Incannex Healthcare Announces Strategic Financing for up to $60 Million with Arena Investors

September 10 2024 - 7:00AM

Incannex Healthcare Inc. (Nasdaq: IXHL), (the “Company” or

“Incannex”), a clinical-stage biopharmaceutical company developing

life-changing medicines for people with chronic diseases and

significant unmet medical needs, today announced it has entered

into an agreement to issue up to $10 million in secured convertible

notes to Arena Investors, LP (Arena) and its affiliates. Under the

terms of the agreements, Incannex will also secure a $50 million

equity line of credit (ELOC) with Arena affiliate, Arena Business

Solutions (“ABS”), which the Company does not anticipate drawing

upon at closing.

“We are pleased to be partnering with Arena and ABS on this

strategic financing, which strengthens Incannex’s ability to

advance our lead programs through key late-stage clinical

milestones,” said Joel Latham, Incannex’s President and Chief

Executive Officer. “We look forward to updating investors on our

progress, including progressing IHL-42X through Phase 2/3 trials

for the treatment of obstructive sleep apnea, PsiGAD through a

Phase 2 study for generalized anxiety disorder, and IHL-675A

through a Phase 2 trial for rheumatoid arthritis.”

Incannex intends to use the proceeds from the strategic

financing to support the ongoing clinical trials of the Company’s

proprietary drug candidates, and for working capital and other

general corporate purposes. Incannex will determine allocation of

funds according to the company’s strategic needs. The initial

funding tranche of $3.33 million will be received by Incannex upon

closing. The Company may elect to access to two subsequent tranches

up to a total of $6.67 million. All three tranches will include a

10% original issue discount and are subject to customary closing

conditions. Incannex has also entered an ELOC with Arena with ABS.

Under the terms of the agreement the Company will have the right,

but not the obligation, to issue and sell to Arena up to $50

million of shares of common stock over a period of 36 months,

subject to customary conditions.

Further information regarding the Securities Purchase Agreement

and the ELOC Agreement are provided in the Current Report on Form

8-K filed today with the Securities and Exchange Commission.

About Arena Investors, LPArena is an

institutional asset manager founded in partnership with The Westaim

Corporation (TSXV: WED). With $3.5 billion invested and

committed assets under management as of June 30, 2024, and a

team of over 180 employees in offices globally, Arena provides

investment capital to a broad range of industries, including

healthcare. The firm brings individuals with decades of experience,

a track record of comfort with industry complexity, the ability to

deliver within time constraints, and the flexibility to engage in

transactions that cannot be addressed by banks and other

conventional financial institutions. Arena Business Solutions, an

affiliate of Arena, provides equity capital markets solutions for

emerging public companies. For more information, please visit

www.arenaco.com.

About Incannex Healthcare Inc. Incannex is a

clinical-stage biopharmaceutical development company focused on

developing innovative medicines for patients living with chronic

diseases and significant unmet need. With three programs currently

in Phase 2/3 and Phase 2 development, Incannex is advancing

proprietary, synthetic first- and best-in-class cannabinoid and

psychedelic-assisted therapeutics targeting sleep apnea, anxiety,

and inflammatory diseases. Incannex’s lead programs include IHL-42X

for the treatment of obstructive sleep apnea (OSA), Psi-GAD in

development to assess the use of psilocybin-assisted therapy for

generalized anxiety disorder, and IHL-675A in Phase 2 trials for

rheumatoid arthritis. Each of these programs target conditions for

which there are either no approved treatments or the available

treatments are inadequate. For further information, please visit

www.incannex.com.

Forward-looking statementsThis press release

contains "forward-looking statements" within the meaning of the

"safe harbor" provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements are made as of

the date they were first issued and were based on current

expectations and estimates, as well as the beliefs and assumptions

of management. The forward-looking statements included in this

press release represent Incannex's views as of the date of this

press release. Incannex anticipates that subsequent events and

developments may cause its views to change. Incannex undertakes no

intention or obligation to update or revise any forward-looking

statements, whether as of a result of new information, future

events or otherwise. These forward-looking statements should not be

relied upon as representing Incannex's views as of any date after

the date of this press release.

Not an offer of securitiesThis announcement

does not constitute an offer to sell, or a solicitation of an offer

to buy, securities in the United States or any other jurisdiction.

Any securities described in this press release have not been, and

will not be, registered under the Securities Act of 1933 and may

not be offered or sold in the United States except in transactions

exempt from, or not subject to, the registration requirements of

the Securities Act and applicable state securities laws.

Contact Information:Incannex Healthcare

Inc.Joel LathamPresident and CEO

investors@incannex.com.au

Investor Relations Contact – United States

Jennifer Drew-Bear Edison GroupJdrew-bear@edisongroup.com

Arena Investors, LPParag Shahir@arenaco.com

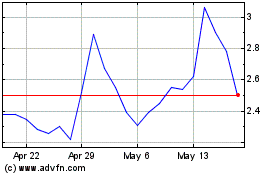

Incannex Healthcare (NASDAQ:IXHL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Incannex Healthcare (NASDAQ:IXHL)

Historical Stock Chart

From Nov 2023 to Nov 2024