annual meeting of the stockholders

will be August 7, 2024. If a stockholder proposal is not submitted to the Company by August 7, 2023, the Company may still grant discretionary

proxy authority to vote on a stockholder proposal, if such proposal is received by the Company by October 21, 2024 in accordance with

Rule 14a-4(c)(1) of Regulation 14A of the Exchange Act. If the date for the annual meeting in 2023 is moved by more than 30 days, the

Company will update the stockholders regarding the deadlines set forth above by filing a Current Report on Form 8-K in relation thereto.

Under the Company’s bylaws, stockholders may submit nominees

for election to the Board pursuant to the requirements set forth therein. The written notice of such nominations must be provided to the

Company’s Corporate Secretary, at the Company’s headquarters at Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240,

Denver, Colorado, USA 80111, not less than 30 days prior to the date of the annual meeting of stockholders; provided, however, that in

the event that the annual meeting of stockholders is called for a date that is less than 50 days after the date on which the first public

announcement of the date of the annual meeting was made, notice may be made not later than the close of business on the 10th day following

such public notice date pursuant to the Company’s bylaws.

In addition to satisfying the foregoing requirements under the Company’s

bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than

our nominees for the 2024 annual meeting must provide notice that sets forth the information required by Rule 14a-19 under the Exchange

Act no later than October 28, 2024, unless the date of our 2024 annual meeting has changed by more than 30 days calendar days from this

year’s annual meeting in which case such notice will be due on the later of 60 calendar days prior to the date of the annual meeting

or the 10th calendar day following the day on which public announcement of the date of the annual meeting is first made.

How can I obtain a copy of the most recent Annual Report on Form

10-K?

The Company’s most recent Annual Report on Form 10-K, including

financial statements, is available through the SEC’s website at www.sec.gov.

At the written request of any stockholder who owns shares on the record

date, the Company will provide to such stockholder, without charge, a paper copy of the Company’s most recent Annual Report on Form

10-K as filed with the SEC, including the financial statements, but not including exhibits. If requested, the Company will provide copies

of the exhibits for a reasonable fee.

Requests for additional paper copies of the Annual Report on Form 10-K

should be mailed to:

Assure Holdings Corp.

7887 E. Belleview Ave., Suite 240

Denver, Colorado, USA 80111

Attention: John Farlinger, Chief Executive Officer

What materials accompany this Proxy Statement?

The following materials accompany this Proxy Statement:

| 1. | The Notice of Special Meeting; and |

How is the Company accommodating stockholders amid the COVID-19

pandemic?

The Company

is continuously monitoring coronavirus (“COVID-19”). The Company reserves the right to take any additional precautionary

measures it deems necessary in relation to the Special Meeting in response to further development in respect of COVID-19 that the Company

considers necessary or advisable including changing the time or location of the Special Meeting. Changes to the Special Meeting time,

date or location and/or means of holding the Meeting may be announced by way of press release. Please monitor the Company’s press

releases as well as its website at www.assureneuromonitoring.com for updated information. The Company advises you to check its website

one week prior to the Special Meeting date for the most current information. The Company does not intend to prepare or mail an amended

Proxy Statement in the event of changes to the Special Meeting format, unless required by law.

PROPOSAL 1 — APPROVAL OF THE INCREASE

TO THE AUTHORIZED SHARES OF COMMON STOCK

Introduction

The Board has unanimously approved, subject to stockholder approval,

an amendment to our Amended Articles of Incorporation (“Articles of Incorporation”) to increase the number of authorized

shares of our common stock from 250,000,000 shares, par value $0.001, to 2,000,0000 shares, par value $0.001 (such amendment as shown

in Appendix B). The remaining provisions of our Articles of Incorporation would remain unchanged. The Board has determined that this amendment

is in the best interest of the Company and its stockholders and recommends that the stockholders approve this amendment.

Why did the Board approve the Authorized Share Increase?

The Board

approved the Authorized Share Increase in relation to the Company’s plan to regain compliance with the listing requirements of the

Nasdaq Capital Market (the “Nasdaq”) by July 22, 2024. In relation thereto, the Company plans to conduct the

following transactions and undertake the following actions, after which, without the Authorized Share Increase the Board does not believe

that the Company would have sufficient authorized capital to meet its ongoing needs for share capital.

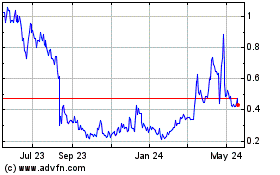

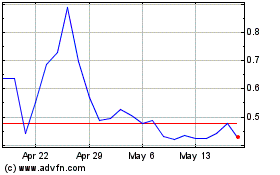

On July 25, 2023, the Company received a

written notice from Nasdaq that, because the closing bid price for the Company’s common stock had fallen below $1.00 per share for

30 consecutive business days, the Company no longer complies with the minimum bid price requirement for continued listing on the

Nasdaq.

On August 16, 2023, the Company received

notice from the Nasdaq that the Company no longer satisfies the $2.5 million stockholders’ equity requirement for continued listing

on the Nasdaq, or the alternatives to that requirement - a $35 million market value of listed securities or $500,000 in net income

in the most recent fiscal year or two or the last three fiscal years - as required by Nasdaq Listing Rule 5550(b).

On May 16, 2024, the Company received

a written notice from the Nasdaq Hearing Panel that it had granted the Company an extension to regain compliance with the continued listing

requirements for the Nasdaq. The Hearings Panel granted the Company an extension until July 22, 2024, by which date the Company will

be required to demonstrate compliance with all applicable initial listing requirements for the Nasdaq Capital Market in relation to its

completion of its previously announced transaction with Danam.

On June 11, 2024, the Company terminated its agreement with Danam and

submitted a new plan of compliance to the Nasdaq Hearing Panel. As of the date hereof, the Company is still awaiting notice from the Nasdaq

Hearing Panel whether the Company’s previously granted extension to July 22, 2024, remain in place.

As part of this plan to regain compliance, the

Company is conducting the following transactions:

| |

· |

An offering of shares of common stock and warrants to purchase shares

of Common Stock pursuant either to (i) the Company’s registration statement on Form S-1 as filed with the SEC on June 24, 2024,

for up to an aggregate amount of gross proceeds of approximately $9 million or (ii) on a private placement basis. |

| |

· |

An exchange offer for the Company’s convertible debentures whereby each $1,000 principal face amount of the Company’s 9% convertible debentures due and payable in 2023 and 2024 would be exchanged for shares of common stock at a per share price of $0.233 such exchange offer to expire at 11:59 pm Denver Time on July 19, 2024. |

| |

· |

Issuing shares of common stock to holders of up to $6 million of the Company’s outstanding accounts payable as part of subscriptions for shares of Common Stock to settle such accounts, such issuances to occur from time to time as a price per share equal to the Nasdaq Closing Price immediately prior to the signing of the binding agreements for such subscriptions. |

| |

· |

Exchanging up to $8 million of its outstanding debenture with Centurion Financial Trust into shares of common stock at a price per share equal to the Nasdaq Closing Price immediately prior to the signing of the definitive agreement regarding such exchange. |

| |

· |

This special meeting of the stockholders to consider and approve the Authorized Share Increase and the Blank Check Preferred Amendment. |

| |

· |

A reverse stock split in the Company’s outstanding shares of

common stock and authorized capital to be effective on July 9, 2024, at a ratio of 1-for-18. |

We believe that the Authorized Share Increase, if approved, will provide

us with the ability to cover the shares of common stock underlying warrants to be issued in our recently announced equity financing (many

of which are not exercisable until stockholder approval is obtained for the terms of such warrants, which will be subject to a separate

stockholder vote in the future), finish settling our debt obligations under the outstanding convertible notes and debentures through the

issuance of shares of our common stock, settle outstanding accounts payable in shares of common stock and provide room to issue stock

awards to help retain our officers and employees and to issue shares of common stock in future equity financings to meet our ongoing capital

requirements.

How many shares of Common Stock are currently outstanding or subject

to issuance?

As of July 1, 2024, we had 250,000,000 shares of common stock authorized

for issuance under our Articles of Incorporation of which 10,602,306 shares are issued and outstanding and 239,397,694 shares of common

stock were unissued. We have the following current and future obligations to issue shares of common stock, which total approximately 2

million shares of common stock:

| · | 186,328

shares of common stock issuable upon the exercise of outstanding warrants with an average weighted exercise price of $69.92; |

| · | 14,395

shares of common stock issuable upon the exercise of outstanding stock options with an average weighted exercise price of $119.79; and |

| · | 30,584

shares of common stock issuable upon conversion of 9% convertible notes due in 2023 and 2024. |

If the Authorized Share Increase is approved, it will increase the

number of shares of common stock available for issuance to (i) settle our obligations under our convertible notes, our debenture with

Centurion Asset Management Inc. and our trade accounts payable, (ii) meet our obligations under our outstanding warrants and warrants

anticipated to be issued in the ongoing equity financing, (iii) provide room to issue stock awards to help retain our officers and employees,

and (iv) issue shares of common stock in future equity financings to meet our ongoing capital requirement. Absent the availability of

shares of common stock, the Company may be forced to settle its obligations under the convertible notes, debenture with Centurion, convertible

note with Danam and our trade accounts payable entirely by the payment of cash, if available. If the Company does not have sufficient

cash to settle these obligations, the Company may be unable to continue operations if it cannot otherwise negotiate the settlement of

such obligations.

For this reason, the Board determined that the Authorized Share Increase

would give the Company greater flexibility in settling these debts and accounts payable by increasing the number of shares of common stock

available for issuance.

What effect will the planned reverse stock split have on the Authorized

Share Increase?

The Company has authorized a 1-for-18 reverse stock split to be effective

at 12:01 a.m. on July 9, 2024. The reverse stock split will reverse both the authorized shares of Common Stock together with the issued

and outstanding shares of Common Stock.

Assuming the reverse stock split is effective as planned, the Company’s

authorized shares of Common Stock will be reduced by a factor of 18 from 250,000,000 shares of Common Stock to 13,888,888 shares of Common

Stock. The Company will not correspondingly reduce the number of authorized shares of Common Stock being requested under the Authorized

Share Increase. Therefore, the Authorized Share Increase will still have the effect of increasing the Company’s number of authorized

shares of Common Stock to 2,000,000,000.

This means that following the reverse stock split, assuming it is effective

as planned on July 9, 2024, the Company will have 13,888,888 shares of Common Stock authorized for issuance under our Articles of Incorporation

of which approximately 589,017 will be issued and outstanding leaving 13,299,871 shares of Common Stock available for issuance. Following

the Authorized Share Increase, and assuming no issuance of further shares of Common Stock, the Company would have 1,999,410,983 shares

of Common Stock available for issuance.

What is the purpose of the Authorized Share Increase?

The Board recommends the Authorized Share Increase for the following

reasons:

| · |

To provide the Company sufficient share capital to meet complete its plan of compliance with Nasdaq and have sufficient authorized capital thereafter to meet ongoing capital requirements through future equity financings. |

| · |

To provide flexibility for the Company to settle its obligations under its convertible notes, debenture with Centurion and trade accounts payable through the issuance of shares of common stock; |

| · |

To permit the Company to make future issuances or exchanges of common stock for capital raising purposes or to restructure outstanding securities of the Company; and |

| · |

To permit the Company to make future issuances of options, warrants and other convertible securities. |

What could happen if the stockholders do not approve the Authorized

Share Increase?

In the event the Authorized Share Increase is not approved, we believe

we will have sufficient share capital to complete our planned equity financing and certain of our planned debt to equity conversions.

| |

· |

Based on our current market price of $0.3730 as of July 1, 2024, and assuming an offering size of $9 million in aggregate gross proceeds, we would issue approximately 24.1 million shares of common stock in our equity financing and need to reserve approximately 24.1 million shares of common stock for issuance upon exercise of warrants immediately exercisable upon issuance. |

| |

· |

Based on the same $0.3730 price, we would issue approximately 21.4 million shares of common stock upon the conversion of up to approximately $8 million of our debenture with Centurion. |

| |

· |

Based on the same $0.3730 price, we would issue approximately 16.1 million shares of common stock upon settlement of up to approximately $6 million of accounts payable. |

| · | Based on the tender price of $0.233 per share in the exchange offer for our convertible debentures, we could issue up to approximately

13.7 million shares of common stock on exchange of $3.1 million in face amount of convertible debentures plus accrued and unpaid interest. |

In aggregate total we could issue up to approximately 75.3 million

shares and reserve an additional 24.1 million shares of common stock upon exercise of outstanding warrants to be issued in the proposed

financing that are immediately exercisable. Based on our current issued and outstanding, this would result in approximately 85.9 million

shares issued and outstanding and 24.3 million shares of common stock reserved for issuance on exercise of outstanding warrants and options.

This would leave approximately 139.8 million shares of common stock available for issuance.

Following the planned reverse stock split of 1-for-18 on July 9, 2024,

and assuming the above issuances, we would have approximately 4.18 million shares of Common Stock issued and outstanding and approximately

1.35 million shares of Common Stock reserved for issuance on exercise of outstanding warrants and options. This would leave approximately

8.4 million share of Common Stock available for issuance based on 13,888,888 authorized shares of Common Stock following the reverse stock

split.

If the above financing, conversions or settlements occur at a price

below $0.3730 per share, we could issue substantially more shares of common stock and have little to no room left in our authorized capital

to complete all anticipated conversions and settlements. For example, if we issued shares of Common Stock in the financing, settlement

of our debenture and settlement of accounts payable at $0.15 per share, this would result in the issuance of approximately 167 million

share of Common Stock, resulting in approximately 177.6 million shares of Common Stock issued and outstanding with approximately 60.2

million shares of Common Stock reserved for issuance. This would result in us having only approximately 12.2 million shares of Common

Stock available for issuance.

Following the planned reverse stock split of 1-for-18 on July 9, 2024,

we would have approximately 9.87 million shares of Common Stock issued and outstanding with 3.33 million shares of Common Stock reserved

for issuance. This would leave approximately 0.7 million shares of Common Stock available for issuance based on 13,888,888 authorized

shares of Common Stock following the reverse stock split.

Further, we may issue additional warrants in the proposed financing.

If we issue an additional warrant in the proposed financing, assuming the same pricing above, we would be required to reserve for issuance

and additional 24.1 million shares of Common Stock at a price of $0.3730 or an additional 60 million share of common stock at a price

of $0.15. This would leave only approximately 79.8 million share of Common Stock available for issuance at an assumed price of $0.3730

per share for the above transactions or a shortfall of approximately 47.8 million shares of Common Stock available for issuance at an

assumed price of $0.15 per share for the above transactions.

If the Authorized Share Increase is not approved there may not be sufficient

shares of common stock to settle our convertible notes, our debenture with Centurion or our trade accounts payable. If we are unable to

issue shares of common stock in settlement of these obligations, the Company will be required to settle such obligations, in whole or

in part, in cash amounts as calculated pursuant to the terms of those securities. The Board considered the considerable dilution in settling

these securities and obligations in shares of common stock would have on current stockholders, but given the Company’s current cash

position, the Board has determined that not having the flexibility to settle the obligations in shares of common stock and perhaps having

to settle those obligations, in whole or in part, in cash would potentially materially, negatively impact the Company’s business

plans and not be in the best interests of the Company’s stockholders despite the dilutive effect of settling such securities and

obligations in shares of common stock. To the extent our cash and cash equivalents are insufficient to enable us to make cash payments

with respect to these securities and obligations and the number of shares of common stock required to settle these securities and obligations

is beyond our authorized capital, if we are unable to negotiate a settlement or restructuring with the holders of such securities or obligations,

we may be subject to a lawsuit or forced to declare bankruptcy. Further Centurion, the holder of our debenture, could foreclosure on its

security interest over all our assets causing us to seek protection under federal bankruptcy laws.

While, depending on the price per share at which our proposed financing

is completed and our conversions of debt and settlement of shares is completed, we do anticipate that we currently have sufficient authorized

capital to complete the transaction necessary to stay on the Nasdaq, as detailed above, if we do not increase our authorized shares of

common stock and our stock price drops significantly, we may be unable to complete the above transactions necessary to meet the listing

standards of Nasdaq by July 22, 2024. Further, even if we are able to complete such transactions and maintain our Nasdaq listing, following

the above issuances we expect to need to increase our authorized capital to have sufficient capital to cover the exercise of warrants

that will become exercisable upon stockholder approval of their terms and to meet our ongoing capital requirements through equity financings.

If we do not close the above transactions, we will likely lose our

listing on the Nasdaq.

What dilutive effect will the Authorized Share Increase have?

If the stockholders approve the Authorized Share Increase, the Board

may cause the issuance of additional shares of common stock without further vote of the stockholders of the Company, except as provided

under Nevada corporate law or under the rules of any national securities exchange or automated quotation system on which shares of common

stock of the Company are then quoted, listed or traded. The relative voting and other rights of holders of the common stock will not be

altered by the authorization of additional shares of common stock. Each share of common stock will continue to entitle its owner to one

vote. When issued, the additional shares of common stock authorized by the amendment will have the same rights and privileges as the shares

of common stock currently authorized and outstanding.

Issuance of significant numbers of additional shares of the Company’s

common stock in the future (i) will dilute current stockholders’ percentage ownership, (ii) if such shares are issued at prices

below what current stockholders’ paid for their shares, will dilute the value of current stockholders’ shares and (iii) by

reducing the percentage of equity of the Company owned by present stockholders, would reduce such present stockholders’ ability

to influence the election of directors or any other action taken by the holders of common stock and (iv) issuance of a material number

of shares of common stock could create downward pressure on the per share price of the common stock, thereby further diminishing the value

of stockholders’ shares of common stock.

If the Authorized Share Increase is approved, our stockholders will

likely experience significant dilution as a result of shares of common stock issued pursuant to (i) conversion of our outstanding convertible

debentures, (ii) conversion of our outstanding debenture, (iii) settlement of our accounts payable and (iv) completion of our proposed

equity financing, each as described above.

For the convertible debt, if the entire approximately $3.1 million

in face value of convertible notes was converted into shares of common stock at the exchange price in our tender offer of $0.233 per share,

then the Company would issue approximately 13.7 million shares of common stock. Based on 10,602,306, shares of common stock outstanding

as of July 1, 2024, this would result in approximately 56% dilution to existing stockholders.

Further, in relation to the debenture with Centurion, we do not currently

have an agreement with Centurion to convert any portion thereof into shares of common stock but we do anticipate that a significant amount

of the approximately $11 million in face value of the debenture would be settled in shares of common stock, however, if any portion thereof

is ultimately settled in shares of common stock it could have a substantial dilutive effect on stockholders. We anticipate converting

up to $8 million face value of the debenture, which if converted into shares of common stock at $0.3730 per share (the closing price per

share on July 1, 2024, as reported on the Nasdaq), then the Company would issue approximately 21.4 million shares of common stock. Based

on 10,602,306, shares of common stock outstanding as of July 1, 2024, this would result in approximately 67% dilution to existing stockholders

and when combined with the dilutive effect of the conversion of convertible notes described above would result in approximately 77% dilution

to existing stockholders.

Further, to settle the balance of trade accounts payable in common

shares, we anticipate that up to approximately $6.0 million will need to be converted into shares of common stock, based on $0.3730 per

share (the closing price per share on July 1, 2024, as reported on the Nasdaq), this would require the Company to issue approximately

16.1 million shares of common stock. Based on 10,602,306, shares of common stock outstanding as of July 1, 2024, this would result in

approximately 60% dilution to existing stockholders and when combined with the dilutive effect of the conversion of convertible notes

and the conversion of the Centurion debt described above would result in approximately 83% dilution to existing stockholders.

Further, we do need to raise additional capital and anticipate that

we will do so through the proposed equity financing. Assuming completion of an offering for $9 million in gross aggregate proceeds, at

a share price of $0.3730 per share (the closing price per share on July 1, 2024, as reported on the Nasdaq), we would issue approximately

24.1 million shares of common stock. Based on 10,602,306, shares of common stock outstanding as of July 1, 2024, this would result in

approximately 69% dilution to existing stockholders and when combined with the dilutive effect of the conversion of convertible notes,

the conversion of the Centurion debt and the settlement of accounts payable, as described above, would result in approximately 88% dilution

to existing stockholders

Further, we anticipate issuing warrants exercisable for up to approximately

24.1 million shares of common stock. Assuming the exercise of all warrants, when combined with the dilutive effect of the conversion of

convertible notes, the conversion of the Centurion debt, the settlement of accounts payable and the share of common stock to be issued

in the proposed financing, as described above, would result in dilution of approximately 90% dilution to existing stockholders.

If the stockholders approve the Authorized Share Increase, does

the Company have plans for future issuances of shares of Common Stock?

In addition to the issuance of shares of common stock upon settlement

of convertible notes, our debenture with Centurion, our trade accounts payable and our proposed equity financing, as described above,

and for settlement of current securities of the Company, as discussed above, given the Company’s current available capital, its

cash and cash equivalents, its history of operating at a loss and its need for additional capital to implement its plan of operations,

the Company currently anticipates that will be required to commence an offering of its equity securities in the next twelve months.

This Proxy Statement shall not constitute an offer to sell or a solicitation

of an offer to buy nor shall there be any offer or sale of these securities in any state or jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

Would the Authorized Share Increase have any Anti-Takeover Effects?

Although the Authorized Shares Increase is not motivated by anti-takeover

concerns and is not considered by our Board to be an anti-takeover measure, the availability of additional authorized shares of common

stock could enable the Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of the

Company more difficult or time-consuming. For example, shares of common stock could be issued to purchasers who might side with management

in opposing a takeover bid that the Board determines is not in the best interests of our stockholders, thus diluting the ownership and

voting rights of the person seeking to obtain control of the Company. In certain circumstances, the issuance of common stock without further

action by the stockholders may have the effect of delaying or preventing a change in control of the Company, may discourage bids for our

common stock at a premium over the prevailing market price and may adversely affect the market price of our common stock. As a result,

increasing the authorized number of shares of our common stock could render more difficult and less likely a hostile takeover of the Company

by a third-party, or a tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the possible

removal of our incumbent management. We are not aware of any proposed attempt to take over the Company or of any present attempt to acquire

a large block of our common stock.

Does the Board recommend approval of the Authorized Share Increase?

Yes. After considering the entirety of the circumstances, the Board

has unanimously concluded that the Authorized Share Increase is in the best interests of the Company and its stockholders, and the Board

unanimously recommends that the Company’s stockholders vote in favor of the Authorized Share Increase.

What amendment is being made to the Articles of Incorporation?

The THIRD paragraph of the Articles of Incorporation which currently

reads as follows:

“3. Authorized Stock: (numbers of shares the corporation is authorized

to issue) Number of Shares with par value: [250,000,000/13,888,888]*, Par value per share: $0.001 Number of Shares without par

value: 0”

*- Current authorized shares of Common Stock will be reduced from 250,000,000

to 13,888,888 shares of Common Stock assuming effectiveness of the planned 1-for-18 reverse stock split on July 9, 2024.

will be amended to read as follows:

“3. Authorized Stock: (numbers of shares the corporation is authorized

to issue) Number of Shares with par value: 2,000,000,000, Par value per share: $0.001 Number of Shares without par value:

0”

The Certificate of Change to the Articles of Incorporation is attached

hereto as Appendix B.

When will the amendment be made?

If our shareholders approve the Authorized Share Increase at the Special

Meeting, we will file the amendment to our Certificate of Change with the office of the Secretary of State of Nevada to implement the

increase in the authorized number of shares of common stock as soon as practicable following the Special Meeting. Upon approval and following

such filing with the Secretary of State of Nevada, the amendment will become effective on the date it is filed.

Required Vote of Stockholders

The affirmative vote of the holders of a majority of the outstanding

common stock is required to amend our Articles of Incorporation to effect the Authorized Share Increase. Failures to vote, abstentions

and broker “non-votes”, if any, will be the equivalent of a vote AGAINST this proposal.

IF OUR STOCKHOLDERS DO NOT APPROVE THE AUTHORIZED SHARE INCREASE,

THE BOARD BELIEVES THAT THE LONG-TERM FINANCIAL VIABILITY OF THE COMPANY COULD BE THREATENED DUE TO (I) OUR POTENTIAL INABILITY TO COMPLETE

OUR PROPOSED FINANCING AND TO SETTLE OUR OBLIGATIONS UNDER THE CONVERTIBLE NOTES AND THE DEBENTURE AND (II) THE COMPANY’S INABILITY

TO CONSUMMATE FUTURE EQUITY OFFERINGS TO MEET ITS ONGOING EXPENSES. SOME OF THESE CONSEQUENCES MAY BE MITIGATED IF THE AUTHORIZED SHARE

INCREASE IS APPROVED AND IMPLEMENTED.

THE

BOARD RECOMMENDS A VOTE “FOR” THE AUTHORIZED SHARE INCREASE

PROPOSAL 2 — APPROVAL OF THE BLANK CHECK

PREFERRED AMENDMENT

Introduction

We are requesting our stockholders approve and adopt an amendment to

the Company’s Amended Articles of Incorporation in order to authorize the issuance of 10,000,000 shares of preferred stock, with

rights and preferences to be determined by the Company’s Board of Directors from time to time (the “Blank Check Preferred”).

Why did the Board approve the Blank Check Preferred Amendment?

The Blank Check Preferred Amendment would permit the Board to issue,

without further approval by our stockholders, up to a total of 10,000,000 shares of preferred stock in one or more series. Our Board of

Directors may establish the number of shares to be included in each such series and may fix the designations, preferences, powers, and

other rights, and any qualifications, limitations or restrictions of the shares of a series of preferred stock. Our Board of Directors

could authorize the issuance of preferred stock with voting or conversion rights that could dilute the voting power or rights of the holders

of common stock.

The issuance of preferred stock would provide flexibility in connection

with (i) settlement of our convertible notes and our debenture with Centurion, (ii) financing opportunities to fund ongoing operations,

(iii) possible acquisitions and (iv) other corporate purposes. The issuance of preferred stock could, among other things, have the effect

of delaying, deferring or preventing a change in control of the Company and might harm the market price of our common stock.

What would be the terms of the Blank Check Preferred?

The particular terms of any series of preferred stock offered by us

may include:

| · | the number of shares of the preferred stock being offered; |

| · | the title and liquidation preference per share of the preferred stock; |

| · | the purchase price of the preferred stock; |

| · | the dividend rate or method for determining the dividend rate; |

| · | the dates on which dividends will be paid; |

| · | whether dividends on the preferred stock will be cumulative or noncumulative and, if cumulative, the dates from which dividends shall

commence to accumulate; |

| · | any redemption or sinking fund provisions applicable to the preferred stock; |

| · | any securities exchange on which the shares would be qualified for trading; or |

| · | any additional dividend, liquidation, redemption, sinking fund and other rights and restrictions applicable to the preferred stock. |

Holders of preferred stock will be entitled to receive, when, as, and

if declared by our Board of Directors, the dividends, whether cash or in-kind or in shares of additional securities of the Company, at

the rates and on the dates established by such series of preferred stock. Dividend rates may be fixed or variable or both. Different series

of preferred stock may be entitled to dividends at different dividend rates or based upon different methods of determination.

What will be the impact on holders of the Company’s shares

of common stock?

While the ability of the Board to issue shares of Blank Check Preferred

cannot be precisely determined unless and until the Board designates the rights, privileges, and preferences to attach to some or all

of the authorized shares of Blank Check Preferred Stock, it is likely that any series of preferred stock so designated will have one or

more material features that are superior to our shares of common stock and/or previously designated and issued classes of preferred stock.

There are not currently any agreements of the Company pursuant to which the Board would authorize and issue preferred stock and there

are not currently any plans, discussions or negotiations to do so.

Would the Blank Check Preferred Amendment have any Anti-Takeover

Effects?

Although the Blank Check Preferred Amendment is not motivated by anti-takeover

concerns and is not considered by our Board to be an anti-takeover measure, the availability of additional authorized shares of preferred

stock could enable the Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of the

Company more difficult or time-consuming. For example, shares of preferred stock could be issued to purchasers who might side with management

in opposing a takeover bid that the Board determines is not in the best interests of our stockholders, thus diluting the ownership and

voting rights of the person seeking to obtain control of the Company. Such shares of preferred stock could also be granted super-voting

rights that could further inhibit the ability of a person seeking to obtain control of the Company. In certain circumstances, the issuance

of preferred stock without further action by the stockholders may have the effect of delaying or preventing a change in control of the

Company, may discourage bids for our common stock at a premium over the prevailing market price and may adversely affect the market price

of our common stock. As a result, the issuance of preferred stock could render more difficult and less likely a hostile takeover of the

Company by a third-party, or a tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the

possible removal of our incumbent management. We are not aware of any proposed attempt to take over the Company or of any present attempt

to acquire a large block of our common stock. We do not have any present intention to issue preferred stock or to use the issuance of

preferred stock as an anti-takeover mechanism.

What am I being asked to approve?

At the Annual Meeting the Board will submit the following resolution

to the stockholders for a vote to approve the Blank Check Preferred Amendment:

“RESOLVED, that the stockholders hereby approve the Amendment

of the Company’s Amended Articles of Incorporation to amend and restate Article III in its entirety with the text set forth in Appendix

C to the Proxy Statement provided to stockholders in connection with this annual meeting of stockholders.”

The full text of the Blank Check Preferred Amendment is set forth in

Appendix C to this Proxy Statement.

The Board believes that the adoption the Blank Check Preferred Amendment

is appropriate and that it will provide authorized capital that will be attractive for investors and provide the Company with the flexibility

needed for future capital raising endeavors. If the Blank Check Preferred Amendment is adopted, it will become effective upon the filing

of a certificate of amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada.

Required Vote of Stockholders

The affirmative vote of the holders of a majority of the outstanding

common stock is required to amend our Articles of Incorporation to effect the Blank Check Preferred Amendment. Failures to vote, abstentions

and broker “non-votes”, if any, will be the equivalent of a vote AGAINST this proposal.

THE BOARD RECOMMENDS A VOTE “FOR”

THE AMENDMENT OF THE ARTICLES OF

INCORPORATION TO EFFECT THE BLANK CHECK PREFERRED AMENDMENT

PROPOSAL 3 -APPROVAL TO ADJOURN MEETING TO

SOLICIT ADDITIONAL PROXIES

If at the Special Meeting, the number of shares entitled to vote present

or represented and voting in favor of Proposal 1 or Proposal 2 is insufficient to approve such proposal, the Company would like the discretionary

authority from our stockholders so that the Company has the ability to move to adjourn the Special Meeting solely in relation to Proposal

1 or Proposal 2 (the “Discretionary Adjournment”). In that event, you will be asked to vote upon the adjournment, postponement

or continuation proposal and not on Proposal 1 or Proposal 2.

If our stockholders approve the adjournment, postponement, or continuation

proposal, we could adjourn, postpone, or continue the Special Meeting in relation to Proposal 1 or Proposal 2 and any adjourned session

of the Special Meeting, to use the additional time to solicit additional proxies in favor of Proposal 1 – The Authorized Share Increase

and Proposal 2 – the Blank Check Preferred Amendment. This could include the Board’s solicitation of proxies from stockholders

that have previously voted against such proposal. Even if proxies representing a sufficient number of votes against Proposal 1 and Proposal

2 have been received, you are authorizing us to adjourn, postpone, or continue the Special Meeting without a vote on Proposal 1 or Proposal

2 and seek to convince the holders of those shares to change their votes to votes in favor of the approval of Proposal 1 and Proposal

2.

What am I being asked to approve?

In this proposal, we are asking you to authorize the holder of any

proxy solicited by the Board of Directors the ability to call for a Discretionary Adjournment of the Special Meeting. The affirmative

vote or consent of the holders of at least a majority of the votes cast at the Special Meeting is required for the approval of any such

adjournment. The Board recommends the stockholders grant this discretionary authority, if necessary, to permit it to solicit approvals

of the charter amendment set forth in Proposal 1 and Proposal 2, which the Board believes will benefit the Company.

THE

BOARD RECOMMENDS A VOTE “FOR” THE ADJOURNMENT PROPOSAL

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth information as

of June 21, 2024, regarding the beneficial ownership of our common stock by (i) those persons who are known to us to be the beneficial

owner(s) of more than 5% of our common stock, (ii) each of our directors and named executive officers, and (iii) all of

our directors and executive officers as a group.

Except as otherwise indicated, the beneficial

owners listed in the table below possess the sole voting and dispositive power in regard to such shares and have an address of c/o Assure

Holdings Corp, 7887 E. Belleview Ave., Suite 240 Denver, Colorado. As of June 21, 2024, there were 9,010,000 shares of our common

stock outstanding.

Beneficial ownership is determined in accordance

with the rules of the SEC and generally includes voting or investment power with respect to securities. shares of our common stock

subject to options, warrants, notes or other conversion privileges currently exercisable or convertible, or exercisable within 60 days

of the date of this table, are deemed outstanding for computing the percentage of the person holding such option, warrant, note,

or other convertible instrument but are not deemed outstanding for computing the percentage of any other person. Where more than

one person has a beneficial ownership interest in the same shares, the sharing of beneficial ownership of these shares is designated in

the footnotes to this table.

On March 4, 2023, the Company effected a

reverse stock split on a twenty (20) to one (1) share basis. All information regarding stock options and warrants have been updated

to reflect the reverse stock split unless provided otherwise.

| | |

Amount and nature of | | |

| |

| Name and Address of Beneficial Owner | |

beneficial ownership | | |

Percent of Class | |

| John Farlinger (1) | |

| 50,476 | | |

| * | % |

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | |

| | | |

| | |

| Christopher Rumana (2) | |

| 95,626 | | |

| * | % |

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | |

| | | |

| | |

| Steven Summer (3) | |

| 96,126 | | |

| * | % |

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | |

| | | |

| | |

| John Flood (4) | |

| 96,345 | | |

| * | % |

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | |

| | | |

| | |

| Paul Webster (5) | |

| 1,680 | | |

| * | % |

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | |

| | | |

| | |

| Directors and Executive Officers as a Group (5 persons) | |

| 340,252 | | |

| 3.8 | % |

| | |

| | | |

| | |

| Brad Hemingson | |

| 660,000 | | |

| 7.3 | % |

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | |

| | | |

| | |

| Robert Koppel | |

| 459,371 | | |

| 5.1 | % |

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | |

| | | |

| | |

* Less than 1%.

| (1) | Mr. Farlinger is CEO and Executive Chairman of Assure. Consists of 44,376 shares of common stock

and 6,100 shares of common stock acquirable upon exercise of stock options (4,500 shares) and warrants (1,600 shares) within 60 days

of June 21, 2024. Of the shares of common stock beneficially owned by Mr. Farlinger, 3,000 shares were issued under a restricted

stock grant agreement, subject to forfeiture, such shares are fully vested. Includes options exercisable to purchases: 4,500 shares of

the Company at an exercise price of $106.00 which expire on February 1, 2026. |

| (2) | Mr. Rumana is a director of Assure. Consists of 94,235 shares of common stock and 1,391 shares of common

stock acquirable upon exercise of stock options (1,000 shares) and warrants (391) within 60 days of June 21, 2024. Includes fully vested

options to purchase 1,000 common shares of the Company at an exercise price of $106.00 which expire on January 27, 2026, pursuant to options

awarded to Dr. Rumana on January 29, 2021. |

| (3) | Mr. Summer is a director of Assure. Consists of 93,235 shares of common stock and 2,891 shares of common

stock acquirable upon exercise of stock options (2,500 shares) and warrants (391) within 60 days of June 21, 2024. Includes fully vested

options to purchase (a) 1,500 common shares of the Company at an exercise price of Cdn$171.00 which expire on October 4, 2024, pursuant

to options awarded to Mr. Summer on October 4, 2019 and (b) 1,000 common shares of the Company at an exercise price of $112.00 which expire

on January 27, 2026, pursuant to options awarded to Mr. Summer on January 29, 2021. |

| (4) | Mr. Flood is a director of Assure. Consists of 94,845 shares of common stock held directly and 1,500 shares

of common stock acquirable upon exercise of stock options within 60 days of June 21, 2024. Includes fully vested options to purchase 1,500

common shares of the Company at an exercise price of $112.00 which expire on April 15, 2026, pursuant to options awarded to Mr. Flood

on April 15, 2021. |